Shahid Jamil

Apple (NASDAQ:AAPL) has been one of the most resilient stocks this year amid the broader market selloff triggered by increasing investors’ concerns of a deteriorating economy. Although the stock has lost more than 16% of its value since briefly surpassing the $3 trillion mark earlier this year, it has continued to outperform the broader market by wide margins – key benchmarks like the S&P 500 and tech-heavy Nasdaq 100 have lost more than 22% and 30% of their values this year, respectively. The Apple stock’s performance this year is largely consistent with our earlier expectations that it will prove more resilient compared to peers against near-term macro headwinds given its “immense cash flows and commitment to return money to shareholders”.

In the latest development, the Apple stock has shown increased sensitivity to the performance of its iPhone 14 sales over the past two weeks, in addition to the rapid deterioration in general market sentiment after Fed officials reinforced their hawkish stance on taming inflation. On the brighter side, the higher priced and more profitable iPhone 14 Pro models – which feature the bulk of the new line-up’s upgrades, spanning the Dynamic Island, the upgraded A16 chip, and enhanced camera technologies – have been met with better take-rates than the standard counterpart, which are largely similar to the iPhone 13. This has very well unfolded to Apple’s favor, as it has strategically planned the newest iPhone family launch in such a way to fuel higher-priced upsells in an attempt to “overcome a broader slump” amid weakening consumer spending. Yet, Apple’s shares buckled this week after industry reports of weaker-than-expected demand – the company has reportedly told suppliers to “pull back from efforts to increase assembly of the iPhone 14 product family by as many as 6 million units in the second half of the year… [and instead] aim to produce 90 million handsets for the period, roughly the same level as the prior year and in line with Apple’s original forecast this summer”.

Ongoing fluctuations in Apple’s product sales business due to its cyclical nature continue to underscore the importance of the company’s increasing shift in focus towards growing its higher-margin services segment in recent years. In 2017, Apple – under the leadership of Tim Cook – vowed to double its services revenue by 2020. Since then, the segment has delivered with a multi-year compounded annual growth rate (“CAGR”) of more than 20%, boasting close to $68.5 billion in annual revenues during fiscal 2021, and approaching $80 billion in the current fiscal year ending this week. Earlier this year, Wall Street predicted that Apple’s services segment amounts to a $1.5 trillion value on its own, similar to our own predictions which will be discussed in further detail below.

Although services sales growth has decelerated from its heights last year due to the moderation in demand from pulled-forward subscriptions during the pandemic era alongside broad-based macro weakness, the segment continues to boast robust double-digit expansion, reinforcing the bullish thesis surrounding Apple’s sustained long-term growth and profitability trajectory. While our previous coverage on the stock has delved into how Apple’s ecosystem of offerings is anchored by the iPhone, we view the company’s portfolio of services as what will ultimately compensate for the near-term cyclical headwinds facing hardware sales. Paired with the continued expansion of Apple’s portfolio of services, alongside attractive offerings such as the Apple One Bundle to capture demand, the segment plays an increasingly critical role in reinforcing the company’s long-term growth prospects.

The Base Case – Services Lead Growth Alongside Hardware Sales

Apple’s services segment has been a highlight in recent years, setting new sales records year after year. The company has come a long way from iTunes with paid downloads that were fighting for market share from torrent sites, to now Apple Music and Apple TV+ subscriptions that are putting respective industry leaders in audio and video streaming on notice. App Store traffic and iCloud subscriptions have also gained momentum in recent years, gradually growing their respective contributions to the services segment’s performance despite mounting regulatory noise. Apple’s sprawling paid subscription and active product installed base of more than 860 million and 1.8 billion, respectively, has also bolstered its grip on the burgeoning digital ads sector, as well as digital payments and other service offerings.

Circa 2017 when Cook aspired to double services revenues by 2020, the company has delivered with change to spare. The segment’s sales have expanded at a more than 20% CAGR since, with related gross margins expanding from 55% to more than 71% over the same period. The services segment’s contribution to consolidated sales mix has also expanded from 14% in 2017 to almost a quarter today, underscoring its increasingly critical role in supporting Apple’s bullish narrative.

As discussed in our latest coverage on the stock, Apple’s iPhone serves as a critical anchor to its sprawling ecosystem of offerings, while the company’s add-on services are key to compensating for the comparatively moderate growth in hardware sales. Specifically, the iPhone allows Apple to partake in the expanding market for connected services enabled by the advent of internet access, while the company’s extended portfolio of service offerings reinforce demand for its hardware, supporting an ecosystem that continues to seamlessly integrate across daily consumer life settings. And to revisit the favorable forward market trends for Apple’s services business:

The segment is expected to keep benefiting from continued growth in market demand for centralized music and video streaming apps, cloud storage services, virtual payment solutions, and advertising. The global market for mobile applications is expected to grow at a CAGR of 18.4% and reach a market value of more than $407 billion by 2026. With AAPL hosting one of the largest and most used app stores in the world, it would be reasonable to assume that related revenues would grow at a similar pace.

The global market for online video and music streaming services is also expected to grow on a similar trajectory towards a market value of more than $60 billion by 2026. This represents market growth at a CAGR of about 16%, thanks to increasing global usage of smartphones, laptops and other advanced home electronic products, which have contributed to the accelerated growth of this market. And AAPL is poised to benefit from these trends given its already established music and video streaming platforms, Apple Music and Apple TV+. Growing demands within this market segment are also expected to further propel the company’s ad revenues – even P&G, the second largest ad buyer in the world, has called the TV ad system “antiquated”, marking the beginning of its shift towards placing ads in new areas of digital media like online video and music streaming.

iCloud is also expected to lead AAPL’s revenues generated from the Services business segment as the data-driven era continues to drive global demand for low-cost, reliable and secure data storage solutions. The global cloud storage market is expected to reach a value of $184 billion by 2026, representing a CAGR of close to 20%.

Source: “Will Apple Stock Reach $200? In Our Opinion, Not If As Is”

And Apple’s growing prominence in services is further corroborated by its high-profile achievements in streaming. Earlier this year, Apple TV+ became the first video streaming platform to win Best Picture at the Oscar Academy Awards with “CODA”. The platform is also poised to emulate the financial success of both traditional linear TV as well as key rivals within the video streaming industry by stepping foot into the sports arena:

Streaming: Announced earlier this month, Apple TV+ has secured the rights to air “Friday Night Baseball” beginning July, as well as other exclusive accompanying content such as “Countdown to First Pitch” and “MLB Daily Recap”. And just about two weeks ago, Apple has also secured rights to stream Major League Soccer for the next 10 years on Apple TV+, as well as other exclusive MLS content, under a $250+ million per year deal.

The enhanced sports offerings are also complemented by a step-up in Apple News offerings to accommodate new feature “My Sports”. My Sports allows users to follow their favourite sports leagues to obtain information like scores, schedules and standings in real-time right in the news feed.

To put into better perspective regarding the traction that sports broadcasting brings to streaming, we turn to Amazon’s (AMZN) success with its latest partnership forged with the NFL:

Amazon.com Inc.’s first regular-season NFL broadcast drew 13 million viewers to its streaming service, delivering an online audience that rivals traditional TV.

The total, reported by Nielsen, was up 47% from last season’s week 2 Thursday night game, which aired only on the NFL Network, and it was more than the 12.6 million viewers Amazon is guaranteeing that advertisers will reach.

Source: Bloomberg

Amazon.com Inc.’s broadcast of “Thursday Night Football” attracted a record number of new Prime subscriptions for a three-hour period, even beating out events like Cyber Monday and Prime Day, according to an email reviewed by Bloomberg.

“By every measure, ‘Thursday Night Football’ on Prime Video was a resounding success,” Jay Marine, Amazon’s vice president in charge of the streaming service, said in the email.

Source: Bloomberg

Apple has also leveraged its strategic sports partnership to better capture consumer demand for its ecosystem of services. In addition to cross-app sports entertainment offered between Apple TV+ and Apple News as discussed in the earlier section, the company has also leveraged monumental moments in sports – such as New York Yankees outfielder Aaron Judge’s record-tying homerun this week – to draw additional traffic to its streaming platform, even if it is offered for free. The economics goes beyond recurring subscription revenues, and will play an increasingly substantial role as Apple aims to deepen its reach in the growing digital advertising market.

