Vasyl Cheipesh/iStock via Getty Images

Description

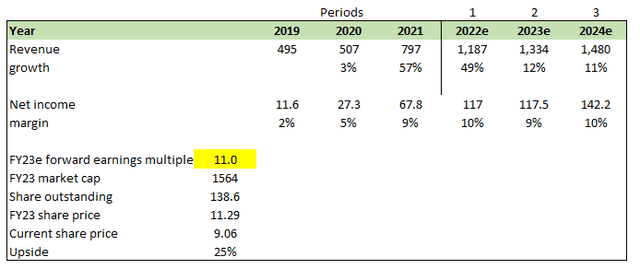

I believe Arhaus (NASDAQ:ARHS) is worth $11.29/share in FY23, representing a ~25% upside from the date of writing. Arhaus is a rapidly growing lifestyle brand and omnichannel retailer of premium home furniture. The company is at a mature stage with a unique business model that has proven its sustainability in the market. Its omnichannel strategy provides more opportunities to interact with customers. Further, the company’s global supply chain strategy and culture are very robust.

Company overview

ARHS is an omnichannel retailer of premium home furnishings with a fast-expanding lifestyle brand. The business offers artisan-quality furniture and home decor through a unique direct-to-consumer strategy that reflects its commitment to livable luxury. By cutting out the middleman – the wholesaler or dealer – Arhaus offers an exclusive range at a reasonable price by sourcing directly from manufacturers and suppliers. ARHS competes in what it thinks is the more profitable premium home furnishings market, where prices and quality of goods are higher than in the rest of the market.

ARHS has a distinct business concept

ARHS offers a novel and differentiated concept, revolutionizing the high-end furniture industry with its compelling combination of style, quality, value, and practicality. Arhaus items are handmade by skilled artisans and sourced from around the world, setting them apart from those sold by both large and small competitors. Arhaus product designs combine characteristics of durability and usefulness. Because it caters to families, not only those in the ultra-luxury bracket, I believe the company can reach a far larger customer base. In addition, ARHS provides its customers with one-of-a-kind Showrooms, eCommerce, catalogs, and excellent client support. I am confident that it can grow its market share despite facing competition from several smaller, independent firms thanks to the combination of its premium lifestyle positioning, outstanding quality, large scale, and high convenience.

There is, without a doubt, a lot of room for the omnichannel business model to expand in the United States. Recent research and surveys commissioned by ARHS have given its business reason to believe that the number of its Showrooms might be increased to more than 165 in both new and existing markets. The reason I believe it can be done is because Arhaus’s omnichannel concept has been successful throughout all regions of the country, all retail formats, and all market sizes, as seen by the company’s thriving Showroom footprint. Although ARHS’s top 10 Showrooms in terms of net revenue are spread over 10 different states, the company’s business strategy has historically been effective in a wide range of markets and economic conditions. Management plans to open between five and seven new stores every year, which suggests it can exploit the whitespace opportunity within the next fifteen years. A big part of my confidence stems from ARHS’s extensive investments in its digital platform; it will be able to enhance its eCommerce penetration, speed up the expansion of its omnichannel model, and give customers more freedom in choosing when, where, and how they conduct business with Arhaus.

Omni-channel approach increases customer touchpoints

Leveraging its omnichannel strategy, ARHS aims to provide its products to customers in any way they like to shop. I believe that Arhaus is completely agnostic when it comes to sales channels. Through the use of its own data and innovative technology, the company can accommodate its customers regardless of whether they like to do their shopping at home, on the go, or in one of its Showrooms. ARHS’s fully integrated infrastructure and massive scale, combined with its innovative product development and omnichannel go-to-market attributes, enable the business to provide customers with an omnichannel experience in terms of design, quality, and value.

I must agree that the awe-inspiring Showrooms at Arhaus serve as an extraordinarily potent tool for expanding the company’s brand and attracting many clients. Its showrooms, which are meant to seem like miniature theaters, give customers an iconic “wow” moment by giving concrete expression to the company’s philosophy of “livable luxury.” In order to continually improve the visual appeal and inspirational potential of the company’s Showrooms, a team of highly qualified and imaginative visual managers walks the floors every day. Arhaus also has enthusiastic and well-informed sales associates, allowing them to completely engage customers and offer advice and service that is second to none.

When it comes to the company’s digital presence, clients may do research and discovery, and begin and complete transactions on the digital platform thanks to the company’s full-suite omnichannel approach. ARHS’s eCommerce platform is supported by its online design services team, which interacts with customers and offers them guidance and resources in the form of virtual tools and human consultants, no matter which channel they choose.

