Nikada/iStock Unreleased via Getty Images

Investment Thesis

Apple (NASDAQ:AAPL) has absolutely dominated the smartphone market, particularly in the western world, and in doing so has created a formidable ecosystem that competitors are finding difficult to crack. Yet there are other risks this company faces, such as potentially slowing growth or increasing government scrutiny.

So does Apple look like a good investment right now? I put it through my framework to find out.

Business Overview

Now I know Apple is a fairly obscure company, but I’ll do my best to describe it:

Apple designs, manufactures, and sells smartphones, PCs, tablets, wearables, and accessories, and also sells complimentary services. I think most of you will be aware of everything the company offers, but just to recap, Apple has the following core products:

- iPhone: Apple’s smartphones that utilize its iOS operating system, which include different generations & iterations

- Mac: personal computers that use Apple’s macOS operating system. These can include smaller laptops or larger desktops, with the latest releases all being powered by the Apple M1 chip. The company released a redesigned MacBook Pro in October 2021 that can be powered by either the Apple M1 Pro or M1 Max chip.

- iPad: multipurpose tablets that run on Apple’s iPadOS operating system, which come in a range of sizes, and are also powered by the Apple M1 chip.

- Wearables, Home and Accessories: includes AirPods, Apple TV, Apple Watch, Beats products, HomePod, iPod touch, and accessories.

And in terms of services:

- Advertising: includes third-party licensing arrangements and Apple’s own advertising platforms

- AppleCare: a range of fee-based service and support products that grants access to technical support, repair and replacement services, and can also include additional coverage for the likes of accidental damage or theft.

- Cloud Services: stores and keeps customers’ content up to date across multiple Apple devices and Windows PCs

- Digital Content: includes the App Store, and allows customers to download a variety of digital content such as books, music, videos, games, and podcasts. This also includes Apple’s subscription-based digital offerings such as Apple Arcade, Apple Music, Apple News+, Apple TV+, and Apple Fitness+

- Payment Services: predominantly Apple Pay, a contactless payment service, but also includes the Apple Card, a co-branded credit card

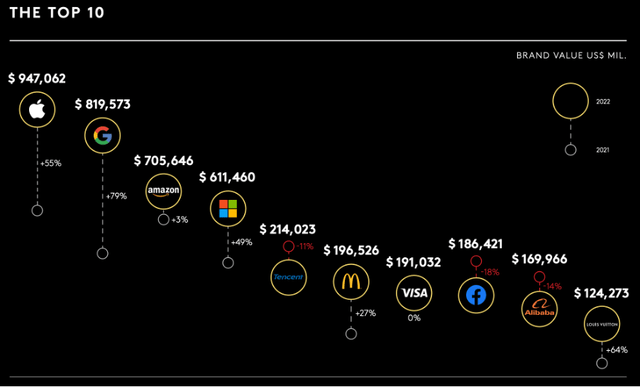

So perhaps a few things there that made you go ‘ahh, I didn’t release that’, but all in all a broad range of products that people know around the globe. But it’s no surprise that these products are no surprise to you, since Apple has the most valuable global brand according to the Kantar Brandz 2022 Most Valuable Global Brands report. Not only is it the clear leader, but its value actually grew 55% compared to Kantar’s 2021 report.

Kantar’s report breaks down some of the reasons that Apple has managed to grow its leadership, and I couldn’t agree more.

Even among top brands, Apple stands out for its high degree of differentiation and control. By manufacturing its flagship A15 and M1 processing units in-house, Apple has gained even more pricing power and logistical flexibility in the market.

Just as importantly, Apple’s hardware advances have powered new consumer facing breakthroughs in areas like computing speed and camera processing. These breakthroughs are then, in turn, brought to eye-popping life by the brand’s best-in class marketing communications team – which has protected and expanded the brand’s edge in measures of Difference.

In the regulatory realm, Apple’s new data collection policies for its iOS software have reshaped the advertising and social media industries as profoundly as any government regulations. Going forward, don’t be surprised if Apple becomes the world’s first brand to cross $1 trillion in brand value in the Kantar BrandZ ledgers.

