HJBC

APA Corporation (NASDAQ:APA) explores for, develops, and produces natural gas, crude oil, and natural gas liquids. The company’s operations are in the United States, Egypt, and the North Sea of the United Kingdom, and APA also explores offshore energy opportunities in Suriname.

The company has been around since 1954, and in 2021, Apache Corporation moved to a holding company under APA Corporation. APA acquired the Suriname and Dominican Republic subsidiaries from Apache, a direct and wholly owned subsidiary of APA. At $42 per share, APA had a $13.23 billion market cap. The stock trades on Nasdaq, and nearly 9.3 million shares on average change hands daily. APA pays its shareholders a $0.50 dividend, translating to a 1.2% yield.

The trend in APA shares has been bullish since finding a bottom at $3.80 in March 2020, just before natural gas fell to a quarter-of-a-century low of $1.44 per MMBtu. APA shares tend to reflect the wild price variance in the natural gas futures arena. At just below $7 per MMBtu on Oct. 6, natural gas was 4.84 times the price at the June 2020 bottom. Meanwhile, APA shares at $42 were over eleven times higher. As we move into the winter months, the peak season of natural gas demand, we could see much higher natural gas futures prices, supporting gains in APA shares.

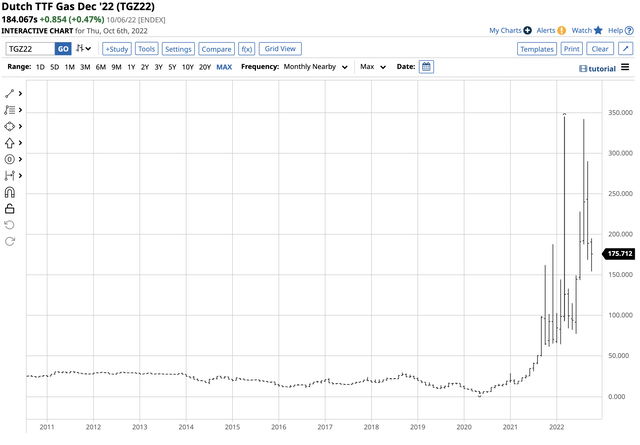

Natural Gas rallied in Q3 and was over 80% higher than the 2021 closing level

While the bull market in most energy commodities stalled in Q3, and the sector’s composite posted a 12.89% decline, natural gas bucked the trend with a 25.85% gain. Over the first nine months of 2022, natural gas was 83% higher at $6.826 per MMBtu on Sept. 30.

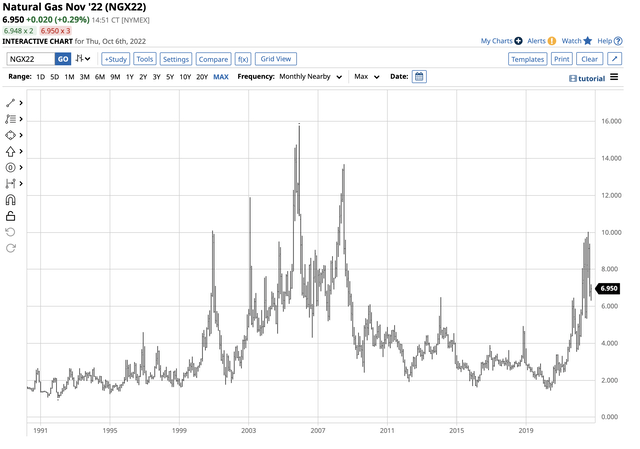

Long-term NYMEX Natural Gas Futures Chart (Barchart)

As the chart shows, November natural gas futures were higher and flirting with the $7 per MMBtu level on Oct. 6. In 2022, natural gas traded in a $6.39 range, over 4.4 times higher than the June 2020 $1.44 per MMBtu low. The energy commodity reached $10.028 in August.

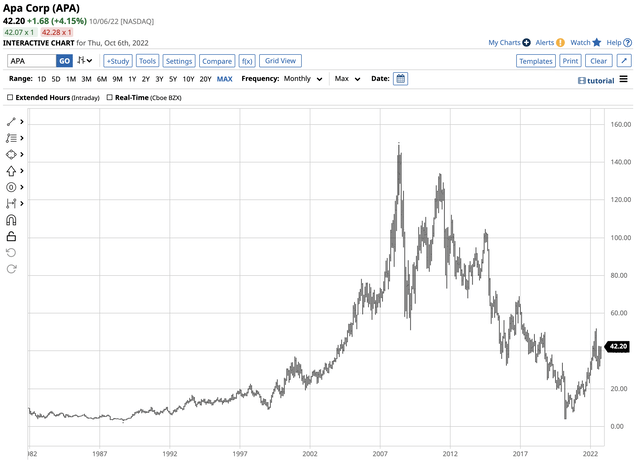

APA shares have soared

After reaching rock bottom at $3.80 per share in March 2020, APA shares have soared with the natural gas price.

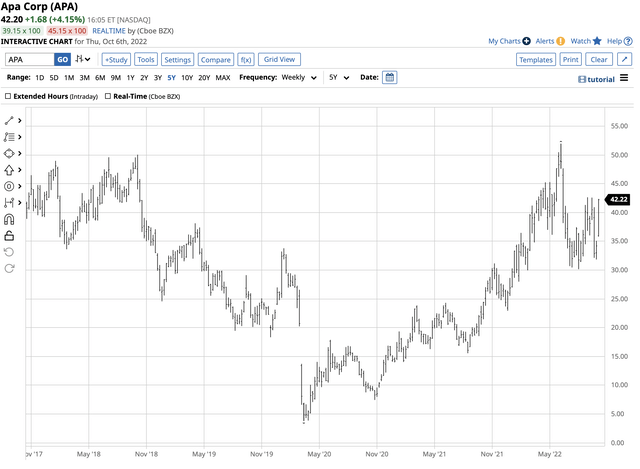

Chart of APA Shares (Barchart)

The chart highlights the bullish pattern of higher lows and higher highs that took APA to $51.95 in June 2022. At the $42.20 level, APA is over eleven times higher than the 2020 low. Commodity production is a highly leveraged business, and producer companies tend to outperform the commodity during rallies and underperform on a percentage basis during bear markets. APA has been the poster child for outperformance with its over ten-bagger return since March 2020.

The injection season ends next month – inventories are low

As we head into the 2022/2023 peak season for demand during the winter, US natural gas inventories are low compared to past years.

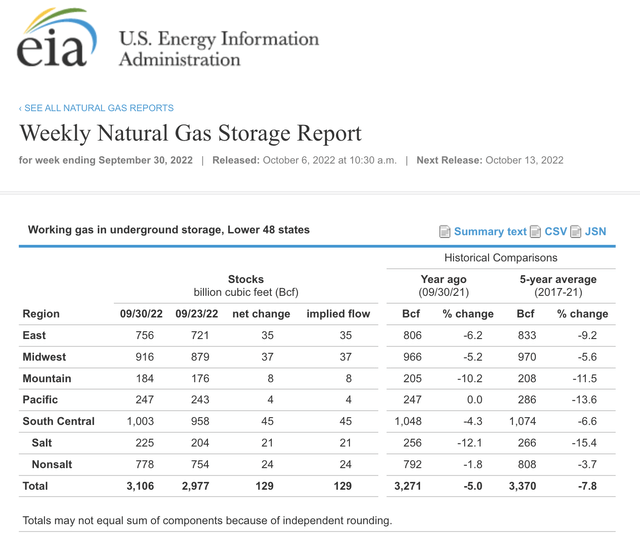

US Natural Gas Inventories- The Week Ending on September 30, 2022 (EIA)

The chart highlights US natural gas stockpiles at 3.106 trillion cubic feet were 5% below last year’s level and 7.8% under the five-year average for the end of September. Next month, natural gas will begin to flow out of storage as the peak heating season begins. Low US inventories translate to less LNG export availability to regions with far higher prices, putting upward pressure on US prices.

Natural gas has experienced price explosions and implosions in 2022, with a $6.39 range from the January 2022 $3.638 low to the August $10.028 high. At $6.972 on Oct. 6, the energy commodity was just above the year’s midpoint, with the explosive season on the horizon. US natural gas futures tend to peak in November through February during the peak demand season.

Europe faces shortages this winter

While US natural gas prices could soar to new multi-year highs over the coming months, European prices have come down from all-time peaks in March 2022 but remain at record levels compared to before 2021.

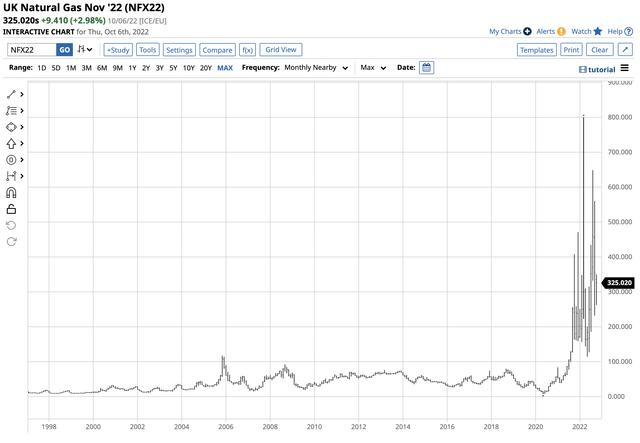

UK Natural Gas Futures (Barchart)

The chart shows at the 325 level, UK natural gas prices are at lofty levels going into the peak demand season.

Dutch Natural Gas Futures Prices (Barchart)

Prices in The Netherlands are in the same position at 184.067 as the pre-2021 high was at just over the 30 level.

Western Europe depends on the Russian natural gas pipeline network. As Russia uses natural gas as a weapon against “unfriendly” countries supporting Ukraine, prices are likely to soar, and availabilities could become scarce over the coming winter. The low US inventory levels and US energy policy prevent replacing Russian with US supplies as Europe faces a frigid winter in 2022/2023. Higher European prices will only put additional upside pressure on US prices during the peak demand season.

APA shares – More upside ahead for one of the world’s leading independent energy companies

The path of least resistance of natural gas prices remains higher as the seasonal energy commodity heads into the 2022/2023 withdrawal period, lasting from November through March. Natural gas is the energy commodity in the crosshairs of the war in Ukraine and the deterioration of Russian relations with the West. Increasing natural gas prices puts pressure on the European and the US economies, stoking inflation at the retail and wholesale levels.

APA shares tend to move higher and lower with natural gas prices, which could send the shares much higher over the coming weeks and months.

Long-Term APA Price Chart (Barchart)

The long-term chart shows the first technical resistance level above the June $51.95 high stands at the December 2016 $69 high. After making lower highs and lower lows from 2008 through 2020, APA’s trend has turned bullish, supported by the price action in the natural gas market. The 2008 all-time high of $149.23 is the ultimate upside target. However, a 50% retracement of the move from the 2008 peak to the 2020 low stands at $76.515 per share, over 81% above the current $42.20 price level.

The prospects for natural gas and APA are bullish in early October 2022. Markets reflect the political and economic landscapes, supporting higher natural gas prices. APA has pulled back from the June high, which could be the perfect time to hop on board this bullish trend, as the trend is always your best friend in markets.

Be the first to comment