Based on the title “Never Trust A Skinny Chef”, readers might think this article is about a restaurant chain. Far from it. Today, I am covering Appian Corporation (NASDAQ:APPN), a company at the heart of the digital transformation movement. Appian provides tools for business process management (BPM) meant to revolutionize BPM by introducing digital process automation, dynamic case management, and a low-code development environment.

(Source: Appian)

The article title is quoting a famous saying that implies that you should avoid restaurants where the chef doesn’t sample or eat his (or her) own food preparations.

(Source: DrSue.ca)

With this allusion in mind, I am going to suggest that Appian either isn’t using its own BPM tools or isn’t using them to advantage. Appian should be its own poster boy, but it isn’t, and therefore you might not want to trust its product.

A company using next-generation BPM should demonstrate good operating margins. But Appian appears to be burning an excess amount of cash and also has a poor free cash flow margin. The skinny chef is akin to Appian’s bloated financials, and the company is missing the best marketing opportunity: demonstrating its BPM product on its own financials.

Also, if Appian were using its own software internally, then the development of such software could be capitalized, something that some S/W companies are doing to improve their margins and free cash flow. I am not seeing any reference to capitalized software in the annual report, so I assume that it is not being capitalized.

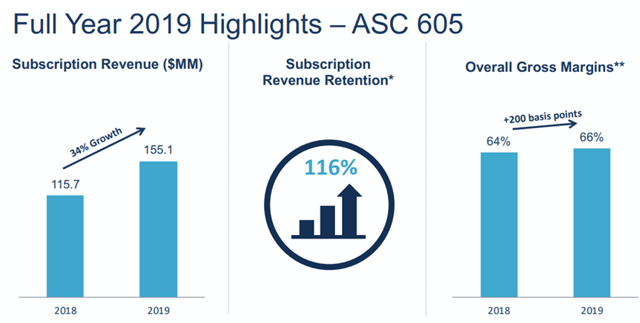

Another issue is that Appian was late to the party with regards to accounting standards, specifically with implementing FASB Topic 606. The standard was in effect at the beginning of 2018 for public business entities. Appian IPO’ed in May of 2017, but did not implement ASC 606 until January 2019. One would think that a leader in BPM would be on the ball with regards to accounting regulations, but what do I know? I study and write about more than 100 stocks, and to my recollection, Appian is the only company that is still referencing ASC 605 in its literature and making excuses for why the company’s reported revenue is less than it would be without the accounting change.

(Source: Appian latest earnings call presentation)

Cash Burn

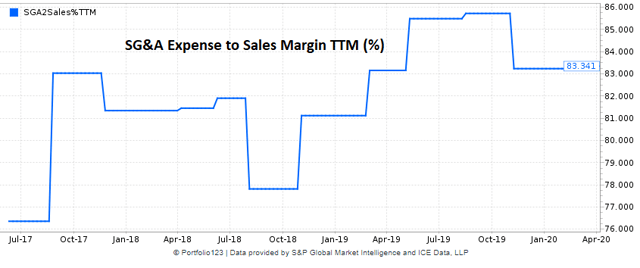

I indicated that Appian is burning too much cash, and here is why I believe that this is the case. I assess a company’s cash burn by examining the SG&A expense relative to sales.

Note that SG&A includes Sales & Marketing, General & Administrative, and R&D.

(Source: Portfolio123)

Appian has an SG&A expense margin of 83%, which means that more than 4/5ths of revenue intake is being spent on SG&A expenses (plus R&D). This figure is likely to go up during the remainder of the year if revenue growth is subdued as a result of the impending global recession which will put further pressure on margins.

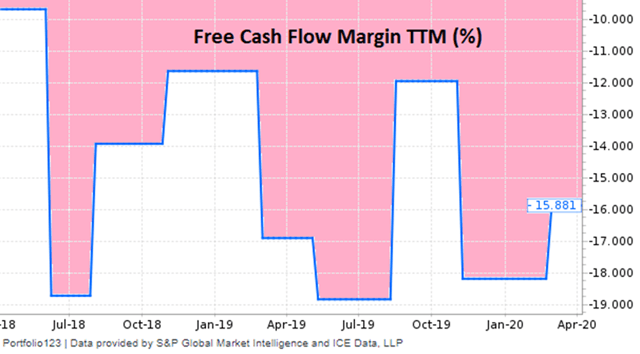

Free Cash Flow

One of the most disappointing factors with Appian’s financials is the free cash flow margin. This company is quite underwater with a -16% free cash flow margin. Appian has never achieved free cash flow as a public company.

