Jack Taylor/Getty Images News

Bruce Wayne: Why didn’t you just kill me?

Bane: Your punishment must be more severe.

Bruce Wayne: Torture?

Bane: Yes, but not of the body. Of the soul. I will build you and Growth up with hope and then destroy you. Hope is really the key to torture. Growth will build to a point of joy and then be wiped from the map.

Bruce Wayne: You are a madman.

Bane: When Growth is ashes, then you have my permission to buy.

Source: The Dark Knight Rises (first draft)

Everyone enjoys growth in their portfolio. Alongside the good feeling that you get with seeing revenues and profits move up, you also have the hope that you might just strike it rich on the next Amazon.com Inc. (AMZN) or Microsoft Corporation (MSFT). Unfortunately the last six months have not been too kind to growth investors. ARK Next Generation Internet Fund (NYSEARCA:ARKW) is one we have covered in this sphere a few times. When we last wrote about it, we explained what had killed all the growth stocks and why we were structurally bearish but tactically neutral.

So ARKW has a long, long way down until realistic valuations set in. We need to fall another 80% from here to get to the overall 96% drop. Tactically, though, shorting this low below its 200 and 50-day moving averages is suicide for the trader. Yes, it may work, but the risk reward is not well set up. Hence we rate this as neutral/hold for now and would look on the short side near the 50-day moving average.

Source: And Then There Were None

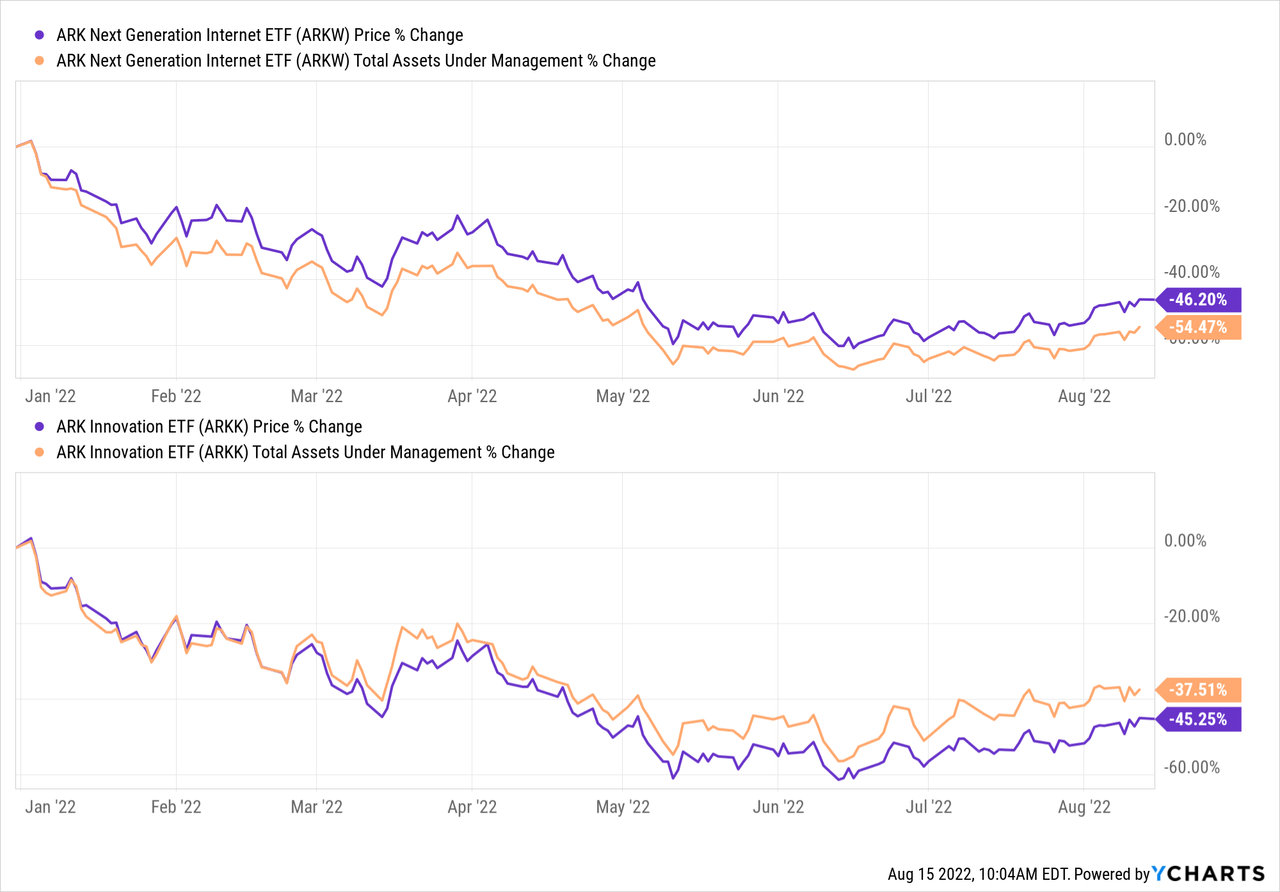

ARKW went lower initially but rebounded strongly in the last month, validating our desire not to press on the short side.

And Then There Were None

While the bounce has been strong, we are now approaching what we believe is the next leg down and we tell you why below.

The Fund

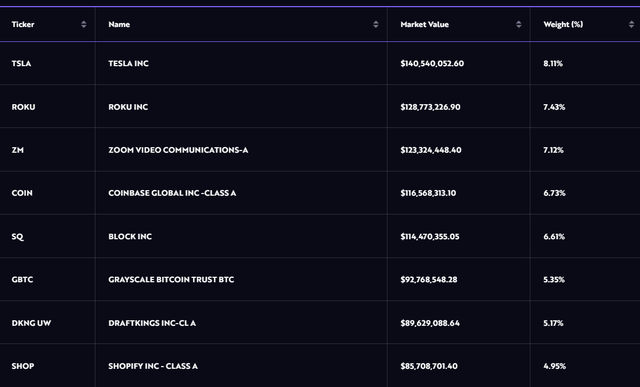

ARKW has made one thing empirically clear since the beginning — it is not afraid to double or even triple down on its big bets. The top-8 stocks made up more than 40% of the fund and this is about in line with previous settings.

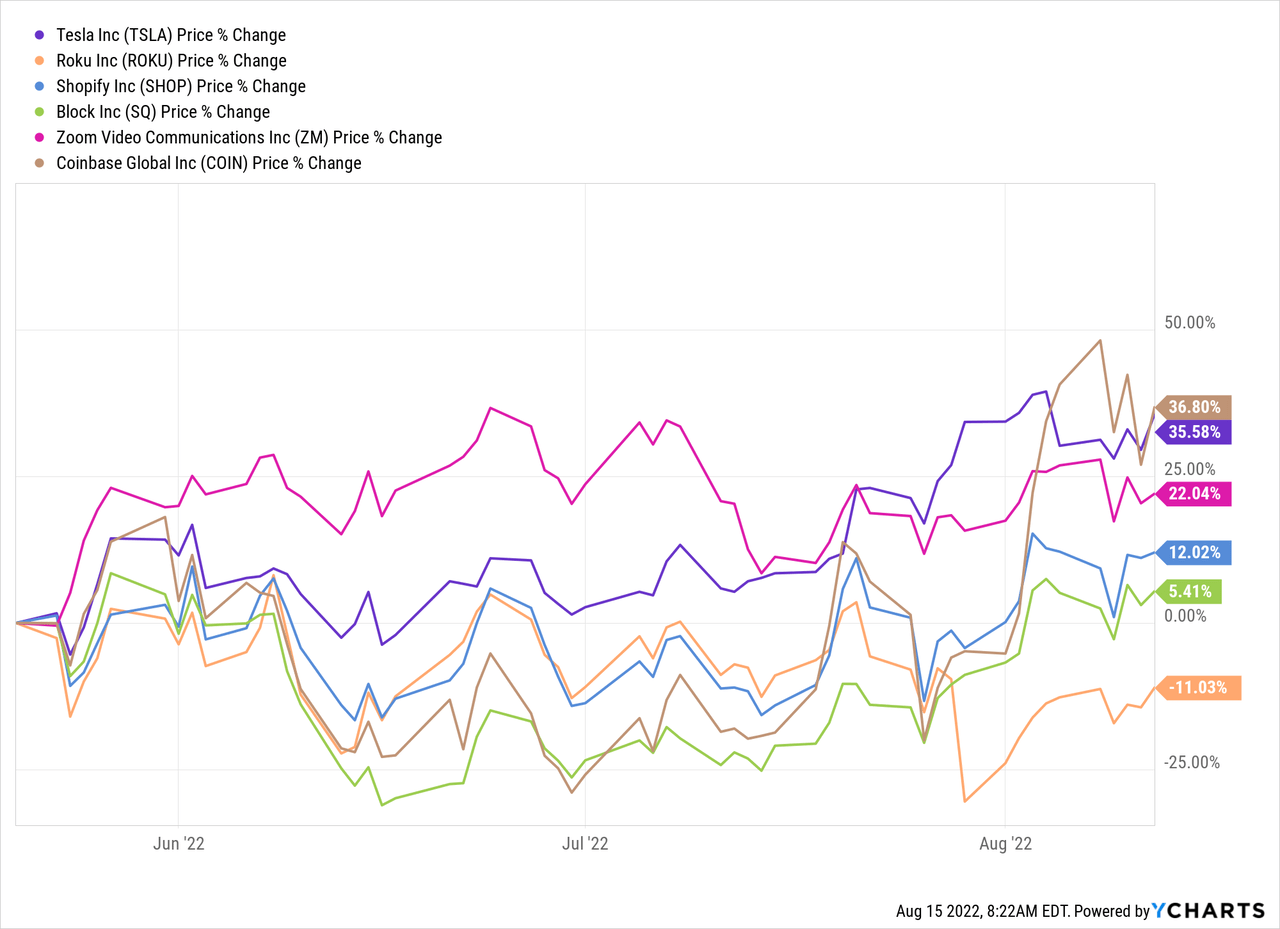

On our last coverage Roku Inc. (ROKU) was in the number one spot, but has since been displaced by Tesla Inc. (TSLA). That was primarily a performance based change of positions as ROKU has really done badly compared to the other ARKW holdings.

Coinbase Global Inc. (COIN), Zoom Communications (ZM) and Shopify (SHOP) rebounded strongly as well as investors cheered that the worst was behind them and looked to get back on the road to riches.

Outlook

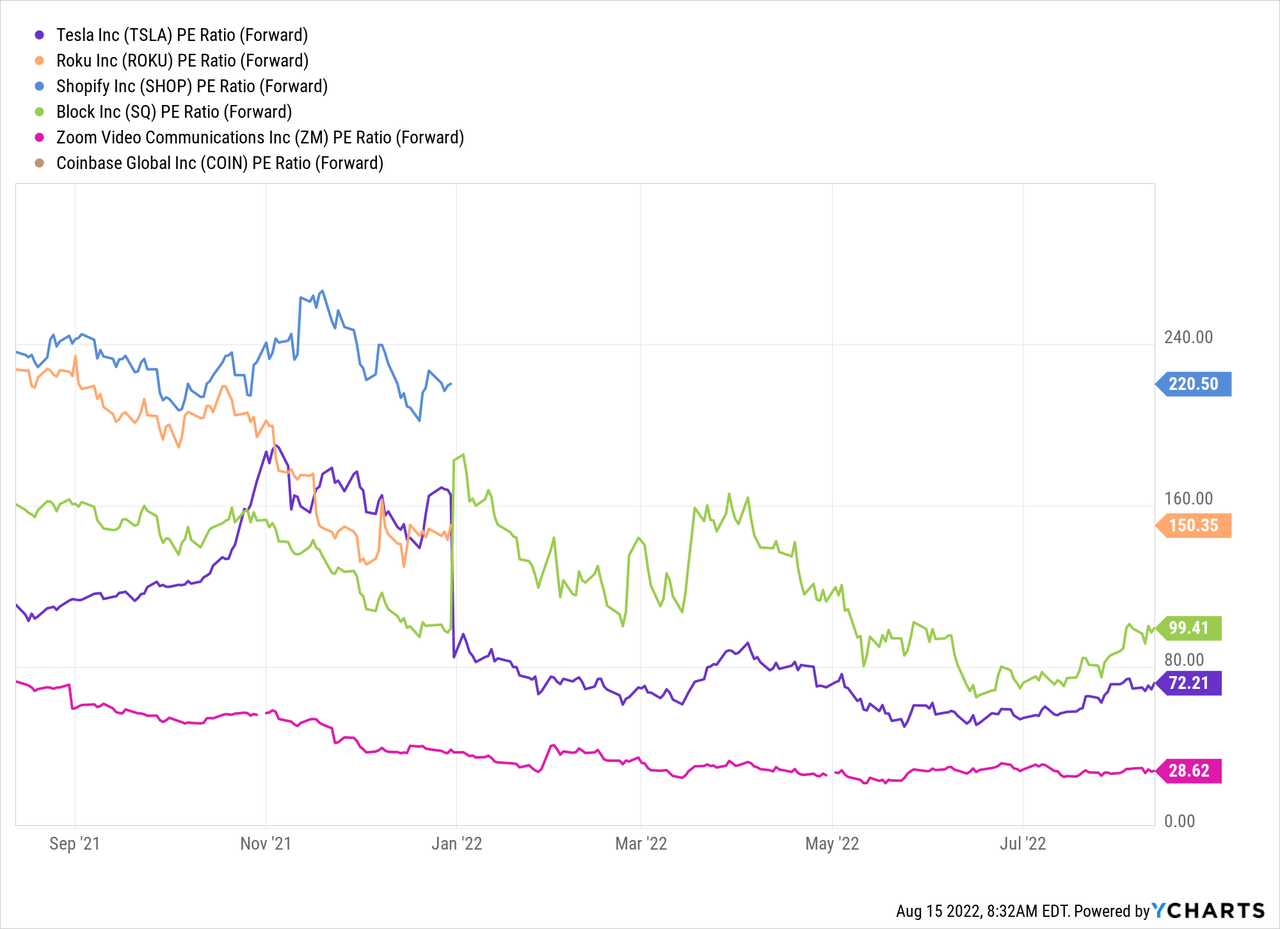

As the holdings here have remained relatively static since we first covered this fund, one can make a directional call on the fund by making a directional call on its top holdings. Here, there are two major themes. The first being that earnings are still a rather elusive unicorn for these stocks. Now in their defense, many of them do show a positive P/E ratio and here are five of the six stocks showing just that.

Of course, as we have said before, we really don’t care about non-GAAP profits. What we care about is actual profits that shareholders can see and use. That remains elusive.

