baranozdemir

Thesis

Arch Resources (NYSE:ARCH) reported a robust Q2 card after a massive surge in coal futures prices in Q2. However, we believe the market’s tepid reaction suggests it’s looking ahead, assessing for potentially falling coal prices, given worsening macroeconomic headwinds.

Notwithstanding, we believe that ARCH is likely at a bottom on its medium-term chart. Therefore, dip buyers could be using the current support to add exposure, further corroborated by a bear trap price action (indicating the market denied further selling downside).

Our analysis suggests that ARCH could stage a short-term rally given its bottoming process. However, we don’t encourage investors to join this potential rally, as we anticipate a steeper fall in coal prices ahead.

Our valuation model also suggests that adding at the current levels could lead to significant market underperformance over the next four years.

Given its recent bottom, we rate ARCH as a Hold for now. Investors are urged to use its next top to sell and cut exposure after a potential short-term rally.

Q2 Was Absolutely Great!

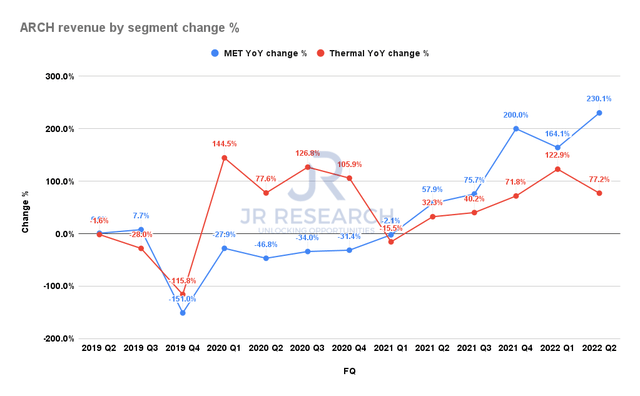

ARCH revenue by segment % (Company filings)

As seen above, Arch Resources delivered another remarkable quarter in Q2. Met revenue grew by 230% YoY, following Q1’s 164% surge. Thermal also posted revenue growth of 72% YoY, down from Q1’s 122.9%. Overall, Arch Resources posted revenue of $1.13B, up 151.6%.

We believe it demonstrated another highly impressive quarter for Arch as it leveraged record high coal prices in Q2, driven by the tight supply/demand dynamics, Europe’s energy and geopolitical crisis, and global demand. The company also believes that the medium- and long-term drivers underpinning the company are robust. CEO Paul A. Lang highlighted (edited):

We see market dynamics, particularly in the supply arena, that should continue to support a healthy long-term supply and demand balance in the coking coal markets. Underinvestment in coking coal capacity in recent years continues to weigh heavily on the long-term outlook for global metallurgical coal supplies, which should bode well for the longer-term pricing environment. (ARCH Q2’22 earnings call)

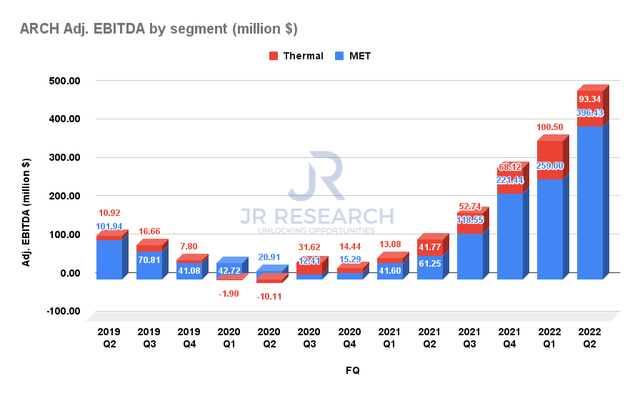

ARCH adjusted EBITDA by segment (Company filings)

Notably, met has also been driving its adjusted EBITDA gains tremendously. In addition, the company also sees the opportunity to further develop its thermal coat market, given the current pricing dynamics. COO John Drexler accentuated (edited):

The opportunity is significant given the price that we’re seeing in the thermal markets now. The interest is extremely high. We’re in a position now where we’re going to evaluate the opportunities. But, don’t get us wrong. We’re not changing into a thermal coal producer. But in our met segment, we do plan on taking advantage of what we see with the dislocation currently, which we think over time could put more pressure on the markets. Clearly, we’ll continue to work closely with our metallurgical customers. But right now, with where we see the opportunity, we’re going to optimize value here as we go forward. (ARCH earnings)

But, What’s Next?

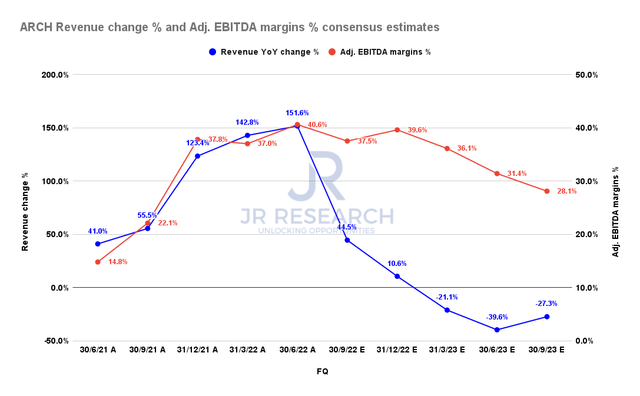

ARCH revenue change % and adjusted EBITDA margins % consensus estimates (S&P Cap IQ)

However, the consensus estimates (very bullish) suggest that Arch Resources’ revenue growth has likely peaked in Q2 and could continue to moderate through FY23. Furthermore, its adjusted EBITDA margins are also expected to fall markedly through FY23 as topline growth slows, giving back its leverage gains.

The Newcastle Coal futures contract pricing of $252.95 for May 2026 also indicates a marked fall from the current month’s contract pricing of $405. Therefore, we believe the Street consensus seems credible, and investors need to factor the potentially steep fall in coal pricing into their valuation models. Arch Resources also cautioned in its filings (edited):

Our profitability and the value of our coal reserves depend upon the prices we receive for our coal. Declines in the prices we receive for our future coal sales contracts, could materially and adversely affect us by decreasing our profitability, cash flows, liquidity and the value of our coal reserves. (ARCH 10-Q)

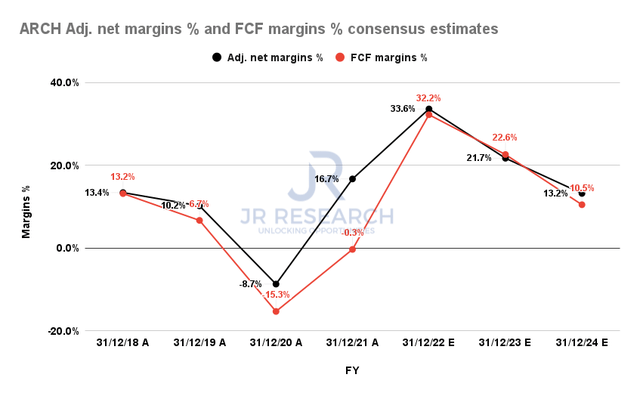

ARCH adjusted net margins % and FCF margins % consensus estimates (S&P Cap IQ)

Some investors could point to the company’s solid capital allocation policy, as it committed to returning 50% of its prior quarter’s discretionary cash flow (modeled as free cash flow (FCF) in our chart) through dividends. Moreover, its plans for the remaining 50% include strategic stock repurchases, which could boost shareholder value further.

However, investors need to be wary that the company’s FCF profitability could continue to fall markedly through FY24, impacting its capital allocation model. Hence, we aren’t surprised to learn that Arch Resources added a new risk in its Q2 filings. It emphasized (edited):

Our ability to declare future dividends and make future share repurchases will depend on our future financial performance. Therefore, our ability to generate cash depends on the performance of our operations and could be limited by decreases in our profitability or increases in costs, regulatory changes, capital expenditures or debt servicing requirements. Any failure to pay dividends or repurchase shares of our common stock could negatively impact our reputation, lessen investor confidence in us, and cause the market price of our common stock to decline. (ARCH 10-Q)

ARCH’s Price Action Looks Ominous

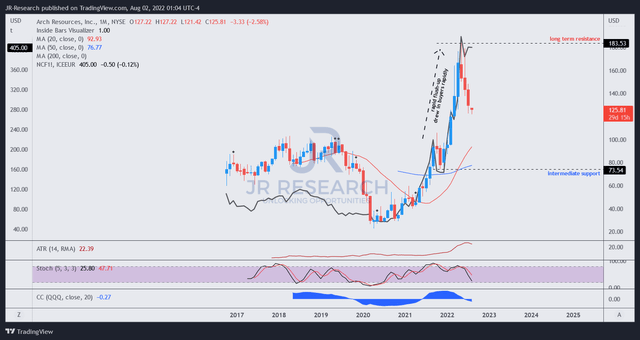

ARCH price chart (monthly) (TradingView)

ARCH formed a double top bull trap (indicating the market denied further buying upside resolutely) in May 2022, which saw it fall more than 30% to its current levels. ARCH’s de-rating also came ahead of coal futures (black line overlay), as seen above.

However, we believe coal futures should align with ARCH’s de-rating, as rapid, vertical surges are not sustainable.

Is ARCH Stock A Buy, Sell, Or Hold?

ARCH is likely at a medium-term bottom. But, we don’t encourage investors to buy this dip. Instead, investors should consider its next top (after a potential short-term rally) to sell and cut exposure.

Therefore, we rate ARCH as a Hold for now.

Be the first to comment