Evkaz

Who would have guessed that the labor market would be the most significant threat to mortgage real estate investment trusts? But here’s what’s going on:

Strong hiring conditions in the United States in August strongly suggest that the Federal Reserve will raise short-term interest rates even faster than expected, exposing mortgage real estate investment trusts such as Annaly Capital Management Inc. (NYSE:NLY) to significant valuation headwinds.

With another super-sized rate cut looming at the end of the month, Annaly may finally begin to trade at a discount to book value once more.

Annaly Book Value Premium Undeserved

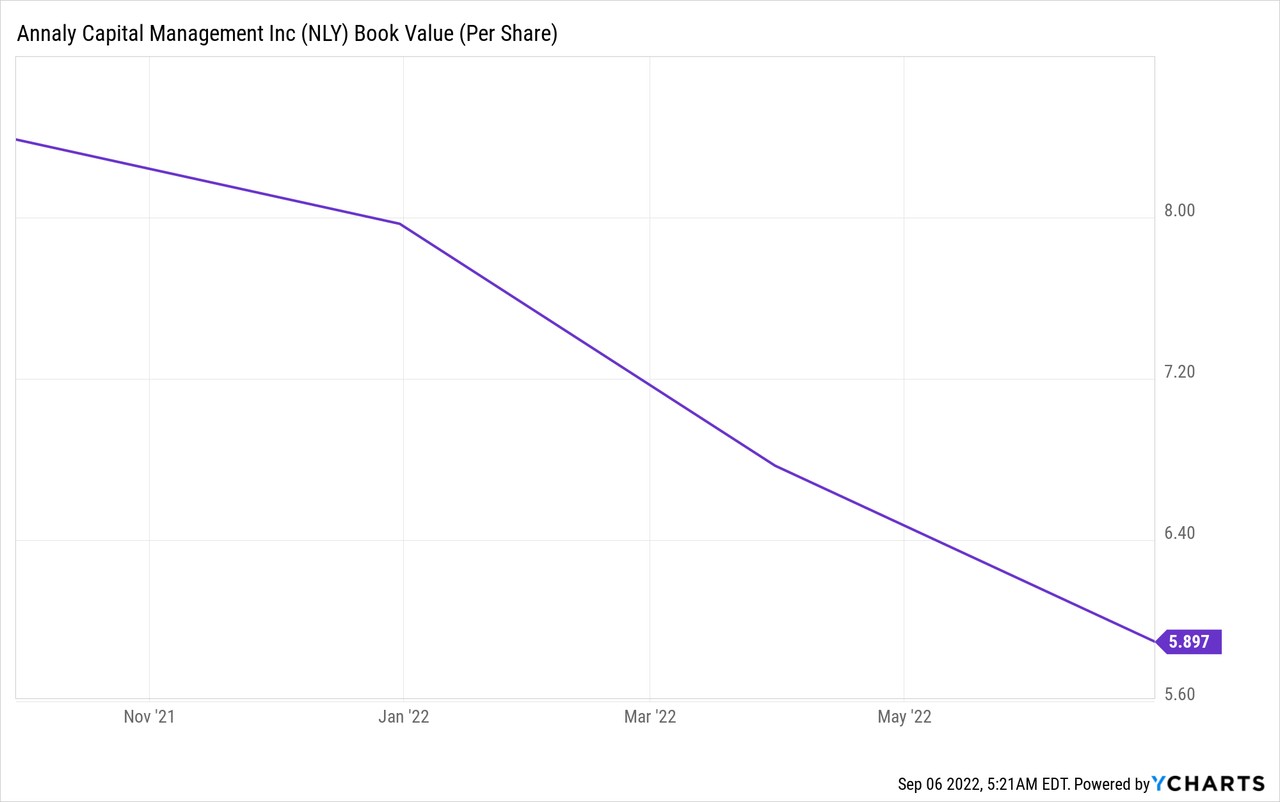

The market has not been kind to the mortgage trust. Higher interest rates and widening spreads in the mortgage-backed securities market have resulted in significant book value losses for Annaly. Annaly’s book value has dropped 26% between now and June 2022.

The mortgage trust’s book value at the end of 2021 was $7.97 per share, which dropped to $6.77 per share in 1Q-22 (down 15% QoQ) and then to $5.90 per share (down another 13%) due to the reasons mentioned above.