Non-GAAP to GAAP And Why You Should Care

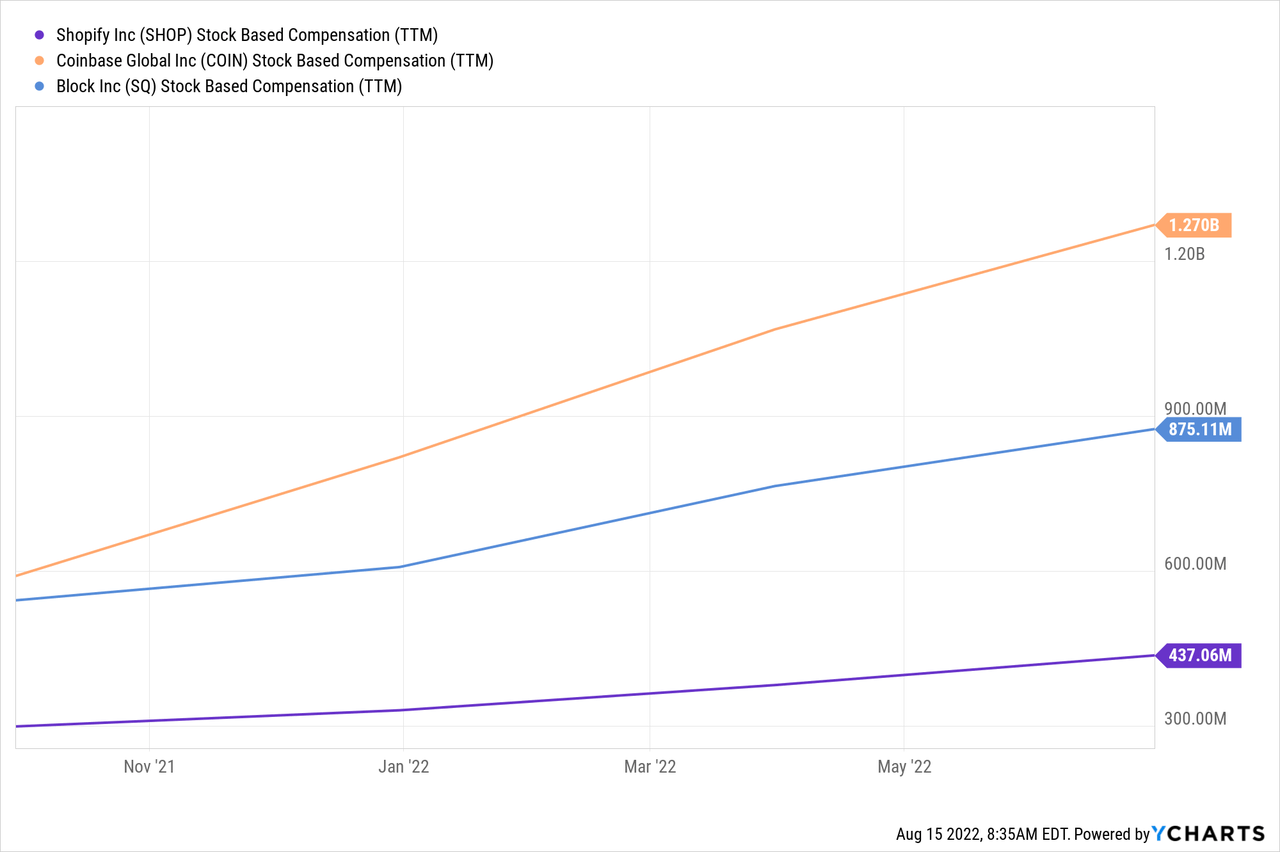

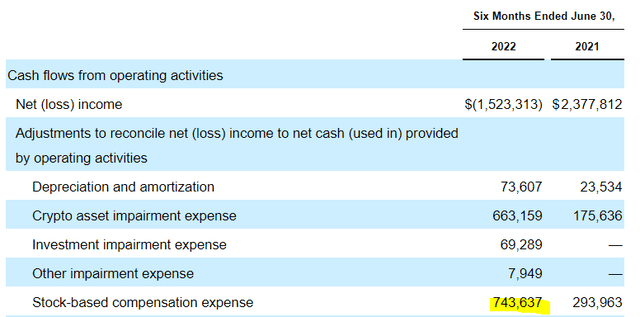

The biggest factor here as we move from GAAP to Non-GAAP still remains stock based compensation. This is an area where companies are showing zero restraint. Below we have shown the trailing 12-month stock based compensations for three firms.

You can bet that is not going in the direction of the stocks. Stock based compensation has also become an exceptional tool for the companies in general to control salary expenses. With inflation raging at 8.5%, alongside an ultra tight labor market, companies are trying to maintain non-GAAP margins by using stock based compensation. While they are all ridiculously bad, and we have covered some previously, we do want to look at just one in more depth.

COIN

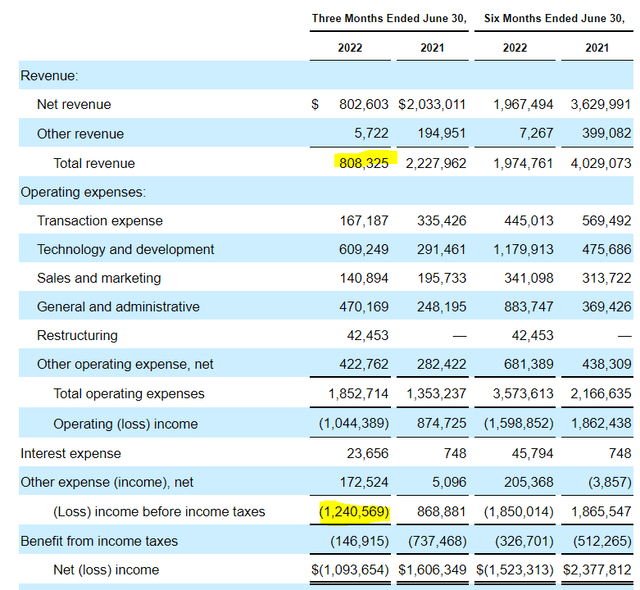

We chose this one as it is about as far removed from reality as we get to see in ARKW’s stock selection. COIN reported a large $4.98/share loss in Q2-2022 or at an annualized $20 per share run rate. The Q2-2022 results were just breathtakingly bad and it was a special treat to see just how far off base the bulls were on this one. The company reported revenues that almost dropped by two thirds (growth stock, so why not) and it managed to lose $1.24 billion pre-tax on $800 million of revenues.

For the first half of the year, stock based compensation was $743 million.

That is 35% of revenues.

For Q2-2022, stock based compensation was 48% of revenues.

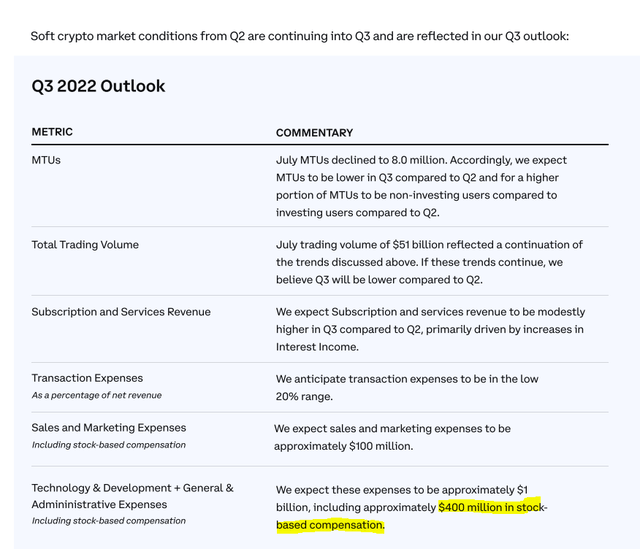

For Q3-2022, stock based compensation should rise to $400 million and we expect a similar number for Q4-2022.

That $400 million now accounts for over 60% consensus revenue estimates for Q3-2022.

Think about that. Stock based compensation is making up 60% of revenues. Do you expect this firm to ever hit profitability? Our answer is no and we expect the firm will likely visit single digits pretty soon.

Verdict

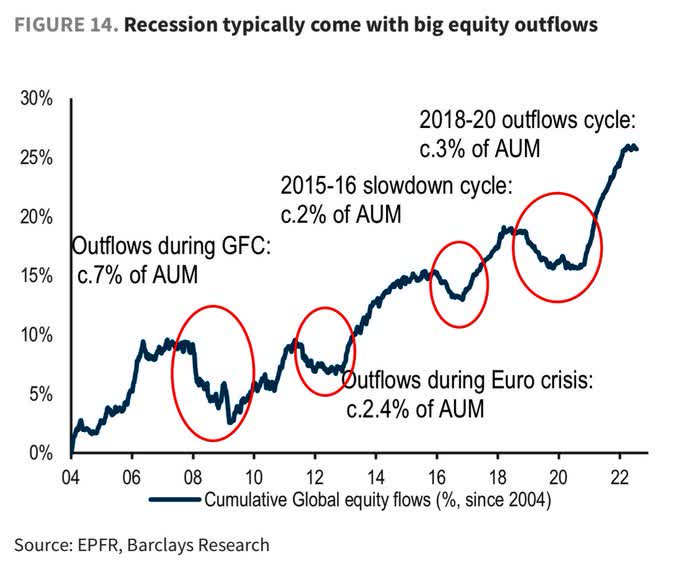

True capitulation requires three things. Unbridled selling, washout sentiment and great valuations. So far selling has been muted.

Barclays

Even for the ARK funds and we threw in ARK Innovation ETF (ARKK) as well, the assets under management have fallen due to price declines.

True capitulation would require some extreme selling and extreme decrease in assets under management, the kind we are not even close to.

Overall sentiment has rebounded nicely with meme stocks making a comeback and investors disregarding horrid losses like the one COIN just reported.

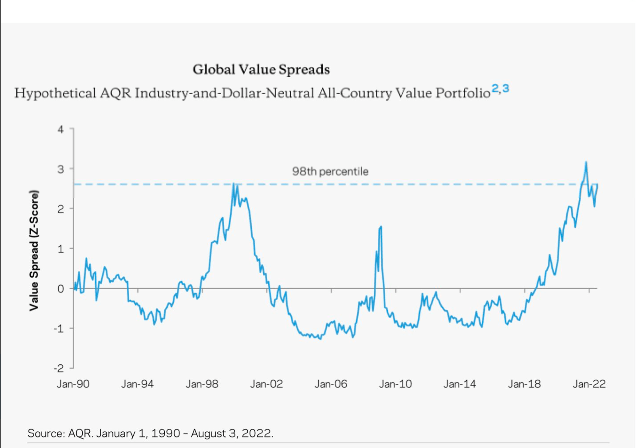

Finally, valuations look as bad or worse than what we saw at the peak 12 months back.

Growth is now in the 98th percentile of its “expensiveness” vs value.

AQR

We stand by our target for ARKW to drop at least 90% from the all time peak and that would imply another 80% drop from here to under $20/share. We are downgrading this back to a Sell rating as the rebound has made risk-reward far more attractive.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment