Dan Kitwood

Back in the summer, when I last covered Apple (NASDAQ:NASDAQ:AAPL), I said you should ignore the temptation to buy. The idea was that the company is now neither growth nor value, meaning I didn’t see a case for it outperforming the market. Of course, it rallied sharply during the broader market rally, but over the past three months, it has produced almost exactly the same return as the S&P 500. My goal in my personal investing – and for that of my subscribers – is to find not only stocks that will rise in value, but rise in value more quickly than the rest of the market. So, three months on, does Apple fit that description?

In short, ‘no’

When I look at Apple’s prospects, I still see a company that has been valued like a growth stock in the past, even though it isn’t. While what makes a ‘growth stock’ to one person can be different to another, I will never be convinced a company growing earnings at 6% or 8% a year is a growth stock. That’s where Apple is today, and that’s where it is likely to stay barring some massive, unforeseen change. That’s fine, but the valuation needs to reflect that. Today, I see the valuation as much more sustainable than it has been in the past couple of years, and that’s good news for the stock.

The other bit of good news is that this stock is very oversold, as I shall now demonstrate.

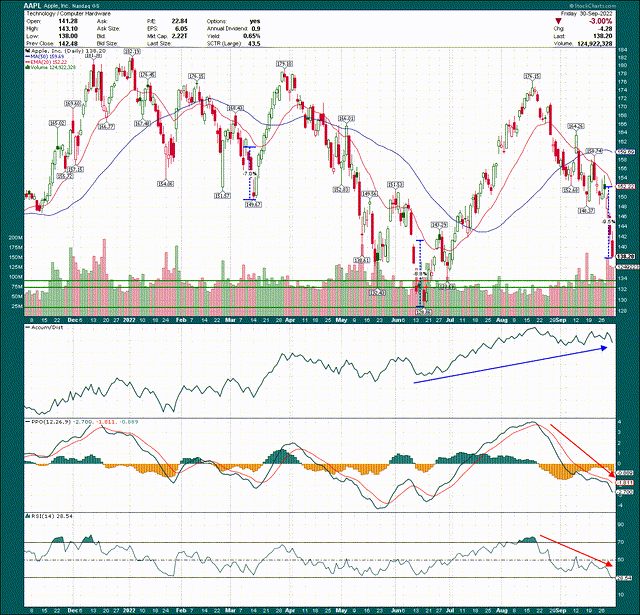

We can see on the daily chart that Apple has been absolutely destroyed in the past six weeks or so. The stock hit a relative high of $176 in mid-August, and is indicated at $136 as I write this. For one of the world’s largest companies, that is a gargantuan move. That has caused a ton of technical damage to AAPL stock, but there are some silver linings.

First, I’ve annotated on the chart the difference between the 20-day exponential moving average and the price low for the past two selling episodes, and the current one. The March selling episode saw a max difference of about 7%, the June low saw about 9%, and today’s is knocking on the door of 10%. That magnitude of difference is certainly significant, and in conjunction with the other indicators, it argues for a bounce, even if that bounce proves unsustainable.

The accumulation/distribution line continues to oscillate around its highs, meaning there is big money buying dips, rather than selling rips. When bullish momentum does return, it will likely return quickly, as we saw in July and August.

The PPO and 14-day RSI are both well into bearish territory, and both are showing oversold conditions. There has to be sustained selling for the PPO to end up where it is today, and it’s gone from +4 to -3 in a straight line.

While it appears Apple is likely to test support at ~$133, I don’t see a reasonable scenario where it should fall further than that. That’s only a few dollars lower than today’s price, so that, along with all the indicators showing this thing is oversold, argues for a bounce. Apple, of course, is so large that if it bounces, the broader indices will almost certainly do the same, so that would be good for the whole market.

The other point is that the company is set to report earnings in about four weeks’ time, and this setup looks very similar to the July earnings setup. In other words, June produced a massive selling episode that bottomed before a pre-earnings rally saw the stock fly into the report, and beyond. We have an almost identical setup today, and given my views on the daily chart, I see a pretty high possibility of a pre-earnings advance, rather than more selling.

