hanibaram/iStock via Getty Images

In 2022 and through 2024, the semiconductor and semiconductor equipment market will have gone through a Bust, and Bust cycle. In this article I will present the timeframes of each cycle, the catalyst for the start and stop, and the semiconductor and semiconductor equipment companies most impacted.

I will show that these two Bust cycles are different, and Applied Materials (NASDAQ:AMAT) has the largest revenue exposure to each of these catalysts causing the bust. AMAT announces F3Q earnings after market close on August 18, 2022, and investors need to consider the issues presented in this article.

Bust #1

Dismal Guidance from Semis

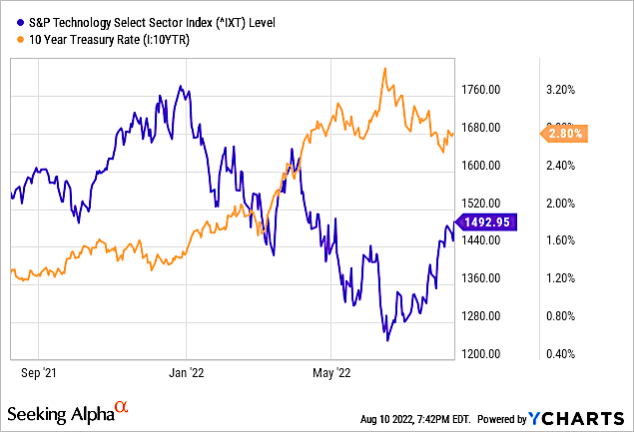

The semiconductor industry started an upcycle on 6/16/22 when The 10-year Treasury rate started dropping, confirming the low in the S&P, as shown in Chart 1.

I have been discussing the 10-year in a series of several Seeking Alpha articles, such as my July 1, 2022 Seeking Alpha article entitled “Why Are Tech Stocks Selling Off And What Is The Outlook?” where I noted that during this period, the S&P Technology Select Sector Index (IXT) dropped about 43%, as seen in Chart 1.

YCharts

Chart 1

I had noted in my article:

“This correlation has been strong in 2022. Although analysts at Morningstar found minimal correlation between the 10-year treasury and technology stocks over a 15-year period, since January 2022 the rise in the 10-year due to inflation fears has significantly impacted technology stocks. Thus, as I stated above, if looking to buy the dip in tech stocks, you want to wait for the 10-year to top out.”

Well, the 10-year has indeed topped out and we can see the IXT beginning to increase in this inverse relationship.

Then Micron (MU) gave weak guidance on 6/30/22, alerting investors to an upcoming period of uncertainty and unevenness in share performance. MU reported a slowdown in consumer electronics products such as PCs and smartphones.

This news has caused a knee-jerk reaction among other semiconductor companies, as they too announced plans to curtail equipment purchases to reduce inventory and get supply-demand dynamics back on track. Companies responding to this downturn include:

- Micron Technology said it had lowered its capex plans amid weakening demand for consumer PCs and smartphones.

- SK Hynix has indefinitely postponed plans for a $3.3 billion expansion of a memory chip plant. The company is also considering cutting its 2023 capital expenditure by about a quarter to 16 trillion won ($12.2 billion).

- Samsung Electronics (OTCPK:SSNLF) scaled back facility spending by around 13% during the first six-month period from a year ago as it has become unsure of the second-half business prospects

- Taiwan Semiconductor Manufacturing (TSM) reduced its capital expenditures target for 2022 to the low end of its guidance range of $40 billion to $44 billion.

- Vanguard International Semiconductor has revised downward its capex outlook this year to NT$23 billion (US$766 million) from the NT$24 billion set previously.

- Waning demand from makers of smartphones and TV components is forcing SMIC to readjust its manufacturing plans. The economic downturn and inventory adjustments have spurred “rapid freeze and urgent order halts” as some clients hold off on placing new orders according to co-CEO Zhao Haijun.