With that said, the recent drop in Annaly’s book value is not a bearish anomaly, and yield chasers should be aware of this. Annaly’s book value has been evaporating for much longer than just the last two quarters.

If you consider Annaly’s book value to be an approximation of the mortgage trust’s intrinsic value, a long-term decline in the trust’s book value is extremely concerning, especially for yield chasers who have previously fallen into Annaly’s yield trap.

Annaly’s book value was $11.19 per share exactly five years ago, implying a 48% loss in total book value.

On a per share basis, this is how the trust’s long term book value growth story looks:

This graph illustrates the risks of investing in stocks that pay out double-digit dividend yields while presenting investors with a significant loss of intrinsic value.

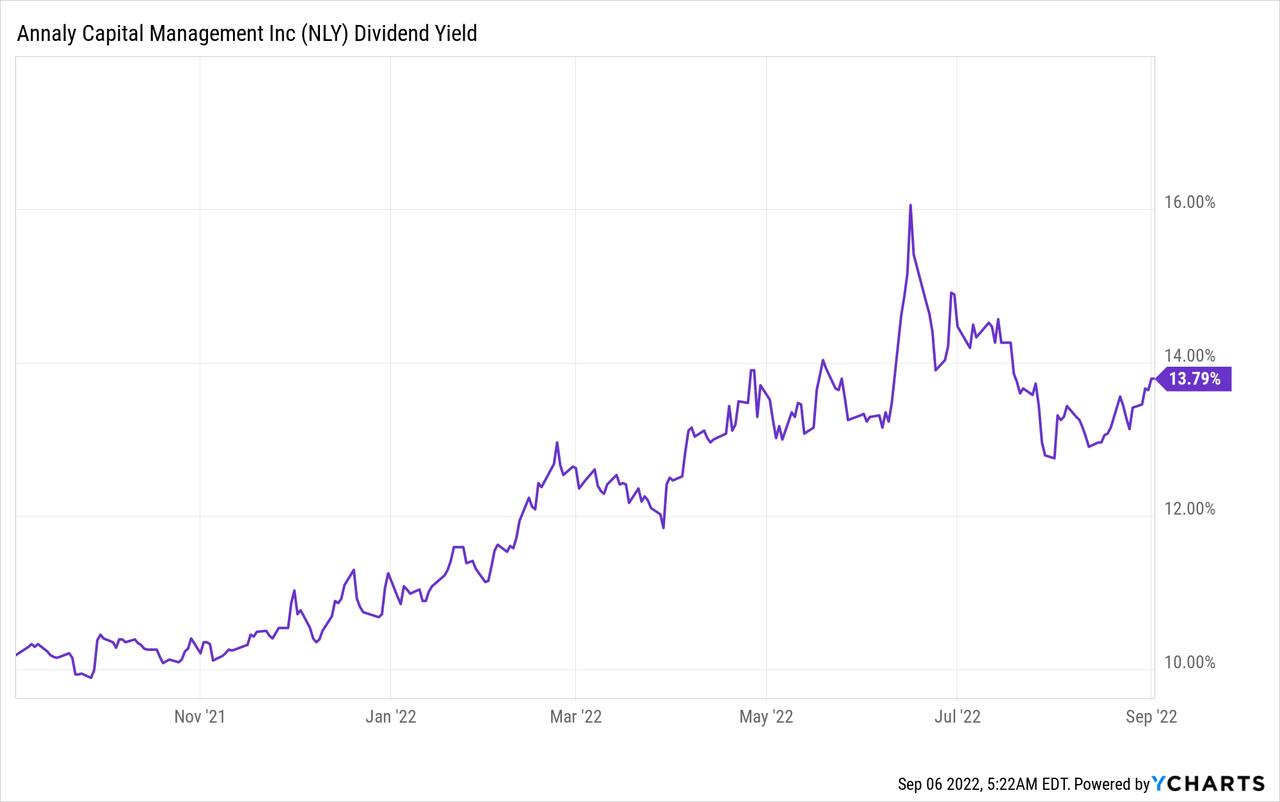

These 12% dividend yields are frequently unsustainable and represent yield traps for investors. Annaly currently has a stock yield of 14%, indicating that investors should avoid the bait.

