Geber86/E+ via Getty Images

Although often seen as a mundane and outdated business practice, the fact of the matter is that there is a large and growing demand for printing. Consumers and businesses alike sometimes need such specialized service that it can make more sense, financially, to outsource their print jobs. And one company that is there to meet this need is ARC Document Solutions (NYSE:ARC). Although financial performance seen most recently has shown some improvements for the enterprise, the past several years have been defined by falling revenue and cash flows. Long term, this does create some risk for investors, though that risk needs to be put in context and needs to factor in recent upside and long-term catalysts. In addition, when you factor in just how cheap shares of the company are, it seems likely that some upside is warranted.

An expert in digital printing

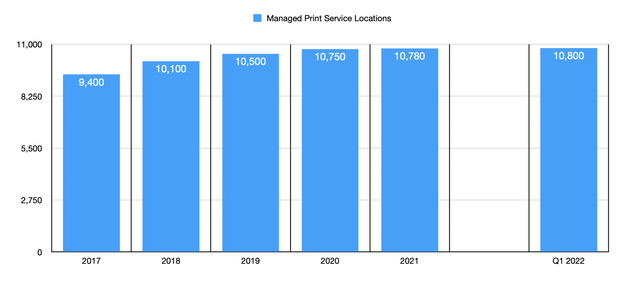

The management team at ARC Document Solutions describes the company, first and foremost, as a digital printing business. to be more specific, the company will print documents of any size or color on materials ranging from plain paper to vinyl to fabric and more. It will also print fabric, metal, wood, and even three-dimensional substrates. From time to time, the company does produce high page count material like manuals or catalogs. But most of its digital printing is focused on low volume content of a high-quality nature that the company can turn around to its customers quickly. It also offers other printing-related services. Its managed print services focus on acquiring digital printing equipment and placing it in its customers’ facilities for their own use based on service level agreements. Across its network, the company provides these operations at more than 10,800 locations. Included in this line of business is the software that helps customers control their print expenses and to connect their customers’ remote employees with their offices and with its own ARC print centers nationwide.

Another service the company offers is referred to as scanning and digital imaging. In short, the enterprise scans hardcopy small format or large format documents, typically saving them in a PDF format for their customers. the company is also able to handle sensitive documents in a way that complies with HIPAA. Through this line of offerings, the company also provides cloud-based document management software and other digital hosting services to its customers. And finally, the company also sells equipment and supplies to some of its customer base. Services under this umbrella include providing equipment maintenance.

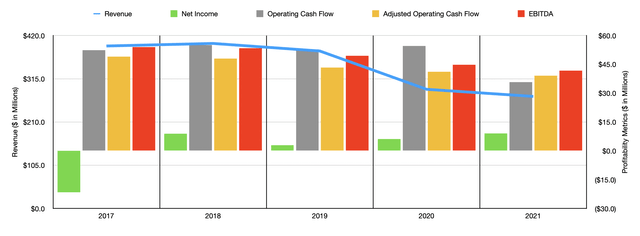

Over the past few years, the financial picture for ARC Document Solutions hasn’t been all that great. After seeing revenue tick up from $394.6 million in 2017 to $400.8 million in 2018, it began a consistent decline. In 2019, it fell to $382.4 million. In 2020, it fell further, plunging to $289.5 million as a result of the COVID-19 pandemic. There might have been some hope of a recovery in 2021, but that proved to be fruitless. That year, sales dropped further to $272.2 million. It is worth mentioning, however, that the decline in 2021 was driven entirely by weak results in the first quarter of the year. The rest of the year, sales came in stronger than they did one year earlier. In the final quarter, for instance, revenue totaled $69.2 million. That was 7.6% above the $64.3 million seen one year earlier.

The bottom line for the company has looked quite a bit mixed in recent years. Net income, for starters, has been all over the map. The worst year was 2017 when the company generated a loss of $21.5 million. In 2020, net profits of $6.2 million dwarfed the $3 million achieved one year earlier. And in 2021, net income rose further to $9.1 million. Probably a better measure of the company’s profitability would be cash flow. But in this case, we do see some weakening over time. After hitting $55 million in 2018, it fell to $35.8 million in 2021. If we adjust for changes in working capital, the picture becomes much clearer. From 2017 to 2021, the metric fell year after year, declining from $49.1 million to $39.1 million. Another metric that followed a very similar trajectory was EBITDA. It ultimately dropped from $54 million to $41.7 million over this same window of time.

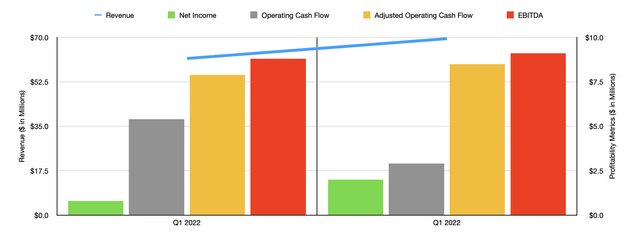

The good news for investors is that we are starting to see something of a recovery. Not only did the company see positive revenue growth in most of 2021 but it also experienced an increase in sales in the earliest stages of 2022. During the first quarter of this year, the company generated sales of $69.5 million. That’s up from the $61.7 million seen one year earlier. Net profits jumped from $0.8 million to $2 million. Operating cash flow did worsen, declining from $5.4 million to $2.9 million. But if we adjust for changes in working capital, it would have risen from $7.9 million to $8.5 million. Meanwhile, EBITDA for the company also grew, inching up from $8.8 million to $9.1 million.

Overall, the industry for digital printing services looks set to continue growing. According to one source, the global market for this was worth $24.8 billion in 2021. The expectation is for this to continue growing at an annualized rate of 6.7%, eventually hitting $34.3 billion in 2026. Investors who are worried about ARC Document Solutions possibly returning to a downturn given historical performance should pay attention to one very close metric. That would be the number of managed print service locations the company has. I believe that as long as this number continues to grow, the company will ultimately set itself up for long-term growth as well. Back in 2017, the number of locations was just 9,400. That number increased each year, including through the pandemic, eventually hitting the 10,800 we have today. Admittedly, growth has slowed to a crawl, with the company adding just 30 locations from 2020 through 2021 and adding only 20 locations in the latest quarter. But any sort of increase should be an indication of long-term potential for the enterprise.

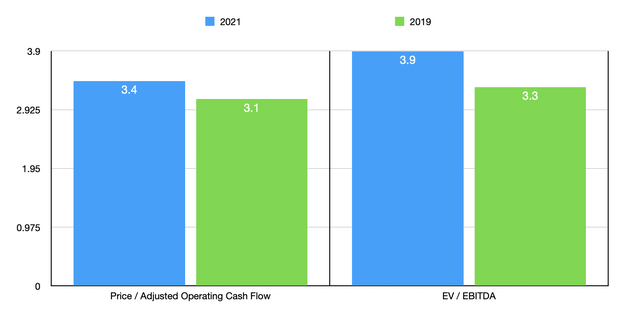

In addition to this, there is the undeniable fact that shares of the company look incredibly cheap at this point in time. Using our 2021 results, the firm is trading at a price to adjusted operating cash flow multiple of 3.4. Using the EV to EBITDA approach, the multiple comes in at just 3.9. If the company reverts back to the kind of performance it achieved in 2019, these multiples would be even lower at 3.1 and 3.3, respectively. To put this in perspective, I decided to compare the company to five other companies that have similarities to it. However, I must say that none of these are perfect comparables. Of the five, four had positive results. Using the price to operating cash flow approach, these companies ranged from a low of 3.5 to a high of 23.6. Using the EV to EBITDA approach, the range was from 4.6 to 31.8. In both cases, ARC Document Solutions was the cheapest of the group.

| Company | Price/Operating Cash Flow | EV/EBITDA |

| ARC Document Solutions | 3.4 | 3.9 |

| Atento S.A. (ATTO) | 12.5 | 8.6 |

| Virco Manufacturing (VIRC) | 3.5 | 31.8 |

| American Rebel Holdings (AREB) | N/A | N/A |

| Kimball International (KBAL) | 20.6 | 31.6 |

| NL Industries (NL) | 23.6 | 4.6 |

Takeaway

Based on all the data provided, ARC Document Solutions strikes me as a fundamentally cheap company that the market has not yet recognized as a likely turnaround prospect. I do not deny the fact that the company’s historical performance leaves a bad taste. But overall, I think fears regarding the business, while not wholly unfounded, are overblown at this time.

Be the first to comment