dejan Jekic/iStock via Getty Images

When constructing any building, there are numerous activities that must be engaged in if that building is to be built properly. One example would be the production of ceiling systems. Though the ceiling may be viewed by some as a routine part of the construction process that requires little to no significant thought, the fact of the matter is that ceilings are incredibly important. Not only does the design send a particular message, there’s also the fact that the design and the materials can impact how that property is used. One company dedicated to producing ceiling systems and other related offerings is Armstrong World Industries (NYSE:NYSE:AWI). At present, the market seems to be concerned about anything related to the construction space. To be clear, this is a legitimate concern that could result in some companies in the construction industry suffering in the near term. As shares are priced today, I would normally be bullish about the company if market conditions were different. But seeing as how we might be still at the early stages of some economic pain that will have a delayed impact for the construction industry, I do think a wait-and-see approach is more appropriate for a company like this. As such, I have decided to rate the company a ‘hold’, reflecting my belief that it’s likely to generate returns that more or less match the broader market for the foreseeable future.

A solid firm

As I mentioned already, Armstrong World Industries operates as a manufacturer and designer of ceiling systems. These systems are largely used in the construction and renovation of commercial and residential buildings throughout the Americas. To truly understand the company, however, we should dive into the two key operating segments the company has. The first of these is the Mineral Fiber segment. According to management, this unit produces suspended mineral fiber and soft fiber sealing systems for commercial and residential settings. Mineral fiber products provide customers with significant performance attributes ranging from acoustical control, to rated fire protection, to aesthetic appeal, and even including health and sustainability features. This segment also includes the results of WAVE, an entity that manufactures and sells suspension system products and ceiling component products for the company. At present, Armstrong World Industries owns a 50% equity interest in WAVE. During the company’s 2021 fiscal year, this segment was responsible for 74% of the firm’s revenue and for 98.4% of its profits.

The other, much smaller, segment that Armstrong World Industries has is called Architectural Specialties. This unit is responsible for the production, design, and sourcing of ceilings and walls for use in commercial settings. The company produces these using a variety of materials, such as metal, felt, would, and more. It produces these in a variety of shapes as well. The purpose of this segment is to produce specific performance attributes related to acoustics, fire protection, and aesthetic appeal. The primary customers of this segment include resale distributors and direct customers, the latter consisting mostly of ceiling systems contractors. Unlike the Mineral Fiber segment, revenue associated with the Architectural Specialties segment can be rather volatile since these are niche offerings that are largely project-driven. During the company’s 2021 fiscal year, this segment accounted for 26% of the company’s revenue but for only 1.6% of its profits.

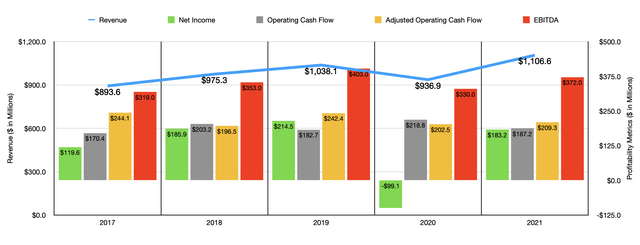

If you ignore the impact that the pandemic had, Armstrong World Industries has generated pretty consistent financial performance on its top line in recent years. Between 2017 and 2019, revenue rose from $893.6 million to $1.04 billion. Revenue dropped to $936.9 million in 2020 before shooting up to $1.11 billion last year. The 18.1% increase in revenue from 2020 to 2021 was driven by a combination of factors. Higher volumes, including the impact of acquisitions made in 2020, contributed $99 million to the company’s sales growth. To put that in context, these aforementioned factors were responsible for 58.3% of the rise in sales the company experience. Higher pricing, meanwhile, contributed $71 million to the firm’s top-line growth from year to year.

On the bottom line, things have been a bit more volatile, but the trend has been largely similar. Between 2017 and 2019, net income rose from $119.6 million to $214.5 million. Profits turned negative to the tune of $99.1 million in 2020 before climbing back up to $183.2 million last year. Operating cash flow has been slightly more volatile. But for the most part, its trend has also been positive. From 2017 through 2020, the metric rose from $170.4 million to $218.8 million. In 2021, it dipped to $187.2 million. If we adjust for changes in working capital, however, the metric actually would have risen in 2021, climbing to $209.3 million compared to the $202.5 million reported for the 2020 fiscal year. The trend regarding EBITDA has very closely mirrored what we saw with net income. The metric rose from $319 million in 2017 to $403 million in 2019. In 2020, it dipped to $330 million before shooting up to $372 million last year.

