olm26250

The recent uptick in bond yields have some believing that the 60/40 rule of allocating 60% to stocks and 40% bonds is back. I would argue, however, that this allocation methodology is still set up for mediocre returns, considering that stubbornly high inflation would eat up most of the income from the bond side of the portfolio.

That’s why I believe a portfolio of safe income producing stocks is the best bet for those who seek a growing income stream to cover everyday living expenses, whether if you are a retiree, early career, or in your prime working years.

This brings me to Ares Capital (NASDAQ:ARCC), which remains attractive, especially after the recent drop due to its equity raise. In this article, I highlight what makes ARCC a good growing income stock to buy on the dip, so let’s get started.

Why ARCC?

Ares Capital is the largest BDC by asset size, and is externally managed by the well-respected Ares Management (ARES), a leading alternative asset manager that operates in the credit, real estate, and private equity spaces. It was founded 18 years ago, and at present, carries a $21.2 billion investment portfolio at fair value, that’s spread across 452 different portfolio companies.

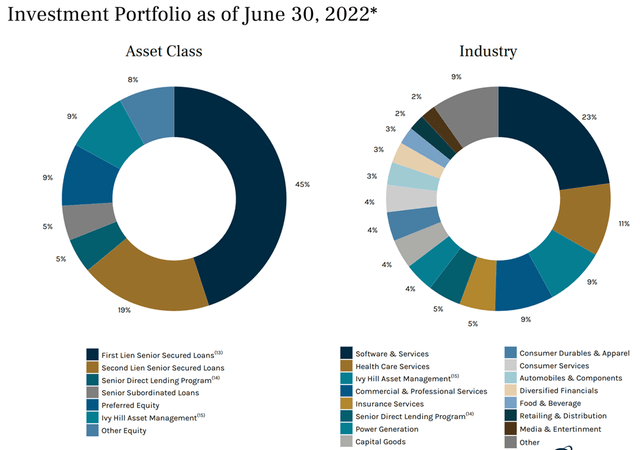

ARCC’s portfolio is well balanced with around two-thirds of it being senior secured loans (45% first lien, 19% second lien) and the remainder is comprised of higher yielding subordinated loans, preferred equity, and common equity for a growth kicker. Notably, ARCC is also invested in another asset manager, Ivy Hill Asset Management, whose president is affiliated with ARCC. As shown below, ARCC’s investment portfolio is geared towards growing and defensive sectors, with software and services, healthcare, and business services being its top 3 sectors.

ARCC Portfolio Mix (Ares Capital)

ARCC just posted strong Q2 results, with core EPS of $0.46 beating the consensus estimate by $0.02, and rising by 9.5% YoY from $0.42 in the prior year period. This was driven by benefits of rising rates, higher dividends from its portfolio companies, and credit stability within its portfolio.

Notably, NAV per share did decline by 1% YoY to $18.81. I’m not too concerned, however, as this was due to market volatility and economic uncertainty, which resulted in wider credit spreads between corporate and U.S. Treasury bonds. This results in lower valuations on loan principal as investors expect to get a higher yield for taking on more risk.

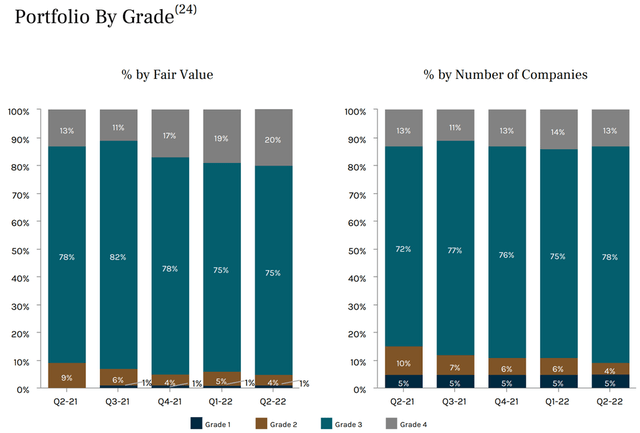

Meanwhile, its investment portfolio remains stable, with just 1 new loan added to nonaccrual status during Q2. Its total nonaccruals represent 1.6% of portfolio cost, sitting well below ARCC’s 10-year average of 2.5%. As shown below, ARCC’s portfolio credit quality has improved over the past year, with a material movements between grade 2 and grade 3 (the higher the better) segments.

ARCC Portfolio Quality (Ares Capital)

Looking forward, ARCC is set to benefit from rising rates, as 74% of its debt investments are floating rate. Rising rates have benefitted ARCC’s weighted average yield on debt, which currently sits at 9.5%, comparing favorably to 9.0% in the prior year period. It also maintains plenty of dry powder to fund its pipeline, with $4.6 billion in total available liquidity, and the balance sheet remains solid with a 125% debt to equity ratio, sitting comfortably below the 200% statutory limit.

Management has expressed the opportunity presented by rising rates and the ability of portfolio companies to withstand higher interest payments, as noted during the conference call:

We believe the continued increase in market interest rates present a potential opportunity for the growth of our core earnings given our largely floating rate loan portfolio and is financed by mostly low-cost, fixed-rate, unsecured sources of financing. If the full impact of the market rate moves this quarter had flowed through our entire quarter, we calculate that our second quarter core earnings could have been about 11% higher on a run rate basis.

Additionally, should market rates increase 100 basis points from the June 30 levels, our quarterly core earnings could benefit by about $0.08 per share or a 17% increase over our second quarter core earnings. We believe the benefits of these market rate increases to earnings will be more impactful in the third quarter and beyond.

We also do not believe the currently projected increase in rates will result in deteriorating credit performance. Holding all else equal, including leverage at the borrower level, a 150 basis point increase in market rates would result in a weighted average interest coverage ratio in the portfolio of approximately two times. Importantly, this analysis doesn’t consider any EBITDA growth or deleveraging that has historically occurred in the portfolio.

Meanwhile, ARCC recently rewarded shareholders with a 2.4% dividend bump to $0.43 per share, resulting in an 8.9% dividend yield. Moreover, ARCC is currently paying a $0.03 special dividend per quarter, which boosts the yield to 9.5%. The regular dividend is also well-covered by Q2 core EPS of $0.46.

I see value in ARCC, especially after its drop after the equity raise announcement. At present, it carries a price-to-book ratio of 1.03x. As seen below, ARCC has generally traded in the 1.1-1.2x range over the past 3 years, outside of periods with material discounts.

ARCC Price-to-Book (Seeking Alpha)

Investor Takeaway

Ares Capital Corporation is a high-quality BDC that’s well-positioned to benefit from rising rates. It has a strong portfolio, plenty of liquidity, and a solid balance sheet. The dividend is also well-covered and offers a high yield. I believe the recent equity raise announcement has created an opportunity for investors to buy ARCC at a discount to historical valuations.

Be the first to comment