(Source: Portfolio123)

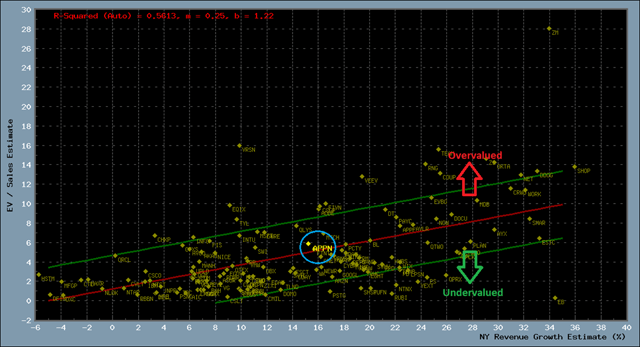

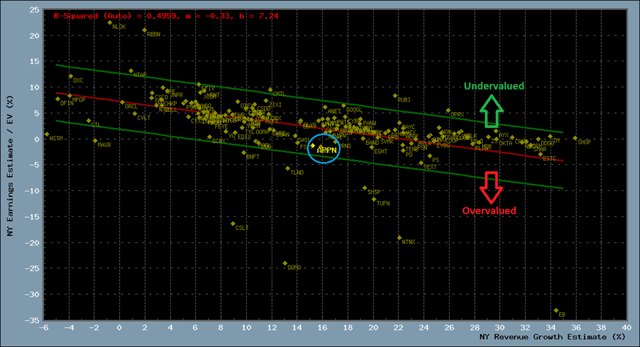

Stock Valuation

Moving on to Appian’s stock valuation, I use a custom technique to estimate the relative valuation of the stock price versus the remaining stocks that I track. The technique consists of creating a scatter plot of enterprise value/forward sales versus estimated forward Y-o-Y sales growth. The plot below illustrates Appian’s stock valuation relative to the 152 stocks in my digital transformation stock universe.

(Source: Portfolio123/private software)

A best-fit line is drawn in red on the scatter plot and represents a typical valuation based on next year’s sales growth. As can be seen from the scatter plot, Appian is situated almost on top of the best-fit line suggesting that the company is fairly valued on a relative basis.

But remember my observation regarding Appian’s bloated financials? If I substitute next year’s earnings estimates for forward sales, then my assessment changes.

(Source: Portfolio123/private software)

The results shown on this second scatter plot indicate that Appian is overvalued based on next year’s earnings estimates. This re-assessment is a direct result of the high SG&A expense margin.

High Level of Professional Services

My last observation for today has to do with Appian’s high level of professional services, services that are described in the annual report:

Since inception, we have invested in our professional services organization to help ensure that customers are able to deploy and adopt our platform. We believe our investment in professional services, as well as efforts by partners to build their practices around Appian, will drive increased adoption of our platform.

When we first acquire a new customer, our professional services experts or our deployment partners’ professional services experts start the implementation process. Delivery specialists facilitate deployment of our platform and training personnel provide comprehensive support throughout the implementation process. Customers have access to our Appian Academy, which caters to a diverse range of skill sets and roles within organizations and trains developers on our platform. We also provide instructor-led courses at our Tysons, Virginia headquarters and certain of our other offices, as well as virtual classrooms for self-paced learning and on-site training at our customers’ offices.

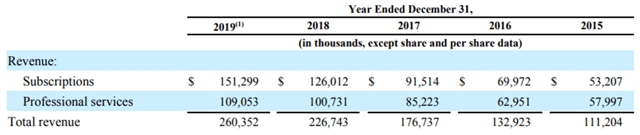

At present, professional services account for approximately 39% of total revenue and aren’t decreasing significantly over time.

(Source: Appian)

While it is interesting that the company can extract such a high level of non-recurring revenue from its customers, the situation results in some issues.

The first issue is that Appian’s prime selling point is “low code development”. It appears that low code development doesn’t translate to easy implementation, hence the high level of services performed to integrate the Appian BPM application into the customer platform.

Secondly, the high level of professional services implies that this is a high friction application. There are significant upfront costs that may deter customers from onboarding. This is particularly relevant during the work-from-home movement during the pandemic. I expect that Appian will not benefit as much as other digital transformation companies simply due to the high friction onboarding.

Let us not forget that Appian operates in a market with minimal barriers and significant competition:

Our main competitors fall into three categories: (1) providers of low-code development platforms, such as salesforce.com, ServiceNow, Outsystems, Mendix and Bizagi; (2) providers of business process management and case management software, such as Oracle, Pegasystems, SAP, Microsoft and K2; and (3) providers of custom software and customer software solutions that address, or are developed to address, some of the use cases that can be addressed by applications developed on our platform.

Summary and Conclusions

Appian provides next-generation tools for the BPM market, tools that are designed to vastly improve business processes. But I am not seeing the results reflected in the company’s operating performance. SG&A expenses are high and the free cash flow margin is poor. And to boot, the company was very slow in the implementation of ASC 606. Apart from having a skinny chef, it appears that Appian’s product is not low friction, meaning that customers have to spend a lot upfront with presumably a lot of time involved in the onboarding process. In the absence of competition, this may be acceptable and maybe even desirable if it can get away with it. But Appian is competing with big players such as ServiceNow (NOW) and Salesforce.com (CRM) and the high cost of professional services will likely be a drag on forward revenue growth. During the Covid-19 panic, I believe that Appian will not benefit as much as other cloud companies due to the necessary professional services. For these reasons, I am giving Appian a neutral rating.

Digital Transformation is a once-in-a-lifetime investment opportunity fueled by the need for businesses to convert to the new digital era or risk being left behind. You can take advantage of this opportunity by subscribing to the Digital Transformation marketplace service.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment