Nature/iStock via Getty Images

Thesis

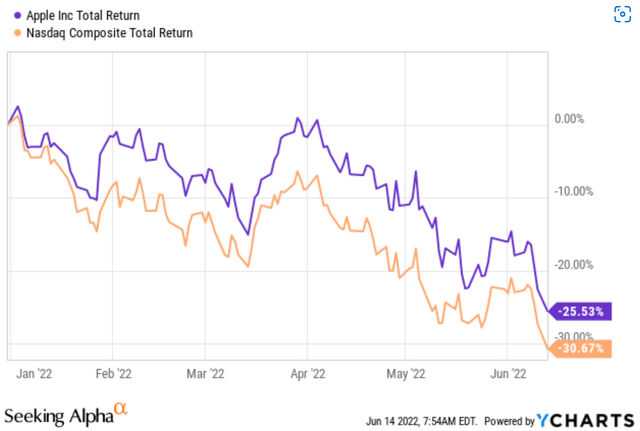

Recent market corrections have provided a rare entry opportunity to buy Apple (NASDAQ:AAPL) shares at an attractive valuation. As you can see from the following chart, the NASDAQ 100 index suffered more than a 30% correction YTD. AAPL shares are more resistant but still retreated by more than 25% also. The combination of price retreat and earnings growth has now brought it FW PE to about 21.4x, almost at most attractive level in a decade.

On the business side, its fundamentals remain strong, probably even stronger than it was at the beginning of the year. A highlight involves the M2 chip officially released during its WWDC2022 Apple Developer Conference in early June. As to be elaborated immediately below, I see the M2 chip as a key to unlocking its next new growth cycle. It will further augment its already powerful product lineups, catalyze new products, and ultimately maintain AAPL’s pricing power and profitability for years to come.

M1, M2, and AAPL’s strategic shift

Roll back two years to 2000, AAPL’s WWDC presentation announced its plan to shift to its own chips. The shift of the Macintosh line is expected to take about 2 years, which would be 2022. Shortly after the announcement, AAPL achieved wild success with the M1 chips not only in its Mac product line but also in the tablet line. The success boosted sales by 15% despite supply chain difficulties. As CEO Tim Cook commented in the 2022 Q2 earnings report (the emphases were added by me):

Last month we announced another breakthrough with M1 Ultra, the world’s most powerful chip for a personal computer. The incredible customer response to our M1-powered Macs helped propel a 15% year-over-year increase in revenue, despite supply constraints. We now have our most powerful Mac lineup ever, with the addition of the entirely new Mac Studio.

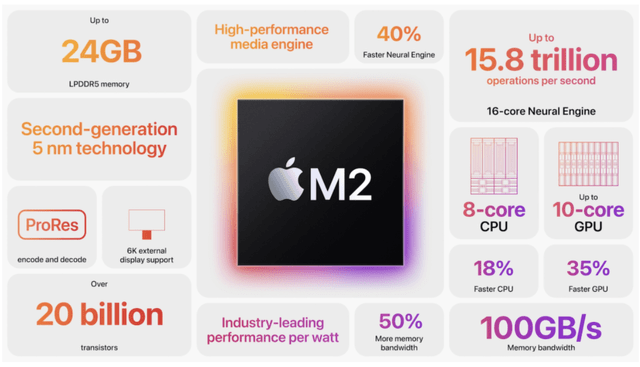

Now looking forward, M2 is even more powerful, more energy-efficient, and better positions AAPL for the megatrend toward mobile computing. According to the following specifications provided by CPU Ninja, under the same power consumption, the M2 packs 20 billion transistors (25% more than the M1) and provides 100GB/s memory speed (50% faster than M1). And its CPU performance is 18% higher than M1, and its GPU performance is 35% faster.

These technical improvements will be directly reflected in its end products to benefit end-users, as discussed next.

Pricing power continues and M3

Thanks to the performance boost and power efficiency, the M2 chip dramatically improved end products, both hardware, and software. For example, with the M2, AAPL’s new MacBook Air is 25% now smaller, thinner (only 11.3 mm thick 0.44 inch), and lighter (now it weighs only 1.24kg or 2.73 lbs).

