fazon1

If there is only one earnings report that investors should focus on this earnings season, it has to be Apple (NASDAQ:AAPL) in my opinion. The technology giant will report this Thursday afternoon, providing key clues into the global consumer mindset as well as supply chain issues. With the stock’s large weight in multiple major indices, a large move afterwards could determine which way US markets move in the coming weeks.

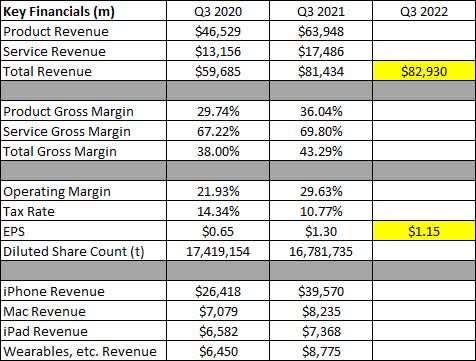

Investors did not like the news three months ago that Apple was facing supply chain constraints that could impact revenues by up to $8 billion for its June ending fiscal Q3 period. We knew that China was shut down for a time due to Covid, but there were hopes that Apple’s factory situation was faring better than that. Unfortunately, the US dollar has also strengthened a bit since the company’s previous report, which will add a headwind to overall sales. In the graphic below, you can see the previous two years’ key fiscal Q3 results, with this year’s headline analyst estimates seen in yellow.

Q3 Key Financials (Apple Earnings, Analyst Estimates)

The numbers that analysts are currently looking for call for year over year revenue growth of 1.8% and an earnings per share decline of 11.3%. That means a bit of margin compression, some of which will come from new products like the revamped iPhone SE. The dollar headwind will also flow down the income statement, and commodity price inflation will likely have impacted gross margins on the hardware side a little. I think analysts are a little bearish on the bottom line currently, especially given the company’s earnings beat history plus help from the buyback, but we’ll see on Thursday.

Looking forward to the current period, which is the September ending Q4, investors will be looking to see if the consumer is being pressured around the globe. This year’s iPhone launch will be an interesting one, as the Mini version of the phone is expected to be replaced by a larger screen non-Pro version. That would mean two 6.1 inch screen models and two 6.7 inch ones as depicted in the graphic below. The key question will be pricing as a result, especially with commodity prices and the dollar up a bit since last year. If Apple management makes the new smartphone line too expensive, consumers may wait to upgrade or trade down to the cheaper SE. There also have been rumors that the non-Pro models will get the same chipset as last year’s models, meaning they won’t be that much of an upgrade.

Currently, analysts are looking for more than 8% year over year revenue growth in fiscal Q4, as well as almost 5% growth in the December holiday fiscal Q1. A lot of these growth hopes are expected due the easing of supply chain constraints, so we’ll get a better idea of total demand in these quarters. There is one important note I should make, and that is that the calendar seems to be in Apple’s favor this year. It appears that the December period will be 14 weeks instead of the normal 13, with the last Saturday of that month being New Year’s Eve this year. Last year, Apple’s fiscal Q1 finished on Christmas Day, so there should be extra sales days in this year’s period and that will impact growth metrics this calendar year and in late 2023.

Perhaps the only good thing about Apple’s recent decline in share price is that it can potentially help the company’s share repurchase plan. If we assume that management continued along its $20 billion or so per quarter pace, Apple will have been able to buyback more shares at these lower prices. This will help boost earnings per share over time, while the more than half a trillion dollar buyback so far has significantly reduced the outstanding share count from its split-adjusted highs. While some investors over the years have called for a much larger dividend, Apple has continued to prefer buybacks when it comes to capital returns.

Recently, Apple shares have bounced about $25 from their recent low as markets have gotten a little less nervous. Still, shares are almost $30 from their all-time high as the chart below shows. The stock is trying to get back above its 200-day moving average (orange line), but a bad report this week would likely send it back down towards the 50-day (purple line). If shares can stay where they are or even rise after earnings, a rising 50-day could provide support over the next couple of months, and perhaps even get the key short term technical trend line eventually back up to its longer term counterpart.

Apple Last 6 Months (Yahoo! Finance)

With Apple set to report later this week, investors will get a good idea how the global consumer is doing. The technology giant’s fiscal third quarter was projected to be pressured by supply chain constraints and a stronger US dollar. Looking forward, analysts are expecting growth to accelerate, but it may depend on pricing of this year’s iPhone line. While the stock is off its highs, it hasn’t been crushed like many other tech names, and shares enter earnings between two key moving averages.

Be the first to comment