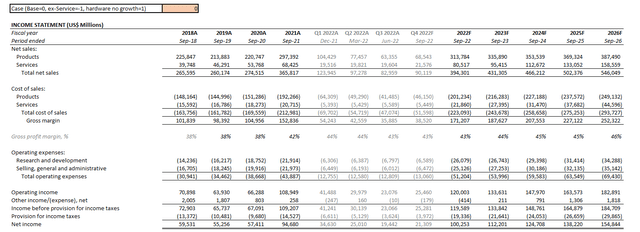

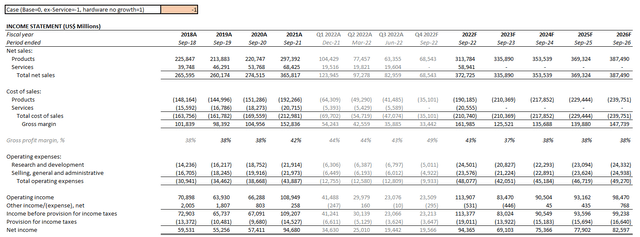

Drawing on our latest base case forecast for Apple, product and services sales are expected to expand at a five-year CAGR of 4% and 15%, respectively, consistent with historical growth trends as well as forward market expectations based on the company’s existing portfolio of offerings. Meanwhile, gross profit margins are forecast to expand from the current 43% towards 46% over the same period on a consolidated basis, buoyed by expectations for the higher-margin services segment’s increasing contribution to overall sales mix and relative scale. Throwing in key valuation assumptions – including a 4% perpetual growth rate in line with blended GDP expansion estimates across Apple’s core operating regions with an added premium for its market leadership, as well as a cost of capital of about 8% to reflect the company’s capital structure and risk profile considering its ability to generate significant free cash flows – our base case analysis assumes an intrinsic value of $210 apiece.

Apple Base Case Financial Forecast (Author) Apple Base Case Valuation Analysis (Author)

Apple_-_Forecasted_Financial_Information.pdf

The Bear Case – Hardware Sales Growth Stalls

In contrast to the robust momentum observed in Apple’s services segment, hardware product sales have been more prone to cyclical headwinds given its sensitivity to consumer demand amid weakening economic conditions. Today, with mounting uncertainties over the path of monetary policy tightening, looming recession risks, as well as record-high inflation, consumer sentiment has waned towards historical lows.

And Investor’s concerns are rising as smartphone and PC sales worldwide aboard a rapid decline. Global PC shipments have already shown accelerating declines in the first half of the year – first quarter volumes dropped by 6.8% compared to the prior year to 78 million units, while second quarter volumes dropped by more than 15% to 71 million units, as consumer discretionary spending power weakens due to rising inflationary pressures. Global PC shipments are on track towards a 9.5% decline this year, led by an estimated 13.1% drop in consumer PCs and 7.2% drop in enterprise PCs. Meanwhile, global smartphone sales are expected to contract by 3.5% this year to slightly above 1.3 billion units.

Yet, Apple has continued to defy market declines observed across its key product segments. On the PC front, Apple Mac shipments continued to grow in 1H22, while take-rates for the iPads have also remained strong despite adverse impacts from protracted supply shortages. Meanwhile, iPhone 14 sales over coming months are expected to sustain similar levels as the iPhone 13’s initial run last year, despite weakening economic conditions across key end-markets like China. The company’s resilience is further corroborated by lower-than-expected lost sales due to ongoing supply shortages and macro headwinds during the fiscal third quarter, which came in below the previously projected range of $4 billion to $8 billion.

Nonetheless, hardware sales are expected to imminently grow slower than Apple’s services sales, given product revenue cycles are comparatively lengthier. For services, recurring revenues stemming from subscriptions come on a monthly or annual basis. But for products like iPhones and Macs, their lifecycles have grown from two years in the past to now about three to four years and more than five years, respectively, thanks to continuous technological improvements. To put into perspective, the standard iPhone 14 starts at $799, which translates to about $266 in revenue per share if broken down based on a three-year lifespan. Comparatively, an annual subscription for the Apple One Bundle starts at $179.40 per year (or $14.95 per month), which is not too far off from the average annual revenue per iPhone, while boasting significantly more profitable margins. And while Apple’s iPhone sales may be benefiting from broader industry tailwinds stemming from 5G transition, its large installed base is bound slow in growth based on the law of large numbers, signaling the double-digit multi-year CAGRs it once enjoyed are no more. It is no wonder that the company has been reportedly working on the launch of a product subscription model to safeguard better economics over the longer term.

