Two of Wall Street’s biggest names report after the close, here are some ideas to trade Apple and Amazon. tunart

This week’s ‘Big Tech’ earnings have been a mixed bag when it comes to results, but when it comes to the results that investors care about, how the stock price reacts, we have seen more negative price action than positive. We recently discussed how to trade Microsoft (MSFT) ahead of earnings, and while that trade may not have been popular among investors, it was a nice little money grab before the stock pulled back. With the clarity provided by recent quarterly results and the market’s reaction to those results, we think we have two similar trades for the other ‘Big Tech’ names reporting this week; Apple (AAPL) and Amazon (AMZN).

Let’s first look at Apple…

We have gone on the record stating that we think Apple is a ‘Sell’ but for this article, we are focusing on something we have discussed numerous times; finding alpha in core positions that you sometimes HAVE to hold. Both Apple and Amazon fit this description, but Apple being the largest individual holding within the S&P 500 (among other indices) probably is the best example of this phenomenon. Not only do institutional investors have large allocations, but so too do individual investors; either through direct stock ownership, or via their passive ETF holdings.

So What About Earnings?

With Apple set to report after the close, we think investors can use their current core positions in the stock to position around the results. Since we are looking at trading around a core position, the goal with this trade is to pick up additional returns by utilizing options to generate option premiums while hopefully maintaining the core position. Looking at Apple’s recent trading history around earnings releases gives us a good idea of parameters around the trade.

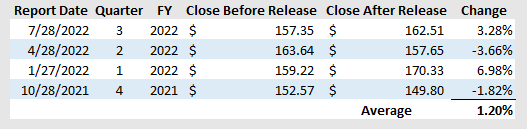

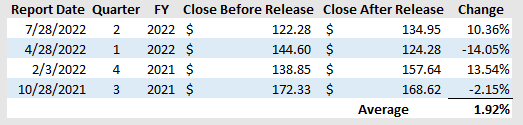

Apple saw the following price action the day after releasing quarterly results over the last four quarters:

Author

While the average change is only 1.20%, the actual delta (or change in price) is roughly 3.94%.

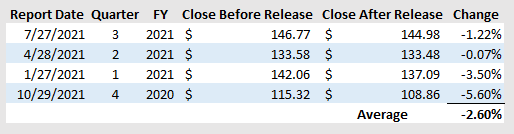

If we look at the 12-month period prior to this, we can see the following price action:

Author

In this period, the average is -2.60%, and the delta is 2.60% as well.

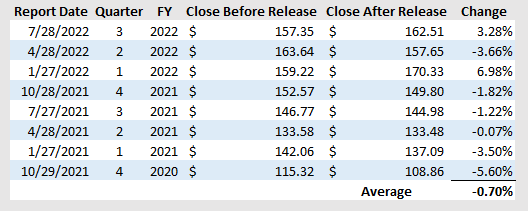

Looking at this data together provides a little more detail:

Author

While the average of Apple’s moves falls to negative 70 basis points, the delta (price movement regardless of up or down) is 3.266%.

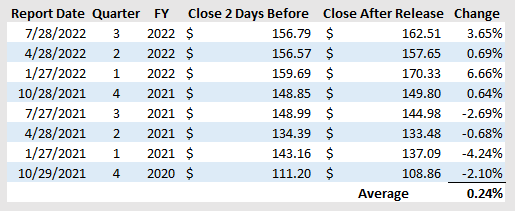

Looking at the price action based on the prior day’s close (or the closing price the day before announcement, so two closings before announcement), since Apple does tend to follow other ‘Big Tech’ names, and the returns do change to show how some of Apple’s returns may be pulled forward:

Author

The average now is a positive 24 basis points, but the delta is 2.67%.

So What Does This Tell Us About Apple?

This indicates to us that one could be pretty comfortable writing calls roughly 4-5% OTM, or out-of-the-money. While one would have to wait until a few minutes before the close later today in order to do this trade, if we use yesterday’s closing price of $149.35/share, the two strike prices one could choose between would be either $155/share or $157.50/share. With the weekly options expiring on Friday, nearly all of the option premium is tied to the implied volatility around Apple’s earnings, so this contract is purely an earnings play at this point.

For someone looking at the 4% area (which is technically $155.32/share), the $155/share strike price would generate roughly $1.20/share, or $120 per contract, in options premiums. That is 80 basis points of return if the call expires worthless. If the shares are called, then the total return would be roughly 4.59% (based off of yesterday’s prices).

If one wanted to use the 5% area (which is $156.82/share), the $157.50/share strike price would generate roughly $0.66/share, or $66 per contract, in options premiums. This is roughly 44 basis points of return if this call option expires worthless on Friday. Should the shares get called, then the total return would be nearly 5.90% (based off of yesterday’s prices). While this premium seems miniscule, we would point out that it is roughly equivalent to three quarters of Apple current $0.23/share quarterly dividend. So while this looks as if the ‘juice is not worth the squeeze’ it is a way to nearly double the annual cash flow from one’s position.

And What About Amazon’s Earnings?

