Seremin

Investment thesis

During the last week of September (September 25 to be exact), I sent an alert to our marketplace members. The alert informed them that I placed a limit buy order for Apple (NASDAQ:AAPL) at $140 and my thought process (the stock price then was about $150.5). A price of $140 corresponds to about 22x of its FW PE. To me, any valuation near 20x is very attractive for a stock with ROCE (return on capital employed) near 100% like AAPL. At about 100% ROCE, a 5% investment rate would provide 5% organic real growth rates (i.e., before inflation adjustments). And a 22x PE would provide about 5% owners earnings yield, leading to a total return close to double digits. For a stock like AAPL, I am always happy to buy/add when the total annual return is close to 10% or above. A 10% return is healthy enough to start with. Once you adjust for the risks (and I consider the risks from AAPL similar to treasury bonds), a 10% annual return is almost 3x of what you can get from bonds in the long term.

Also, to put things under historical perspective, a valuation around 22x is also below the historical average of 24.7x in recent years by about 10% (11% to be exact), leaving a comfortable margin of safety. And also, bear in mind that the stock was so obviously before 2021 and those levels are outliers in my mind. So, the historical average of 24.75x is already biased.

All told, thanks to market volatility, the stock price dipped below $140 a few days later on Sept 30. The order is triggered, and now I own more AAPL shares. I of course do not want to pretend that I have any idea that its price would actually dip below $140 or not. However, I do have a good sense of its intrinsic value and the magnitude of market gyrations. And as a long-term and patient investor, I do know that 22x PE is a good deal for a stock like AAPL.

Near-term challenges

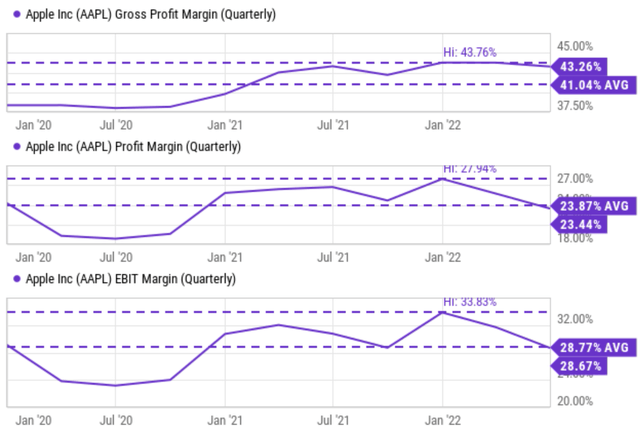

There is no shortage of external challenges in the near term. And these challenges can be substantial, too. They will continue to weigh on performance over the near term. These challenges include new variants of COVID-19, the ongoing war between Russia and Ukraine, unfavorable currency exchange rates, and high inflation and rising interest rates. In particular, you can see the effects that these headwinds have exerted on its margins. Over the past few quarters, its gross margin shrank by more than 200 basis points from a peak of 43.76% to 41.04%. Net profit margin shrank even more, by more than 450 basis points from a peak of 27.9% to 23.4%. China, its key market, had to lock down several of its key cities in the H1 of the year due to COVID-19, and the ongoing pandemic situation probably would lead to more lockdowns, which have impacted its sales and production and would very likely continue to in the near future.

AAPL and Buffettism

However, as Buffett commented, if you have to closely follow the day-to-day stuff of a stock, you should not own it in the first place. He was once asked about his AAPL position during a Yahoo! Finance interview. You can see the full interview here, full of typical Buffett-style wisdom and highly recommended. The following is an excerpt and the highlights are added by me.

Yahoo Finance: how closely do you follow the company? You know, people are concerned they really have not introduced any new products.

Buffett: Well, if you have to closely follow the company, you should not own it in the first place. If you buy a business, say you buy a farm, do you go up and look every couple of weeks to see how far the corn has grown up? Do you worry too much about whether somebody says this year is going to be a year of low corn prices because exports are being affected or something? You know, it does not grow faster if I go and stare at it… Although I do care over the years that it is well tended to in terms of rotating crops. And I hope yields get better.

In my mind, this wisdom is truer for Apple than anything else. A high-yield farm is what exactly it is. As a high-yield farm, investors should have the perspective to overlook its daily (or even yearly) noises and focus on the long term, as detailed next.

Business outlook and projected returns

I am optimistic about its future. The company has displayed remarkable resilience in the face of the difficult operating backdrop in the past. And I am certain that this time is no different. The inflation or drag from foreign exchange rates may worsen in the near term. But remember, Buffett’s other wisdom is not to pick stocks based on macroeconomic parameters – which are totally unpredictable and out of anyone’s control.

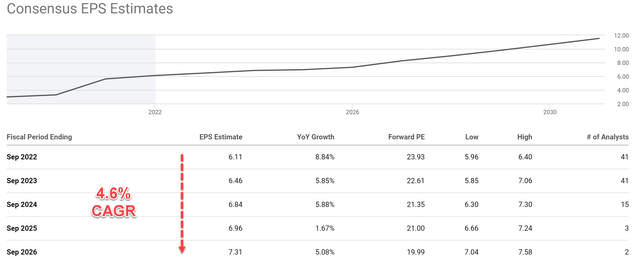

Altogether, consensus estimates look for share net to come in around $6.46 in 2023. And again, at a price of $140, the PE would be about 22x. Based on the consensus estimates, the growth rate would be about 4.6% CAGR in the next few years, which agrees with my back-of-envelope estimate closely. As aforementioned, at about 100% ROCE, a 5% investment rate would provide 5% organic real growth rates.

All told, a 22x entry PE, combined with a ~5% growth rate, should provide about 10% total return for a long-term business owner.

Notably, services-related revenues should continue to advance and represent a strong engine for future growth. In this sense, AAPL is transitioning (or you can argue it has successfully transitioned already) from a hardware business into a subscription-based SaaS business.

According to this report, it added ~30 million paid subscriptions in 2022 alone. Total revenues from services have been growing steadily and rapidly over the years and have reached $19.8 billion. In Q2 2022. Compared to $17.0 billion raked in from services during Q2 2021, this represented an annual growth rate of 16.5%, far outpacing the growth rates of its total revenue. Broadening the timeframe a bit, the growth in its revenues from services has grown more than 230% since 2017, also far outpacing the growth of its product sales (which increased by about 160%). In its latest earnings report, Tim Cook reported a mind-boggling total of 816 million paid subscriptions across its various services ranging from Apple Music, iCloud, and Apple TV+.

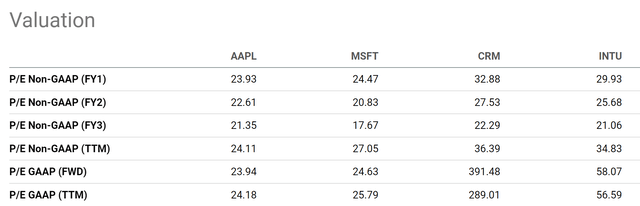

Going forward, I see such a large user base to further grow given Apple’s popularity and premium status. In my view, the market underestimates (or misunderstands) its SaaS potential. As seen from the chart below, it is trading at a sizeable discount relative to other more “standard” SaaS stocks. To wit, in terms of FY1 PE, it is trading slightly below Microsoft Corporation by about 4%, about 20% below Intuit Inc, and more than 27% below Salesforce Inc.

Risks and final thoughts

To recap, there is no doubt that the business faces many short-term challenges. These challenges include the veritable list of the COVID-19 pandemic, the ongoing Russian/Ukraine situation, currency exchange rates, high inflation, and global supply chain disruptions. It also faces its own unique challenges such as margin pressure, cost control, and disruptions in its key China market.

However, the whole point of owning a stock like AAPL is that you do not have to worry about the quarterly noises. If you do, you defeat the purpose completely and should not own it in the first place. To me, any valuation near 20x is very attractive for a stock with ROCE and financial strength like AAPL. A ~20x PE provides about 5% owner’s earnings yield. And an ROCE near 100% easily leads to 5% growth rates with minimal reinvestments, resulting in a double-digit return potential already.

Finally, specific to AAPL, the revenues and growth composition are also shifting to service and subscription, further augmenting its stickiness and profitability. The market underestimates (or misunderstands) its SaaS potential and most likely will regret it.

Be the first to comment