onurdongel/E+ via Getty Images

Antero Resources Corporation (NYSE:AR) has gone from the doghouse to market darling. The oil and gas company that was once considered a bankruptcy threat is now the beneficiary of improving earnings and cash flow.

There is likely more growth ahead as this is really the beginning of an industry recovery. This recovery also features improving ability of companies to export. That may extend the current recovery beyond what many forecast. Once the North American market fully joins the world market through exporting, there will be a far larger potential market with much stronger pricing to aid industry pricing in North America. Consumers may not be thrilled at the prospect of higher prices. But investors are likely to enjoy strong earnings for several years.

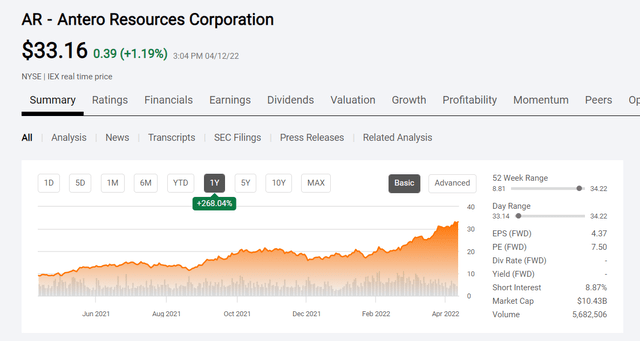

Antero Resources Common Stock Price History And Key Valuation Metrics (Seeking Alpha Website April 12, 2022)

Clearly, fiscal year 2020 marked the end of a long industry downtrend and the beginning of a new cycle. The improvement in natural gas and related prices has been breathtaking. It is still fairly early in the recovery cycle, so the stock likely has some better days ahead before its time to worry about the next downturn.

The last industry downturn was extended by the rapid growth of the unconventional business in North America. About one-third of the natural gas supply comes as a by-product of producers that focus on oil production and liquids production. Those companies make the decision to produce more based upon their far more valuable liquids part of the production. Therefore, the natural gas pricing downturn was a minor issue for them. Now the growth of that business is expected to be slower in the future. So, natural gas prices should not suffer an extended downturn in the future from a supply imbalance.

Management mentioned during the conference call that they elected to increase their working interest in some partnership wells due to the strong commodity prices. That “moved the needle” from no growth to a small amount of single digit growth. This industry is notorious for being unable to resist strong prices. Besides, the fast paybacks at these prices means that management gets their money back and then “can let the profits run.”

These are long-lived wells. The production of the wells is likely to last through several business cycles while providing a reasonable rate of return through those cycles.

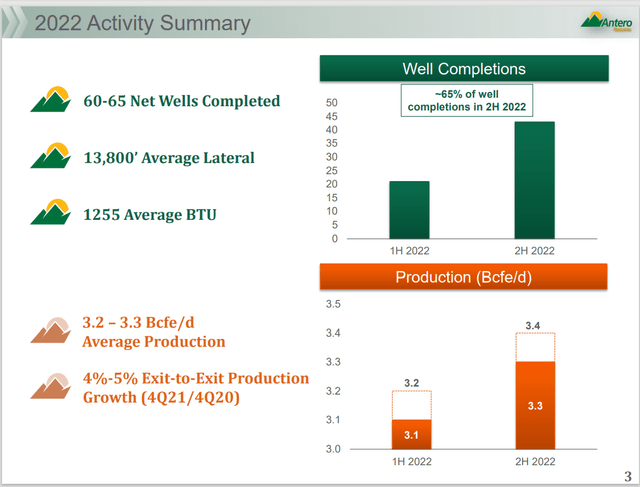

Antero Resources Well Drilling And Completion Activity Summary For Fiscal Year 2022. (Antero Resources Fourth Quarter 2021, Conference Call Slides)

In a way, management is “taking out some insurance” by completing more wells during the all-important heating season. The initial high production rates therefore earn a little more ROI because prices are stronger during the heating season. That makes the payback period shorter. So, there is less risk of the company not getting back its initial investment.

Antero has long had a history of growth. Despite the fact that management now states the company has a mature strategy, it behooves management to maximize production while prices are strong. That would provide more cash flow during periods of weak pricing so that the company does not have to drill until another recovery is well underway.

Therefore, investors should not be too surprised that management has moved from production level maintenance to low growth. If these current prices remain strong, then management could well consider inching that growth up a little more. That long term lack of restraint is an industry characteristic that helps bring the boom times to an end.