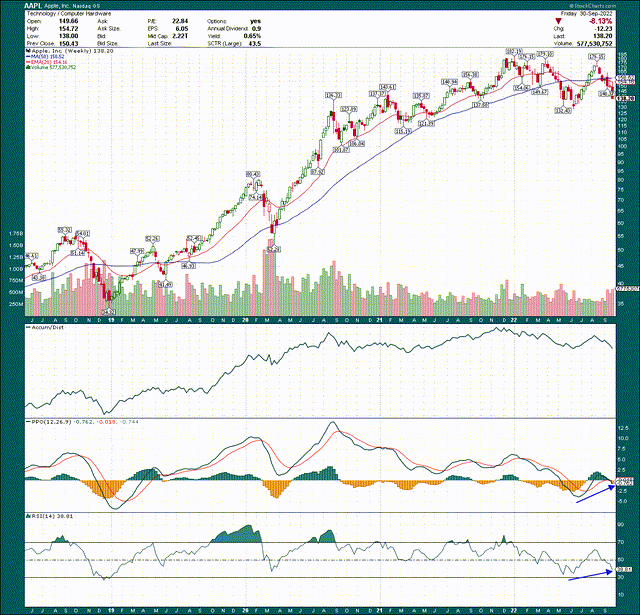

One other point that I believe argues for upside risk instead of downside from here is on the weekly chart, which is pictured below.

The PPO and 14-week RSI are both showing pretty strong positive divergences, meaning on the longer time frames, Apple’s selling momentum is looking pretty tired. The absence of bearish momentum is just as effective as outright bullishness, because when the bears get tired, there’s no one left to sell.

Positive divergences are not, I repeat, not, a guarantee the stock cannot go lower. However, it does increase the odds of the selling being near completion. When we put this alongside the other evidence that I believe supports an impending bounce, Apple’s near-term outlook is for a higher price.

Signs of caution

The world today is full of worries for investors. There are interest rates, recession, supply chain woes, fears of declining consumer spending, and more. Apple is somewhat immune to those given it sells premium products with unbelievable brand recognition and loyalty, but as we can see below, it isn’t completely immune.

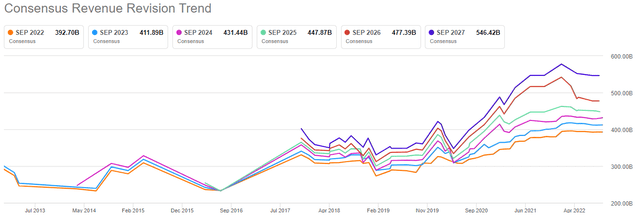

Revenue estimates have actually come down in the past few months, albeit slightly. However, any downward movement is problematic, and the stock has suffered for it. In fact, you can almost perfectly line up the weakness in the price chart with the beginning of the downward revisions in revenue. So, as long as this continues, it’s going to be a tougher job for the bulls. The upside is that the majority of recent revisions have been lower, meaning it is entirely possible the bulk of the cuts have already been made.

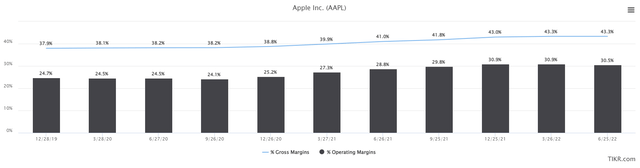

The other problem outside of revenue is that Apple’s margins have begun to decline after several quarters of huge expansion. Below we have trailing-twelve-month gross and operating margins to illustrate this.

TTM gross margins plateaued in the March quarter, after rising sharply from 38% in 2019/2020. That’s a huge amount of margin expansion for a company as massive and mature as Apple, and it led to an equally impressive boost to operating margins. However, operating margins began declining on a TTM basis in June quarter, and we certainly should not be surprised to see that occur again in the September quarter.

The company can overcome part of these headwinds via things like pricing power, which it can facilitate through selling a higher mix of its high-end models, rather than base iPhones. The Pro version of the iPhone 14 could be the way the company intends to deal with its margins. But if that doesn’t work, that’s a downside risk to the stock.

Apple could also use services revenue – which is extremely high margin – to pick up the potential slack in rising input and freight costs. It appears the inflection point on that came earlier this year, and this is a big risk for Apple.

