JuSun/iStock via Getty Images

It’s generally a good idea to buy above average companies at below average prices. Such may be the case with Applied Materials (NASDAQ:AMAT) whose share price performance has been rather disappointing so far this year, returning -14% since January 1st, underperforming the -5% return of the S&P 500 (SPY) over the same time period. In this article, I highlight what makes AMAT a good candidate at current prices for potentially strong gains, so let’s get started.

Buy AMAT Before Everyone Else Does

Applied Materials was founded 55 years ago with operations across the globe in the U.S., Asia, and Europe. It’s a leader in materials engineering with solutions that are used to produce virtually every new chip and advanced display in the world.

The company’s expertise includes modifying materials at atomic levels and on an industrial scale, and its manufacturing equipment, services, and software serve the semiconductor, display, and related industries. It has an installed base of more than 43K tools with field service engineers and leading chip manufacturers worldwide.

It’s set to benefit from the current strong tailwinds in the semiconductor industry (driven by data center build-outs, 5G deployment, gaming, and autonomous driving), as well as the accelerating adoption of electric vehicles (EVs), which will need increasingly complex semiconductor chips. This puts AMAT in a sweet spot and it’s expected to see strong growth in its top and bottom lines over the next few years.

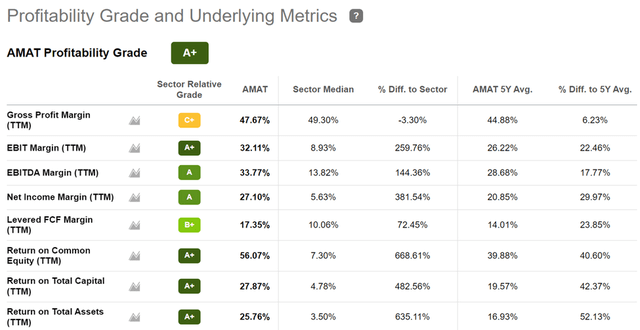

This is reflected by the robust 21% revenue growth it saw during Q1’22 (ended Jan 30) to $6.3 billion. Additionally, AMAT is driving efficient scale, as adjusted operating margin grew by 270 bps year-on-year to 31.7%. This helps AMAT to earn an A+ profitability rating with sector leading EBITDA and Net Income Margins of 34% and 27%, respectively, as shown below.

AMAT Profitability (Seeking Alpha)

Risks to AMAT relate to the supply chain constraints that AMAT and many semiconductor firms are facing right now. However, management remains bullish on the full-year 2022 outlook, noting long-term secular trends that should drive its markets structurally higher. Plus, semiconductor manufacturing is becoming more complex, and Morningstar expects collaboration between chipmakers and equipment providers to reach “unprecedented levels”.

This is also supported by management comments around the important role of silicon and semiconductors and the regionalization of supply in the coming years during the recent conference call:

Today, 9 of the top 10 most valuable companies in the world either design or build chips. Eight of the nine are now designing their own customized silicon in-house, and the other one manufactures a large percentage of the world’s chips by value. I think this is a great example of the fundamental role silicon plays in driving the system level, power, performance and cost improvements that will unlock the full potential of digital transformation and the metaverse.

In addition, the strategic and economic importance of semiconductors is being recognized at a national level. In the coming years, government support and incentives in the US, Europe and Japan will translate into regionalization of supply. As I’ve highlighted before, these regional supply chains will be more resilient but also less capital efficient, which is an additional tailwind for us. Overall, our outlook for the next decade is very positive. We expect semiconductor and wafer fab equipment to grow significantly faster than the economy with outsized opportunities for Applied Materials.

Meanwhile, AMAT sports a strong A rated balance sheet with $5.7 billion in cash and short-term investments on hand. While the 0.76% dividend yield is rather low, it does come with a very low 13% payout ratio and the dividend has grown by 18% since the start of last year.

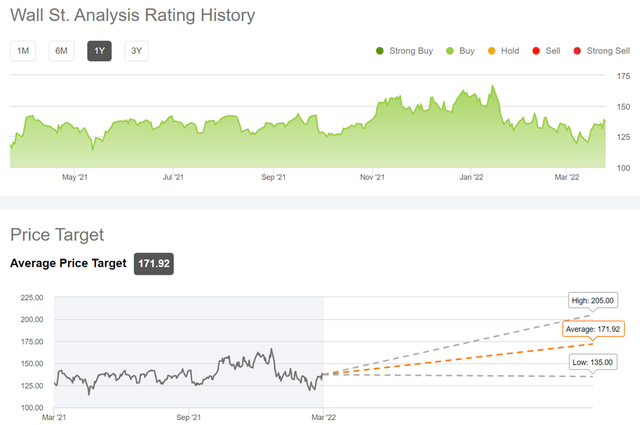

I see value in AMAT at the current price of $137, trading well below its 52-week high of $167. It carries a forward P/E of 16.8, which is reasonably low considering that analysts expect between 9% – 29% EPS growth over the next 4 quarters. Sell side analysts have a consensus Buy rating on AMAT with an average price target of $172, implying a potential one-year 26% return.

Investor Takeaway

Applied Materials is a strong growth stock that is benefiting from the long-term tailwinds in the semiconductor industry. It has a strong balance sheet and is trading at a reasonable forward P/E of 16.8 considering the robust forward estimates. Meanwhile, it’s grown the dividend at an impressive pace in recent years. I see value in AMAT at the current price for potentially strong total returns.

Be the first to comment