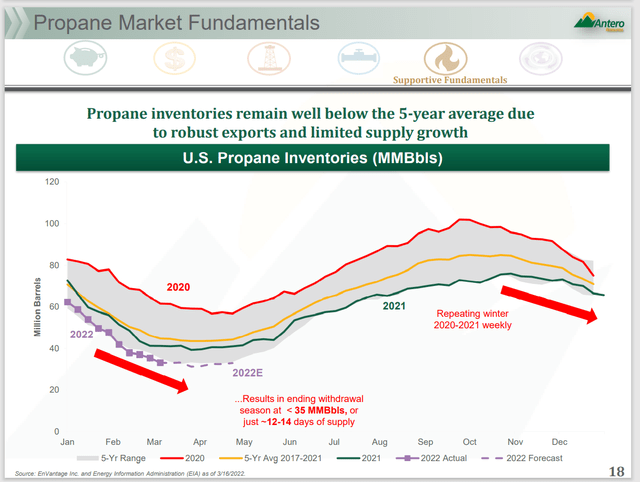

Antero Resources Description Of Propane Market (Antero Resources Presentation At The Antero Resources Presentation At The Scotia Howard Weil 50th Annual Energy Conference March 22, 2022.)

Antero Resources reports the various liquids market pricing because those liquids have a material effect upon the company cash flow and earnings. Shown above is propane. But the ability to export the various liquids produced has materially strengthened pricing throughout the North American market. That is likely to continue for the reason shown in the slide above. Inventories of just about all liquids are lower because they are no longer in oversupply. Therefore, liquids rich producers are enjoying a boom that they have waited for (a long time).

Some of the liquids, like ethane, are a key ingredient to many plastics used by the green revolution. Natural gas itself is a source of hydrogen for the rapidly growing hydrogen market. These unexpected developments and more predictable growth establish a robust market for natural gas for years to come. The natural gas companies have been trumpeting this for years. But only recently has the market begun to even contemplate what these companies are stating.

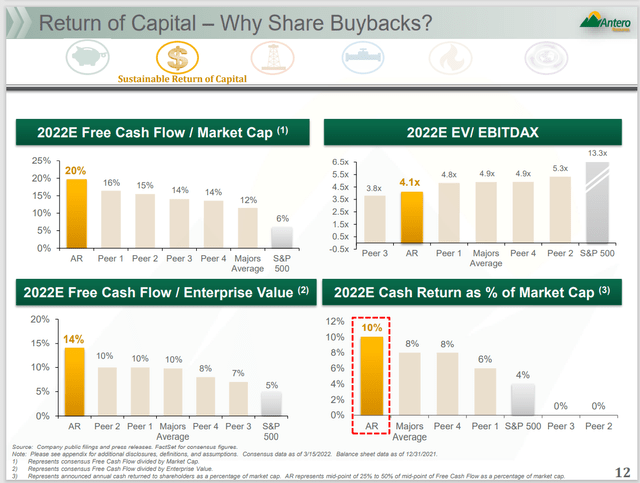

Antero Resources Free Cash Flow Projections Compared To Competition (Antero Resources Presentation At Scotia Howard Weil 50th Annual Energy Conference March 22, 2022.)

The result of all the good news is a relatively cheap company when compared to the competition. The next business cycle is likely to feature higher prices throughout the cycle because North America exporting ability is growing. Before North America became oversupplied with a lot of products that had nowhere to go.

Rarely is it true that “this time it will be different.” But that exporting ability that rapidly grows appears to make the case that “this time it will be different.”

In the meantime, it is early in the recovery cycle. Slowing supply growth is a market demand to return some cash to shareholders combined with an absence of speculative money. That speculative money used to enter the industry near market highs and push production higher to the point that the late entering money did not earn an adequate return. That makes it more difficult for companies to lend money to grow rapidly. The lack of rapid growth should measurably extend the period of strong commodity prices.

Sooner or later the presence of strong commodity prices should prove to be irresistible to the market. That rapid influx of money leading to strong production growth throughout the industry will most likely be the signal that it is time to lighten up on upstream investments. Right now such a scenario is nowhere in sight. That makes the current stock price outlook pretty bright in spite of the fact that this stock is up quite a bit from its lows.

Investors need to remember that the market frequently goes overboard on the upside only to go overboard on the downside and then repeat the process. We are definitely not overboard in anyway shape or form in this industry. In fact, the recent house-cleaning in fiscal year 2020 probably means this company and the natural gas industry will continue to outperform the latest stock market correction by a wide margin. That is excellent news for shareholders and potential investors.

Be the first to comment