I believe that underlying all of these is ARHS’s strong team of in-house designers. Clients’ conversion, order size, and overall experience are all boosted by the company’s in-home designers, who work with clients both in the Showroom and in their residences. Relative to its eCommerce platform, ARHS’s in-home designer services give clients a more personalized experience. Appointments are not necessary for the clients to take advantage of the company’s free in-home designer services. Clients that use its in-home designer services program are much more likely to make additional purchases. In fact, about 40% of its lifetime customers fall into this category (data from the prospectus).

Strong global supply chain strategy

I believe that ARHS can increase its market share, respond quickly to new developments in the industry, and maintain its relevance to clients thanks to its innovative approach to product development.

In terms of offering excellent quality, innovative customization, and appealing value, ARHS is able to do this because of its direct global sourcing ties. As far as I can tell, the company has been working with the same vendors for quite some time, and that gives it several advantages over the competition, including the stability of product quality and the security of a large portion of its offerings thanks to vendor guarantees. To put things in perspective, in 2020, only Arhaus will be able to sell about 95% of the goods that bring in money.

In addition to its extensive global network of direct suppliers, the company has a team of highly skilled in-house product designers and developers that collaborate with suppliers to build cutting-edge, customer-specific products. Experts from ARHS travel all over the world in quest of fresh and original design ideas. Arhaus’s in-house design team has a broad pool of highly competent and experienced employees and is responsible for the creation and development of many of the company’s products instead of a third party. Consistent with previous investments, the company has made many critical strategic hires to strengthen its product development capacity. In my opinion, these investments will help the company stand out by giving customers high-quality, customized products at a good price, which will increase net revenue. ARHS is also capable of manufacturing upholstery products in addition to its expertise in furniture design. With these capabilities, the business can produce sophisticated, high-quality merchandise with healthy profit margins.

All in all, I believe the company has a strong foundation for sustained long-term growth because of its capacity for product and service innovation, category and service integration, and the quick scaling of these initiatives throughout its unified omnichannel platform. Furthermore, Arhaus can offer superior products at lower rates than its smaller independent competitors and larger competitors thanks to its vertical business model and extensive network of direct sourcing partnerships (ARHS has built a vast direct sourcing network that includes hundreds of suppliers, some of whom have been partners since the company’s founding). Together with its direct sourcing partners, ARHS’s product development teams bring to market unique, one-of-a-kind items that offer customers a good value and give the company a good profit margin.

Strong culture from within

To put it simply, ARHS was founded on the principle that home furnishings and décor should be obtained ethically, crafted with care, and designed to last. John Reed, who along with his father co-founded Arhaus in 1986, is currently the company’s CEO. John has been at the helm of the company since its foundation, and he has a deep and unyielding devotion to Arhaus. The company is also run by a group of experienced executives who have worked for public companies and have a lot of experience in the retail sector.

Since its founding, Arhaus has aimed to help make the world greener and honor nature. The company cares deeply about the communities it serves and about forming partnerships with groups that share its values. Arhaus collaborates with a wide variety of organizations whose aims are consistent with its own, such as American Forests and Small World, and with local craftspeople throughout the world whose work reflects the company’s dedication to ethically sourced materials.

Valuation

I believe ARHS is worth USD11.29/share in FY23, representing a 1-year return of 25% upside from the date of writing.

This value is derived from my model based on the following assumptions:

- FY22 revenue and earnings to follow management’s guidance since 3Q of the year has already pass.

- Revenue will grow in the low-teens range as what consensus estimates

- Since ARHS is a relatively mature company and margins are more or less in the mature stage, although there are still some room to grow, I assumed margins to stay within the same range moving forward. If margins were to increase, it would only be good news.

- ARHS currently trades at 11x forward earnings and I expect no changes to this.

Key Risks

Dependency on certain key suppliers

The core of ARHS’s business model is the sale of uniquely crafted, premium products that the company sources from a wide variety of suppliers. Although many of Arhaus’s vendors have been working with the company for a long time and the company does not rely on just one or a small number of suppliers for the majority of its products, certain suppliers are the only ones who can provide the company with certain products. As a result, the company might be dependent on particular vendors who provide popular products and might find it difficult to find a replacement if one of those suppliers stopped doing business with Arhaus.

Recession

Clearly, a recession is not good for ARHS as they sell items with high price tags. It is possible that the trust of customers and the amount they spend would decline dramatically and remain low for an extended period, which would result in a decrease in sales.

Summary

ARHS is undervalued at its current share price as of the date of this writing. One of the fastest-growing lifestyle brands, Arhaus operates as an omnichannel retailer of high-end furnishings for the home. The business has reached maturity, and its distinctive business model has proven successful in the marketplace. Since it uses an omnichannel approach, it can reach out to its clients in a wider variety of ways. The business also has a very solid global supply chain strategy and ethical culture.

Be the first to comment