As the stock markets enter panic mode, the furious sell-offs tend to impact the whole spectrum of companies, notwithstanding their market position, financial health or future growth prospects. As a result, the panic times can, besides huge losses, also lead to some extremely attractive long-term opportunities. As Baron Rothschild said: “Buy when there’s blood in the streets, even if the blood is your own.” And there is a lot of blood in the streets right now.

In this series of articles, I want to present several companies that experienced huge share price declines, although their longer-term prospects are very good. In other words, companies that represent a very attractive buying opportunity at their current prices. However, I must stress that the current market situation is very complicated, and there is no warranty that the companies, although cheap, won’t get even cheaper before they start to recover. A bargain today may become an even bigger bargain tomorrow. This is why investors should be very cautious, not bet all money on one card, and not bet them at once.

The first three articles of the “Armageddon bargain hunting” series were focused on Fortuna Silver Mines (FSM) (you can read it here), RNC Minerals (Royal Nickel Corp.) (OTCQX:RNKLF) (you can read it here) and Ivanhoe Mines (OTCQX:IVPAF) (you can read it here). The fourth one introduces Gran Colombia Gold (OTCPK:TPRFF), a company that owns a profitable high-grade gold mine, and what is important, its indebtedness is low and it holds a lot of cash, which is very important in the current market situation.

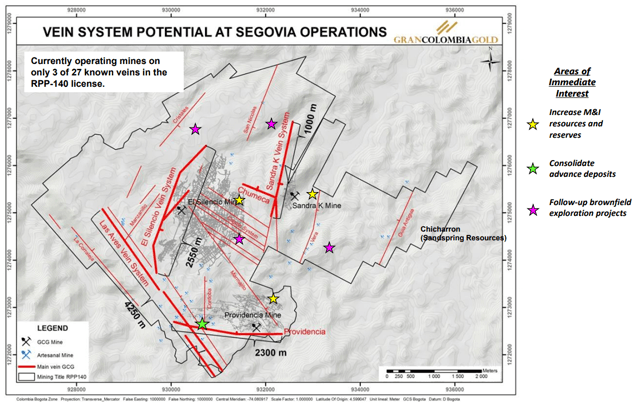

Gran Colombia’s cornerstone asset is the 100%-owned high-grade Segovia gold mine. The mine (better said a complex of mines) is located in the Antioquia region of Colombia. Gran Colombia’s property covers an area of 90 km2 and gold is being extracted there for at least 150 years, mostly by artisanal miners. It is estimated that around 5 million toz gold were produced. The property includes three underground mines: El Silencio, Providencia, Sandra K (another mine is located on a separate property, approximately 10 km to the south). The ore is processed at the Maria Dama processing plant, with a throughput capacity of 1,500 tpd. Gran Colombia acquired the property back in 2010 and for the last 10 years, it kept on optimizing the operations, growing the production and reducing the production costs. In its current shape, Segovia is able to produce around 200,000 toz gold per year (193,050 toz in 2018, and 214,241 toz in 2019), at an AISC around $900/toz.

According to the December 31, 2018, report, Segovia contained reserves of 688,000 toz gold at a gold grade of 11.03 g/t. The resources contained 2.48 million toz gold at a gold grade of 11.18 g/t. As 214,241 toz gold were produced in 2019, there should be reserves of only 474,000 toz gold remaining. However, Gran Colombia keeps on drilling and discovering more ore. And given the extent of already known resources, it is almost sure that the Segovia mine life is far from over.

The Segovia property contains 24 known veins that are still not being mined. Moreover, 45,000 meters of drilling is projected for 2020. Also the 2019 drill campaign was pretty successful. The most promising drill holes include SK-IU-089 (13.9 g/t gold and 28 g/t silver over 10.6 meters), SK-IU-095 (39.24 g/t gold and 62 g/t silver over 2 meters) or PV-IU-201 (10.57 g/t gold and 6.1 g/t silver over 4.46 meters).

Besides Segovia, Gran Colombia owns a significant interest in another gold mining project. Only in February, Gran Colombia completed the spin-off of its Marmato gold mine. A new entity named Caldas Gold was established. Caldas Gold owns Marmato and Gran Colombia retained a 72% controlling interest in Caldas. Only today, Gran Colombia announced that it increased its Caldas interest to 74.4%. Shares of Caldas Gold are traded on CVE, under ticker CGC. At the current share price of C$1.46, the market capitalization of the company equals approximately C$74 million, which means that Gran Colombia’s stake is worth around C$55 million or $39 million.

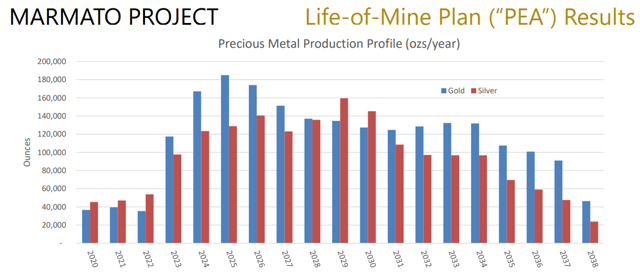

Caldas Gold controls the Marmato gold mine that has measured, indicated and inferred resources of 5.35 million toz gold. Right now, there is a small underground operation that produces around 25,000 toz gold per year (25,750 toz in 2019) at an AISC around $1,200/toz. However, the plan is to expand the production rate significantly. According to the 2019 PEA, the gold production should average 35,000-40,000 toz gold per year over the 2020-2022 period. During this time, $269 million should be invested in the development of the Deep Zone that will help to elevate the average annual production to 130,000 toz gold at an AISC of $885/toz, during the 2023-2038 period. A PFS is being prepared, it should be completed by the middle of this year.

What is important to mention, Gran Colombia has been able to acquire significant equity positions in another two companies. Gran Colombia owns 20.6% of Gold X Mining (OTCQX:SSPXF) (formerly known as Sandspring Resources) and 19.89% of Western Atlas Resources (OTC:PPZRF). Gold X Mining is interesting for its Toroparu Project that contains measured, indicated and inferred resources of 10.5 million toz gold. The 2019 PEA envisions production of 187,500 toz gold per year, at an AISC of $820/toz. The mine life is estimated at 24 years and the initial CAPEX should be $360 million. Gran Colombia is Gold X Mining’s biggest shareholder. At the current share price, Gran Colombia’s equity interest has a market value of approximately $7 million. Western Atlas is a tiny company, with a market capitalization of less than $3 million. It owns early-exploration stage properties in Canadian Nunavut (Meadowbank) and in Venezuela (Lo Increible).  Gran Colombia’s share price bottomed (at least for now) at $2.1, on Monday. It was 63% below the February 24 high at $5.62. On Tuesday, the share price jumped up strongly, to the $2.9 level. However, even there, the share price remained almost 50% below its recent peak. Right now (shortly after the market close), the share price stands at $2.59. At this share price, the market capitalization of the company equals $158 million.

Gran Colombia’s share price bottomed (at least for now) at $2.1, on Monday. It was 63% below the February 24 high at $5.62. On Tuesday, the share price jumped up strongly, to the $2.9 level. However, even there, the share price remained almost 50% below its recent peak. Right now (shortly after the market close), the share price stands at $2.59. At this share price, the market capitalization of the company equals $158 million.

According to the 2020 guidance, Gran Colombia should produce 200,000-220,000 toz gold. Although an AISC guidance hasn’t been provided, it is reasonable to expect it somewhere around $900/toz. It means that at a gold price of $1,500/toz (at this moment the gold price stands at $1,525/toz), the 2020 free cash flow should be around $126 million. Even at a gold price of $1,300, Gran Colombia should be able to generate cash flow over $80 million. In both cases, the price-to-free cash flow ratio is less than 2, at the current market capitalization.

It shows that Gran Colombia is heavily undervalued. Yes, there are some risks. The company operates in Colombia, which is not a safe jurisdiction. In the past, Gran Colombia had to deal with some illegal miners. Moreover, the operations are located in Antioquia, which is the same region where three geologists of Continental Gold (OTCQX:CGOOF) were killed back in 2018. Some investors may be discouraged also by the relatively low volume of reserves. However, the resources are pretty big and there is a significant exploration potential. As a result, I don’t doubt that Gran Colombia will be able to keep on replenishing the extracted reserves.

The low valuation cannot be explained even by Gran Colombia’s indebtedness, as it is well under control. The total debt equaled $68.8 million, as of December 31, 2019. But the cash on hand equaled $84 million. By the end of January, the debt declined to $63.9 million and on February 6, Gran Colombia completed an equity financing, under which it issued to Eric Sprott 7,142,857 shares and the same amount of warrants with a strike price of C$6.5 ($4.58) for total proceedings of C$40 million ($28 million). Sprott’s shareholding increased to 11% and Gran Colombia obtained money that will be used to redeem further gold notes worth approximately $20 million, which should reduce the outstanding debt approximately to $44 million, by the end of this quarter.

While the purpose of the abovementioned equity financing is questionable, given Gran Colombia’s robust cash position, right now, after the steep share price decline, it looks like a good decision. And it would be even better if the company decided to start buying back its own shares at the current depressed price levels. At the current share price, the recently issued volume of 7,142,857 shares could be repurchased for approximately $18.5 million.

Conclusion

Gran Colombia Gold is a highly undervalued gold miner. It should produce more than 200,000 toz gold, at an AISC around $900/toz, this year. Even at a gold price of $1,300/toz, it should generate free cash flow over $80 million, which would warrant a market capitalization of $400 million, even at a very conservative price-to-free cash flow ratio of 5. It means a very conservative 150% upside. The company is in good financial condition, as it held cash of $84 million, as of the end of 2019. The debt was $68.8 million, but it should be reduced to $44 million by the end of this quarter. Moreover, there was the $28 million equity financing in February. And 37,175 toz gold were produced over the first two months of 2020, which should mean cash flow of more than $20 million, given the average January and February gold price ($1,560/toz and $1,600/toz, respectively). It means that right now, Gran Colombia’s enterprise value is less than $100 million. Let’s deduct the market value of its equity interests in Caldas Gold, Gold X Mining and Western Atlas Resources, and we are below $50 million. It looks almost too good to be true. However, it is important to note that the financial markets are extremely volatile right now and it is possible that Gran Colombia’s share price will decline to even more ridiculous levels before the market returns to its senses. The best strategy is to build a position only slowly, not by investing all the dedicated sum of money at once.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in TPRFF over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment