Kevin Frayer/Getty Images News

Investment Thesis

Apple (NASDAQ:AAPL) is a premium company trading at a premium valuation. There’s a lot to like about Apple, and I would not be one to throw Apple under the bus. Indeed, Apple continues to focus its business on its Services segment, which goes a long way to support its above-market multiple.

That being said, its Services segment narrative is very well disseminated and priced into the stock.

My contention is Apple carries too much ”China risk”.

In the analysis that follows, I put a spotlight on China’s recent move to award Xi Jinping with a third term, and why that’s likely to negatively impact Apple’s valuation.

China, the Silent Risk

We are in a bear market rally. Investors are so eager to buy the dip in tech stocks, that any time that risk appetite comes back, tech stocks jump hard. Only to fall back in the coming weeks.

Yet, everything that got us here in the first place, namely, high-interest rates and geopolitical tensions, have not been resolved. Meanwhile, although energy costs appear to have abated, I believe that for the most part, that’s because China is now looking set to persist with its Covid lockdown policies.

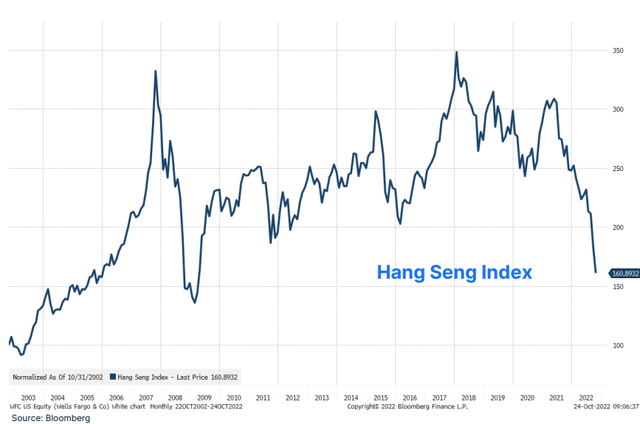

And this brings me to the core of my argument. Chinese stocks have traded at a low multiple because investors have been fearful that Chinese politicians would interfere with China’s economy, and be unfazed by potentially damaging their economy.

As you can see above, Chinese stocks have rolled over. Chinese stocks are down nearly 50% in the past twelve months. And more than 50% from their highs in 2018.

Investors’ capital is running away from China’s slowing economy. And this leads me to my next argument.

Capital Flows Will Likely Continue to Support Apple’s Multiple

I wish to be absolutely clear, I do not believe that Apple will substantially sell off post-Q4 earnings! That’s not the message that I’m looking to convey. In fact, we know that 7% of the S&P 500 (SPY) is made up of Apple.

So if the S&P 500 ETFs continue to get capital inflows, as investors continue to buy into the ETF, there’s a strong likelihood that Apple’s valuation will remain elevated for a lot longer than it would naturally make sense, even after Q4 earnings come out.

Hence, this is my point, I am not attempting to make a market call to sell out ahead of Apple’s stock prior to Q4 earnings this week. My argument is more nuanced than that.

My aim is to drive home this point. Over the coming year, we should expect to see Apple’s multiple compresses, given the elevated China risk.

Rather than positioning this analysis as a binary ”bet” that Q4 earnings disappoint or impress, investors should look out over the next twelve months. And over the next year, I believe that we are likely to see Apple’s multiple compresses. Why?

AAPL Stock Valuation – 23x Next Year’s EPS

Author’s calculation, SEC filings

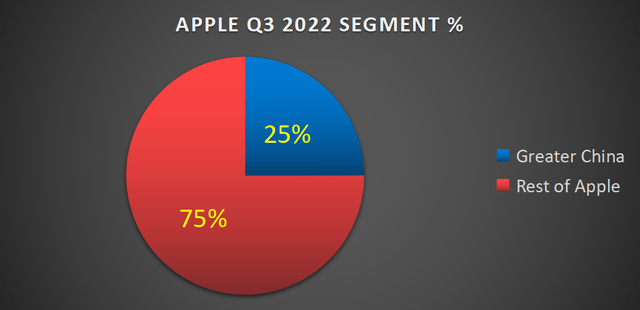

Greater China makes up 25% of Apple’s total operating income. What happens in China right now is more important than just a headline.

I make the case that it doesn’t make sense to pay more than 20x forward earnings for Apple while the company is probably going to grow its EPS at 5% to 8% y/y over the next twelve months.

And we know that China is suffering from its own economic malaise. For the most part, investors sought out Apple because it’s a secular growth story. Because investors likely didn’t want to have to be concerned with macro headwinds. Investors wanted a growth story and were willing to pay up for a premium growth story. What investors probably didn’t want is to be worried about the ongoing impact of China’s lockdown policies.

While, for its part, Apple is the poster child for globalization. And when we were in a favorable environment in the past several years, with every country playing its role, Apple thrived. But China is now resolute to carve out its own path. A path that puts economic prosperity in second place, behind party loyalty.

The Bottom Line

Roughly speaking, 25% of Apple’s operating income comes from China. China is not only a superpower but wants to be respected as a superpower.

While, for their part, the White House is imposing restrictions on supplying Chinese chipmakers.

Accordingly, this begs the following questions.

- Is there a scenario where China retaliates and declares that Apple can not repatriate a portion of those revenues for ”distributions to foreign investors”?

- Could China put in place measures that stop those revenues from being used for stock repurchases?

- The bulk of Apple’s iPhones are made in China, could China enact sanctions on the production of iPhones?

- With China’s frequent Covid lockdown policies in place, and the economy slowing down, is there a risk that Apple’s growth drivers could slow down in the coming twelve months?

I contend that in the same way that Chinese stocks are today being priced at single digits to earnings, as investors are concerned about China’s political meddling in companies, I believe that there’s too much risk premium not factored into Apple at more than 20x forward earnings, particularly when China makes up such a large proportion of the bull thesis.

Be the first to comment