Feline Lim/Getty Images News

Investment Thesis

Apple Inc. (NASDAQ:AAPL) stock has had a remarkable year in 2022. Even though it’s down 5.5% YTD, it has outperformed all its FAAMNG peers and the Invesco QQQ ETF (QQQ). However, despite Apple’s notable performance, bearish investors have continued to front their negative thesis, most notably against its “undeserved” premium.

We concur that AAPL stock is relatively more expensive than six months ago. Its relative outperformance against the market and its poorer-performing peers was the clear driver of its relative valuation.

Despite that, we think AAPL stock’s risk/reward remains pretty well-balanced at the current levels. Furthermore, China’s recent supply chain headwinds and production lockdowns have done little to unsettle Apple investors. Instead, it demonstrated investors’ preference for stocks with robust free cash flow prowess in challenging macro environments.

Investors can consider taking a 10-15% haircut from the current price levels for a less aggressive entry. We also present a simple valuation model for investors to use without the need for DCF sophistication.

We discuss why Apple remains a Buy.

AAPL Stock’s Outperformance Baffles The Bears

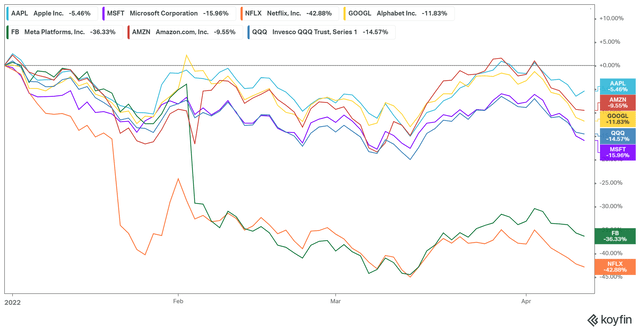

AAPL stock performance Vs. FAAMNG peers (koyfin)

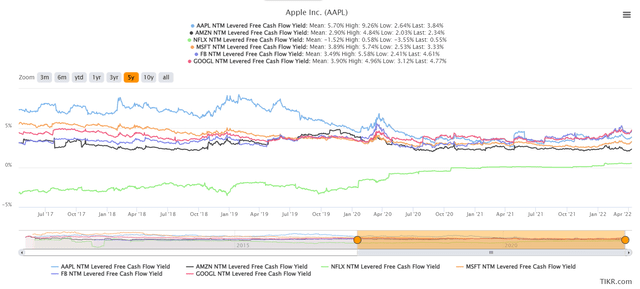

AAPL stock NTM FCF yields Vs. FAAMNG peers (TIKR)

Readers can observe AAPL stock’s relative outperformance against its peers since the start of 2022. For instance, the stock’s -5.5% decline was much better than its closest challenger Amazon’s (AMZN) -9.6% drop. It was also ahead of the QQQ’s -14.6% return as the NASDAQ emerged from a brief bear market in March.

Therefore, we think AAPL stock has confounded the bears yet again as investors sought safety in it. Why? It’s straightforward. Taking a closer look at the second chart would reveal some meaningful insights. AAPL’s NTM FCF yield of 3.8% was well ahead of its peers, except Meta (FB) and Google (GOOGL) (GOOG). Therefore, some investors argued that FB’s stock and GOOGL’s stock seem more attractive than AAPL at the moment.

While we concur that both stocks are undervalued (based on our DCF and comps models), it doesn’t mean AAPL is not attractive at a fair valuation. Given its robust and improving FCF profitability, we think tech investors remain confident that AAPL stock remains a core stock in their growth portfolios.

But, What About The Impact From Its Supply Chains?

Apple certainly isn’t immune from the supply chain snarls that have worsened recently. China’s full-blown COVID lockdowns have continued, and local state authorities are determined to curb the sharply rising cases. Notably, two of Apple’s key suppliers, Pegatron and Quanta, have suspended their production amid the lockdowns. Bloomberg reported (edited):

On Wednesday, Quanta said it was suspending a Shanghai plant to comply with government restrictions. Kunshan, a bustling city that hosts Apple Inc. suppliers including Pegatron and Luxshare Precision Industry Co., began a city-wide lockdown in early April.

On Tuesday, Pegatron suspended its iPhone assembly campuses in those two cities as China struggles to control the worst virus outbreak in two years. Other key Apple Inc. manufacturing partners including Luxshare and Compal Electronics Inc. also have major operations in Kunshan. – Bloomberg

However, investors should note that Pegatron accounted for about 20-30% of Apple’s iPhone production. Still, Quanta’s suspension will undoubtedly impact its MacBook production, as it’s Apple’s “sole EMS supplier,” according to famed Apple analyst Ming-Chi Kuo. Nevertheless, he highlighted that Foxconn should be able to absorb the impact of its suppliers’ production halt partially. He accentuated: “Foxconn at least can partially support iPhone and iPad supply to lower the impacts of discontinued operations at Pegatron and Compal.”

