luoman/iStock Unreleased via Getty Images

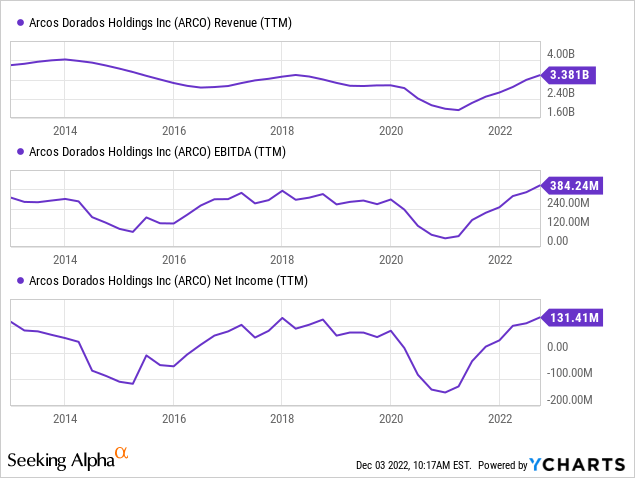

Arcos Dorados (NYSE:ARCO) is a master franchisee of McDonald’s (MCD) in Latin America. The company has been quickly recovering from the pandemic slump. The recovery in Latin America has been slower than in the northern hemisphere while consumers have required more time to get their personal finances back into shape.

Although the stock is not particularly cheap, combining good fundamentals, valuation and technical setup the stock looks fairly attractive for a long-term investor or for a swing trade. The company has posted sales and EBITDA records and it has resumed to pay a dividend. Valuation has room to the upside and combined with good financial development the chart has an interesting potential for a breakout to the upside.

Company overview

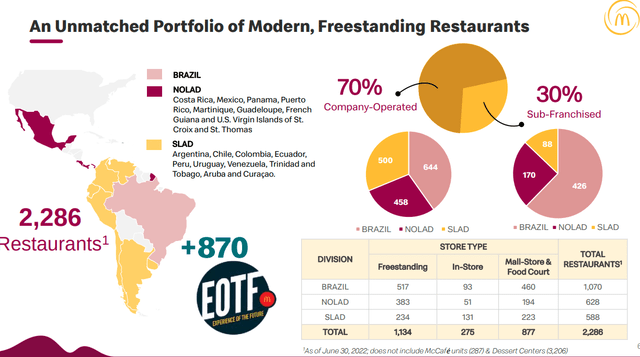

Arcos Dorados operates approximately 2300 McDonald’s restaurants. 70 % of them are company operated and the rest sub-franchised. Nearly half of the restaurants are located in Brazil and the rest in other countries from Chile to Mexico. The company has exclusive franchise rights for McDonald’s in 20 countries.

The footprint of Arcos Dorados (Arcos Dorados company presentation)

The company owns or leases the land and/or the property, operates the restaurant or derives rental income and franchise fees from the sub-franchisees. Arcos Dorados owns nearly all of the buildings of free standing restaurants. The company sources the key ingredients of the food from suppliers approved by McDonald’s and the non-core from local suppliers selected by Arcos Dorados.

Arcos Dorados has the potential to open 1000 restaurants in 10 years. In the following two years the company is planning to open 200 restaurants, which in historical perspective seems achievable. Arcos Dorados is pursuing to increase digital, delivery and drive-thru sales. Digital sales will increase efficiency of the restaurant and the latter two will increase the capacity and the reach of the restaurant. Digital channels generated 42% of third quarter sales.

38% of economic and 75% of voting rights are owned by the chairman Woods Staton, who established the company by acquiring the Latin American operations from McDonald’s in 2007. Most of the leadership of the company has been part of the journey for a very long time. Nine out sixteen members of the management team joined the company before the year 2000 and four out of those nine before the year 1990.

Arcos Dorados has posted several earnings and revenue surprises in the recent quarters. This year the earnings per share has improved tremendously. In the first quarter the EPS improved from a loss of $0.13 to positive $0.12. The following two quarters EPS doubled year on year. Systemwide sales growth has been 42%, 48% and 34% per quarter. In the latest earnings call the company communicated that the last quarter has had a very strong start.

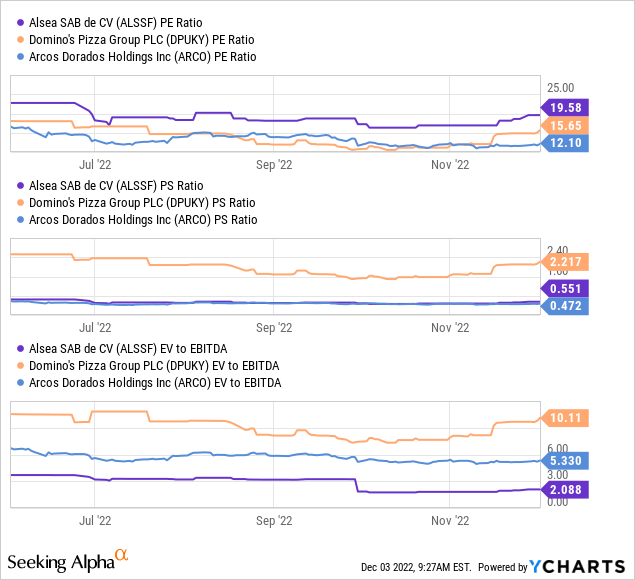

Not cheap but reasonably valued

The expectations for the company’s earnings growth are not very high. Based on annual forward EPS of $0.52, using current P/E of 14 as terminal multiple and 12% discount rate, only 4% annual earnings growth is expected to justify current share price. Lowering the discount rate to 10% and raising terminal multiple to 15, would justify a share price of $9 with 4% annual EPS growth. According to Seeking Alpha the compound annual EPS growth rate has been 10% for the past 5 years.

Equivalent master franchisee companies trade at similar multiples as Arcos Dorados. Domino’s Pizza Group (OTCPK:DPUKY) [LSE:DOM] listed in London and holding the master franchise for Domino’s Pizza in the United Kingdom trades at P/E 16.5 and same store sales growth has been historically 3-4%. Although the company has been overearning due to a pandemic tax relief, DOM deserves slightly higher multiples due to the fact that it mostly sub-franchises restaurants and has very limited direct exposure to actual restaurant operations.

Mexican Alsea, franchisee of multiple chains including Burger King and Starbucks, trades at P/E of 17. With Burger King Alsea is a direct competitor to Arcos Dorados. Alsea’s same store sales growth was 30.5% in the third quarter compared to 34.2% by Arcos Dorados. Alsea has a more diversified portfolio of restaurant chains and could therefore deserve a slightly higher multiple.

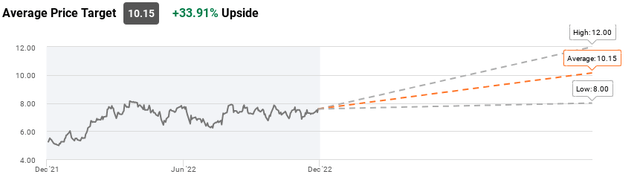

Average target price of ten Wall Street analysts is $10.15, with a low of $8 and a high of $12. All analysts have given either a buy or strong buy rating. The stock has impressively delivered 30% return year-to-date while S&P 500 has declined 15%.

Analyst price targets for Arcos Dorados. (Seeking Alpha)

The stock is interestingly trading between a range that formed itself before the pandemic. Additionally, the stock is forming a symmetrical triangle and long and short moving averages have consolidated around at $7.3. Although the stock has several times attempted to break out from the triangle, further positive earnings surprises could help the stock to break to the upside.

The stock is trading in between long-term range and forming a symmetrical triangle. (Trading view, Author)

Dividend payment recently resumed

The dividend history is sporadic and won’t give a good picture of the company as a dividend stock. Arcos Dorados suspended its dividend during the pandemic and resumed paying the dividend in April 2022. This year the company will pay a dividend of $0.15 per share resulting in a dividend yield of approximately 2%. The dividend is well covered by annual projected EPS of $0.52.

Unfortunately the company does not have clear dividend policy. Arcos Dorados prefers to invest for the growth. Thanks to the recent growth its cash and debt position is comfortable. The debt stands at 1x to EBITDA. Due to the growth ambitions an investor should not base an investment decision to the dividend or its growth.

Downside considerations

Although the company has been posting record sales and EBITDA growth numbers, it’s more than likely that the pace is short-lived. When the growth rates normalize the market could get upset and punish the stock. Therefore it’s important to manage risk appropriately.

Arcos Dorados is expecting to pay a royalty rate of 6% to McDonald’s in the following two years. Additionally the company is contractually required to spend 5% of gross sales on marketing. Fees based on gross sales could be particularly problematic in a current market environment of high inflation. While inflation could nibble the margins, such payments fixed to the top-line will grow in line with the price increases that easily lag cost increases.

Unlike McDonald’s, as a restaurant operator Arcos Dorados is heavily exposed to price increases of key production inputs such as food ingredients, paper and packaging and electricity. Inflation will naturally limit the purchasing power of the consumers. This is particularly concerning for Arcos Dorados due to the fact that McDonald’s is a much more discretionary choice for eating out in Latin America than it is in the United States or Europe. Naturally, a further depreciation of the currencies of emerging markets could dampen good financial development.

Conclusion

Arcos Dorados is a servant of one of the most respectable brands on earth. Latin America offers growth potential as it has done for many decades while letting down investors from time to time. Basic necessities can anyhow be a growth industry and the umbrella of McDonald’s works as an extra protection.

The return to the normal is still on-going in Latin America providing a short-term tailwind to the restaurant industry. Reasonable valuation, strong momentum and good fundamentals could provide an interesting entry point for an investor looking for a swing trade or longer investment backed by growth prospects, a well-covered dividend and a respectable brand.

Be the first to comment