XH4D/E+ via Getty Images

Overview

Archer Aviation (NYSE:ACHR) is an aviation company specializing in Electric Vertical Takeoff and Landing aircraft, or ‘eVTOL’ in the industry’s parlance. The electric part of EVTOL is self-explanatory, and Vertical Takeoff & Landing is exactly how it sounds – an aircraft that fits this description would not require a runway to get into the air.

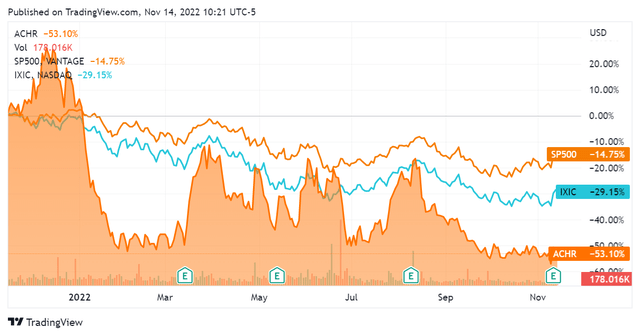

The company entered the public markets via a SPAC merger with Atlas Crest Investment Corporation in Q4 2021 and has been a relatively volatile stock since then, with its overall price performance now trailing both indices significantly.

SeekingAlpha.com ACHR 11.14.22

What makes Archer unique is that it is extremely early in its growth cycle to be trading as a public security. The company is still in its research & development stage, as it has not yet even developed its go-to-market product. It is currently in the process of building and testing a prototype to submit for approval. As it moves towards launch/go-to-market, it faces two primary types of hurdles: the various kinds of regulatory approval that it will require, as well as establishing a supply chain and manufacturing process for its product. Of course, the business model itself must also prove to be viable.

This article will look at the company through the lens of what it is – an early stage and relatively speculative business that happens to also be a publicly traded instrument. To this end, we will look into the strategic concept underlying the business as well as its progress toward its objectives.

Strategic Review

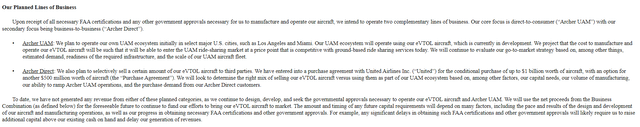

Archer Aviation is set to have two primary lines of business: Archer Urban Air Mobility ‘UAM’ and Archer Direct. Archer UAM will essentially be Uber except with electric aircraft, with the company stating that it expects this direct-to-consumer service to be price-competitive with existing ground mobility offerings.

Archer Direct is more straightforward and involves selling the planes to business customers. It’s worth noting that these two businesses are economically complementary since they both make use of the same asset – eVTOL airplanes – albeit for two distinct customer types (consumer and business). If executed properly this creates economies of scale for product manufacturing while not having either business line cannibalize the other.

SEC Atlas Investment Corp 8-K Q1 2021

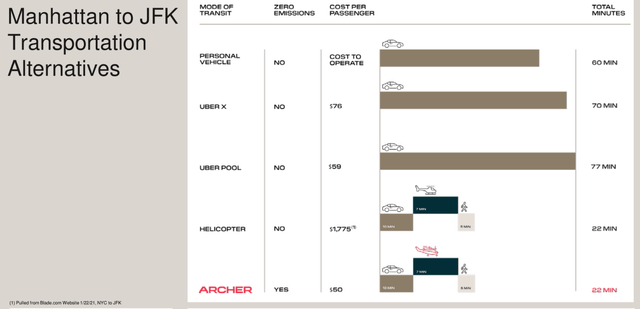

To contextualize this further, the Urban Aerial Mobility business can be readily compared to helicopter transport. The existing reality of helicopter transport proves the concept and establishes a floor for demand. The distinction here is in the pricing and general availability of the offering; can Archer make this rarefied method of transport generally available and generally affordable? That remains to be seen, but they are intimately aware that this is the problem to be solved.

SEC ACHR Investor Presentation Q1 2021

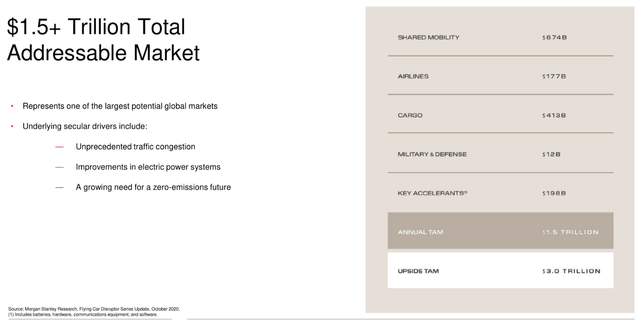

The expected market size for this business is expected to be significant. Looking at the SEC disclosures that Atlas Investment Corporation released in the process of its merger with Archer, we see an estimate of a $1.5 – $3.0T market by 2040 established by Morgan Stanley. It is outside of the scope of this article to look into the assumptions underlying this metric.

SEC ACHR Investor Presentation Q1 2021

Additionally, the aforementioned market size estimate includes all components of eVTOL, inclusive of the hardware, software, and services that are to be provided. Since Archer is building the first iteration of an eVTOL aircraft and associated business model, it will have to build each of these components in turn – and should thus be able to deliver value across the entire spectrum of its target market. As such I find it reasonable overall to take this as an estimate of the size of its target market.

Progress

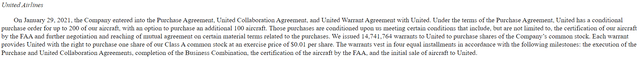

Archer had already achieved significant milestones towards entering the market when it became a publicly traded security, namely its conditional purchase agreement with United Airlines. This represented the first agreement of its kind within the nascent eVTOL industry.

Since then, Archer has also established licensing around a route for its service, between Newark International Airport and a helipad in downtown Manhattan. While this is some time away it indicates that management has continued to deepen the relationship and work towards the $1B (+$500MM option) conditional purchase commitment that it had previously signed with United. As with its previous agreement, it represents the first agreement of its kind within the space.

The company has also been executing test flights of its GTM aircraft for its UAM offering – dubbed ‘Midnight’. This represents the actual production variant of the aircraft ‘Maker’ that it has been working on, i.e. the exact model to be certified and subsequently manufactured. As of the end of Q2 2022, Archer states that this design is feasible for entering FAA certification as it now stands. It has probably demonstrated its vertical liftoff capability and is now undergoing tests for its full flight and landing capabilities as of this article.

The company has continued to demonstrate progress on compliance/certification, having initially signed a G-1 Certification Basis with the FAA in Q4 2021. This represents the first step in the certification process for aircraft. Worth noting is that the FAA has updated its requirements for this type of certification since, although Archer makes explicit that its aircraft had already been designed with these elements (certain kinds of air durability) in mind; management does not expect any further design changes will need to be made.

Since Archer intends to unveil its production aircraft ‘Midnight’ on 11/16/2022, it actually appears to be somewhat ahead of schedule in delivering its objectives.

SEC ACHR Investor Letter Q3 2022 11.14.22

Additionally, management has stated that it has 64% of its bill of materials (exhaustive list of components for construction) established.

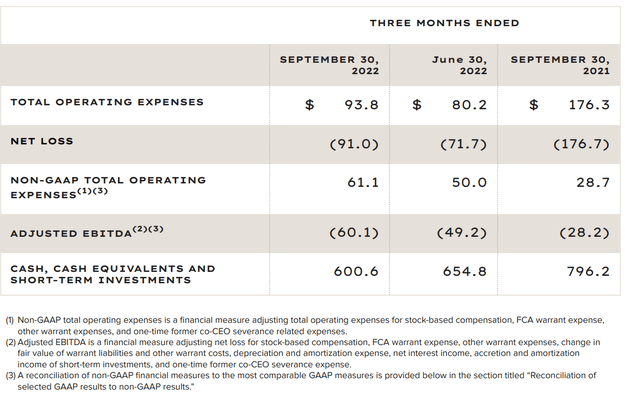

The company also disclosed details about its cash position and operating expenses, with the company estimating a further $100-$110M loss in the following quarter.

While this may be significant, the firm has $600.6M cash & cash equivalents on hand, which should allow it to operate into mid-2024 without any further financing. Given the company’s uniquely strong momentum within its space, I am of the opinion that further financing would not be an issue for the firm. Additionally, United Airlines’ $10M down payment could represent the first batch of what will be a more sizeable sum down the line.

SEC ACHR Investor Letter Q3 2022 11.14.22

Conclusion

Archer Aviation has demonstrable momentum toward executing its vision. While very early stage, it has achieved significant milestones and appears to be very much on track to be certified and in production on time.

I expect that the company’s press release on 11/16/2022 will draw further attention to the company and could actually drive some appreciation in the near term. Overall, this looks like the market leader in terms of momentum within the eVTOL space. While I only took a cursory look at management, the presence of Ken Moelis and Marc Lore give me comfort about the company’s capacity to raise additional capital if necessary.

It will be worth continuing to pay attention to this growth story. Since this is an early-stage growth stock and difficult to price according to future expected cash flows, its current market capitalization of $637M does not reflect an accurate price of it even being able to enter and capture its target market.

As more news comes out and management stays on track as to executing its vision, future performance will price into the stock and it would be fair to expect appreciation. I like the specificity of this company’s vision and its material progress on its (also specific) objectives, and I am additionally optimistic as it has achieved several industry ‘firsts’. Considering all of these factors together, I rate this stock a buy.

Be the first to comment