skynesher

Dear readers/followers,

Recall my article on Aon plc (NYSE:AON)? I went “HOLD” on the business at a time when it, based on historicals, was neither grossly overvalued, but also wasn’t appealingly undervalued. Well, my choice, in this case, avoided a 10% total RoR in less than 6 months, which in this sort of market needs to be viewed as very attractive. As such, my stance was too conservative.

I revisit Aon plc to see if there’s value in changing my stance as we look at the company at a higher valuation.

Aon plc – An update

Aon plc isn’t an insurance company, as some would believe. Aon is a 40-year-old company but with a history that goes back to the purchase of a Detroit-based insurance agency that specialized in low-cost low-benefit accident insurance, underwriting, and on-site policy sales.

The company has existed through thick and thin and has been delivering value for its customers and clients for decades. Aon began building a global presence through M&As of various insurance brokerages and groups. Aon was actually, for a brief period of time and thanks to a merger, the largest insurance broker on the planet.

I noted how the company was up 22% YTD in my last article. Add another 10% to that, and a 32% outperformance thus far in an environment that has seen indices fall by almost the same, which means that Aon can claim a negative correlation to the market for this year, which is something that’s extremely rare overall.

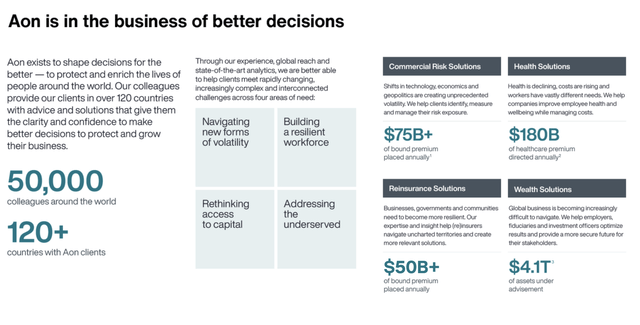

The company’s business is focused on Risk, reinsurance, health, and wealth solutions, where it does retail brokering, specialty solutions, reinsurance, and capital markets, consulting and brokerage for health, and retirement, pensions, and investments.

The company’s revenues are a product of its commissions, compensation from its collaborative partners in insurance and reinsurance, and customer fees. These vary depending on premium, contract type, and size. The company also earns interest income from the premiums, claims, and in-transit funds by investing them in interest-bearing securities, typically within a short-term time period. There’s a decent amount of seasonality to company earnings, with buying patterns giving a strong 1Q and 4Q.

I actually follow many of the company’s direct competitors – such as Marsh & McLennan. This segment is no stranger to me, but Aon is one of the largest in it, with a market capitalization that’s closing in on around/over $60B at this time.

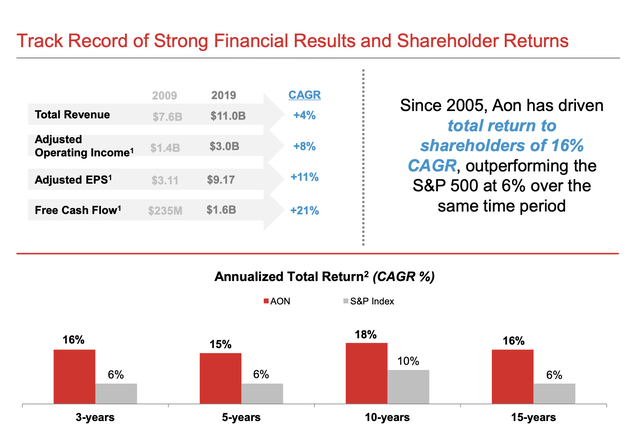

Aon is also used to doing what it did for the past 6 months – outperforming the market, averaging 11% for the past 20 years, which means that anyone who invested in Aon, did far better than the market did.

If the company had a yield that was above 2%, I would have been pushing capital to work here ages ago. But it doesn’t. Aon’s biggest drawback to me as an investment is that it has a sub-1% yield. There are very few things that can work to make this interesting to me in such a case.

This is specially made tricky because Aon doesn’t provide analysts such as myself easy ways to analyze performance – Aon doesn’t provide a segment-by-segment breakdown of operating income, even if they do provide a revenue breakdown. This makes guesswork a more than-preferred part of forecasting and modeling the company.

We know, for instance, that Commercial Risk Solutions is the company’s by far largest generator of revenue, at over 50% of the company’s annual. Wealth Solutions is the smallest at around 12%. Aside from Wealth Solutions, all of the company’s income segments are quite seasonal in their ebb and flow. But we don’t know enough or as many details as I’m used to know. This always puts Aon at a disadvantage, because we have to “trust” that the company knows what it’s doing.

That’s a difficult position for me to be in because I want more control.

At the same time, Aon has plenty of advantages. It’s well-placed in new markets, and things like cyber risk and IP insurance are very in “the now”, even if such new growth segments are unlikely to de-throne commercial risk as a revenue generator.

The latest company results give us some color to the company’s latest bout of outperformance – or shall we say, oddly enough, lack of color.

Because this is pretty much what I expected in my last piece. Inflationary pressures and other headwinds made top-line growth 0% YoY, with an operating margin for 3Q22 that’s below 22%, which is to be compared to closer to 30% for the full year.

This is not to say the company did horribly. The company did improve its margin expansion from a Q-o-Q perspective, the same with top-line revenue growth, and the same with adjusted EPS, despite FX impacts. I may have to adjust my expectations for inflation impacts here because as it seems, the company is managing things decently, even if we’re not seeing 20%+ EPS growth levels as we did back in 2020-2021.

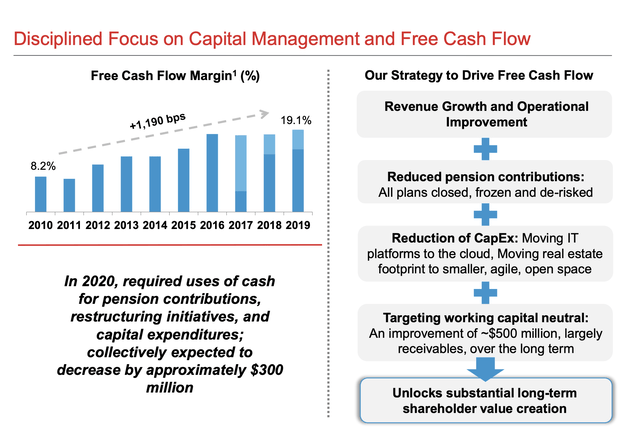

However, some of my bearishness regarding the bottom line remains. I also don’t see a convincing bullish case for the company’s argument for margin expansion. Historically speaking, Aon has achieved margin expansion and efficiencies by restructuring costs, which seems to be able to be done at only limited amounts from here on forward. While the company has executed well in 1H22, the company’s recent results seem to take a different cadence, margin differences of upwards of 600+ bps.

It’s my stance that Aon’s growth will be single-digit between 3-5% – possibly as much as 7%, but no more than that. This begs the question of how much we should be paying for a 0.8% yielding, A-rated company.

The market is clearly saying that it’s willing to pay more – though I don’t understand this stance.

Let me clarify.

Aon Valuation

That Aon deserves some kind of premium, there is no doubt or argument about. The company is too good to trade at a simple 14-15x P/E, too big, and too much of a moat in a global market.

