AppFolio Inc. (NASDAQ:APPF) has been one of my favorite stock picks this past year. In fact, I gave the company a bullish rating back in early January. The stock price has held up as well as could be expected since then, losing 11% versus the 13% for the S&P 500 in the extremely turbulent market conditions.

(Source: Seeking Alpha)

AppFolio provides a SaaS platform that primarily focuses on real estate property management. I have been bullish on this company as a result of its great performance, with strong annual revenue growth of 35% and a positive free cash flow margin of 12%. These are factors that would be quite desirable in a strong market.

But the pandemic changed everything in a heartbeat. The macroeconomy has shifted dramatically and is undoubtedly putting tremendous pressure on real estate and the housing market. More than 20 million Americans have lost their jobs and the government has not been particularly clear on landlord/renter strategies other than that they should work together:

Multifamily Housing encourages all owners to work with impacted residents and families to adjust rent payments, enter into forbearance agreements, and lessen the impact on affected residents. At this time, no additional subsidy funding has been made available.

Across the country, only three-fourths of renters would be able to cover one month of their housing expenses with the $1,200 one-time payment by the government. One has to wonder what will happen when the pandemic-driven economic slowdown stretches to six months, one year and beyond.

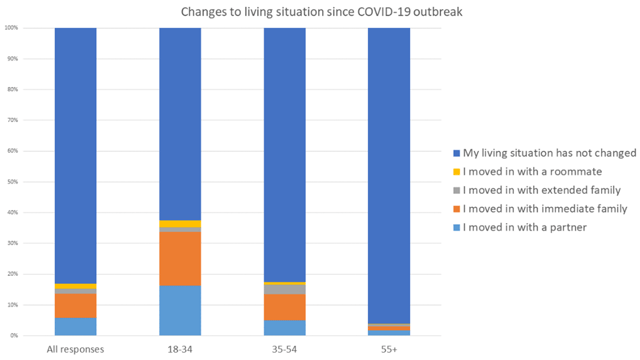

In one survey, a little over 80 percent of respondents have stayed put, while the remainder has moved in with family, a partner or a roommate since the start of COVID-19.

(Source: realtor.com)

It is also unlikely that very many rental units will be filled during the government-mandated shutdown. Under the current circumstances, it is difficult for prospective tenants to view rental units, and they prefer to see a rental home in person. In all likelihood, many rental units will be empty during the government-mandated shutdown portion of the pandemic.

So, despite the recurring revenue business model, I expect that AppFolio will not be immune to the pressures seen by property managers and tenants. Property managers (AppFolio’s clients) will most certainly be asking for concessions from AppFolio. Additional pressure on AppFolio’s revenue stream may result from usage-based fees from some of the Value+ services.

There is one bright side, and that is the company’s electronic payment services for rent collection which may become very popular as a result of social distancing.

Stock Valuation

There are numerous techniques for valuing stocks. Some analysts use fundamental ratios such as P/E, P/S, EV/P, or EV/S. I believe that one should not employ a simple ratio, and the reason is simple. Higher growth stocks are valued more than lower growth stocks and rightly so. Growth is a significant parameter in discounted cash flow valuation.

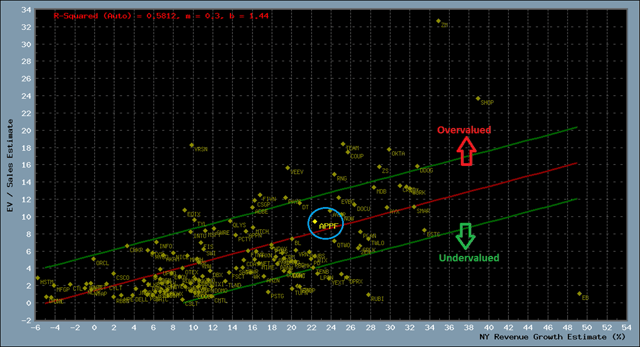

Therefore, I employ a technique that uses a scatter plot to determine relative valuation for the stock of interest versus the remaining 152 stocks in my digital transformation stock universe. The Y-axis represents the enterprise value/forward sales, while the X-axis is the estimated forward Y-o-Y sales growth.

The plot below illustrates how AppFolio stacks up against the other stocks on a relative basis.

(Source: Portfolio123/private software)

A best-fit line is drawn in red and represents an average valuation based on next year’s sales growth. The higher the anticipated revenue growth, the higher the valuation. In this instance, AppFolio is situated slightly above the best-fit line. This suggests that AppFolio is modestly overvalued on a relative basis. However, the overvaluation is so minor that I wouldn’t reject investment in AppFolio based on this factor alone.

The Rule Of 40

One industry metric that is often used for software companies is the Rule of 40. The metric sidesteps the valuation dilemma for high-growth companies that generally don’t show profits. The Rule of 40 allows for both revenue growth and profitability (expressed as a margin) in combination such that they must add up to at least 40%. Analysts use various figures for profitability. I use the free cash flow margin.

The rationale for the Rule of 40 is as follows. If a company grows by more than 40% annually, then you can turn a blind eye to negative free cash flow to some extent. On the other hand, if a company grows by less than 40%, then the company should have a positive free cash flow to make up for the less than ideal growth.

This rule accommodates both young high-growth companies as well as mature moderate growth companies. Young companies tend to have high revenue growth but are burning cash. Mature companies have lower revenue growth, but they make up in terms of free cash flow. The 40% threshold is somewhat arbitrary but typically divides the digital transformation stock universe in half, separating the best stocks from the so-so.

For a further description of the rule and calculation, please refer to one of my previous articles.

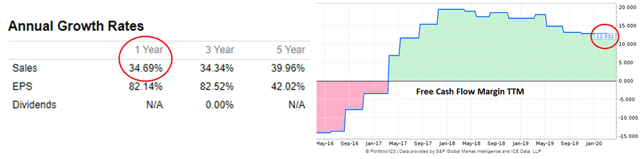

(Source: Portfolio123/MS Paint)

In AppFolio’s case:

Revenue Growth + FCF margin = 35% + 12% = 47%

AppFolio scores above the 40% needed to fulfill the Rule of 40. Exceeding the Rule of 40 signifies that AppFolio has a healthy balance between growth and profitability.

Rising Expenses

According to the Q4 2019 earnings call transcript, the company management indicated that expenses have risen faster than revenue:

total costs and operating expenses for the fourth quarter increased 41% year-over-year, compared to an overall 34% increase in total revenue. The year-over-year increase in costs is primarily related to a 38% growth in headcount to support growth areas that we believe will positively impact long term shareholder value.

The timing for the increased headcount was unfortunate, given the expected economic downturn that will likely affect future results.

Summary and Conclusions

AppFolio provides software for the real estate market that is designed to meet the operational and business needs of property management companies. This company has great fundamentals, including 35% annual revenue growth, 12% free cash flow margin and handily meets the Rule of 40. But these figures are historical, and it is quite likely that AppFolio will be subjected to the same heartaches as the rest of the real estate market during the pandemic and likely recession to follow. The high unemployment rate is causing renters to have difficulty with rent payments with the end result that many are moving in with family or friends. It is unlikely that many empty rental units will be filled during social distancing. It is unlikely that AppFolio will be completely insulated from the economic damage. Therefore, I am giving AppFolio a neutral rating.

Panning for gold is so much work, and so last millennium! There is an easier way. Sign up for Digital Transformation, a Seeking Alpha Marketplace, and learn all about investing in the 21st century.

Panning for gold is so much work, and so last millennium! There is an easier way. Sign up for Digital Transformation, a Seeking Alpha Marketplace, and learn all about investing in the 21st century.

Tap into three high-growth portfolios, industry and subindustry tracking spreadsheets, and three unique proprietary rating systems. Don’t miss out on the digital revolution.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment