Seremin/iStock Editorial via Getty Images

On September 7, Apple (NASDAQ:AAPL) plans to host the annual event to announce the new iPhone, amongst other products. The event typically occurs in early September, allowing Apple to release the latest smartphone prior to the end of the FY, allowing for sales to easily flow during the holiday period. My investment thesis remains negative on the stock due to valuation and the event to unlikely include the announcement of new key AR/VR products.

iPhone 14 Launch Event

Apple is expected to announce an iPhone 14 lineup of four models (Pro, Pro Max, Max, and base model). As well, the tech giant could announce new versions of the Apple Watch and a new AirPods Pro product. Though, the company isn’t expected to announce the new mixed reality headset in a huge disappointment.

The iPhone continues to generate 50% of total sales and outshines all other products and Services by a long shot. With Apple not expected to sell more units this holiday season, the market has latched onto hopes the tech giant will successfully raise prices by up to $100.

Analyst Wamsi Mohan has speculated that a $50 hike to the Pro-model would provide a $0.20 tailwind to EPS. However, some indications suggest Apple might be required to raise prices in order to cover higher storage costs. Investors shouldn’t assume that any price hikes are necessarily going to drop to the bottomline with the iPhone 14 Pro models expected to start with 256GB of storage.

The new iPhone is purported to include camera updates, improved sensors and larger batteries improving processor performance. The smartphone continues to evolve, but the improvements in this model aren’t revolutionary like the 5G chip included in the iPhone 13 version from last year.

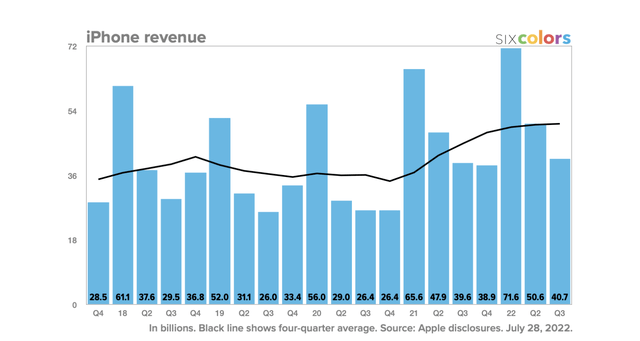

iPhone sales got a huge boost from last year with the delay of iPhone 12 sales into FY21 and the inclusion of the 5G chip the following year. The combination with some covid pull forward demand created a scenario where Apple will have a very difficult time topping iPhone sales from the last year no matter how spectacular the technology improvements to the new smartphone lineup.

The current FQ4 sales aren’t meaningful to the Apple story considering the iPhone launch is always so late in the quarter with around a week worth of sales included in the September quarter. Consumers wanting a new iPhone typically wait until after the launch pushing most of the sales into the FQ1 holiday period. For FQ1’22, Apple saw iPhone sales balloon to $71.6 billion, up 9% from the $65.6 billion the prior FQ1.

The biggest hurdle is likely the FQ2 numbers where Apple grew revenues 5% last year to $50.6 billion from the FQ2’21 quarter where sales surged 66% to $47.9 billion. The largest two iPhone quarters of each year have the largest hurdles due to the dynamics created by covid and the 5G launch last year.

EPS Beat Needed

If Apple can top these quarterly sales numbers, the tech giant will have truly done an impressive job. Unfortunately, the stock continues to be priced for perfection where Apple needs to easily exceed these high hurdles.

Not only does Apple need to raise the Pro model prices by $50 to $100 each, but the company needs to restrict cost increases. A lot of consumers seem unwilling to purchase the Pro models with price increases pushing the price tag above $1,000 for the base storage models.

The average Apple product gross margin is ~34%. On an average price increase of $100, the tech giant would normally only capture $34 in additional gross profit as an indication of the higher costs faced by the new iPhones.

With all else being equal where Pro model sales remain strong despite an additional $100 price tag, Apple would definitely be better off by each iPhone generating $34 in higher gross profits. Of course, the operating expense base would have to stay flat in order for these higher profits to not just easily be absorbed.