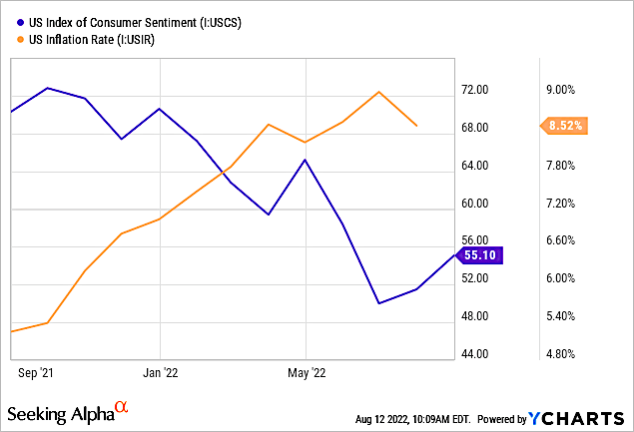

These cuts in capex are based on consumer electronics products, and in Chart 2, I show the inverse correlation between Consumer Sentiment (blue line) and Inflation Rate (orange line). Consumer Sentiment rose from 50.0 previously, which was the lowest recorded level since the university started collecting consumer sentiment data in November 1952.

The slowdown in PCs and smartphones was responsible for weak guidance given by semiconductor manufacturers discussed above and the resulting capex cuts. This slowdown was a result of consumers cutting back on discretionary spending of items using semiconductor devices and using that money to pay for food and gasoline.

YCharts

Chart 2

This cut in consumer discretionary electronic products isn’t too surprising when we see statistics showing that Inflation is costing the average American $717 a month, as shown in Chart 3, with data provided by the Joint Economic Committee Republicans.

It shows the average monthly household inflation costs by spending category, July 2022, relative to January 2021 price levels state rank percent increase in prices since January 2021.

Chart 3

The JEC Calculations were obtained using: Bureau of Economic Analysis, Personal Consumption Expenditures; Bureau of Labor Statistics, Consumer Expenditure Survey; Census Bureau, American Community Survey.

To date, the greatest impact of the slowdown in PCs and Smartphones has impacted memory companies, given their readjustment of capex plans. But consumer electronics products contain more than memory chips.

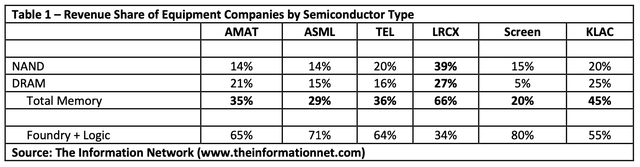

Table 1 shows the percentages of revenues recorded by semiconductor type for the top six semiconductor equipment suppliers. We see that LRCX had the greatest revenues from memory, representing 66% of revenues. In the near term, I expect LRCX to address this issue in an upcoming earnings call.

But again, consumer electronics products are filled with logic and processor chips, which means a strong impact on AMAT and ASML, according to The Information Network’s report entitled “Semiconductor Equipment: Markets, Market Share, Market Forecasts.”

Bust #2

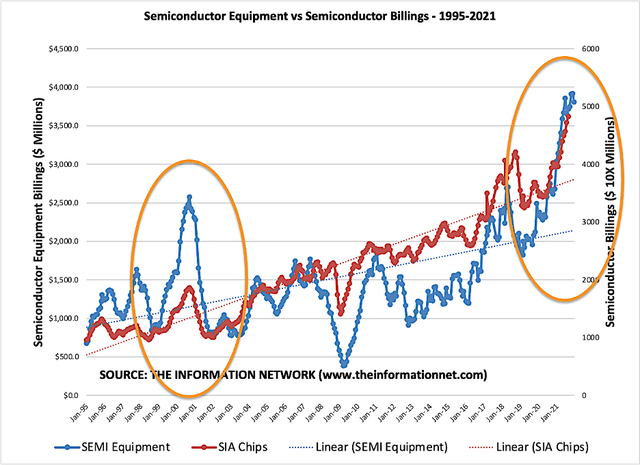

The strong growth of semiconductors and semiconductor equipment in 2021, as shown in Chart 1 above, will also be a problem in 2023.

On June 24, 2021 I published on Seeking Alpha an article entitled “Applied Materials: Tracking A Likely Semiconductor Equipment Meltdown In 2023.” One year later:

- The economy of the U.S. and to a lesser degree most countries, has been turned upside down

- Analysts are just beginning to cut estimates of WFE sales in 2023, nearly a year after to the day after I published my thesis.

For example, UBS analysts in a June 28, 2022 cut earnings estimates and price targets on the group of semiconductor equipment makers, citing lower forecasts for the rest of the year and into 2023. Note that this cut came out before Micron’s June 30 earnings call.

“We see major producers building inventories in hopes of demand improvement and we expect they will additionally cut capex and are already starting to push out tool shipments.”

The basis of my thesis on the drop in equipment markets in 2023 is due to the overspend of equipment resulting in an oversupply of chips, primarily coming from foundries, which had the largest fab construction growth.

Fab construction continued unabated with 29 fabs built in 2021 and 2022 that could produce as many as 2.6 million wafers per month, according to SEMI consortia. Of these:

- 15 fabs are foundry facilities with capacities ranging from 30,000 to 220,000 wafers per month.

- Four are memory fabs with higher capacities ranging from 100,000 to 400,000 wafers per month

Currently, new 300mm semiconductor volume fabs expected to begin operation from 2022 to 2025 raises the count to 199 volume fabs by 2025.

This supercycle came on the heels of recovery from Covid and a “semiconductor shortage” that resulted in supply chain disruptions across a broad spectrum of industries, but primarily the auto industry.

Interestingly, back in 1998 there was another “semiconductor shortage” from erroneous DRAM forecasts, which I detail in the above article. Chart 4 shows that the rise and abrupt fall in equipment billings in 2000 mirrors the growth in 2021. The resultant market crash lasted two years and resulted in $10 billion in excess inventory.

I base my thesis for a meltdown in semiconductor equipment and oversupply of foundry/logic chips on the commonality of the 2000 crash. I refer readers to my original article of 2021 for a detailed analysis presented.

Chart 4

It is also important to note that this chain of events:

- excess capex spend,

- fab build,

- equipment purchases, and

- chip oversupply

is independent of the recently approved Chips Act. That won’t factor into the supply-demand dynamics for a few years.

Investor Takeaway

Impact on Individual Semi Companies

In this article I discussed several semiconductor and semiconductor equipment companies, impacted positively and negatively by this supercycle. We entered in the past six weeks Bust #2 and will enter Bust #3 in 2023. These are the companies I’m most concerned about:

Bust #2 – Semiconductor Companies

Micron – Micron had its earnings call June 30, 2022, and its stock was battered on weak guidance due to slow PC (and smartphone) sales. Micron blew it when it didn’t pre-announce extremely weak FQ4 earnings prior to its FQ3 earnings call. The slowdown in consumer electronics products was actually noted three months earlier by TSMC Chairman Mark Liu, but MU CEO Mehrotra apparently ignored it. Then in another stroke of genius, on August 9, Mehrotra pre-announced noting that even its F4Q guidance actually issued in the FQ3 call may be too high. He also extended the guidance for FQ1 2023, and bit shipments are now expected to decline sequentially, and the company expects significant sequential declines in revenue and margins.

Western Digital – Western Digital (WDC) issued weaker-than-expected results and guidance in its FQ4 2022 earnings call, prompting a sell-off in related semiconductor stocks. Shares fell more than 7%. Western Digital CEO David Goeckeler noted in the earnings call: “PC market dynamics are accelerating the final phase of the shift of client devices from HDD to flash technology. Consequently, the client HDD market is now declining at an accelerated rate relative to the period before the onset of the pandemic. To reflect this reality, we are now taking aggressive action to restructure our HDD manufacturing footprint to reflect this market dynamic.”