Of course, it also will cost you more. The price of the new MacBook Air with an M2 chip starts at $1199, a price increase by $200 compared to the previous version with M1 chips, or a full 20% price increase. Yet, I firmly believe that consumers will still be flocking to buy based on past experiences with new AAPL products, as detailed in my earlier article below.

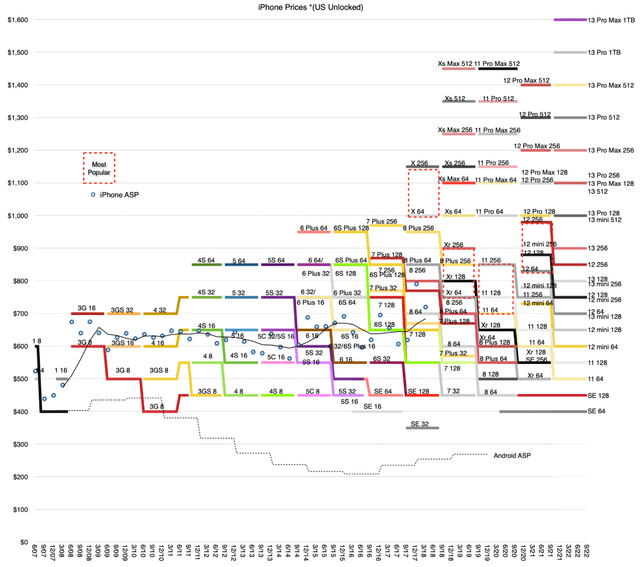

Much has been written about how wonderful AAPL products have been. Here I just want to draw your attention to the following chart and use iPhone as an example to showcase AAPL’s pricing power. It is a busy chart with quick a bit of information. My key takeaways are:

- Apple’s iPhone prices have skyrocketed over the past 14 years, iPhone 13 is 81% more expensive than the original iPhone. That is a 4.3% CAGR maintained over a 14-year period, far exceeding the inflation (about 2%) over the same period.

- Put in absolute terms, this means that an iPhone is on average US$437 more expensive now than in 2007. AAPL sold more than 234 million iPhones last year, and the $437 price hike translates to more than $100 billion of ADDITIONAL revenue.

Looking further out, Taiwan Semiconductor Manufacturing is said to be testing designs for the M3 processors. Using the more advanced 3nm technology, the M3 will feature even higher transistor density and more computing power.

Valuation

Despite the strong business fundamentals and most powerful product lineup, AAPL is not for sale at an attractive valuation due to the recent corrections as aforementioned. As you can see from the following chart, its FW PE has fluctuated between a bottom of about 19.5x to a peak of about 29.6 in the past decade. And its average FW PE is about 24.6x. Currently, it is priced at 21.46x FW PE, about a 13% discount from its historical average.

Relative to the overall market, the current valuation of the Nasdaq 100 index is about 19.8x and S&P500 19.0x PE. So AAPL is only marginally above the overall market, by about 8% to 12%. I view such a small premium as mispricing. AAPL’s profitability as measured by return on capital employed is above 100%, more than 5x of the average market. Its financial strength is way stronger than the majority of the stocks in the Nasdaq 100 index or S&P500 index. An 8% to 12% premium undervalues AAPL and provides a substantial margin of safety.

Final Thoughts and Risks

Recent market corrections have brought APPL’s valuation to a 13% discount from its historical average. Compared to the overall market, it is now for sale at only about 8% to 12% premium, which is clearly mispriced in my view given its far superior profitability and financial strength to the market average. On the business side, its fundamentals remain strong, arguably with the most powerful product lineup in its recent history. Particularly, the M2 (and M3 after that) will provide a strong catalyst to propel its innovation and new product design, and ultimately to maintain pricing power and profitability for years to come.

Finally, risks. I do not see any structural risks to AAPL. But in the near term, a recession is a tangible risk. Ramparting inflation and the market’s expectation of the biggest Fed rate hike since 1994 could trigger a further correction or even a recession. The ongoing Russian/Ukraine war and global supply chain disruptions further compound these issues and increase the odds of a recession. AAPL share prices would suffer together with the overall market as we’ve seen already. However, my view is that AAPL shares will fare better (relatively) given its strength and long-term investors should look past price actions and focus on fundamentals.

Be the first to comment