PhonlamaiPhoto/iStock via Getty Images

Applied Materials (NASDAQ:AMAT) stock is currently down 19% so far this year, far more dramatic than the 4.64% decline of the S&P 500 (SPY) in the same time frame. Much of this underperformance can be supply chain challenges arising from the ongoing Russia-Ukraine conflict and the company’s significant exposure to customers in China and Taiwan amidst ongoing China-Taiwan tensions. While none of these concerns are to be taken lightly, there is still a lot that is working in favor of Applied Materials.

Agreed that this may be a slightly risky pick for retail investors, but it also comes with significant growth potential considering the many secular tailwinds that are fueling semiconductor demand. Here are a few reasons why retail investors can consider opting for this stock in April 2022.

Company overview

Applied Materials is a highly diversified leading material engineering company offering semiconductor and wafer fab equipment, services, and software to the semiconductor and display industry (chip and display manufacturers). The company is currently a market leader in providing tools for nanomanufacturing and has operations in over 17 countries. Samsung and Taiwan Semiconductor Manufacturing (TSM) are the two major customers of Applied Materials. The company competes with ASML Holding N.V (ASML), LAM Research (LRCX), KLAC Corporation (KLAC), and Tokyo Electron (OTCPK:TOELF).

Demand for semiconductor equipment is expected to be strong in the short and long run

Applied Materials is well poised to benefit from the rapid expansion of the global semiconductor equipment industry, estimated to grow from $95.3 billion in 2021 to $175 billion in 2027. In fact, the company expects global WFE (wafer fab equipment which involves equipment required for physical and chemical processes used to create circuits on silicon wafers) spending to reach $100 billion in 2022, mainly driven by rising spending on foundry/logic equipment. The company expects even higher WFE spending in 2023.

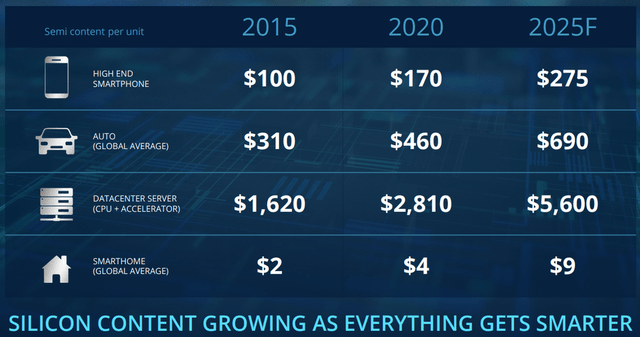

Foundry and logic spending accounted for over 60% of the total WFE spending (in the mid-$80 billion range) in 2021. With rising demand for chips in the cloud and edge computing and for smaller and more advanced chips in areas such as communications (smart devices), Internet-of-Things, automotive, power electronics, and sensors, the percentage of foundry/logic spending as a percentage of WFE spending is expected to remain at 2021 levels or even rise in coming years.

Semiconductor chips are also witnessing increasing complexity, thanks to the evolvement of new chip architectures for workload-specific chips, improved power utilization, rising chip density, and advanced chip packaging. Applied Materials stands to benefit from these trends, considering that all these new innovations imply increased capital spending for new and advanced equipment by the semiconductor industry.

Currently, nine out of the topmost valuable companies are in the semiconductor designing or manufacturing business. With eight of nine most valuable companies opting to shift a major chunk of chip manufacturing in-house, the demand for semiconductor equipment will continue to be strong. The ongoing supply chain constraints for silicon have also forced customers to opt for long-term capacity planning, which is again a solid positive for this semiconductor equipment player.

Finally, countries around the world are now preferring regionalization of semiconductor supply in face of increasing geopolitical tensions, rather than relying on outsourcing. There has been a focused effort in shifting semiconductor manufacturing reliance out of Asia into U.S. Intel has already announced $100 billion worth of investments for building a chip manufacturing complex in Ohio. Taiwan Semiconductor Manufacturing is also investing billions to expand its hip manufacturing in the U.S. and Japan.

While the increasing redundancy may protect from supply chain disruptions in the future, it also results in inefficient capital investments. This is a positive for Applied Materials as it means more and sustained demand for semiconductor capital equipment in the coming years.

Recent earnings performance and balance sheet

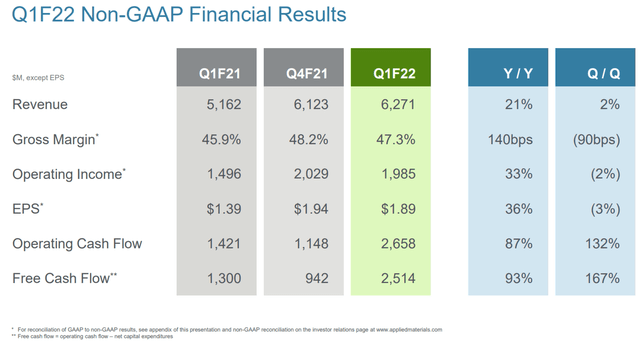

Despite the supply challenges associated with certain silicon components, Applied Materials managed to report a 21.48% year-over-year hike in revenues to $6.27 billion in the first quarter of fiscal 2022 (ending Jan. 30, 2022). The company generated a free cash flow of $2.51 billion in the first quarter, which translates into almost 40% of the topline.

