Nikada

Thesis

Apple Inc. (NASDAQ:AAPL) stock has continued to demonstrate increasingly likely signals of breaking down further from its recent October/November lows.

Despite the recent recovery after its initial post-earnings selloff, Apple buyers have been unable to muster significant upward momentum to regain its bullish bias, a notable red flag.

For a stock that last traded at an NTM P/E of 24.1x, much higher than the S&P 500’s (SPX) (SP500) NTM normalized P/E of 17.2x, Apple buyers adding at these levels could face significant value compression moving ahead.

The consensus estimates have continued to be revised downward for Apple, as it faces significant challenges at Foxconn’s (OTCPK:FXCOF) Zhengzhou iPhone factory due to a shortage of manpower linked to its COVID restrictions.

As such, we believe Apple’s shipment forecasts for its critical December quarter could be at significant risk for further revisions as the situation in China could potentially worsen. In addition, Mac is already expected to face weaker demand in FQ1, as highlighted in our previous update, in line with management’s commentary.

Advertising is also too small a segment to move the needle to mitigate the iPhone impact. And the hype generated by the potential launch of its 3D mixed reality device in 2023 should not be considered as an opportunity to buy AAPL now.

We urge investors not to lose focus on what matters for Apple to justify its valuation premium: Apple’s iPhone segment performance.

With an FY22 revenue of nearly $395B, Apple buyers are reminded that it cannot afford to make glaring mistakes in its iPhone segment. While the company has continued to diversify its reliance on its Chinese partners, it’s unlikely to be significant in the near- to medium term given Apple’s significant supply chain exposure in China.

Therefore, we believe AAPL needs to undergo a period of significant value compression to improve its reward/risk markedly for investors to consider adding more positions.

Maintain Sell.

Apple’s China Risk Worsened In Its December Quarter

Recent earnings commentary by Apple’s critical iPhone assembler Foxconn indicated that it saw tremendous headwinds in 2023 that could force its revenue growth to be “flat.” Chairman Young Liu accentuated:

For next year, we see cloud data center and networking products being the robust growth drivers … but overall, consumer electronics and smart electronic devices will still be slow and a bit weak. – Nikkei Asia

Despite that, the revised consensus estimates (bullish) penciled in a 3.3% topline growth for Apple for FY23 (ending September 2023), down nominally from October’s 3.4% growth estimates.

Hence, we believe Street analysts as a whole could be overly optimistic over Apple’s ability to weather the consumer electronics headwinds. Furthermore, recent reports from Foxconn’s Zhengzhou iPhone facility were particularly disconcerting.

It’s important to note that Zhengzhou accounts for 90% of Apple’s iPhone 14 series shipments, according to DIGITIMES sources. Therefore, the near-term shift in capacity diversification to India or Vietnam will unlikely mitigate the impact of China’s supply chain disruptions on Apple’s iPhone shipments. Therefore, Apple investors are urged to keep a close eye on the developments of the recent manpower shortages in Zhengzhou impacting Apple.

Earlier this week, South China Morning Post highlighted that Zhengzhou state officials have been trying to find workers to staff Foxconn’s facility after reports of workers fleeing the COVID lockdowns. Given the increasingly dire situation, it even resorted to appealing to ex-China military personnel to assist. AppleInsider reported:

Officials in Changge county, are asking ex-PLA people to “answer the government’s call,” and “take part in the resumption of production” at Foxconn Zhengzhou. The open letter calls on their history of service and asks that they “show up where there’s a need.” – AppleInsider

Moreover, AppleInsider reported yesterday that Foxconn was still short of 100K workers at its facility, hampering its ability to resume full production. Hence, Foxconn’s Zhengzhou facility operates only with two-thirds of its required workforce.

Therefore, we believe the situation in Zhengzhou is getting increasingly dire, with the Street’s revised estimates for its December quarter (Apple’s FQ1) at risk of significant markdowns.