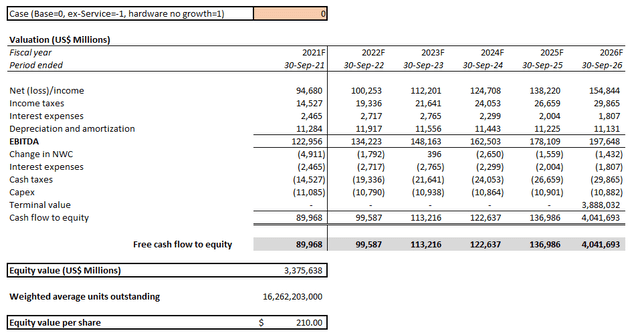

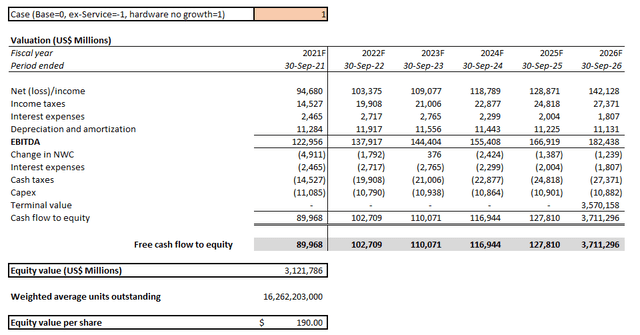

Now, to better gauge the resilience of Apple’s valuation prospects in the event that its hardware sales stalls, we have sensitized our analysis by applying zero growth to the products segment, while the services segment is expected to expand at the same double-digit CAGR explained in the earlier base case section. Under this scenario, while holding all key valuation assumptions constant from the base case (i.e. perpetual growth 4%; WACC 8%), the company would yield an estimated intrinsic value of about $190 apiece. This figure differs from the base case estimate by only about 10%, underscoring the substantial role that Apple’s services segment has grown into in recent years when it comes to bolstering the stock’s long-term valuation prospects.

Apple Financial Forecast – Zero-Growth Product Sales (Author) Apple Sensitivity Analysis – Zero-Growth Product Sales (Author)

However, it is crucial to acknowledge that both Apple’s hardware and services sales are mutually reinforcing. In other words, strong hardware take-rates are critical to supporting continued services segment expansion. If Apple’s hardware installed base declines, its services sales might not be able to materialize on its optimal potential. But considering Apple’s unwavering commitment to renewing its hardware growth trajectory with innovations such as the recent launch of the Apple Watch Ultra, which potentially foreshadows an “Ultra” line-up of enhanced hardware supported by next-generation silicon, as well as the upcoming launch of a new AR/VR segment, continued expansion of its services segment sales over the longer-term remains well in the books.

The Standalone Value of Services

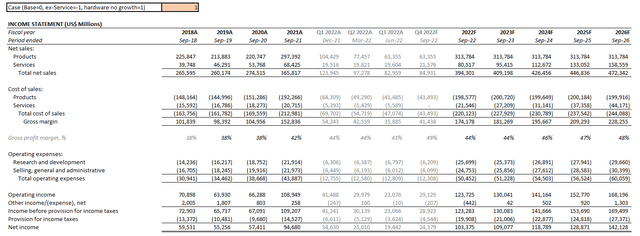

And last but not least, to gauge the estimated standalone value of Apple’s services segment, we have worked backwards by backing out the related forward sales projections from our base case forecast explained in the earlier section. By doing so, we get an estimate of the company’s intrinsic value if it were a plain old hardware sales business (we have held all other key valuation assumptions constant from base case for simplicity and comparison purposes).

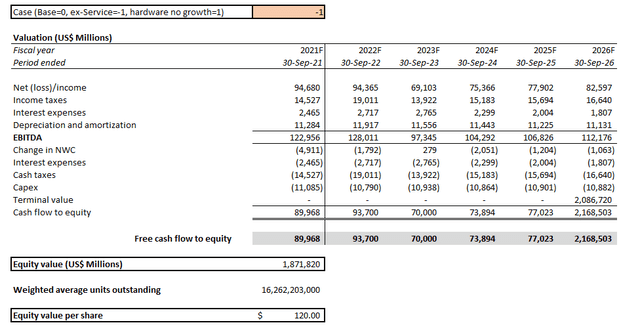

Apple Financial Forecast – ex-Services (Author) Apple Sensitivity Analysis – ex-Services (Author)

The analysis yields an estimated intrinsic value of $120 apiece for Apple ex-services. Backing this figure out from our base case valuation analysis, Apple’s services segment has an estimated intrinsic value of about $1.5 trillion, which approximates the consensus estimate from earlier in the year.

Projected Apple Services Valuation (Author)

Final Thoughts

Based on the foregoing sensitivity analysis, it is clear that Apple’s services segment is playing an increasingly critical role in supporting both the company’s long-term fundamental and valuation prospects. Services is not only a core long-term growth driver for Apple but also the key to safeguarding the company’s resilience under an economic downturn given the segment’s generous profit profile and stickiness. The recurring nature of the bulk of Apple’s services segment sales also provides long-term visibility into its fundamental outlook, while also reinforcing the “must-have” nature of its product offerings (cue the iPhone, which benefits from more Android switchers than defectors).

With a business model that keeps its generous cash flows from operations well-supported, Apple continues to demonstrate strength in weathering the near-term economic storm better than peers. This accordingly makes the Apple stock one of the safest long-term investments with promising prospects for sustained positive returns over coming years, even at its currently elevated levels.

Be the first to comment