SK Hynix – SK Hynix predicted that memory demand would slow in the second half of the year. This is because shipments of PCs and smartphones that contain memory are expected to become lower than initially predicted. SK Hynix stated that it would carefully review next year’s investment plan while monitoring product inventory levels in the second half of the year.

NVIDIA – NVIDIA (NVDA) pre-announced weak F2Q revenue due to a shortfall in gaming-related revenue on August 9. The company said its gaming business was the main culprit of the shortfall, as gaming revenue fell 44% sequentially and 33% year-over-year.

Seagate – on July 21, 2022, Seagate Technology shares plunged 12% after the hard-disk drive maker posted fiscal fourth-quarter results that missed expectations and issued weak guidance, while announcing production cuts.

I am also monitoring cloud and data center results, like SK Hynix, for an indication that the demand for server memory supplied to data center customers is also likely to slow as customers will consume their inventories preferentially. In Q2, US hyperscaler public cloud sales increased on average 6.8% QoQ and 35.8% YoY. Azure (Microsoft (MSFT) increased 40% YoY, AWS Amazon (AMZN) increased 33.3%, and Google Cloud (GOOGL) increased 35.6%.

Bust #2 – Semiconductor Equipment Companies

Bust #2 so far has been associated with consumer electronics products and has affected memory companies and NVDA with its gaming business. These sectors have already provided guidance but there may be more. They also have noted cutbacks in capex as I noted at the top of this article. But it also included TSMC, which reduced its capital expenditures target for 2022 to the low end of its guidance range of $40 billion to $44 billion. TSMC does make DRAM memory chips, but various fabless high-tech companies such as Qualcomm, Broadcom (AVGO), NVIDIA, and VIA are customers of TSMC, and these companies make products for the consumer electronics sector, including Apple (AAPL), its largest customer.

In Table 1 above, I showed that LRCX had the highest exposure of revenues for memory. As a result, it will be most susceptible to memory capex cutbacks, as it was when the memory market crashed in 2019 based on excess capex spend, which I have discussed in numerous Seeking Alpha articles.

AMAT is another supplier to memory, and according to the company 20% of its revenues in 2021 came from memory and foundry customer Samsung Electronics. Another 15% came from TSMC. As a result, AMAT will be significantly impacted.

LRCX announced in its F4Q earnings call that “overall, semiconductor demand remains robust, but with some macro-driven pockets of weakness, particularly in consumer-focused markets.” That means a possible headwind during the second half of 2022 as Lam customers curtail purchases.

Bust #3 – AMAT will Fare the worst

The new fab construction in the past few years, as noted above is skewed toward foundries. Construction of 29 fabs built in 2021 and 2022 that could produce as many as 2.6 million wafers per month, according to SEMI consortia were:

- 15 fabs are foundry facilities with capacities ranging from 30,000 to 220,000 wafers per month.

- Four are memory fabs with higher capacities ranging from 100,000 to 400,000 wafers per month

Foundries impacted by an oversupply of chips as a result of excess capex spend are:

TSMC and UMC (UMC) located in Taiwan; Samsung in Korea; SMIC (OTCQX:SMICY) in China; GLOBALFOUNDRIES (GFS) in the US; and Tower, which was just acquired by Intel. Only TSMC, Samsung, Intel, and SMIC have 7nm and less capabilities.

These are the foundries that will announce pushouts and cancellations of equipment in 2023. Again, AMAT will be impacted the greatest among U.S. suppliers.

AMAT announces F3Q earnings after market close on August 18, 2022. Be aware that since new AMAT management, the term pushout has not once been used in an earnings call. I alert readers to this, because pushouts of equipment are in the works in other semiconductor equipment companies, and this oversupply of consumer electronics products will hit AMAT harder than those companies announcing the previous month.

Be the first to comment