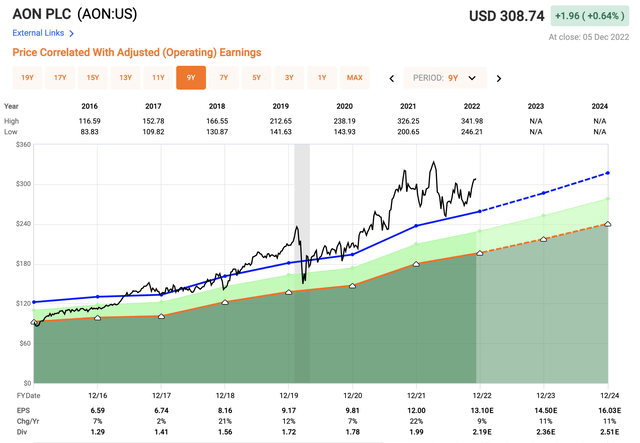

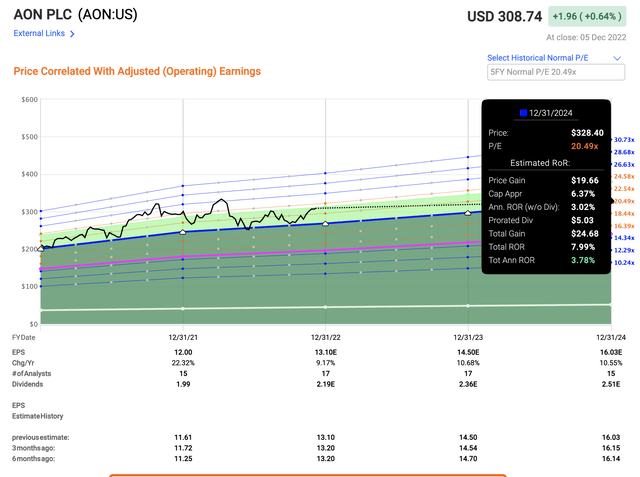

However, the yield also influences how much we want to be paying for the company here. For the past 5-7 years, the company’s premium has been expanding – from trading at a premium of 16-18x P/E, to over 19-20x P/E. Today it trades at 23.71x.

This, to me, makes for a very tricky investment thesis. The company isn’t worth this much, as I see it, even with these growth estimates. There are insurance companies, even brokers, that trade at lower multiples with better upsides.

Even if we allow for the company’s 5-year average of 20.5x, the company’s 2024E RoR comes to less than 4% annually with a share price target of below $330/share. The 0.73% yield doesn’t exactly help matters here.

The fact is that the upside and thesis are now far worse than it was only a few months back. There is no doubt in my mind that the company is one of the leading insurance and risk players on the market. That’s why it continually outperforms.

However, don’t kid yourself in that you can’t lose money or underperform when investing in a business like this. You quite easily can. If you had invested at 22X+ P/E back in 2002, your annual RoR would have been below 3% per year for 10 years due to the valuation that you invested in. I continue to believe that such things are possible if you were to invest at this valuation.

Valuation is gospel for me – it should be at least a consideration for you when you look at a company. because you don’t have dividends to offset the slow growth, that you have in higher-yield companies.

For that reason, my current thesis on Aon plc remains like this:

The company shouldn’t be invested in above a 20x P/E – at the very least you should wait for 19.9x before putting money to work here. Below 20X P/E, you’re investing below the 5-year P/E average – this is the most expensive I would consider attractive here because that’s when we can get those double-digit returns.

Let’s look at analyst targets for the company and how, and if they’ve shifted.

S&P Global considers the company a “HOLD” with a range of $250 up to $360, with an average of around $300 – yet only 2 out of 13 analysts are at a “BUY” here, with 12 at either “HOLD” or “SELL”. These recommendations speak louder than the overall price target averages with their 3% current downside. The short and straight of it is, that even analysts consider the company overvalued at 23x+ P/E – and for once, we’re in complete agreement here.

Me, I would consider the $250 low-end target an excellent price to start accumulating shares. I could stretch as high as $255, but no higher than that.

Despite outperformance, I’m therefore at a “HOLD” for the time being and would consider the following as my thesis.

Thesis

- Aon plc is a superb, fundamental company in financial services and insurance, and risk brokering. It’s one of the leaders in its field and deserves your attention at the right price. That price is around $250/share, as I see it.

- A mix of near-term challenges related to macro, inflation, and premium headwinds calls into question how high an upside on a 3-year basis the company actually has.

- As things stand, I don’t believe management forecasts a bullish perspective quite as much and would go more conservative here.

- Aon plc is a “HOLD” to me for the time being.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

The company does not fulfill my valuation criteria – and therefore it warrants no more than a “HOLD”.

Be the first to comment