Nikada/iStock Unreleased via Getty Images

Apple (NASDAQ: AAPL), despite recent weakness, is the largest publicly traded company in the world, with a massive $2.65 trillion market capitalization. According to reports, prior to AT&T’s (NYSE: T) 2015 acquisition of Time Warner, Apple’s executive leadership discussed a potential $100 billion acquisition, although, at the time, Apple had a less than $600 billion market capitalization.

As we’ll see throughout this article, despite no sign the company is moving forward, we think that Discovery (NASDAQ:DISCA) + Time Warner would make a strong asset for Apple’s portfolio.

Time Warner + Discovery Pros and Cons

The acquisition has been discussed before, so clearly Apple sees some pros. However, since then the pros have increased in our view. First, in late-2019, Apple launched Apple TV+. The business reportedly has roughly 40 million subscribers, offering a niche form of high quality content for interested investors.

The business, assuming all paying subscribers (although there are many free subscribers) could throw off ~$2.4 billion in annual content. However, the company is also spending a much more significant $6.5 billion in annual content spending. That’s a massive amount of content spending that has numerous synergies.

Not only would it have synergies for existing spending but it would provide Apple with HBO Max’s existing 70 million subscribers and a substantial portfolio of legacy content assets. Apple would own incredibly well-known news services, assets such as the DC Universe, and popular shows such as ‘Friends’ and ‘Big Bang Theory’.

Those combined assets would very clearly make Apple TV+ a clear top-three streaming contender along with Netflix (NASDAQ:NFLX) and Disney+ (NYSE:DIS). It would also stop another large tech company such as Amazon Prime (NASDAQ: AMZN) from acquiring the asset for its portfolio. All the reasons that made the acquisition worthwhile in 2015 are much more significant now.

The con, however, is Apple has historically been against large acquisition. The company’s largest historic acquisition has been ‘Beats’ in 2014 for $3 billion. Apple is protective of its culture, and even if it builds a separate streaming division, it would be integrating a massive business. Apple has roughly 150,000 employees, and in 2015, Time Warner had almost 26,000.

There’s definitely ways the businesses could be integrated, but regardless of how it’s down the integration and synergies would take years to be realized likely.

Time Warner + Discovery Acquisition Price

Moving onto the nuances of the acquisition, the question becomes, how much would it cost.

AT&T originally paid a 35% premium for Time Warner. The current value of the deal is $58 billion in debt plus an implied market capitalization of roughly $43 billion for a total of roughly $100 billion. Counting the premium, that could imply a price of up to $120 billion; however, accounting for some volatility etc., we’ll assign a price of $130 billion to the deal.

That acquisition price provides the entire business with a significant potential for additional synergies for investors.

Apple Financial Capacity

The next question, which is a simple one, is does Apple have the financial capacity for such a deal.

The company has appreciated significantly, and it very clearly does have the financial capacity. We think the company could comfortably make the deal as an all-cash acquisition. Apple likes to maintain a massive cash pile and currently has almost $200 billion in cash and marketable securities on hand.

The company has a unique ability to garner great rates on long-term interest rates. Its current long-term interest rate is roughly 2%, down from 3% before the COVID-19 interest reductions. Given Apple’s manageable $100 billion in long-term debt, and more substantial cash position, we expect that Apple will be able to comfortably have and spend $130 billion.

We expect a 2.5% interest rate, or $3.25 billion in annual interest expenditures for the transaction. It’s worth noting a significant amount of this $130 billion is almost $60 billion in long-term debt that the company would be inheriting.

Acquisition Payoff Structure

Apple’s core businesses have sufficient cash flow to comfortably pay down $150 billion in debt; however, for now we’ll focus on the independent business itself.

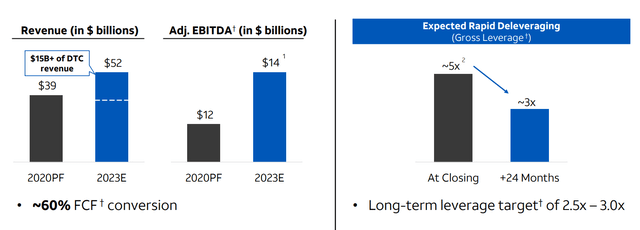

The business is expected to grow its revenue significantly from 2020 to 2023 ($39 billion to $52 billion in revenue). The company is expecting a ~60% FCF conversion ratio; however, that’s with ~$42 billion in long-term debt that’s costing ~$2 billion in annual interest rates. As a result, 2023E FCF of $8.4 billion could be closer to $10.4 billion. This shows a potential pay-off schedule throughout the 2020s.

We’re also going to assume adjusted EBITDA growth at 5% annualized (supported by growing streaming businesses etc.) with a continued 75% FCF conversion rate (not counting interest).

| Year | Debt (YE) | Interest Expenditure | Adjusted EBITDA | FCF (w/out interest) |

| 2022 | $130.0 billion | $3.3 billion (2.5%) | N/A | N/A |

| 2023 | $122.8 billion | $3.1 billion (2.5%) | $14.0 billion | $10.5 billion |

| 2024 | $114.9 billion | $2.9 billion (2.5%) | $14.7 billion | $11.0 billion |

| 2025 | $106.3 billion | $2.7 billion (2.5%) | $15.4 billion | $11.5 billion |

| 2026 | $96.9 billion | $2.4 billion (2.5%) | $16.2 billion | $12.1 billion |

| 2027 | $86.5 billion | $2.2 billion (2.5%) | $17.0 billion | $12.8 billion |

| 2028 | $75.3 billion | $1.9 billion (2.5%) | $17.9 billion | $13.4 billion |

| 2029 | $63.1 billion | $1.6 billion (2.5%) | $18.8 billion | $14.1 billion |

| 2030 | $49.1 billion | $1.3 billion (2.5%) | $19.7 billion | $14.8 billion |

The above graph shows how the company can spend the 2020s paying down the transaction. It’s worth noting that we assumed no synergies and throughout this entire time, Apple TV+ is getting the benefit of Time Warner + Discovery’s massive content library (or vice versa). That is a massive and synergistic portfolio.

Another way to look at this is based on 40 million Apple TV+ subscribers, HBO Max + Discovery would only need to add 13 million subscribers before there starts to be additional synergies. That’s roughly 1% of Apple’s installed base. Lastly, you can look at it as the acquisition could provide enough content and spending for Apple TV+ to decrease its current $6 billion content budget.

That could also add additional synergies. Even without any synergies, by 2030, there’s $49.1 billion in debt for an acquisition with $13.5 billion in post interest FCF. Assuming a 7% FCF yield for fair value (which is double Apple’s FCF yield), that’s $143 billion in added market value to Apple showing how the acquisition has paid off.

That shows the acquisition strength.

Investment Strategy

For those interested in investing utilizing this strategy, we recommend investing in AT&T or Discovery stock. That’d get issue to the combined company which has significant FCF potential, even without the acquisition. We feel the combined company is valuable as a standalone. However, even if it doesn’t stay standalone, with an acquisition you can get a more significant market premium.

It’s also worth noting Apple isn’t the only potential acquirer. In our view, Disney and Comcast (NASDAQ:CMCSA), the other two large streaming conglomerates, come with less interesting side businesses (i.e. Parks) that a large tech company might not want. Netflix has been in the market for ages, but it’s a much more expensive business with less content.

In our view, Amazon or Google (NASDAQ:GOOG), or even Facebook (NASDAQ:FB), are all wealthy acquirers that could be interested in acquiring and picking up the business.

Thesis Risk

In our view, the largest risk to our thesis is two-fold.

The first is “streaming fatigue“. As the number of streaming services escalates, customers are more likely to pick and choose versus the past where Netflix was a “catch-all”. While we feel it’s likely HBO Max + Discovery remains a top choice, there’s no guarantee that that’ll be the case for investors as it happens.

The second is cultural integration with Apple TV+. There are already substantial streaming, software, programming etc. departments at Apple and the presumed aim would be to integrate that as much as possible with HBO Max. With Apple having a tech company culture and Time Warner + Discovery coming from the movie / telecom industry, there might be clashes there.

Overall, we see these risks as manageable and expect investors in AT&T / Discovery will profit handsomely even without the acquisition paying off.

Conclusion

Time Warner + Discovery going public represents a pure-play content business with a massive portfolio of legacy content and a strong streaming business in the streaming age. We expect large technology companies, which can easily buy the company and our estimated $130 billion acquisition price, will be closely eyeing it as a crown jewel acquisition.

The acquisition would be FCF positive from Day 1, after interest on the debt, due to historically low rates. That doesn’t even account for any synergies. It’s an acquisition that Apple could comfortably afford and would attract significant value to the company’s other assets to have a streaming giant within its portfolio.

Be the first to comment