Analysts currently forecast FQ1’23 sales to rise just 3.6% with EPS flat at $2.12 per share. While analysts like Wamsi Mohan of Bank of America and Dan Ives of Wedbush Securities are promoting higher earnings and higher price targets, the numbers aren’t actually flowing into higher consensus estimates.

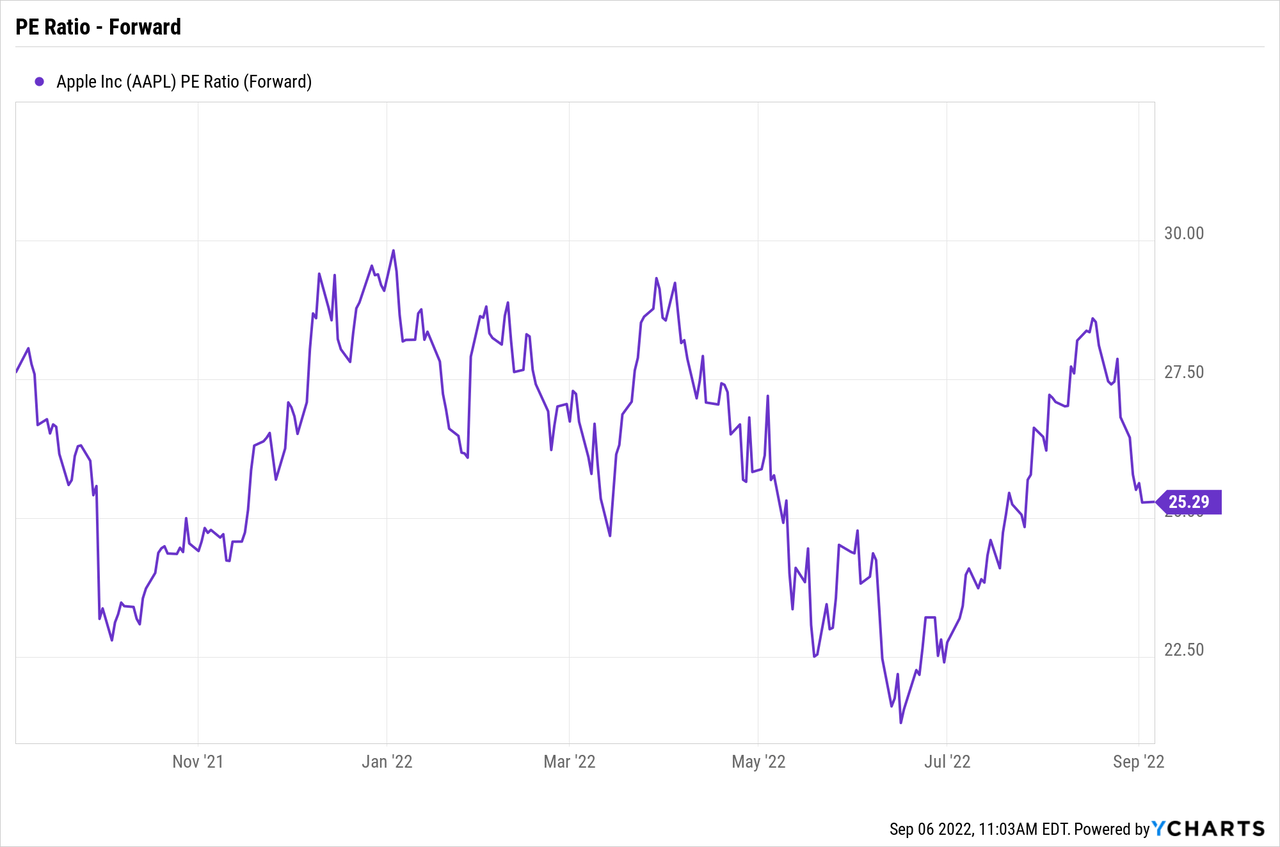

The consensus estimates don’t have Apple returning to material EPS growth until 7% in FQ3’23. The lack of revolutionary new products such as the new AR device will provide much boost to a stock already trading out of line with the actual growth expectations.

Takeaway

The key investor takeaway is that Apple continues to trade based more on hype than reality despite the recent $20 dip in the stock. Apple is a safety trade for a lot of investors, yet the stock is one of the most expensive ones on the market right now.

Be the first to comment