Nikada/iStock Unreleased via Getty Images

Thesis

I am a long-term bull on Apple (NASDAQ:AAPL) (here, here, here). But reflecting on a relatively rich valuation, paired with strong supply concerns relating to the firms’ China exposure (including ESG concerns) I believe a convincing short-term bearish thesis is developing. Moreover, Elon Musk’s feud with Apple, which highlights the iPhone maker’s monopoly power anchored on iOS software sales, is certainly adding pressure to sentiment.

Closing the year 2022 and going into early 2023, I advise to reduce exposure to Apple stock.

China Exposure Is Deeply Concerning

Supply Chain Vulnerability

I have previously argued that Apple’s strong reliance on China for manufacturing is deeply concerning and an underappreciated source of risk. And the latest trends surrounding China’s zero-COVID strategy, which caused somewhat violent protests in Foxconn’s manufacturing facilities highlight the thesis.

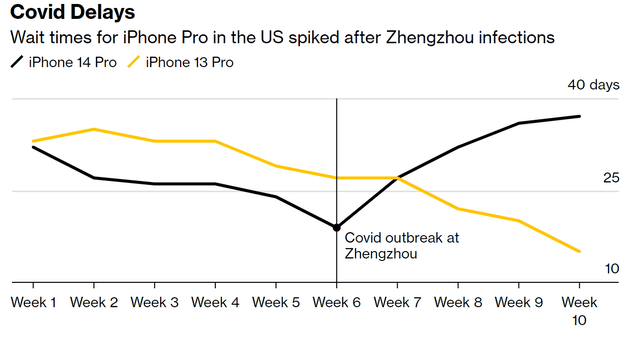

Investors should consider that on the supply side, Asia accounts for approximately 90% of Apple’s hardware manufacturing, most of which is related to China. Some estimate that the percentage of iPhone manufacturing sourced in China approaches even 95%. Accordingly, following the COVID outbreak and subsequent zero-COVID actions at Zhengzhou it should come as no surprise that Apple’s supply chain is severely disrupted. In fact, Apple is likely to suffer a iPhone deliveries shortfall of approximately 6 million units -after Apple has already downgraded guidance for the second half of 2022 to 90 million units (flat year over year versus 2021).

According to Counterpoint Research, customers for the iPhone 14 Pro, which is arguably Apple’s highest handset margin product, are now expected to wait as much as 37 days for delivery, with the trend line still pointing upwards.

Bloomberg

ESG Concerns

But even disregarding Apple’s (short-term) supply chain challenges, investors are arguably not sufficiently pricing Apple’s ESG risk that comes with manufacturing in China. Notably, workers at Apple’s Foxconn factories have frequently complained about ‘unsanitary and deteriorating conditions’, as well as ‘food shortage’. If such claims are true, Apple should (and likely will) be held accountable for taking action towards a more sustainable supply chain, especially as Tim Cook likes to strengthen Apple’s brand image with moral responsibility (emphasis added):

This quarter’s results reflect Apple’s commitment to our customers, to the pursuit of innovation, and to leaving the world better than we found it …

… As we head into the holiday season with our most powerful lineup ever, we are leading with our values in every action we take and every decision we make. We are deeply committed to protecting the environment, to securing user privacy, to strengthening accessibility, and to creating products and services that can unlock humanity’s full creative potential.

Revenue Shortfall Likely Not Yet Priced In

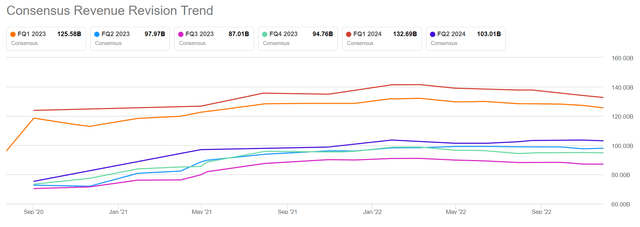

As of late November, 26 analysts have submitted their expectations for Apple’s September quarter, and the median estimate believes that revenues could reach $125.6 billion. Personally, however, I am not sure that such a ‘high’ number is achievable.

Following the announcement of the 6 million iPhone deliveries shortfall, I believe that Apple’s FY 2023 Q1 revenues are likely to be closer to the lower end of analysts’ min/max range of $117.9 billion to $130.2 billion.