While Apple only had a few large moves around earnings, Amazon is a lot more interesting from a volatility standpoint. The company has had some big moves, both up and down, which make it a bit more tricky in this market.

Note: We do want to point out that we have adjusted historical prices in order to account for Amazon’s recent stock split, so some of the pennies are rounded.

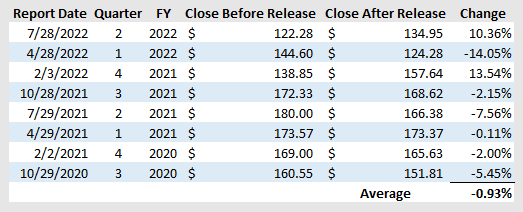

Over the last year, Amazon has seen the following price action after reporting results:

Author

While the average change is 1.92% over this period, the delta is roughly 10.03% – and that is the more important number here because we are concerned about the size of the move, rather than the direction.

Looking at the prior four quarters, Amazon’s price action was as follows:

Author

The prior year was much less volatile on a delta basis.

Combining this data, gives us the following table:

Author

Do not let the average pullback of 93 basis points fool you, because the delta is actually just over 6.90%.

So What Does This Tell Us About Amazon?

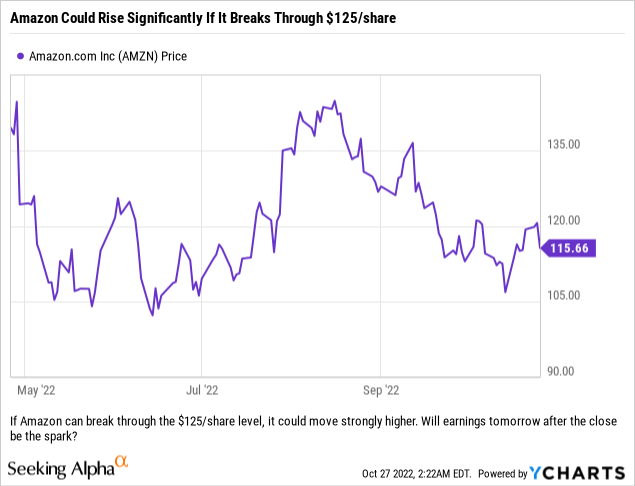

Due to the volatility that Amazon has experienced recently, we think that investors can look at writing two different calls here. Writing OTM calls that are either 7% or 10% out of the money would look like reasonable trades, especially looking at the resistance on the Amazon chart between the $120/share and $124/share level. Based off of yesterday’s closing price of $115.66/share for Amazon, a 7% rise would land the stock at $123.76/share and a 10% move higher would get the stock to $127.23/share.

For someone wanting to look at the 7% OTM call strategy, the $124/share strike price weeklies that expire on Friday would generate an option premium of $1.23/share, or $123 per contract. This generates a return of 1.06% if the call is not exercised against you, and would create a total return of just over 8.27% if the call option is exercised. Basically, you have coverage up to $125.23/share, and once the stock rises above that you have opportunity losses on the trade.

For someone wanting to do a trade using the 10% OTM call strategy, the $127/share strike price is just below that level and the strike price we would use if placing the trade right now. This call would generate a premium of $0.69/share, or $69 per contract. This is admittedly not a lot of money, but it does generate a return of 60 basis points (which is the most recent 12-month yield of Apple for those keeping track) even if the option is not exercised. The total return if the option is exercised would be 10.40% based off of yesterday’s prices, and only one time has Amazon had a move that large to the upside based on the close right before the release. Also, there was only one time where the change (either up or down) was that large based off of the close two days before the announcement.

Our Thoughts

Note: It is important to note that the last few minutes of a trading session before major news is expected, especially quarterly results announcements, tend to see prices for options increase as many swoop in at the close to balance out positions or mark exactly where they want to be based off of prices they expect to be close to the actual close.

We have seen investors kind of shrug off ‘Big Tech’ earnings that look relatively respectable considering the economic backdrop and push many stocks lower. If the results are ok, your stock is probably down. If the results are bad, then your stock is definitely down. Microsoft, Alphabet (GOOG) (GOOGL) and now Meta Platforms (META) have seen their stock prices fall sharply, and rightfully so. While someone who was bearish could take an aggressive stance and sell ATM (or at-the-money), or even in-the-money, calls on their positions to collect much richer call options, we think that the OTM call strategy for core positions which we outlined here does give investors a pathway to create outperformance while also maintaining their exposure to the first and third largest constituents of the S&P 500.

While Amazon does not pay a dividend, Apple does. And that gives us the ability to quantify this trade from that perspective. We hear plenty of talking heads and analysts discuss how they love the stock buybacks and dividends from Apple, and if one buys into those talking points around the dividend, then trading OTM calls, even at the 5% level, should be an attractive proposition. If an Amazon investor thinks that Apple’s dividend yield is attractive, then we would point out that the 10% OTM call trade is right in line with that annual dividend yield.

While neither of these trades will make one rich, we do believe that trading around core positions of Apple and Amazon with OTM calls can create outperformance that over the course of a year could significantly improve one’s returns.

Be the first to comment