Michael Vi/iStock Editorial via Getty Images

It’s a scary time to be investing in the markets, least of all in small-cap stocks. Small caps, in particular, have seemed to lose all investor faith as the risk-off attitude kept piling on this year – but it’s in these names that we can find the greatest bargains.

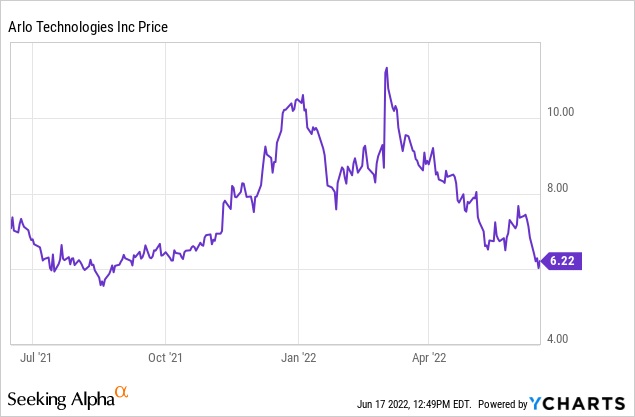

Arlo (NYSE:ARLO), in my view, is worth a fresh look. This security camera maker’s actual fundamental performance has diverged tremendously from its actual share price performance this year. It has notched impressive growth rates, particularly in its recurring subscription business, which has helped to offset margin pressures in hardware. Year to date, Arlo stock is down 40%, doubling the losses of the broader S&P 500 – and in my view, this represents a great entry point.

Arlo is, needless to say, not a stock to invest substantial capital in. But I think a smart play for investors to bank on a rebound is to place small bets on a basket of beaten-down small-cap growth stocks, Arlo included. I’m retaining my bullish view on Arlo and hold fast to the belief that Arlo will outperform the broader market tremendously by year-end 2022.

As a refresher for investors who are newer to this stock, here are the key bullish drivers for Arlo:

- Best-in-class category leader. Arlo has been highly reviewed by major tech publications like CNET and PCMag and is considered one of the top home smart cameras. In addition to this, Arlo is one of the most prominent security companies to promote DIY installation, vs. other cameras that required expensive technicians for installation.

- A return to schools, offices, and normal life means people may be leaving the comfort of their homes all day for the first time in a while. They may think about wanting to have a smart camera system like Arlo in place after they’ve gotten so used to keeping an eye on their home for so long. And with the rise of e-commerce and package delivery, a video doorbell camera becomes more critical than ever.

- Huge TAM. Arlo estimates the market for home security to currently stand at $53 billion, and it also expects this opportunity to grow to $78 billion by 2025. With less than ~$500 million in annual revenue, Arlo has plenty of room to expand and innovate in this space. Given as well that there is no clear leader in the home security camera market, Arlo has a chance to take the crown.

- Partnerships with some of the largest retailers in the country. Arlo products are sold through resellers like Best Buy (BBY), Costco (COST), Amazon (AMZN), and others. Arlo’s visibility to consumers is unmatched, and the company is well-positioned for retail sales growth ahead of the holiday season.

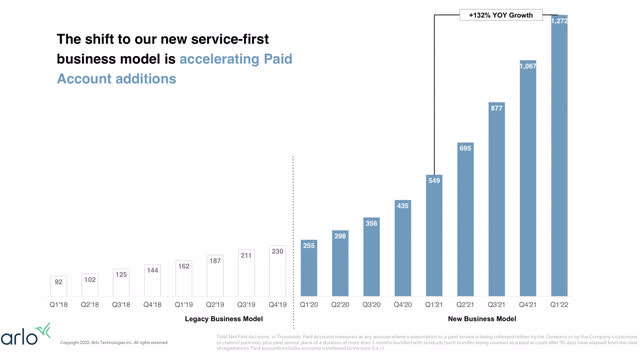

- Building a subscription base. Arlo is moving away from being a pure hardware products company. Paid subscriber accounts, reaching more than 1.2 million as of Arlo’s most recent quarter, are growing at faster than a 2x y/y clip. Arlo also notes that ~65% of new hardware customers sign up for Arlo Secure within six months.

The stock also is undeniably cheap, especially after its year-to-date crunch. At current share prices near $6, Arlo trades at a market cap of $540.3 million. After we net off the $145.5 million of cash on Arlo’s most recent balance sheet (another reason to like Arlo – for a company this small, its debt-free cash balances are quite impressive), the company’s resulting enterprise value is $394.8 million.

For the current fiscal year, Arlo has guided to $490-$510 million in revenue, which puts its valuation at just 0.8x EV/FY22 revenue. Yes, at the moment roughly three-quarters of Arlo’s revenue base is in lower-margin hardware, but that is quickly shifting to higher-margin subscriptions.

The bottom line here: There’s a lot of untapped value here in Arlo. Take advantage of the dip as a buying opportunity, and put Arlo into a basket of beaten-down growth stocks that are well-positioned for a rebound.

Q1 download

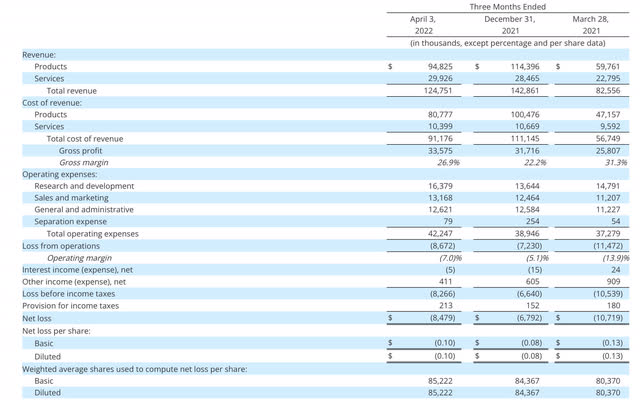

Let’s now discuss Arlo’s latest Q1 results in greater detail. The Q1 earnings summary is shown below:

Arlo Q1 results (Arlo Q1 earnings materials)

Arlo’s revenue in Q1 grew at a very impressive 51% y/y pace to $124.8 million, beating Wall Street’s expectations of $113.4 million (+37% y/y) by a 14-point margin. Product revenue grew at 59% y/y to $94.8 million, representing 74% of overall revenue, while services grew 32% y/y to $29.9 million.

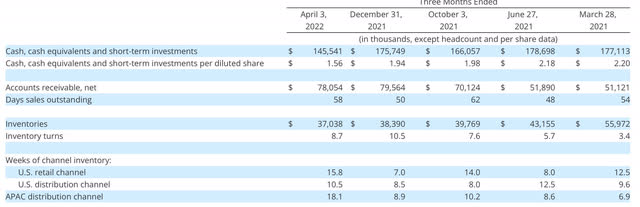

We’ll offer one caution here: Arlo appears to have done a significant amount of channel inventory loading in Q1, which boosted product revenue. At the end of Q1, U.S. retail partners had 15.8 weeks of inventory on hand, vs. just 7.0 at the end of the December quarter and 12.5 in the prior Q1; while U.S. distributors had 10.5 weeks versus 8.5 in December and 9.6 in the prior Q1.

Arlo channel inventory (Arlo Q1 earnings materials)

There are two “so what” items to take away from this. First, the fact that Arlo sold in substantial amounts to partners in Q1 likely means that revenue in Q2/Q3 will be impacted as partners work down channel inventory. However, this does also mean that Arlo is in a fairly healthy supply position across its points of sale, which will prevent its customer sell-through from being constrained (many hardware vendors can’t say the same – Arlo may even gain market share due to its more abundant availability).

Arlo also continues to drive substantial services growth. Paid accounts at the end of Q1 reached a staggering 1.27 million, growing 132% y/y. And note as well that Arlo’s ARR clocked in at $101.3 million (+74% y/y), the first quarter in which the company saw its subscription ARR break past the $100 million mark.

Arlo account growth (Arlo Q1 earnings materials)

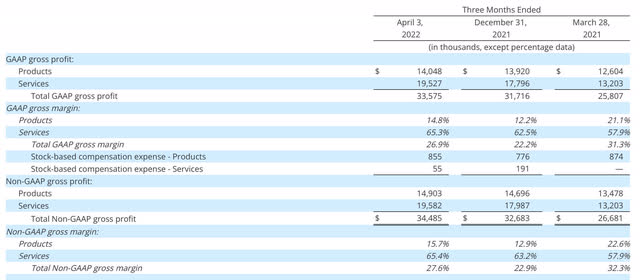

From a margin perspective: Unfortunately, product margins fell in Q1, hit by the same raw component inflation and logistics price squeezes that many other companies are reporting. Product gross margins shed seven points to 15.7%, down from 22.6% in the year-ago Q1 (though they improved three points sequentially from Q4). The optimistic side of this coin is that these are not Arlo-specific problems, and certain factors like logistics constraints may be more transitory in nature.

Services margins, however, boosted to 65.4%, 750bps higher than 57.9% in the year-ago quarter as the company’s subscription business continues to scale. Overall, gross margins fell five points to 27.6%, weighed down by both the reduction in product margins plus the heavier mix of product revenue in the quarter, driven by the aforementioned channel loading.

Arlo gross margin trends (Arlo Q1 earnings materials)

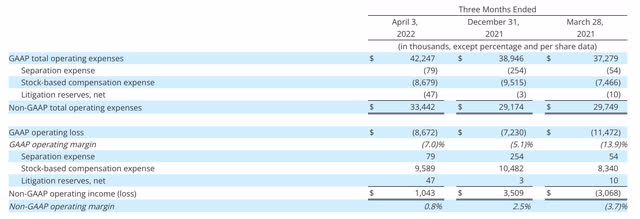

In spite of these gross margin headwinds, however, Arlo was able to drive operating margin efficiencies through opex efficiencies. Q1 pro forma operating margins were 0.8%, a full 450bps better than -3.7% in the year-ago quarter.

Arlo Q1 operating margins (Arlo Q1 earnings materials)

Key takeaways

Arlo is a little-known stock that should not be forgotten. The company is succeeding in expanding its points of sale, boosting its subscription services and achieving positive operating margins. Stay long here and buy the dip.

Be the first to comment