milehightraveler/iStock via Getty Images

Introduction

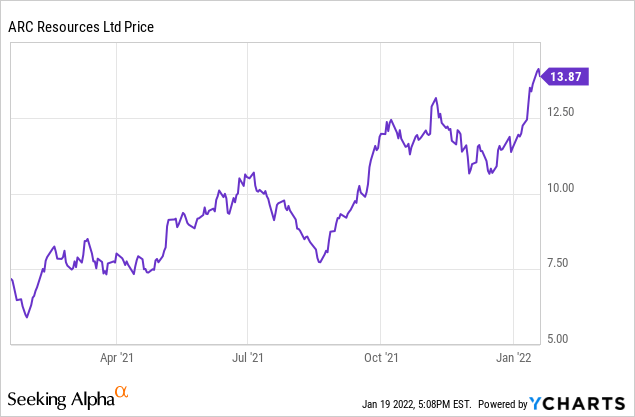

The past year has been great for oil and gas producers. The high and continuously increasing prices allowed most companies to rapidly repair their balance sheet and sparked M&A activity. ARC Resources (OTCPK:AETUF) acquired Seven Generations Energy (OTC:SVRGF) to combine the operations to a producer with an average daily output of approximately 350,000 boe/day. Two thirds of the oil-equivalent output consists of natural gas and with natgas prices trading at very strong

ARC Resources is a Canadian company and I would recommend to trade in the company’s shares using the primary listing on the TSX. ARC is trading with ARX as its ticker symbol and the average daily volume in Canada exceeds 3M shares per day.

A quick look back to the Q3 results explains what we can expect for 2022

Arc Resources has already published its capex guidance for 2022 and this already allows us to project the anticipated free cash flow. A first step is obviously to calculate the anticipated operating cash flow as this will ultimately determine how much free cash flow ARC Resources will be able to generate.

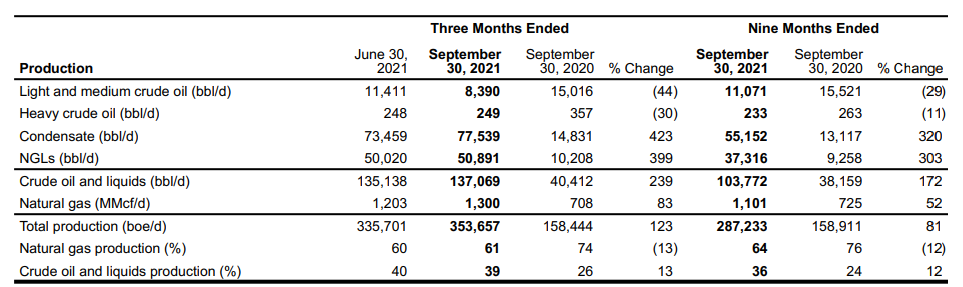

As the company still has to publish its full-year results, I would like to use the Q3 results to have a rough idea of what ARC can achieve in 2022. In the third quarter, the company produced just over 335,000 boe/day, and 60% of the oil-equivalent production consisted of natural gas. Crude oil represented less than 4% of the oil-equivalent production rate and condensate and NGLs are far more important than crude oil. So although ARC Resources publishes its production results in barrels of oil-equivalent, it should be clear the company is and should be valued as a natural gas producer.

ARC Resources quarterly report

The company reported an average realized natgas price of $3.34/Mcf while it received C$74 per barrel of oil, C$78 per barrel of condensate and just over C$22 per barrel of NGL. Applying the normal conversion ratios, this resulted in an average realized commodity price of C$34.90 per barrel of oil-equivalent.

