The Good Brigade/DigitalVision via Getty Images

Why Arbor Realty?

Arbor Realty Trust, Inc. (ABR) is a $2.26 market cap mortgage REIT that invests in a diversified portfolio of structured finance assets in the multifamily and commercial real estate markets, e.g. bridge and mezzanine loans, including junior participating interests in first mortgages, preferred and direct equity, and it operates in two business segments: Structured Loan Origination and Investment Business (or “Structured Business”) and Agency Loan Origination and Servicing Business (or “Agency Business”).

I bought Arbor in May 2020 for $17.50 per share and am considering now whether I should “shop my wardrobe” and add to this position in a near future, or look for new stocks. Since I do not know much about mortgage REITs besides what I learned from preps for the CFA exams, I considered it as an opportunity to catch up with the company’s information for the last few quarters, learn more in-depth about the business model, and write an article about what I think now about Arbor.

I listened to its 4Q 2020, 1Q-3Q 2021 calls, as well as I paged very patiently through its 10-K 2020. I also reviewed a couple of articles by other contributors to SAs who did an excellent job of explaining the business and presenting the numbers as the earnings reports were flowing in. I invite you to read other articles for more details on the business lines breakdown. I do not think I can add much value here by repeating what is already there. I am approaching Arbor from a slightly different perspective – one of a curious ignorant who wants to compound her hard-earned disposable euros by investing them into well-managed businesses. My takeaways from both SEC filings (I read only 10-K for 2020) as well as from the content of earnings calls (including questions of the analysts) are contributing to the formation of a “gut” feeling on whether I trust the management and whether the business makes an overall sense to me. Hence, I will not provide either a comprehensive comparison with the peers (besides stock performance for 2021) or my outlooks on the sector, but rather my take on some major opportunities and risk factors that transpire from the general conversation. The main feature that makes Arbor stand out in my portfolio is that I do not have any other mREIT in my portfolio – although, I do have other REITs (O, STAG, OHI, and some European ones).

I noticed in the four of last earnings calls that there are usually four-five the same analysts, some of whom have followed the company for a while already. What strikes me positively is that all of them are almost at all times extremely positive about the company’s performance (I heard “Wow!” more than once, I believe) and give often kudos to the management for sailing the strange 2020 – 2021 waters so well, and producing an amazing growth story. In fact, the growth is so big that Arbor staff have to send clients away and I got the impression that the company even has temporarily prolonged their announced response time to give more leeway for the processing of requests.

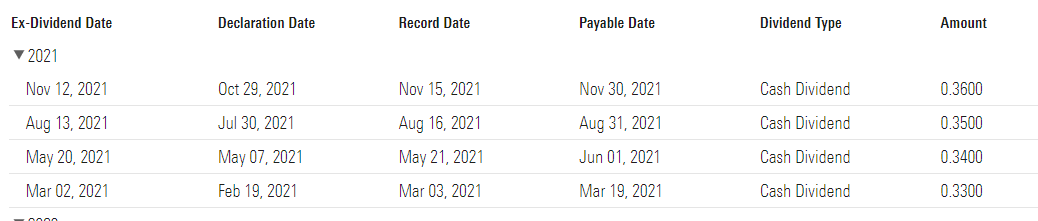

Indeed, the performance of Arbor in comparison to peers has been amazing if you consider that in 2020 alone Arbor returned 7.4 % (total return) while the peers in commercial mortgage space performed with a loss, as Arbor management summarized in the 4Q/full-year 2020 press release. My own comparison of stock price (price return) performance in 2021, in comparison to Blackstone Mortgage Trust’s (BXMT), Starwood Property Trust’s (STWD), Chimera Investment Corporation (CIM), AGNC Investment Corp. (AGNC), New Residential Investment (NRZ), as well as and VanEck Mortgage REIT Income ETF (MORT) is below.

Source: TradingView

The only security that outperformed Arbor was Chimera with a staggering 53.2%. The next one close to Arbor’s 32.5% was Starwood with 31.2%. Blackstone Mortgage Trust’s (BXMT) returned 17%, New Residential Investment (NRZ) nearly 13%, while AGNC Investment Corp (AGNC) finished with a loss: -2.27%. The only ETF in this comparison returned a decent 10.5%.