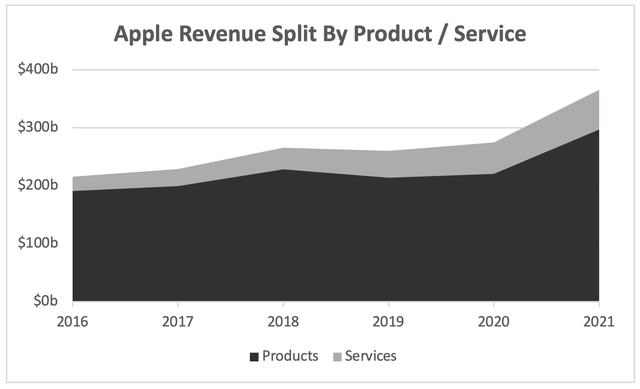

Moving past the brand, I think that the real success story since Tim Cook’s arrival in the corner office relates to the services side of Apple’s business. The company had already built a cohesive offering of high-quality products and a brilliant brand under founder Steve Jobs, but Cook has taken these offerings and turned them into one of the most powerful business ecosystems I have ever seen.

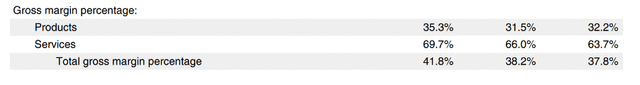

It may not look like much, but from 2016 through to 2021, product revenue grew at a 9% CAGR whereas service revenue grew at a 23% CAGR, going from 11% of revenue to 19% of revenue. Not only is this beneficial since people are keeping their smartphones for longer (negatively impacting hardware revenue), but it’s also critical to Apple’s bottom line, since the services side of the business generates substantially higher margins.

Economic Moats

With every business, I look to see if there are any durable competitive advantages (aka economic moats) that will help the company continue to thrive whilst protecting itself from competition – perhaps unsurprisingly, there are an awful lot of strong moats protecting Apple.

Let’s start with what I deem to be the strongest economic moat: switching costs. I am typing this on a Mac, with my iPhone currently charging away next to it. My partner has her Apple Watch on, syncing her steps to her iPhone whilst watching YouTube on her MacBook. I’ve used the word ecosystem before, and that is what Apple has created – all these different products work together in harmony. My information is synced across all the different types of hardware, and it makes life so much easier – even simple features such as Airdrop, or Wi-Fi password sharing. Once you have multiple products in this ecosystem, it becomes more onerous to switch, and the whole is more than the sum of its parts. Each individual product added makes life that little bit easier, as Apple has a knack of ensuring customers get even more incremental value whenever they add an item to their existing ecosystem.

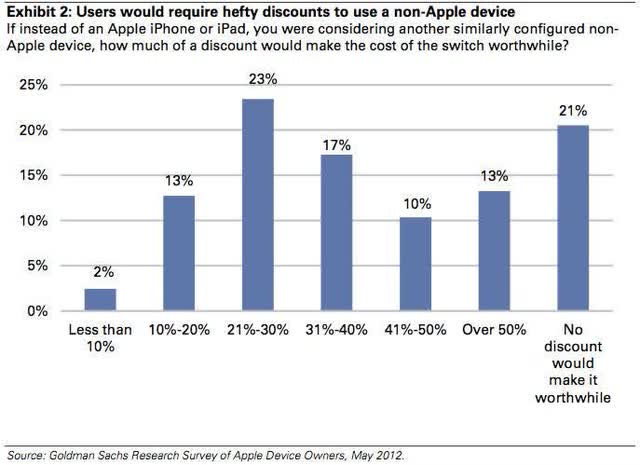

Then there is the other switching cost associated with technology: people like to stick to what they know. I’ve used iPhones for going on 10 years now, and the thought of having to learn an Android operating system makes me feel deeply uncomfortable – and I’m not alone. Apple has successfully created user friendly operating systems that customers feel comfortable with, and this is yet another incentive not to switch away. Unfortunately I could only find a very old Goldman Sachs (GS) survey to back up this theory, wherein 21% of iOS users say they wouldn’t leave Apple at any price, but I think the rationale still holds true to this very day – and if anything, it is even stronger.

The next moat that Apple benefits from is a network effect, and I’ve already touched on one aspect of this. Let’s say that an iPhone owner is considering getting a smartwatch – there are several considerations to be made, but the fact that they already own an iPhone means that there is an additional incentive to opt for an Apple Watch rather than a Fitbit. As I mentioned, Apple adds incrementally more value with each additional product taken. So once you’re in this ecosystem, you are incentivized to use more products and services, which is one of the many ways that Apple has managed to grow throughout this century.

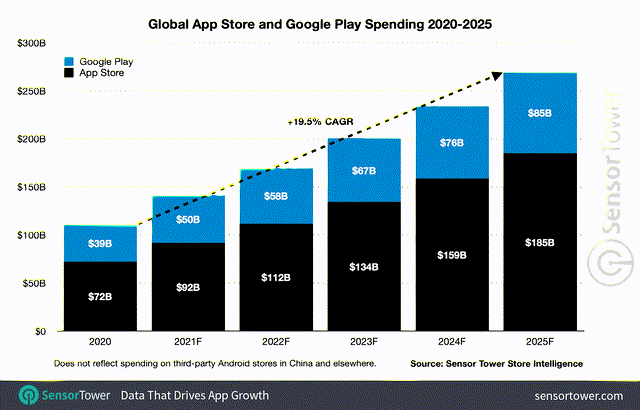

They also have a network effect with their App Store, although this story has somewhat already played out. App developers will want to reach the largest audience possible, and so they will want to put their apps onto Apple’s App Store (regardless of the drawbacks, which I will touch on later). iPhone users will want to access as broad a range of apps as possible, so they too will use the App Store – this is a virtuous cycle that makes Apple’s devices more appealing to both app developers and customers.

I have already talked about brand in the previous section, so I won’t go into detail, but there is no denying that Apple has a moat here. It is the most valuable brand in the world, and history shows that strong brands tend to be strong investments – at least if you exclude the likes of Uber (UBER) and Spotify (SPOT).

I also think that Apple will benefit from a low-cost advantage due to its vertical integration, and this is become even more apparent with its recent foray into computer chips. The benefits of vertical integration become apparent at scale, which Apple clearly has, as not only do you have more control over the supply chain, but it is possible to create goods at a lower cost due to the lack of third-party suppliers. Basically, Apple is able to capture even more of the value within its supply chain.

Outlook

Apple has its fingers in many pies, so it is difficult to know exactly what market to look at in order to forecast the opportunity ahead – but the iPhone remains Apple’s biggest revenue driver, and many of its ancillary services spin off from this main device. According to IDC, the Global Smartphone Market will reach 1.38 billion units shipped in 2022 (up 1.6% YoY) and will hit 1.53 billion units in 2026, a CAGR of 2.3%.

This doesn’t sound like much, but that isn’t necessarily a problem for Apple thanks to the pivot that has been taken under Tim Cook. Smartphone penetration isn’t the opportunity for this company now; the opportunity lies in the estimated 1 billion users who already have an iPhone in their hands.

Apple is continuing to see an increased uptake in its services, with the likes of Apple Pay creating new substantial revenue opportunities that make money regardless of how frequently someone upgrades their device.

Despite units shipped only growing at a 2.3% CAGR, Research and Markets expect the Global Smartphone Market to grow at a 7.6% CAGR through to 2030, eventually reaching a size of $520.7 billion. So even though devices shipped may be falling, the opportunity to monetize these users is well and truly alive.

Management

When looking for potential investments, I always aim to find founder-led businesses where insider ownership is high. Sadly, Apple’s iconic co-founder and former CEO Steve Jobs was taken too soon, but Tim Cook has done a fantastic job since he took the helm. It’s always difficult to take over from a founder-CEO (just ask Steve Ballmer, Bill Gates’ successor who famously laughed at the idea of an iPhone), yet Apple has succeeded under Cook’s tenure.

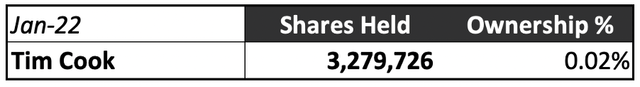

I want to invest in companies where leadership has skin-in-the-game, and perhaps unsurprisingly this is not the case with Apple. CEO Cook owns ~0.02% of all shares in the company. Although this is a small shareholding in absolute terms, it does currently represent over $400m in total wealth that Cook has tied to Apple’s share price – so, a pretty hefty amount! And probably enough to ensure that his incentives are aligned to those of Apple shareholders.

Apple 2022 Proxy Statement / Excel

I also like to take a quick look on Glassdoor to get an idea about the culture of a company, and Apple gets some great scores from the~32,000 reviews left by employees. Any score over 4.0 is impressive, and Apple obtains this in Diversity & Inclusion, Compensation and Benefits, and Culture & Values. It also gets strong scores on Recommend to a Friend, and a good 87% when it comes to CEO Approval. It’s often difficult to create a great place to work in such a broad business, but I think Apple have done a very good job in keeping its employees happy whilst fostering a culture that’s beneficial to all.

Financials

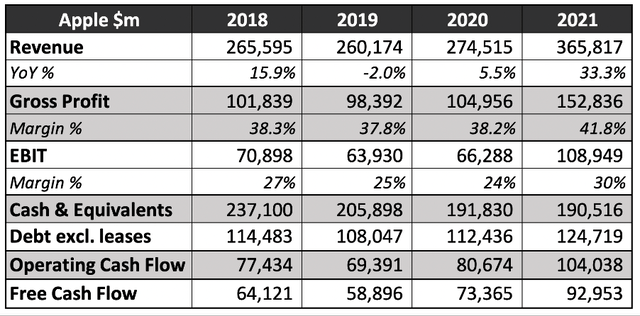

When I look at Apple’s financials, my jaw just hits the floor. This company just prints cash, with a beyond impressive free cash flow of ~$93 billion in 2021. That number is unfathomable to me; they could buy a whole host of fantastic companies with the money they print in one year alone.

In truth, I don’t have much to say about these financials. Clearly, they are fantastic, although it’s worth highlighting that revenue growth can be lumpy depending on what new products (primarily iPhones) were released during the year. Other than that, this is clearly a financial behemoth – if the company keeps executing from a business point of view, then these numbers will only continue to get more and more impressive.

Valuation

I normally look to invest in high growth, disruptive companies where valuation is tough. At least with Apple, I feel like I have something a bit more stable and predictable – so, a bit of a treat for me. When a company is more stable like Apple, I do think valuation is substantially more important than it is for a high growth disruptor. With that said, onto my valuation model:

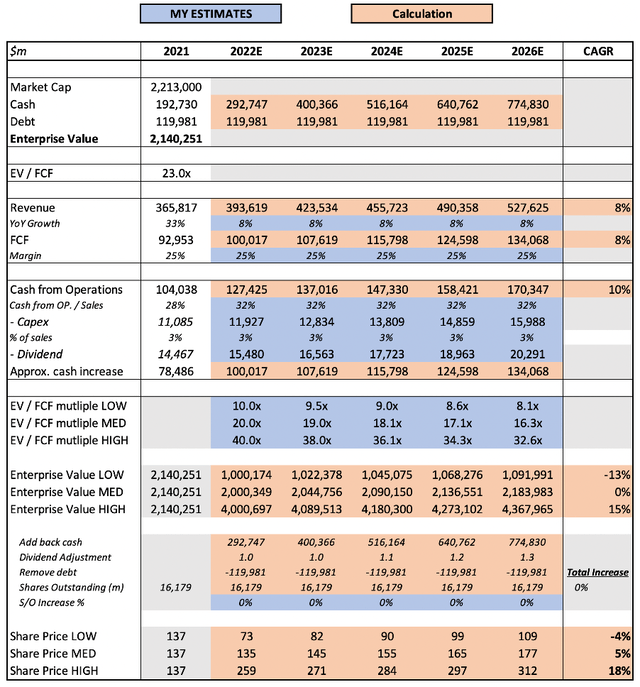

As highlighted before, Apple has a lot of different revenue streams such that it makes it difficult to accurately forecast their revenue growth over the next 5 years. I have taken the approach of keeping it in line with the 7.6% forecasted growth for the global smartphone market, although analysts are expecting lower growth over this period, according to Tikr.

I have also assumed that free cash flow margins will stay around the same as in 2021; Apple is a business that has been optimized for profitability for a long time, and the company’s free cash flow margins have always been ~25%, so I expect this to remain that way for the foreseeable future.

In terms of EV / FCF multiples, Apple has had an average multiple of just over 17x for the past decade – since I think Apple can maintain a good level of growth for its size, I have given it an ending multiple of 16.3x in my mid-range scenario.

Add all this together, and I can see Apple shares achieving a 5% CAGR through to 2026 in my mid-range scenario.

Risks

As the second largest company in the world which has caught the attention of several governments, I think Apple has a number of risks.

Firstly, I do not personally like investing in large companies – clearly big tech has had a fantastic decade, and I would not necessarily bet against them for the upcoming decade. Yet big companies often fail to be nimble enough to react to new trends, they can see cost control failures, and can be bogged down by corporate bureaucracy. This is more of a personal choice to avoid large companies, but there are undeniable risks.

The second risk is also to do with Apple’s size, and more specifically the monopolistic control it has over its ecosystems. Whilst monopolies can be great for companies, they’re often not great for consumers and can face the wrath of governments and competition authorities alike. For example, the European Union recently introduced a law to ensure a common USB-C charging cable across all devices – which iPhones currently don’t use.

This isn’t a particularly big issue, but there are some other proposals that could have a major impact on Apple – such as the EU’s Digital Markets Act which is designed to open up mobile platforms by allowing users to install apps from alternative stores, as well as a US senate panel bill that was approved in February 2022 with the aim of reining in app stores’ monopolistic powers. The lack of power that app developers have in their agreements with Apple has caught the attention of governments, and they are not too happy.

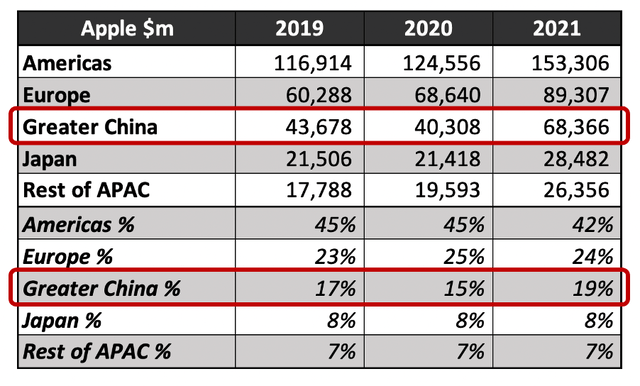

Then there is the geopolitical risk associated with Apple’s presence in Greater China, which made up almost 20% of Apple’s 2021 sales and continues to be a growing market opportunity. It just recently emerged that the Federal Communications Commissioner in the US called on Google and Apple to ban TikTok from their respective app stores, stating that TikTok “harvests swaths of sensitive data that new reports show are being accessed in Beijing” i.e. by the Chinese government. A similar story has played out over the past few years, as several countries banned Huawei from building out their 5G infrastructure over China concerns. With Apple also being a communications company, there is clearly a risk of retaliation from the Chinese Government – and this could substantially hit Apple’s financials.

Bottom Line

Apple is a once in a generation company that has taken the world by storm over the past decades. It now boasts the world’s most valuable brand, and it has built out an ecosystem with seemingly impenetrable moats.

Yet I have my concerns. As I said, I don’t like investing in large companies – I generally go for businesses with market caps below $50 billion – and Apple is no different. There are several risks that I’ve outlined which make me cautious about investing, combined with the fact that I think the growth story for Apple is slowing down. According to my valuation model, shares themselves are currently not priced too attractively, especially given my hesitancy with the risks that Apple faces.

I can understand owning this company, and I can understand being bullish on its future prospects – I certainly would not bet against Apple. Yet I cannot justify opening a position at its current price with the worries I have, so for now I will stick to the sidelines and see what the future holds for this king of technology.

Be the first to comment