ARC Resources quarterly report

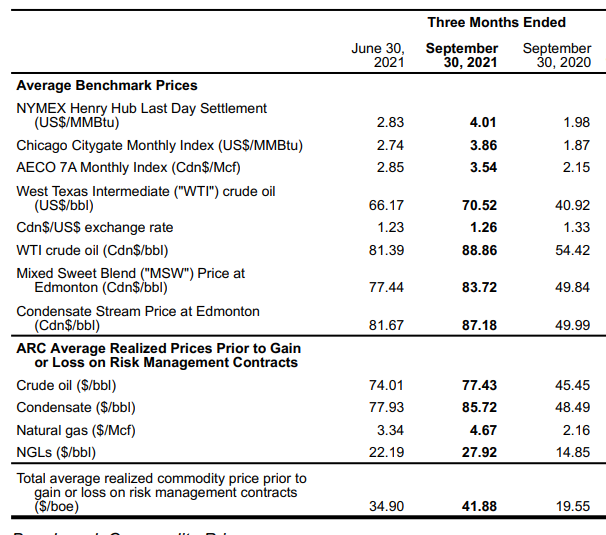

The company reported a net income of C$54M despite recording a loss of almost C$525M on its hedge book, and that’s why it’s more important to have a look at the operating cash flows of ARC Resources.

The image below shows the reported operating cash flow was C$615M, but we need to add back the C$53M investment in the working capital position as well as the C$97M change in other liabilities as these are non-recurring elements. We should deduct the C$20M in lease expenses from that result, and after doing so you end up with an adjusted operating cash flow of C$745M. Note, the company reported an adjusted funds flow of C$765M, but I think it’s only fair to also deduct the lease-related cash outflows.

ARC Resources quarterly report

The total capex in Q3 was just around C$266M resulting in a free cash flow result of approximately C$480M.

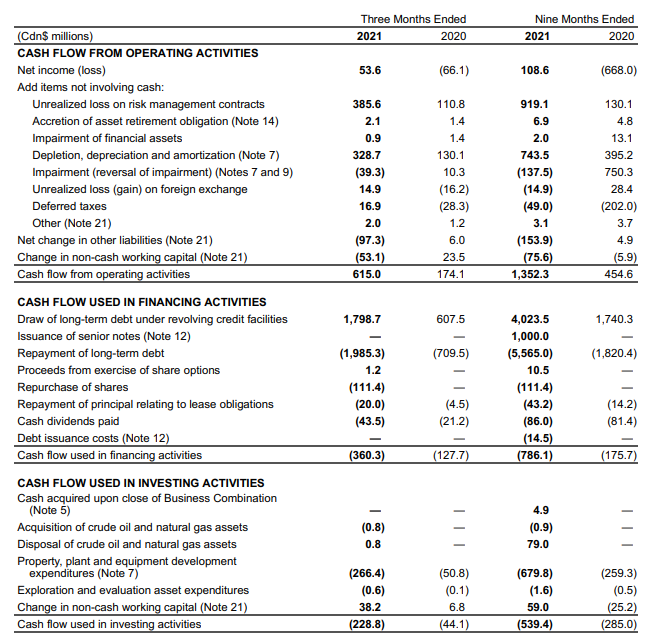

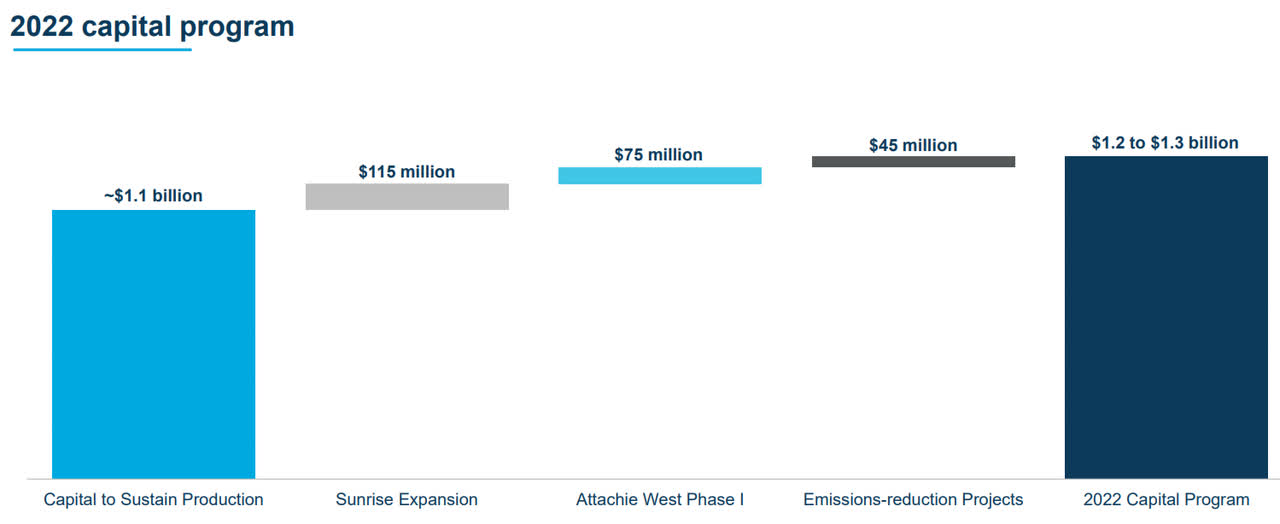

That’s great, but rather than looking backwards, we need to figure out what 2022 will bring. The company has already provided a rough capex guidance as it plans to spend C$1.2-1.3B on capex this year, which should result in an average production rate of 335-350,000 boe/day. The sustaining capex was budgeted at C$1.1B.

The next step is to figure out the anticipated operating cash flow. Using the Q3 results, we end up with an annualized operating cash flow of approximately C$3B. I think the result may be higher than that. First of all, the Q3 results include a realized loss on the hedge book of almost C$200M. So excluding these realized hedging losses, the adjusted operating cash flow would have been approximately C$900M on an after-tax basis.

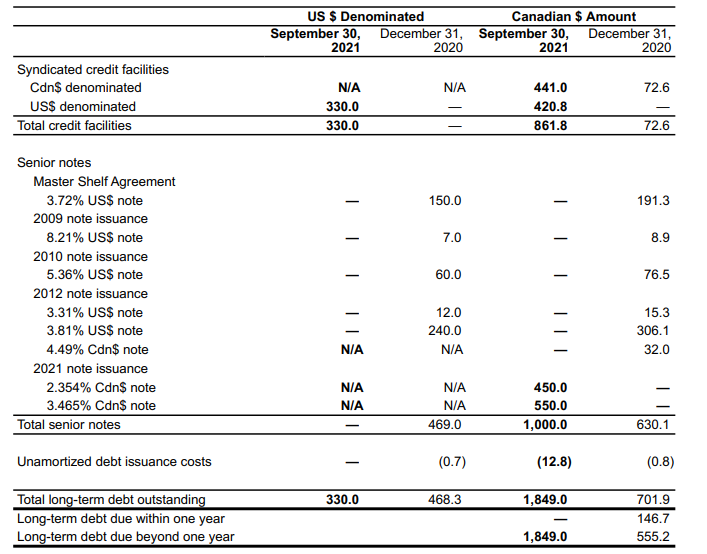

Secondly, As of the end of September, ARC had a total gross debt position of approximately C$1.85B on the balance sheet. About half of this debt is represented by bonds but there’s about C$862M of bank debt.

ARC Resources debt situation

As ARC Resources will generate in excess of C$100M in free cash flow per month, I would assume the bank debt will be repaid accordingly which should reduce the interest expenses and thus boost the cash flow.

Based on the reported results in Q3, and that is including the realized hedge losses and excluding potentially lower interest expenses, the annualized operating cash flow will come in at around C$3B and after deducting the C$1.3B capex (including growth capex), ARC should generate C$1.7B in free cash flow in 2022.

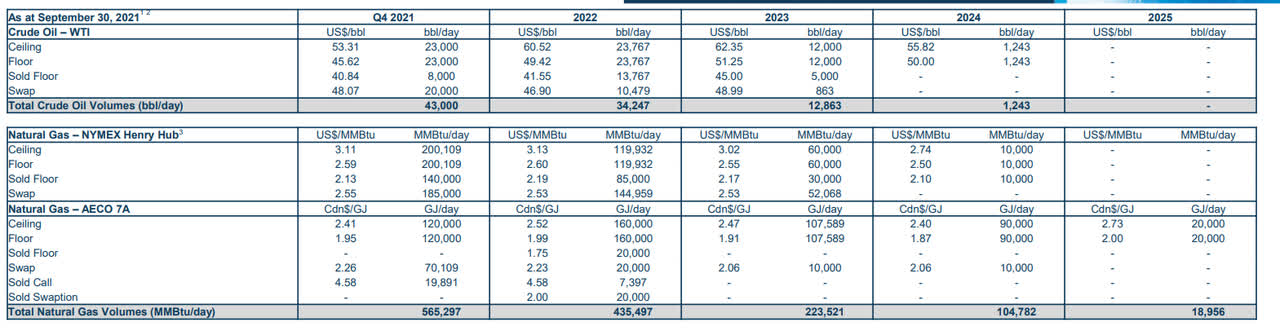

ARC Resources presentation

As the natural gas price remains strong and ARC’s hedges are reducing, I wouldn’t be surprised to see ARC actually exceeding the C$3B in operating cash flow although the realized losses on the hedge book this year will be relatively high (the unrealized losses reported in FY2021 will mainly be realized in 2022). On an underlying basis, ARC’s assets are generating north of C$4B per year in operating cash flow at the current commodity prices.

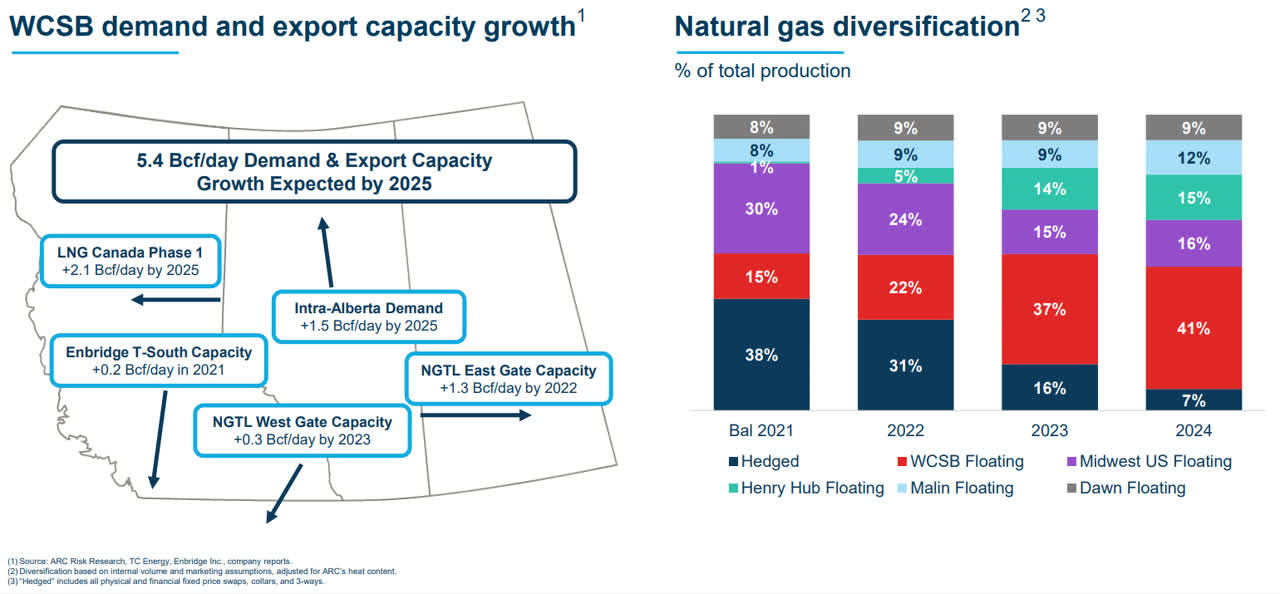

ARC Resources presentation

Investment thesis

ARC Resources has pledged to spend 50-80% of its free cash flows on shareholder rewards. The current quarterly dividend of C$0.10 is costing the company just under C$300M per year so we can expect ARC to spend a substantial amount of cash on special dividends and/or share buybacks.

I hope ARC will apply a 50% ratio when times are good as that will allow for a sufficient margin to keep the shareholders rewards at a high level when the situation changes and starting off at an 80% payout ratio would likely immediately put the company under pressure. And although I’m not worried about the net debt (and neither is the market considering the two bonds have a yield to maturity of 2.7% and 3.5% for the 4-year and 9-year bond), it’s in times like these ARC can rapidly reduce its net debt.

I don’t have a long position in ARC Resources but it is presenting itself as a very valid investment idea to gain exposure to the Montney gas region in Canada. ARC Resources will generate almost C$2B in free cash flow this year (including losses on the hedge book) at the current commodity prices and now it’s up to ARC’s management team to spend the cash wisely.

Be the first to comment