The Labor Market Is Starting To Become A Real Problem For Annaly

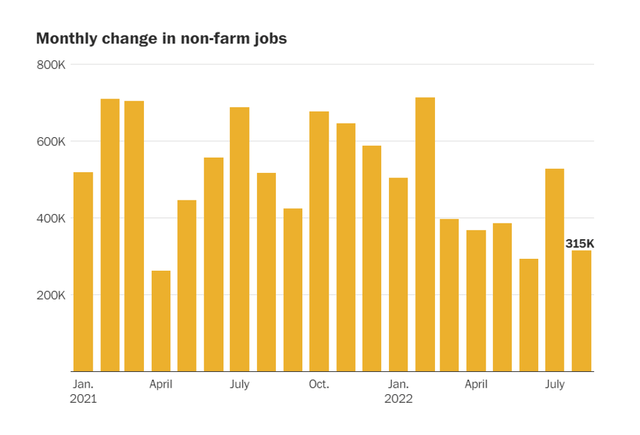

The labor market in the United States showed strength in August, and this has begun to pose a problem for Annaly. The labor market in the United States added 315K jobs in August, falling short of expectations of 318K jobs, but job gains remained solid.

Unfortunately for Annaly, the current state of the labor market makes aggressive interest rate hikes by the central bank more likely.

The U.S. economy added 528K jobs in July, indicating that things are returning to normal.

Monthly Change In Non-Farm Jobs (The Washington Post)

Interest rates and bond yields have risen in 2022 as a new market consensus emerged around a change in monetary policy, but the strength of the labor market may force the central bank to respond even more firmly later this month.

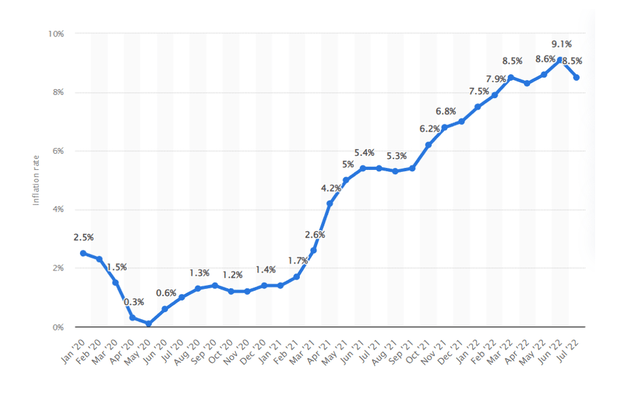

The Fed already raised interest rates by 75 basis points in June and July. Inflation remains at around 8.5% per year. Having said that, the current consensus is for a 50 to 75 basis point interest rate hike in September, and I believe we will see the third super-sized rate hike following the labor market report.

Despite lower inflation, Annaly expects another quarter of book value losses as short-term interest rates rise faster than expected.

Inflation Rate (Annaly Capital Management)

Implications For NLY’s Valuation

Annaly is currently trading at a price to book ratio of 1.08x, which means the stock commands an 8% premium to book value, which has already dropped 26% this year, as I mentioned in the introduction. Given the latest labor market report, I don’t believe the Fed will take its foot off the gas in terms of interest rate hikes anytime soon.

A steeper short-term interest rate path obviously increases the cost of Annaly’s leveraged mortgage investment business, but it also indicates new book value losses for 3Q-22. The results won’t be released until late October, but given the current market environment, I wouldn’t be surprised if the mortgage trust’s book value fell another 5-10%.

Given the risks presented by the strong labor market report, I believe Annaly and other mortgage trusts do not deserve to trade at book value premiums right now.

Why Annaly Could See A Higher Valuation (Against My Expectations)

A weakening labor market and lower inflation would strongly suggest that the central bank’s case for further interest rate increases is also weakening.

Narrowing MBS spreads could also indicate that the market anticipates a more predictable interest rate environment with less volatility at the short end of the yield curve.

My Conclusion

There will be more blood for Annaly and the mortgage real estate investment trust sector as a whole in 3Q-22, and investors should brace themselves for another steep drop in book value after the Fed signaled it will not take the foot off the gas.

Given the current market setup of high inflation and a relatively strong labor market, Annaly’s stock should not be trading at a premium to book value because both factors are set to push the Fed towards another 75-basis point increase at the end of the month.

Annaly’s 14% dividend yield is appealing, but it is likely a trap, as it has been in the past.

Be the first to comment