Analysts Seem Overly Optimistic

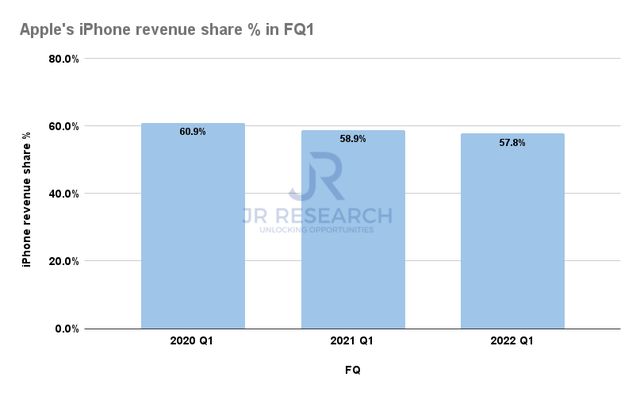

Apple iPhone revenue share % in FQ1 (Company filings)

Apple investors should know the criticality of its iPhone segment’s contribution to its revenue for FQ1.

As seen above, iPhone accounted for nearly 58% of its total FQ1 revenue last year, down from 59% in FQ1’21. With iPhone 14 needing to perform remarkably as Mac’s tailwinds are expected to reverse into headwinds for the December quarter, the risks for Apple have increased markedly.

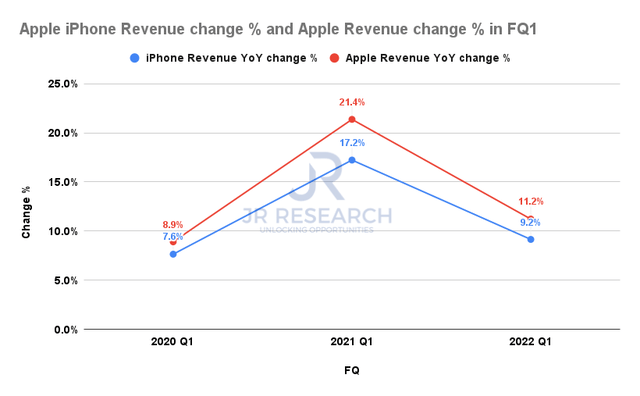

Apple iPhone revenue change % and Apple revenue change % (Company filings)

Hence, it’s easy to understand that Apple’s revenue growth performance has been linked closely to how its iPhone segment performed for FQ1. With the Street still expecting 1.6% revenue growth for its December quarter despite its Zhengzhou malaise, we believe investors need to be prepared for significant disappointment.

Apple needs to increasingly rely on its higher Pro series ASPs to make up for the likely production shortfalls that could hamper its shipment plans leading to a weak performance in FQ1.

Hence, we urge investors not to ignore its Zhengzhou risk in its most critical quarter, which could set the momentum for the rest of its FY.

Is AAPL Stock A Buy, Sell, Or Hold?

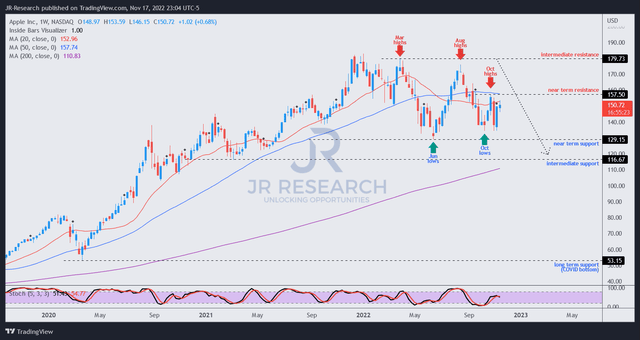

AAPL price chart (weekly) (TradingView)

With the market’s forward-discounting mechanism, Apple bulls could argue that the market has likely anticipated and reflected significant headwinds in Foxconn’s facility.

Our analysis suggests that the market has likely de-rated AAPL based on its price action. As seen above, AAPL’s 20-week (red line) and 50-week moving average (blue line) suggest a reversal of its uptrend had already occurred.

AAPL’s bull trap in April 2022 prevented the surge in August from retaking the bullish initiative. Moreover, AAPL buyers have been unable to lift the buying momentum from its recent recovery, as sellers continue to impede further upward momentum at its October highs.

As such, AAPL’s 50-week moving average has already turned into a dynamic resistance zone, resisting further buying advances.

We assess that the market is likely still distributing, allowing AAPL buyers to “buy the dip” before digesting its momentum toward its October lows. Once those lows are decisively broken down, it could open up a move toward the intermediate support zone ($115) for a re-test to find a likely bottom.

Based on Apple’s revised NTM EPS estimates, that level would imply an NTM P/E of 18.4x or an FY24 P/E of 16.9x. It would also be in line with its 10Y average of 17.5x. That would give investors a much-improved reward/risk profile to add more positions.

Maintain Sell.

Be the first to comment