Albert_Karimov

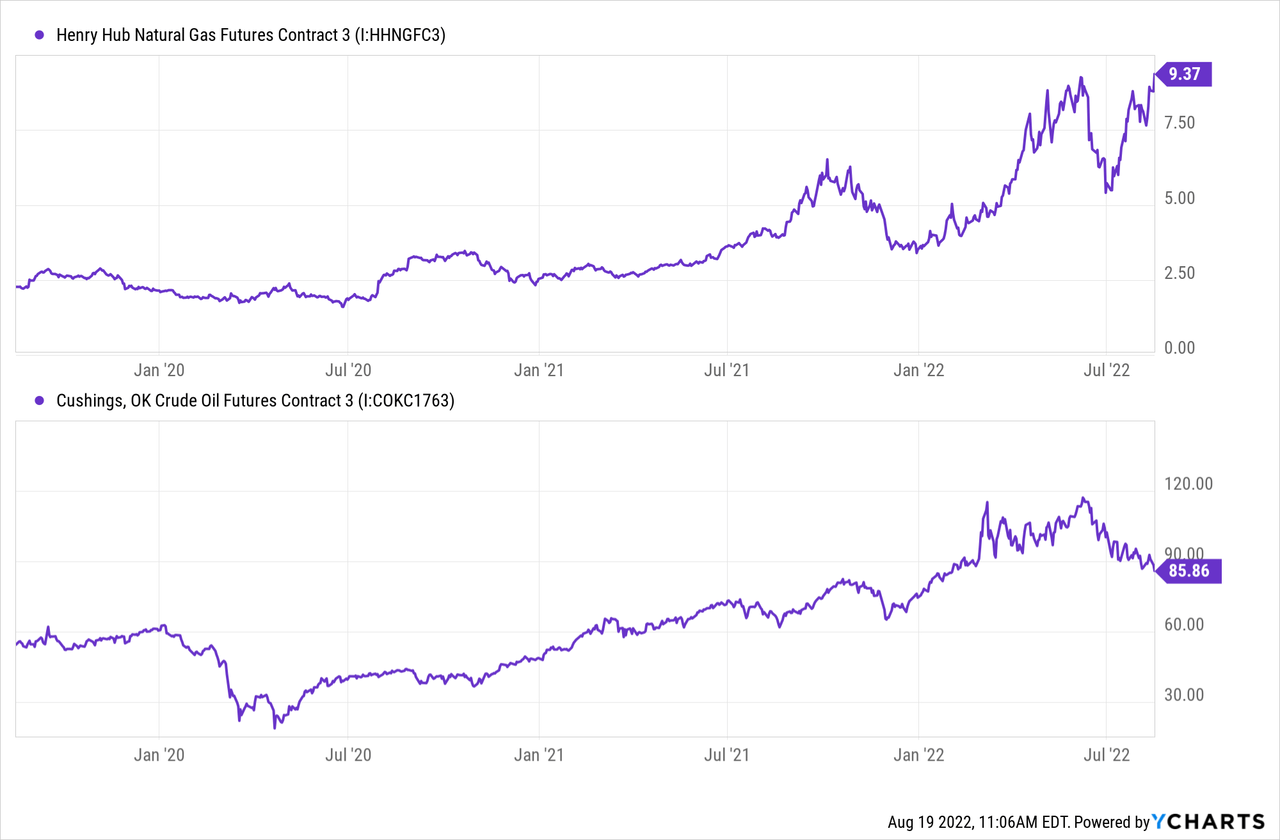

Fossil fuel prices surged during the first months of 2022 but have decreased since. Crude oil is trading at around $90 per barrel, down 25% from its $120 high months ago. However, natural gas has remained at a long-term peak, breaking its past high just days ago. See below:

Crude oil remains weak, but I expect that may shift as the impact of SPR reserve releases ends over the coming months and Europe pursues gas-to-oil energy switching this winter due to its natural gas shortages. While the U.S. situation is not as dramatic as Europe’s, domestic underground natural gas storage levels are at nearly the lowest seasonal levels over the past five years. Even more, recent outlooks have shown shallow injection projections due to weak gas production and increased demand (due partly to weak wind turbine output). Additionally, natural gas export demand is expected to rise later this year as the Freeport LNG plant is reopened after repairs.

Overall, today’s situation points to a sustained natural gas price rise. Earlier this year, I was not keen on natural gas remaining at ~$9, but recent data has shown a peak and potential decline in U.S. natural gas production. Many natural gas companies have faced difficulties expanding production despite high profits due to labor and materials shortages and generally low CapEx levels. With this in mind, natural gas stocks such as Antero Resources (NYSE:AR) may see another round of gains. Of course, general economic weakness and a potential round of broad market volatility remain a crucial threat to natural gas stocks. Let’s take a closer look.

Natural Gas Injection Season to Weaken

I became bullish on Antero Resources last October, as detailed in “Antero Resources May Have Further Upside Due To Winter Propane Shortage.” As expected, natural gas liquids such as propane remained very expensive and rose over the coming months due to low inventory levels. AR is currently 105% more expensive than it was when I covered it last, so it is not necessarily the same value opportunity it was last year. However, its cash flows are expected to substantially increase this year due to the recent sharp rise in natural gas and NGL prices.

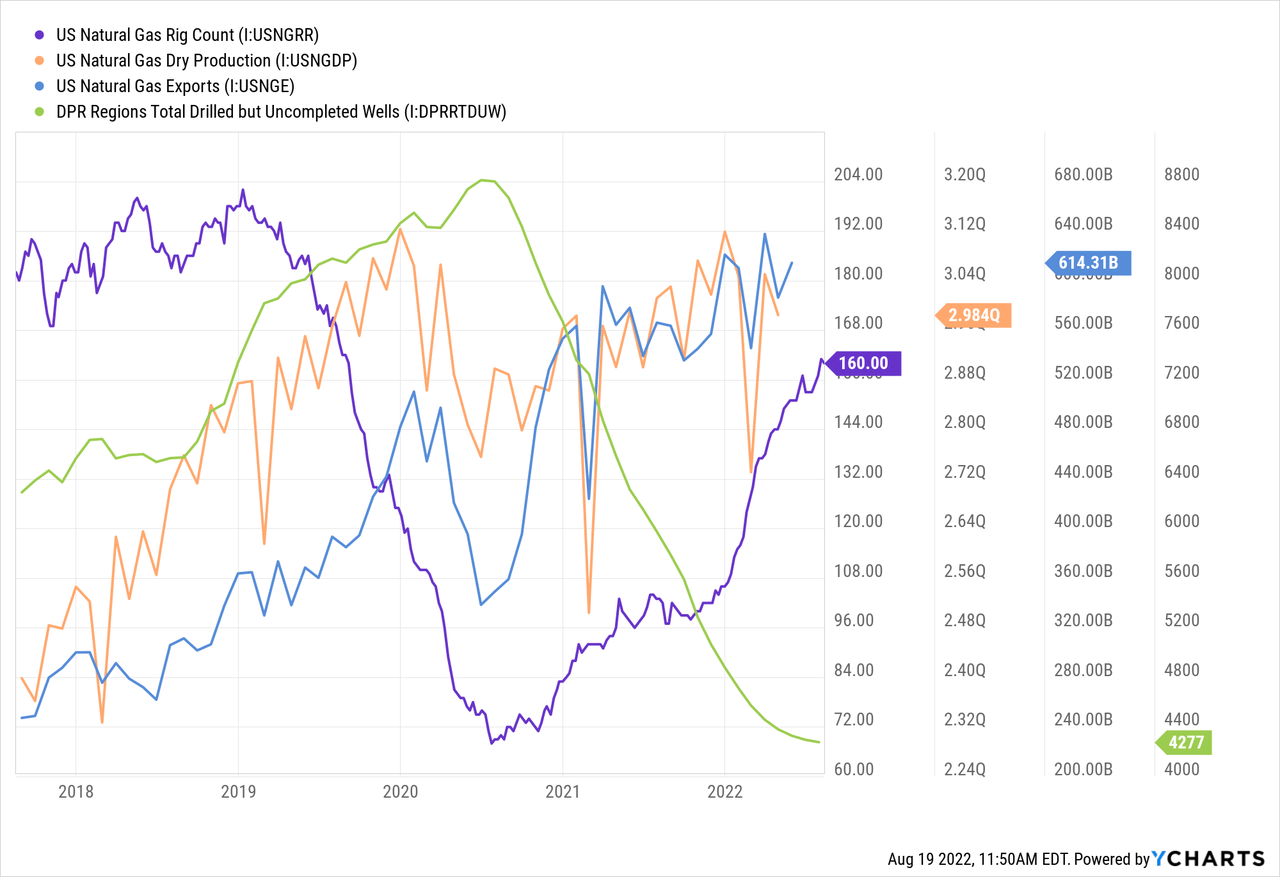

In my view, there is ample reason to believe natural gas will sustain high prices for years to come. After rising for years, natural gas production shuttered in 2020 due to lockdowns and restrictions. The U.S. natural gas rig count collapsed to extreme lows. Production slowly recovered, peaking at the beginning of 2022, but was primarily driven by the completion of “drilled but uncompleted wells.” Limited “DUC” inventory is left today, so an increased rig count is necessary for production to grow. However, the natural gas rig count has stagnated, and exports continue to rise, limiting domestic supplies. See below:

