Nyaaka Photo

Corrupt politicians make the other ten percent look bad. ― Henry Kissinger

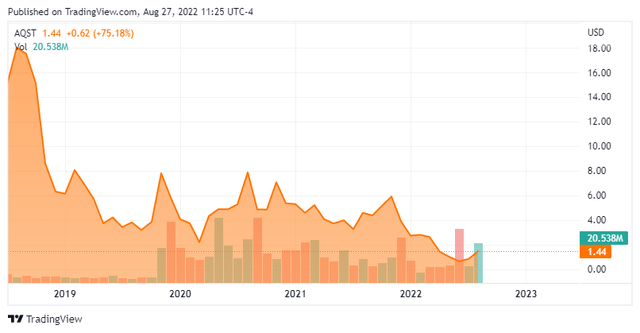

Today, we take our first look at Aquestive Therapeutics, Inc. (NASDAQ:AQST). This biopharma has several products on the market and is pushing two key drug candidates forward. Revenues should increase some 50% in FY2023 but cash burn is a concern. What is on the horizon for Aquestive Therapeutics? An analysis follows below.

Company Overview:

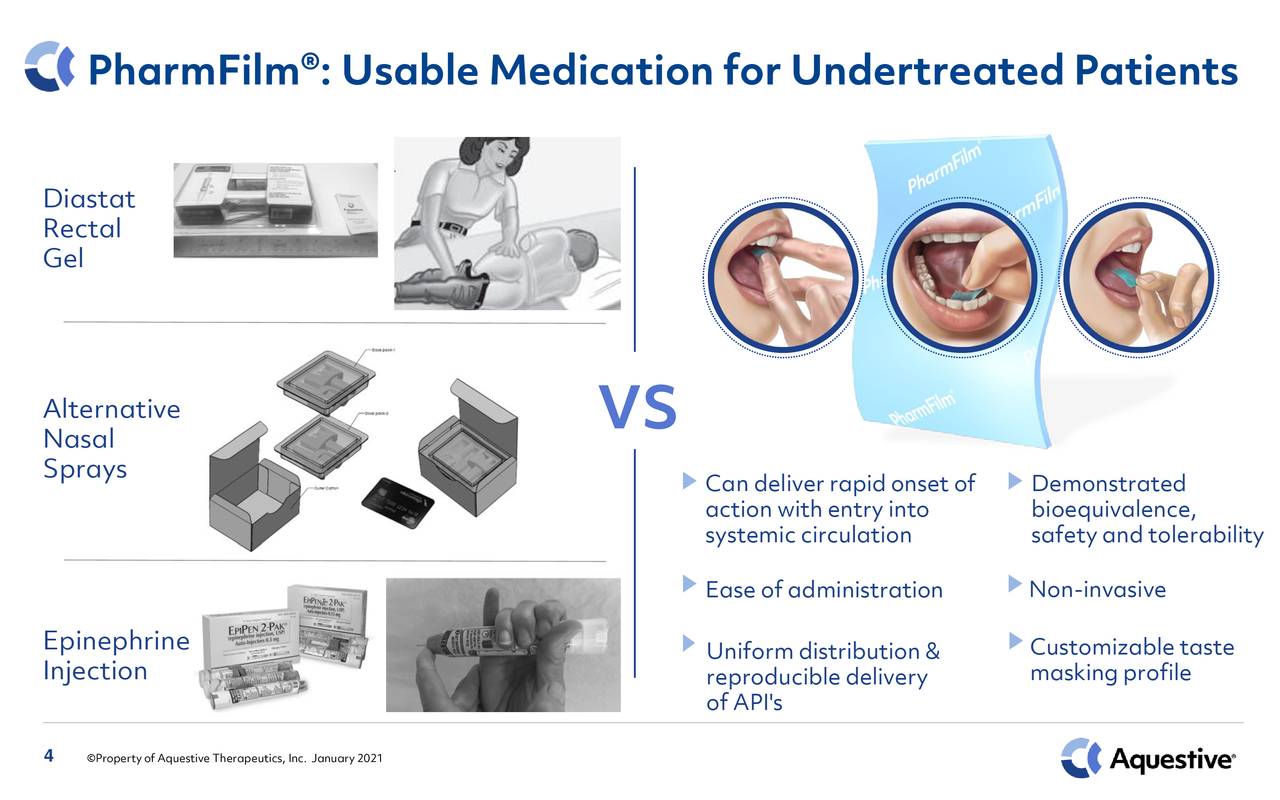

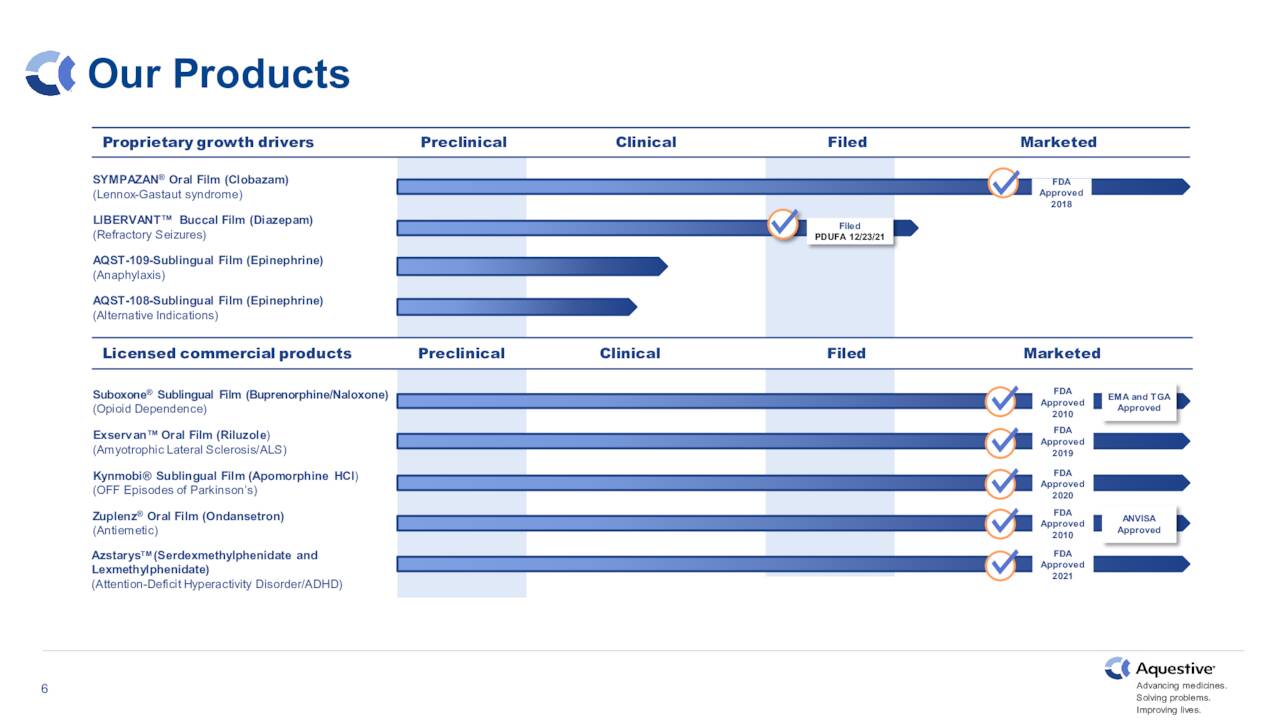

Aquestive Therapeutics is based just outside of New York City. The company leverage’s its highly customizable PharmFilm® technology to deliver products that deliver existing drugs in a more effective way. This small biopharma concern has several products on the market including:

January 2021 Company Presentation

Sympazan

This is an oral soluble film formulation of clobazam for the treatment of lennox-gastaut syndrome

Suboxone

A sublingual film formulation of buprenorphine and naloxone for the treatment of opioid dependence

Zuplenz

This is an oral soluble film formulation of ondansetron for the treatment of nausea and vomiting associated with chemotherapy and post-operative recovery

Azstarys

A once-daily product for the treatment of attention deficit hyperactivity disorder.

The stock currently trades for just under $1.50 a share and sports an approximate market cap of $75 million.

June Company Presentation

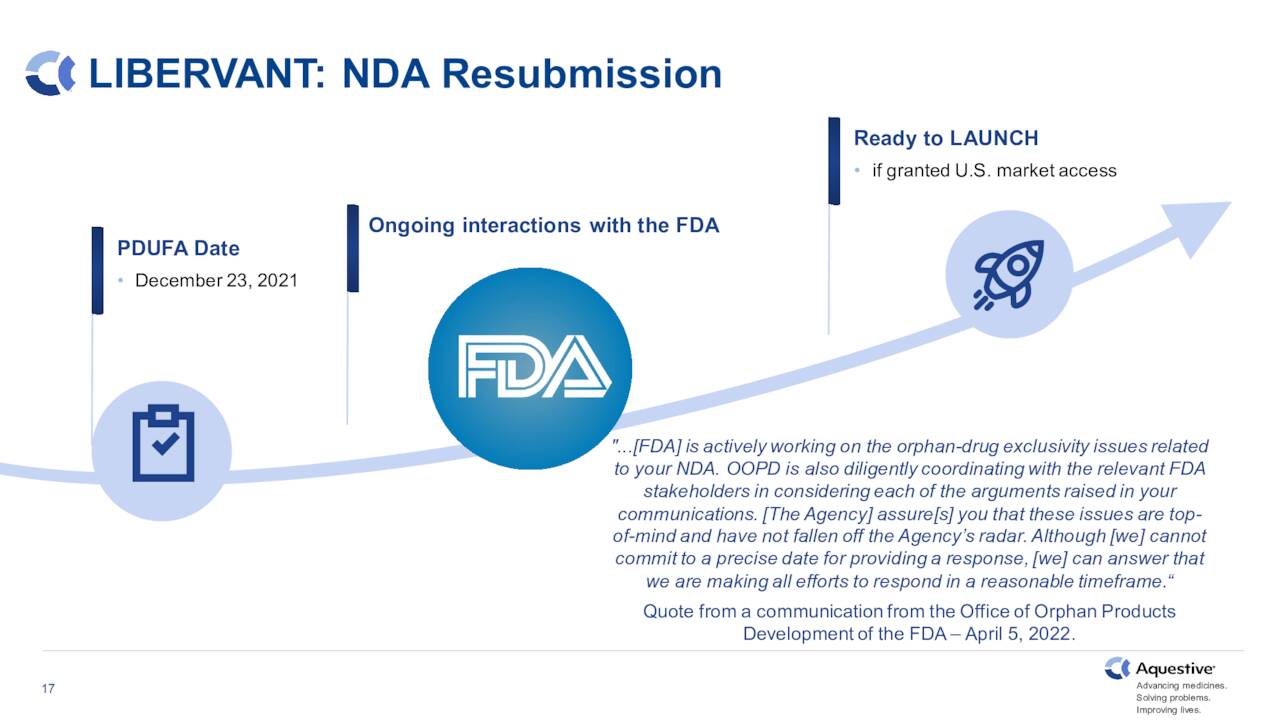

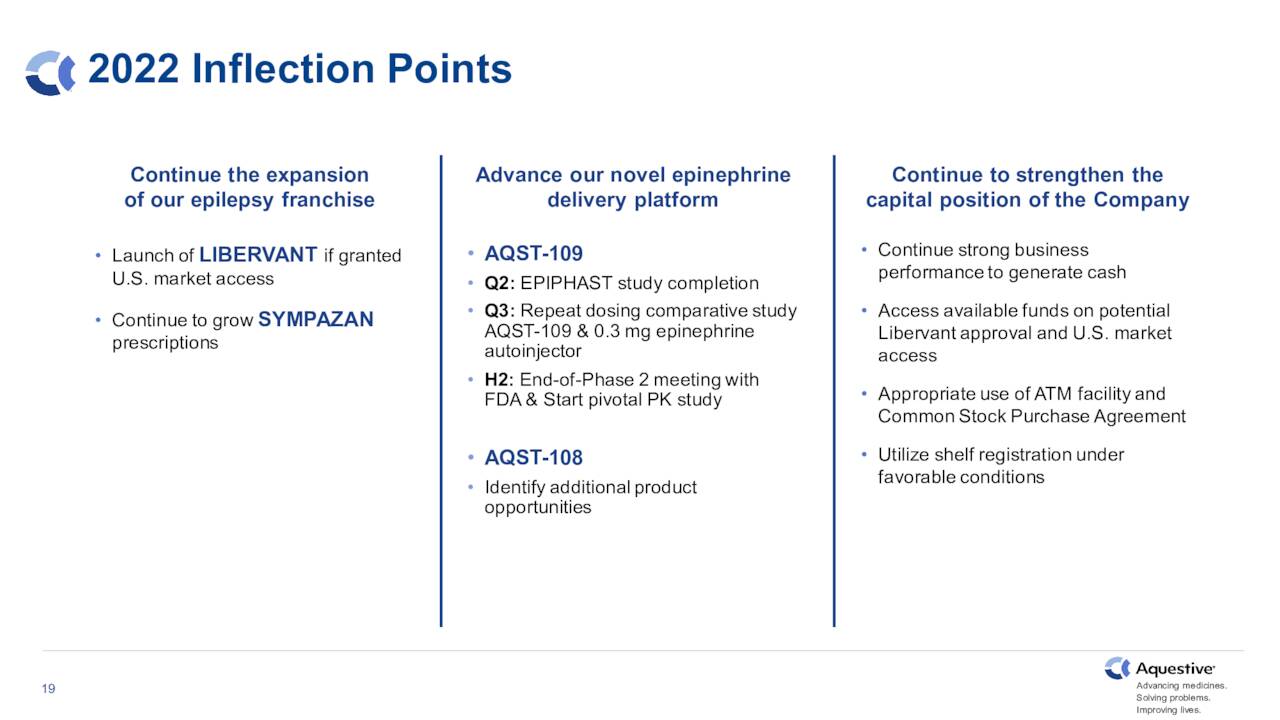

The company has two key acute rescue medications under development that are advancing within its pipeline. The first of these is Libervant, which is a diazepam (known by the brand name Valium) buccal film for the potential treatment of seizure clusters. Approval was supposed to happen at the end of 2021, but was delayed by the FDA. The company is in ongoing conversations with the government agency to get the approval process back on track.

June Company Presentation

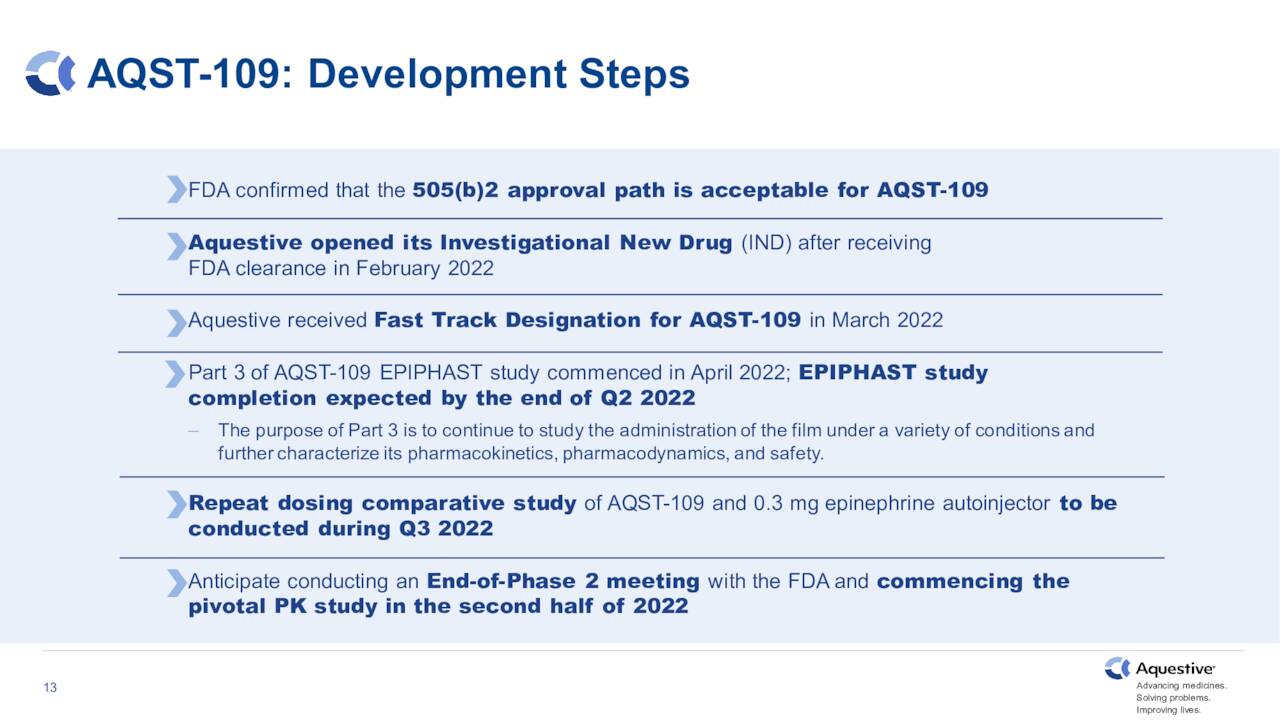

The second candidate moving forward and hopefully in the company’s product portfolio soon is AQST-109. This is an epinephrine sublingual film for the potential treatment of severe allergic reactions, including anaphylaxis.

June Company Presentation

You can see the progress the company has made in 2022, moving this pipeline asset in the approval process. Aquestive is on track to initiate a pivotal study for this candidate sometime before the end of the years. Positive topline results in mid-June from its EPIPHAST study gave the stock a brief boost when they were disclosed and opened the way for this critical next step in AQST-109 approval journey.

June Company Presentation

Second Quarter Results:

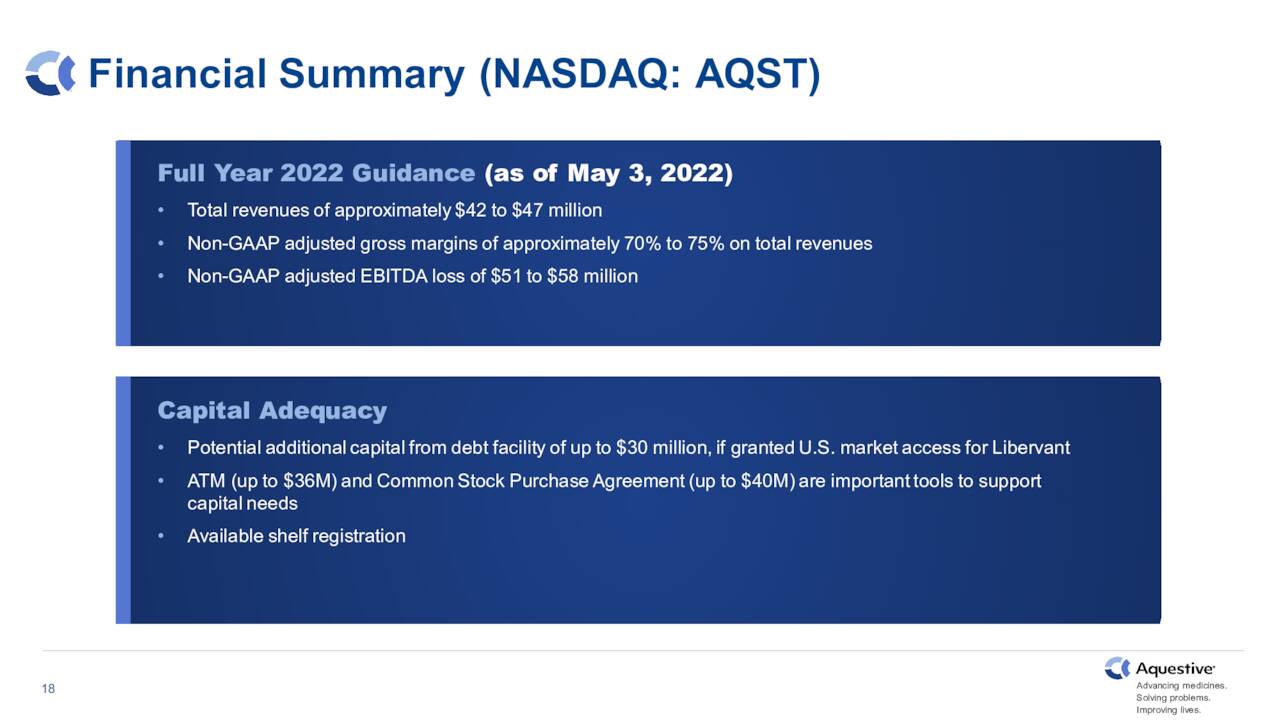

The company posted second quarter numbers on August 2nd. Aquestive had a GAAP loss of 36 cents a share during the quarter, which was in line with expectations. Revenues fell just under 14% on a year-over-year basis to $13.3 million. This was above the consensus but lower than the $15.3 million in 2Q2021. However last year’s results including a onetime $2 million payment. The company bumped up its full year sales guidance to a range of $46 million to $49 million from its previous revenue range of $42 million to $47 million. Management also forecasted a lower full year net loss for FY2022.

| Updated Guidance | Prior Guidance | ||

| Total revenue (in millions) | $46 to $49 | $42 to $47 | |

| Non-GAAP adjusted gross margins | 70% to 75% | 70% to 75% | |

| Non-GAAP adjusted EBITDA loss (in millions) | $37 to $43 | $51 to $58 |

Analyst Commentary & Balance Sheet:

Since second quarter results were posted, JMP Securities ($10 price target), Wedbush ($4 price target) and H.C. Wainwright ($6 price target) have all reissued Buy ratings on the stock.

Several insiders purchased just over $150,000 worth of stock in the first half of June. That is the only insider activity in the shares this year. Just two percent of the outstanding float is currently held short. After posting a net loss of $16.3 million in the second quarter, the company had just $17.7 million of cash and marketable securities on the balance sheet.

June Company Presentation

The company has a potential debt facility access of $30 million upon the approval of Libervant. Leadership has also implemented such expense reductions recently, which included ‘rightsizing‘ its non-sales infrastructure. In addition, it had additional means of funding as described above.

Verdict:

The current analyst consensus has the company losing just over $1.25 a share in FY2022 as revenues fall six percent to $48 million. Sales are expected to rebound by more than 50% in FY2023 and losses are projected to be cut by a third.

June Company Presentation

The company has several potential milestones on the horizon and growth should reaccelerate in 2023. Unfortunately, management is likely to dilute shareholders holders further before Aquestive Therapeutics can achieve break even status. Therefore, until I see the company significantly reduce its quarterly cash burn, I plan to avoid the shares.

And we all know love is a glass which makes even a monster appear fascinating. ― Alberto Moravia

Be the first to comment