Seeking Alpha

Elon Musk Rings The Bell On Apple’s Monopoly Position

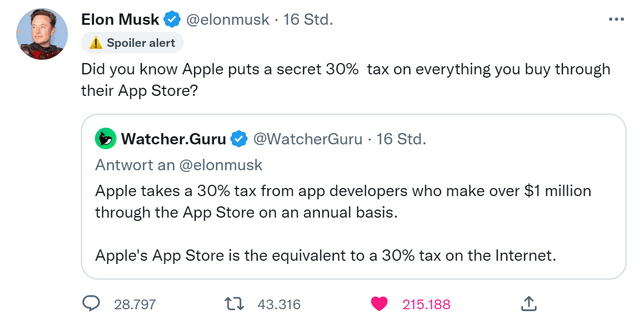

On November 28th, Elon Musk posted a series of tweets implying that Apple would not support free speech. He said that Apple has ‘mostly stopped’ advertising on Twitter – likely as a consequence of Musk’s efforts to make Twitter less censored/ speech restrictive.

While I have no opinion on Apple’s ‘free speech’ position/ action, I would like to point out that the argument has provoked Elon Musk to ring the bell on Apple’s monopoly position implied by the App Store business model: in particular, Musk’s retweet of a post by ‘Watcher.Guru’ points out that Apple’s 15% – 30% profit cut on iOS software sales is like a ‘tax on the internet’.

With Elon Musk raising awareness to the issue, the U.S. government is likely pressured to take a more aggressive stance towards Apple’s monopoly power. Notably, in October the House Judiciary subcommittee published a report that flagged Apple’s ‘monopoly power’ over iOS software purchase.

Rich Relative Valuation Amplifies Risks

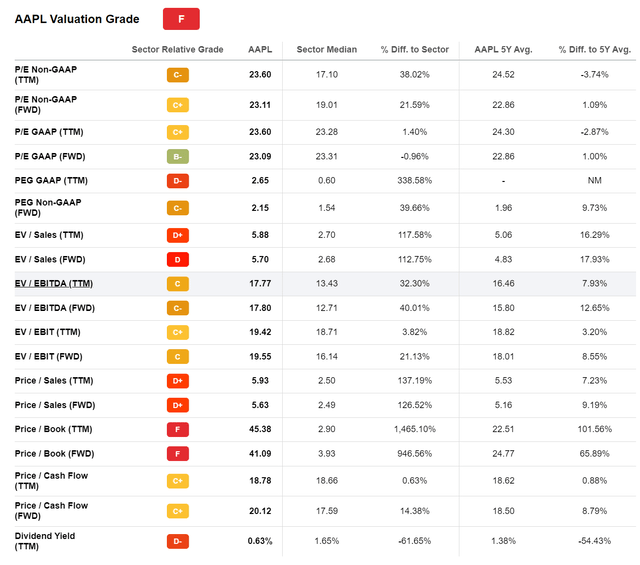

Apple’s relative rich valuation amplifies the risk of a sentiment change. According to data compiled by Seeking Alpha, AAPL shares are currently trading at a one-year forward P/E of x23, a P/B of x45 and a P/S of about x5.6. Depending on which metric an investor would like to anchor, Apple stock trades at a valuation premium to the relevant industry median of 20% – 1200%.

Moreover, investors should consider that these multiples are referenced against the ‘Information Tech’ sector as the relative comparison. But arguably, the consumer ‘Discretionary Sector’ would likely be a more appropriate comparison, which would imply an additional 20% – 30% valuation premium to AAPL shares.

Seeking Alpha

Conclusion

As a long-term investor, I continue to believe that AAPL shares should and could considerably trade higher within the next 12-36 months, anchored on: 1. New market opportunities including VR/AR and the Apple Car, 2. Accelerating strength in Apple’s service portfolio, and 3. Continued financial engineering.

But as a short-term trader, I like the risk/reward set-up of betting against AAPL shares going into FY 2023 Q1 reporting – anchored on the reasons outlined in this article.

As a bonus consideration, investors might also consider that shorting Apple could be a good hedge against a general market downturn. For reference, note AAPL’s strong correlation to the S&P 500 (SPY) below.

Seeking Alpha

Trade Recommendation

Given the speculative nature of the article, as well as the high-risk connected to short selling (losses could be infinite in theory), I believe buying put spreads provides the best risk/reward for investors interested to trade the thesis – given that the loss for call spread is limited to the options premium outlay.

Personally, I advise to buy the 95/85 percent moneyness put spreads with about 8 weeks to expiration (February 17th 2023 expiration). The trade would offer a pay-off of approximately 3:1, if Apple closes below the short strike on expiration ($128 strike).

Be the first to comment