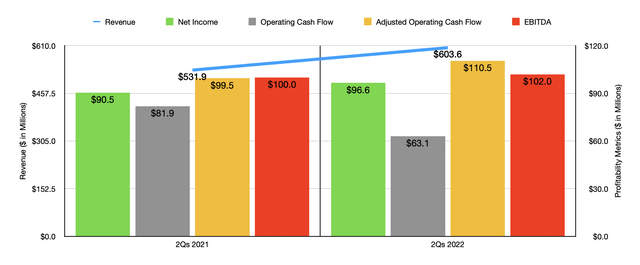

So far, the 2022 fiscal year is looking quite nice for Armstrong World Industries. Revenue in the first half of the year totaled $603.6 million. This translates to a year-over-year increase of 13.5% compared to the $531.9 million reported for the first half of the 2021 fiscal year. Higher pricing contributed $48 million of the $71 million in increased pricing that the company experienced for the year. Even though pricing continued to rise, volume increases still were responsible for adding $24 million to the company’s top line.

On the bottom line, things have been somewhat mixed but generally favorable as well. Net income of $96.6 million beat out the $90.5 million reported in the first half of the 2021 fiscal year. Operating cash flow did fall, dropping from $81.9 million to $63.1 million. But if we adjust for changes in working capital, it would have risen from $99.5 million to $110.5 million. Meanwhile, EBITDA for the enterprise also expanded, inching up from $100 million to $102 million.

For the 2022 fiscal year as a whole, management expects revenue to come in at between $1.225 billion and $1.245 billion. This should translate to a year-over-year increase of between 10.7% and 12.5%. Earnings per share should be between $5.10 and $5.20. At the midpoint, that would translate to net income of roughly $240.5 million. The company anticipates operating cash flow up between $290 million and $320 million, with a midpoint reading of $305 million expected. And when it comes to EBITDA, the firm is expecting a reading of between $410 million and $420 million, with a midpoint of $415 million in all.

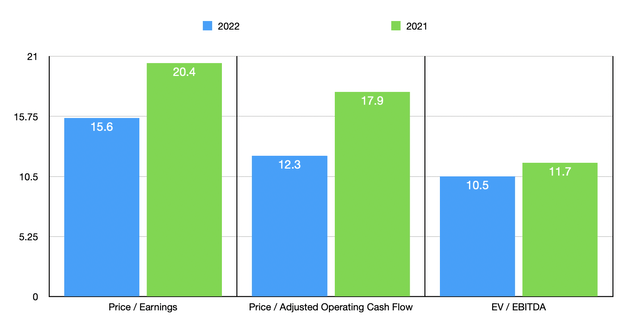

Given these figures, we can calculate that Armstrong World Industries is trading at a forward price to earnings multiple of 15.6. The price to adjusted operating cash flow multiple should be 12.3, while the EV to EBITDA multiples should be 10.5. These numbers compare to the 20.4, the 17.9, and the 11.7, readings that we get using data from the 2021 fiscal year. As part of my analysis, I also compared the enterprise to five similar firms. On a price-to-earnings basis, these companies range from a low of 10.7 to a high of 73.6. Using the price to operating cash flow approach, the range was between 10.8 and 69.7. And using the EV to EBITDA approach, the range was from 6.9 to 118.7. In all three cases, two of the five companies were cheaper than Armstrong World Industries.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Armstrong World Industries | 20.4 | 17.9 | 11.7 |

| Simpson Manufacturing Co (SSD) | 22.7 | 40.1 | 14.2 |

| UFP Industries (UFPI) | 10.7 | 10.8 | 6.9 |

| Zurn Elkay Water Solutions Corp (ZWS) | 37.5 | 20.3 | 118.7 |

| AAON Inc. (AAON) | 73.6 | 69.7 | 42.2 |

| Resideo Technologies (REZI) | 16.0 | 12.3 | 8.6 |

Takeaway

Based on the data provided, Armstrong World Industries looks to be a solid operator and management seems to be very optimistic about the near-term outlook of the firm. In the long run, I suspect the company would do just well. Under more normal market conditions, I would even bring myself to rate it a ‘buy’ because of how affordable shares look on a forward basis. Having said that, a return to profitability levels experienced even in the 2021 fiscal year makes the stock look closer to fair value. And if the picture worsens beyond that, then it’s not unreasonable to think that shares could become overvalued. Given the uncertainty that we are dealing with right now and the absence of a significant margin of safety when it comes to pricing of the stock, I do believe that a more appropriate rating right now would be ‘hold’.

Be the first to comment