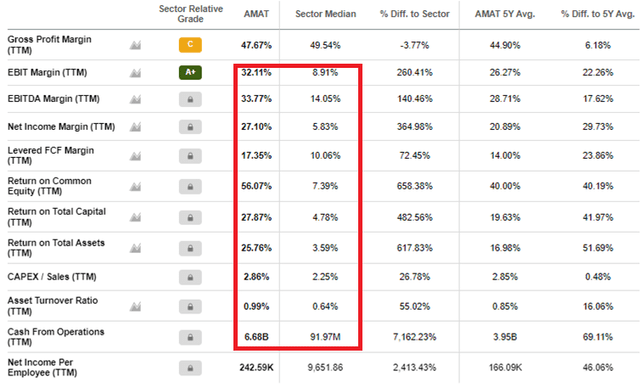

Applied Materials continues to see a consistent improvement in gross margins for the past few years, which has also helped push up EBITDA and net income margins.

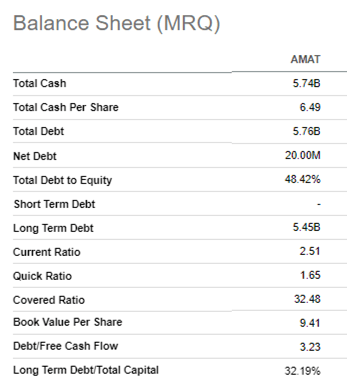

Applied Materials also boasts of a solid balance sheet with $5.7 billion in cash and $5.5 billion in low-interest long-term debt.

Seeking Alpha Premium

The company’s interest coverage ratio is a solid 32.5x, while the debt to free cash flow ratio is 3.23x. This implies that the company will not face any funding-related problems in repaying debt, even if there is any unanticipated downturn in the cyclical semiconductor industry.

Risks

Applied Materials faces the risk of significant supply chain disruptions in face of escalating geopolitical tensions. Further, the semiconductor industry is cyclical and any drop in semiconductor demand can put significant pressure on the company’s business.

In fiscal 2021 ending October 31, 2021, Samsung and Taiwan Semiconductor Manufacturing together accounted for 35% of Applied Materials’ total revenues. The significant customer concentration can prove to be a challenge, in case of escalating China-Taiwan tensions.

Valuation

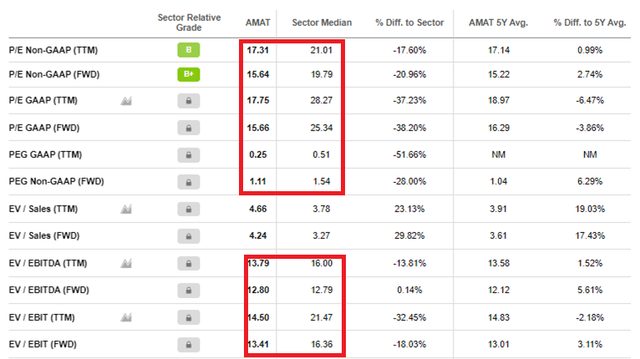

Applied Materials is a very reasonably priced semiconductor player as compared to the average industry valuations.

We see that the company is significantly undervalued as compared to the sector median across multiple valuation metrics.

Yet, Applied Materials ranks much higher as compared to the sector median in terms of profitability margins, cash from operations, and return ratios.

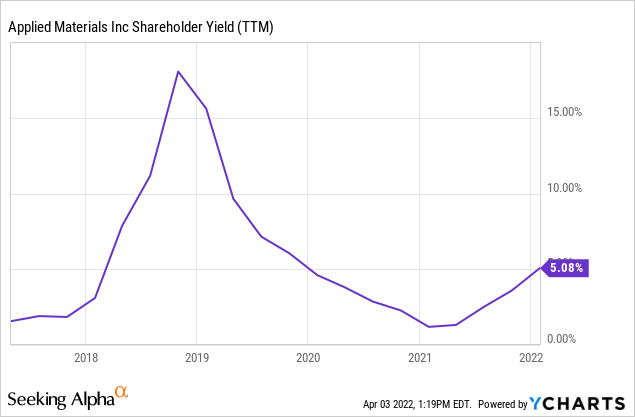

Applied Materials paid $0.2 billion in dividends and returned $1.8 billion as share repurchases in the first quarter. The company’s consistent use of share repurchases to reduce shares outstanding will help improve earnings per share for its existing shareholders.

Hence, retail investors can get their hands on a highly profitable and secularly driven company at significantly discounted rates.

Conclusion

Applied Materials is the largest semiconductor equipment player by revenue. The company enjoys a strong moat, considering its scale and R&D prowess. The entry barriers in terms of capital and technical know-how in this industry are high. With several secular tailwinds driving the company and robust cash flows, the growth prospects of the stock look bright. The company also returns significant capital to shareholders, while the valuation seems quite reasonable.

In this context, I believe that the company offers a favorable risk-reward proposition to retail investors, especially at current prices.

Be the first to comment