It is impossible to know what rig count level is necessary for production to remain flat due to varying depletion rates across wells. However, we know many wells in use today are young due to the massive recent decline in “DUC” inventories. Problematically, natural gas well output levels decline by nearly 80% during their first two years of operation, so significant drilling activity will be necessary to maintain production. As seen in the rig count data, drilling activity has risen from 2020 lows but is still well below past levels. U.S. natural gas production has already slipped slightly, and I believe it will continue to do so over the coming years as producers struggle to drill sufficiently.

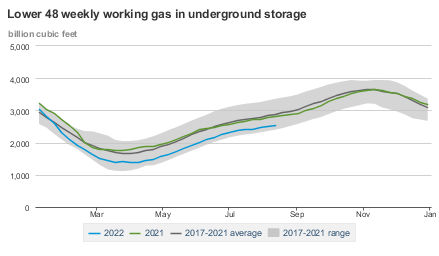

Current U.S. natural gas inventories are well-below typical levels, near the bottom of the 2017-2021 range. Given the potential decline in output, combined with rising export and domestic demand, I expect storage will be dramatically below seasonal norms by mid-fall. This may come as injection season ends, meaning next spring may see a natural gas decline to critical lows unless market dynamics shift. See below:

Natural Gas Underground Seasonal Storage (EIA)

While natural gas is more expensive today than it has been over the past decade, we should keep in mind that $8-$9 natural gas prices were typical throughout the 2000s before the U.S. shale boom. Since 2020, the shale boom appears to have become the “shale stagnation,” meaning market dynamics are reverting toward non-glut levels. Indeed, it may be possible the natural gas market is shifting toward chronic production difficulties, potentially driving natural gas’s “normal range” well above the 2000s range. While U.S. market dynamics are far more favorable than Europe’s, EU natural gas is over 3X U.S. prices, boosting export demand as long as Russian trade remains weak.

I expect natural gas prices to rise over the coming months due to weakening injections and slowing output. The weak injections factor is primarily priced into natural gas today, but the potential for a longer-lasting shortage is not. If more investors realize the shale patch will not deliver endless output growth and may see production declines, natural gas prices should remain elevated long-term. While AR is highly valued today, it may still be cheap if we assume natural gas and NGL prices will remain high for years.

AR Long-Term Earnings Outlook

The current consensus earnings outlook for AR suggests an EPS of $6.55 this year, followed by $7.93 in 2023 and $6.25 in 2024. This outlook gives the firm a forward “P/E” of 5.7X to 6.5X. The company has reduced its financial debt by around 70% from early 2019 peak levels (to only $1.6B today) and, like many “shale-boom” companies, is reaching maturity as CapEx declines and cash flows are returned to investors via buybacks.

Antero is quickly becoming a free-cash flow machine that may be able to sustain a very high dividend over the years to come (though it does not currently pay a dividend). Based on the current EPS outlook, the company has a forward earnings yield of around 16%, and its cash-flow yield will likely be higher due to high depreciation costs. Current earnings outlooks assume a natural gas price range of $8-$10. This range appears reasonable, but shifting dynamics such as fading output may push that range even higher. As such, I believe there is net upside in Antero’s valuation outlook, though it is admittedly far less dramatic than when I covered the company last year.

The Bottom Line

I am moderately bullish on Antero due to its breakout potential and high expected long-term FCF yield. The entire U.S. natural gas industry is reaching another wave of maturity after immense growth over the past decade, meaning few will be looking to expand production rapidly. Indeed, if natural gas production falters despite the rise in demand, U.S. natural gas prices may begin to converge toward Europe’s (assuming Europe’s eventually declines once Russian trade resumes). While natural gas is expensive today, it is hardly more expensive than it was over a decade ago, meaning it’s relatively cheap, adjusting for the ~50% in inflation since the mid-2000s.

Of course, AR is not without risks. The stock is volatile today, and I expect turbulence to continue as the natural gas market is jawboned by shifting EU-Russia dynamics and numerous domestic factors. Natural gas and NGl prices are toward the high-end range; though I expect them to break higher, they may quickly revert lower if U.S. production growth shows signs of resuming. Chiefly, I believe AR is a long-term bullish opportunity due to its potential for high sustained free-cash-flows. Many factors can push the stock higher over the next year, but some may reverse the trend, so I would not bet too aggressively on another short-term spike despite the decent probability of one.

Be the first to comment