Nuts and bolts of financing

I think it’s quite important to understand the mechanics of Arbor’s business. Company’s main business objective is to maximize the difference between the yield on its investments and the cost of financing these investments. Arbor regularly issues debt to fund the growing pipeline of loans and investments. Some of such instruments are collateralized loan obligations (“CLO”). I am not sure about the structures of CLOs for 2021, however, I found in 10-K 2020 some interesting information about the preceding ones. For example, CLO XIII (the only last one launched in 2020), totaled $800 million of real estate-related assets and cash, of which $668 million were investment-grade notes issued to third-party investors. In the 9 months of 2021, Arbor added 3 new CLOs totaling $3.1 billion. On December 13, Arbor announced the closing of a $2.10 billion commercial real estate mortgage loan securitization, which seems to be their biggest CLO to date. In 2020 Arbor closed their first Private Label multifamily mortgage loan securitization totaling $727.2 million. Two additional Private Label securitizations in the 9 months of 2021 reached $985 million. Besides debt, Arbor raised $158 million of growth capital through the issuance of common shares in 1Q and $138 million in 2Q 2021. In November, Arbor announced its plan to make a public offering of 7,500,000 shares of the common stock, from which a part of proceeds would go to purchase 562,000 shares from the company’s executives. The company issues as well preferred shares – recent series D, E & F were offered in 2021.

Arbor Realty operates as REIT and is doing its utmost to keep this IRS status and not to fall under the Investment Company Act. Arbor also needs to be very vigilant to meet all the requirements of Fannie Mae, Freddie Mac, and Ginnie Mae in order not to be kicked out from their agreements with these GSEs. In fact, for 2020, Arbor Realty has been ranked 6th in the Top Fannie Mae DUS Multifamily Lender list. What we need to bear in mind, though, is that GSEs have a cap of $78 B on multifamily loans, so Arbor has been looking for a way out to capture a chunk of a $400 B securitization market left beyond these caps. Hence, the venturing to Private Label securitizations.

Dividend

Arbor finished the year 2020 with the third consecutive quarterly dividend increase reflecting a 10% increase in 2020 in comparison to 2019, with the payout ratio of around 70%, compared to an industry average of 95% to 100%. In 1Q 2021 the payout ratio reached as low as 65%.

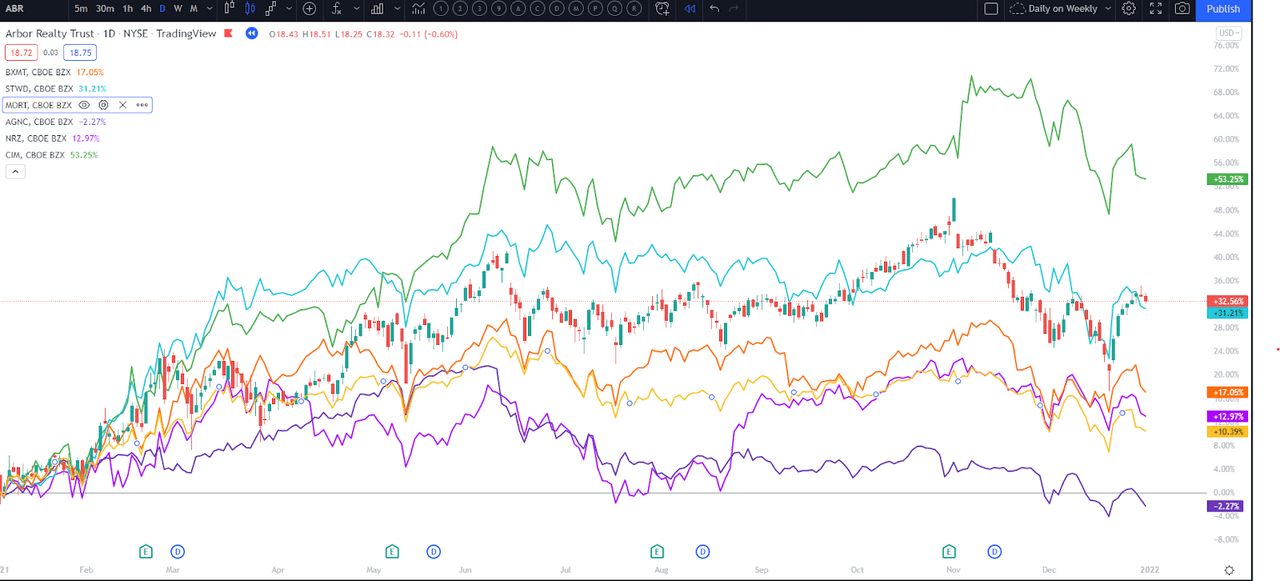

The management (Paul Elenio – Chief Financial Officer, Ivan Kaufman – President and Chief Executive Officer) often reiterated how important it is for them to have Arbor amongst members of dividend elite clubs – which for the company started in 2021 with a 10-year streak of dividend growth. Forward yield (as of January 5) is 7.86% As you can see in the screenshot below, the dividend was increased each quarter in 2021.

Source: Morningstar

Given that Arbor finished 2020 with a current cash and liquidity position of approximately $400 million, I am looking forward to the 2021 Annual report to see the 2021 cash position which will give me some assurance regarding the safety of the dividend coverage.

Ownership

I will turn now to the issue of institutional and insider ownership. I really do like to check the institutional ownership of the stocks I consider or own. For a $2.26 billion market cap REIT with 123,4 million shares float, only nearly 45.5% of shares are owned by institutional investors. The management team holds significant ownership (~14%) which is good news for both teams who believe that under-owned companies hold a promise for the future big inflow of investors when the market starts paying attention to it, as well as for those who believe that strong internal ownership is a good omen of alignment with the rest of shareholders. There are, of course, people who hold both beliefs at the same time. In 3Q 2020, twenty-three more institutions have started a new position or increased the existing ones vs. closing or decreasing moves. A notable and the 2nd biggest new buyer was Canada Pension Plan Investment Board, which manages over $88 B in assets. Amongst increased positions, number 1 is by Blackrock Inc., which purchased $262 million worth of shares. One of the usual participants on the calls is Lee Cooperman, CEO of Omega Family Office, who owns 2,266,837 shares – the 5th biggest institutional owner of Arbor. Mr. Cooperman provides also very sharp questions during the calls. No wonder, since Arbor is his 18th biggest position in their 65-position $1.9 billion-worth portfolio, even after shedding 100 thousand shares according to the 3Q 13-F filing.

Nevertheless, worth noting that in each call the management repeats that they believed that the stock was undervalued and that it should trade at a premium. Accordingly, in 2021 at least four execs purchased the company’s stock for some dozens of thousands of dollars at a time.

Portfolio exposure during COVID-19 pandemic

Arbor had in 2020 very little exposure to the asset classes that have been affected the most by the pandemic-related downturn, such as retail and hospitality – the value of approximately $200 million or approximately 4% of portfolio for 4Q 2020 dropped to only $100 million in 2Q 2021, a 1% allocation of the overall assets respectively. Arbor started in 2020 to position itself towards the single-family built-to-rent space in concordance with the demographic shift toward less dense living spaces. Nota bene, it’s a mission-driven, GSE-compliant workforce housing, not luxury mansions. Arbor pays a lot of attention to the quality of developers with whom they collaborate because they cannot risk loan failures. Hence, relationship building and maintenance is of utmost importance for the management, who are personally involved in nourishing the best of these relationships.

Interest rate

Who says debt, says interest rate. In the case of Arbor, which also invests in debt, we speak also about the yield on their investment. As mentioned above, Arbor earns on the spread between its assets and liabilities. I want to bring in here an excerpt from 10-K 2020:

“The overall yield on our loan and investment portfolio in 2020 was 5.83% on average assets of $5.25 billion, which was computed by dividing the interest income earned during 2020 by the average assets during 2020. Our cost of funds in 2020 was 3.35% on average borrowings of $4.50 billion, which was computed by dividing the interest expense incurred during 2020 by the average borrowings during 2020. As of December 31, 2020, our loan and investment portfolio was comprised of 90% floating rate loans and 10% fixed rate loans.”

The average cost of funds in Arbor’s debt facilities decreased to 2.76% for the 3Q from 2.89% for the 2Q, which is already a visible improvement of the debt servicing that Arbor managed to engineer. Liabilities structuring is a fine art and clearly, Arbor’s executives know how to do that. As presented in the 3Q reporting, Arbor’s $9.2 billion investment portfolio had an all-in yield of 4.97%. Much of the losses in spreads along 2021 have to do with people selling their estates which recently appreciated a lot and prepaying the mortgages (so-called “run-offs”). What consoles Arbor’s business is the prepayment fees that owners need to pay as a “punishment”.

Arbor’s interest rate risk management policy consists of attempts to structure key terms of debts to the terms of its assets. They also use interest rate swaps, the purchase or sale of interest rate collars, caps or floors, options, mortgage derivatives, and other hedging instruments. In Agency Business, there is no need for hedging instruments because Arbor enters into contractual commitments with borrowers providing rate lock commitments having first entered into forward-sale commitments with investors so that spread is calculated ahead before quoting to the borrower.

The “big absentee” in the virtual room of the calls was any update regarding the phasing-off process of LIBOR. Most of Arbor’s Structured Business loans and borrowings are variable-rate instruments, based on LIBOR. In 10-K 2020 we can read:

“The Federal Reserve, in conjunction with the Alternative Reference Rates Committee (“ARRC”), a steering committee comprised of large U.S. financial institutions, announced replacement of U.S. dollar LIBOR with a new index calculated by short-term repurchase agreements, backed by U.S. Treasury securities called the Secured Overnight Financing Rate (“SOFR”). The first publication of SOFR was released in 2018. Whether or not SOFR attains market traction as a LIBOR replacement tool remains in question and the future of LIBOR remains uncertain. Operating ahead of the curve, and under the guidance of ARRC and the Federal Housing Finance Agency, Freddie Mac and Fannie Mae ceased purchases of LIBOR-based adjustable rate mortgages and issuance of LIBOR-based mortgage-backed securities as of January 1, 2021, but have not yet released guidance on the transition relative to portfolio loans”.

Arbor launched an internal task force to oversee the coordination of the transition from LIBOR, which includes evaluating and mitigating the risks associated with the transition in areas as legacy transactions, updating agreements and contracts that use LIBOR as a reference rate, modifying policies and procedures to account for the transition, etc. which all could ultimately have a material adverse effect on Arbor’s business, financial condition and results of operations, including the result of changes in interest rates payable by the borrowers or rates payable by Arbor to its lenders. I’m looking forward to hearing more about the results of this internal work team that has been tasked with preparing the company for such a big change.

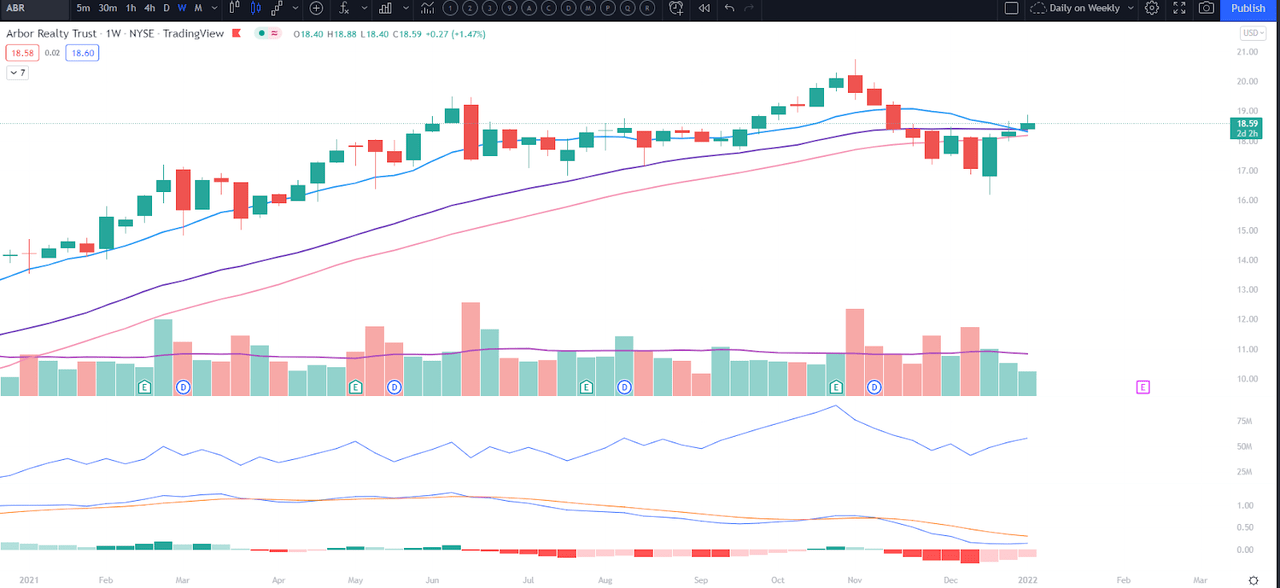

A quick shot at technical analysis

At the current moment, Arbor’s stock could go anywhere. The price is above 10-week (light blue) Moving Average which might for a moment dive under 30-week (dark purple) Moving Average. As long as 30-week MA stays above 40-week MA we can expect also soon MACD to cross above its signal. But one never knows, there might be a shakeout as well in the upcoming weeks.

Source: TradingView

Conclusions

There are lots of things to like about the business: they have stellar Return on Equity, they manage to stay ahead of the cost of debt, they grow their assets while pioneering some financial products and entering a new market of single-family mortgages. I believe the market is waiting for more news on the 2021 results but also on the development of interest rate raises announcements. I have decided to wait a couple of weeks until 10-K 2021 to make a move on the stock. Not for selling in mind, I hope, but rather to time my new allocation.

Be the first to comment