However, the impact on AAPL stock seems much more muted than what we saw with NVIDIA (NVDA) and AMD (AMD) recently. NVDA’s stock was fast approaching its March lows, while AMD has already broken below its March bottom. But, why not Apple?

If we refer to recent commentary regarding its iPhone demand, it has remained robust compared to its Android peers. Therefore, it demonstrated that Apple’s premium end-demand is less sensitive to a surge in costs that have hampered the Android devices. BofA also highlighted in late March that Apple’s lower trade-in prices signify the resilience of its new iPhones. It highlighted (edited):

Apple is offering trade-in values that are less than third parties in the US and UK and it recently cut trade-in prices in both countries, as well as China. In our opinion, lower Apple trade-in prices vs 3rd parties and the reduction in overall iPhone trade-in prices signifies strong demand. – Seeking Alpha

Recent supply chain checks from Apple’s Taiwanese supply chain partners also indicate that “they have yet to receive instructions from customers about revising orders, according to industry sources.” Furthermore, DIGITIMES added (edited):

They noted that shipment estimates originally given by customers for Q2’22 were actually lower than generally expected by market observers, and pull-in momentum from Apple has been rather stable, the sources said.

Due to the good sales performance of the previous iPhone SE 2, it is believed the iPhone SE 5G will help Apple further chip away at Android’s market share. However, based on reports from channels, pre-orders and subsenquent sales have not been as high as expected, resulting in rumors about Apple cutting orders. – DIGITIMES

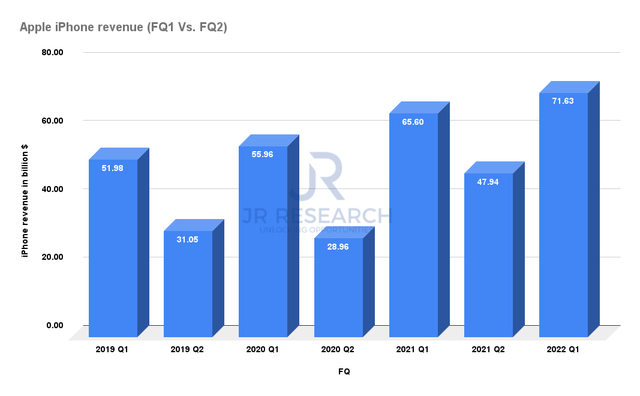

Apple iPhone revenue (FQ1 Vs. FQ2) (Company filings)

Therefore, it’s already within market expectations that Apple’s FQ2 (ending March 2022) would be weaker than its FQ1 (ended December 2021). Keen Apple investors know the criticality of the year-end holiday season to Apple’s iPhone sales. As seen above, Apple’s iPhone revenue has typically surged in its final calendar quarter (Apple’s FQ1). Therefore, the comps with FQ2 are not meaningful due to the seasonality of Apple’s iPhone launch cadence.

Therefore, given the resilience of Apple’s supply chain and the seasonality of demand surrounding its FQ2, we think worries about Apple’s end-demand have been overstated.

Also, Don’t Understate Apple’s Superb Free Cash Flow Margins

We have explained AAPL’s superb FCF yields earlier, despite its recent outperformance against its FAAMNG peers. But, we think bearish investors don’t accord sufficient credit to Apple’s FCF prowess.

So, investors need to understand that Apple is a massive cash flow machine that can efficiently translate its operating leverage gains into FCF profitability. Therefore, AAPL doesn’t need double-digit revenue growth to justify its valuation. Let us explain with a simple model which investors can easily apply.

| Stock | AAPL |

| Current Market Cap | $2.75T |

| Required CAGR | 10% |

| Years Modelled | 10 |

| Estimated Market Cap in Year 10 | $7.14T |

| Required FCF Yield in Year 10 | 3.5% |

| Implied FCF multiple = 1/FCF yield | 28.6x |

| Estimated FCF margins in Year 10 (S&P Cap IQ, Trefis blended estimates) | 28% |

| Implied estimated revenue in Year 10 | $892B |

| Implied Forward revenue CAGR from FY22E (10 years) | 8.47% |

Calculating Apple’s required forward revenue CAGR. Data source: author, S&P Capital IQ, Trefis, company filings

As explained earlier, we don’t think AAPL is undervalued anymore. The massive growth over the last five years is over for now. But, we believe Apple has some optionalities that may not have been factored in fully or partially.

These include higher than expected services revenue (which comes with higher margins accretion), higher subscriptions take-up rates, a more robust ATT framework to take share from Meta and Google, Apple Car, Apple AR, etc.

Therefore, we think buying Apple now is a pretty safe bet if you are comfortable with a 10% CAGR over time. However, if you require 15-20%, you need to wait for a deeper retracement for AAPL stock to reach undervalued levels again.

As such, we reiterate our Buy rating on AAPL stock.

Be the first to comment