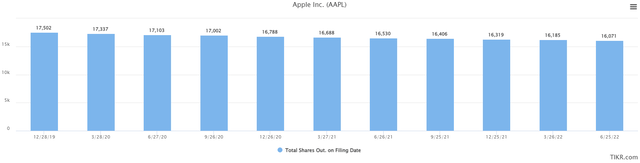

The reason is because there are only three ways a company can grow EPS: 1) revenue growth 2) margin growth and 3) share count reduction. Sales are expected to grow at 4%/5% for the foreseeable future, and the company is reducing the share count slightly each year, which you can see below.

That means that even if Apple sees a 50bps reduction in operating earnings – which is entirely within the realm of possibility – that’s a ~2% headwind to earnings. With 5% revenue growth and a 2% or 3% reduction in the float each year, a 2% headwind is meaningful to say the least. It’s the difference between EPS growth of 8% or 6%, for example. That, in turn, can compress the multiple investors are willing to pay, and that’s what we’re seeing today.

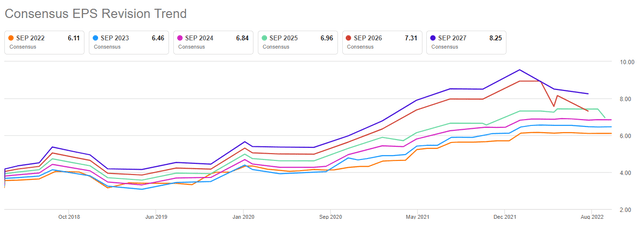

That’s the situation we see below, which is the culmination of all of those factors, resulting in less-than-inspiring EPS revisions.

The current year, and the next two years are showing essentially flat lines. That’s okay, but the out years are all coming down. Whether those numbers come to fruition or not is irrelevant for the moment; what’s relevant is that the most important consumer products company in the world is seeing downward revisions.

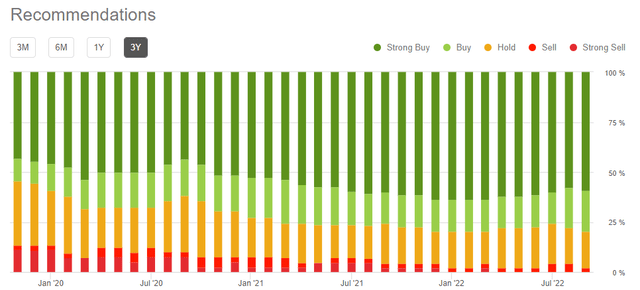

What’s interesting is that analyst sentiment hasn’t been reset. In fact, analysts are about as bullish today as they have been in the past three years. There are almost no sell ratings, a few holds, and the rest are at buy. I would prefer some negative sentiment here to help drive upgrades in the coming months, but that’s simply not the case.

Even recent analyst actions are mixed with Evercore and Rosenblatt offering up bullish revisions last week, while Bank of America took the other side.

Final thoughts

If we take all the information above – an oversold stock, a murky revenue and margins outlook, and mixed analyst sentiment – it’s pretty easy to understand why shares have been punished the way they have. The good news is that if you’ve been patient, Apple is as cheap as it has been in a while.

Shares are at ~22X forward earnings today, which is very near the June low, and near the pre-COVID valuation of the stock. I don’t think we’re going to see 37X earnings again, but this stock is generally more expensive than 22X, so it’s much nearer to a value stock today than it has been.

Is Apple a growth stock? No. Is it a value stock? Perhaps, but even that’s a stretch. It’s also a dividend stock, but the yield of 0.7% is pointless, and no one is buying it for that. We have a stock that is in no-man’s land, then, but I will say that I’m more bullish now than I was in July when I last covered Apple.

The valuation is more tenable today, and the company has already seen a substantial number of revenue and EPS cuts. The stock is very oversold, and is near key price support. All of these combined means that while I still think Apple may struggle to outpace the broader market, it’s worth a look on the long side. If you buy it and it fails price support at ~$133, it would be prudent to get out for a small loss. I think there’s upside to the 20-day exponential moving average at least, which we saw was about 10% overhead from here. That’s solid from a risk/reward perspective, and I’m upgrading Apple as a result of all of these factors. We’ve seen estimates come down, the stock has been obliterated, and enough is enough.

Be the first to comment