jetcityimage/iStock Editorial via Getty Images

Angi: Investment Thesis

I find it far more fulfilling and enjoyable to author articles that describe a Strong Buy for a company enjoying success. Unfortunately, this is not the case with Angi Inc. (NASDAQ:ANGI). Back on Aug. 20, 2020, I published an article, “ANGI Homeservices: Too Pricey By Far,” with the share price at $14.28, and a Sell rating. Around 12 months later, on Aug. 23, 2021, with the share price down to $10.32, I authored article, “Angi Has A Brand Efficiency Issue,” and rated the stock a Sell. Another 10 months have gone by and Angi share price has declined by a further ~55% to $4.65 at close on Jun. 29.

I decided to take another look at Angi Inc. and found, since Aug. 23, 2021:

- The share price has declined by 54.94%, compared to a decline of 14.19% for the S&P 500.

- SA analysts’ consensus EPS estimates for FY 2024 have continued to decline from $0.68 in Aug. 2020 to $0.33 in Aug. 2021, to $0.12 at Jun. 29, 2022.

- As a consequence of the relative declines in current share price and EPS estimates, forward P/E ratio (2024 year) has increased from 21.00 at Aug. 2020, to 31.27 at Aug 2021, and to 38.75 at Jun. 29, 2022.

- SA Quant rating has moved from Hold at Aug. 2020 to Very Bearish (Strong Sell) at Aug. 2021, to Sell at present.

- The group of enterprises to which Angi belongs appear to be “darlings” of Wall Street, which maintains a Buy rating for Angi.

In my previous article in Aug. 2021, I concluded,

The big issue for Angi is an unresolved problem of customer acquisition costs. Until Angi is able to demonstrate an ability to significantly reduce customer acquisition costs I will remain bearish. The stock remains richly priced even following the fall in share price since my previous article. It’s rather telling the SA Quant rating was neutral at the time of my previous bearish article, but current Quant rating is “Very Bearish.”

In taking another look, I have given emphasis to determining how Angi is coming to grips with its customer acquisition costs. Unfortunately, not so well, but recent initiatives might make a difference in future quarters. In the meantime, I remain bearish on the stock, with a Sell rating. Detailed discussion and analysis for Angi follows below.

Angi: Detailed Analysis and Discussion

It matters not how brilliantly conceived a product or service strategy is if it cannot efficiently and economically capture revenue. I will digress a little here to give an example of a real world example I had some involvement with. Back in the dotcom era I was invited to a presentation of a new app designed to enable non-technical people to set up their own website. This app was quite brilliant for this purpose and had won prestigious national awards. The sales manager went through the planned marketing process, starting with purchase of a qualified mailing list. The step-by-step initial unit costs per targeted customer for mailing list, mail outs, call center staff who were to initially answer calls from interested prospects, technical sales staff, and so on were small. Estimated percentages also were given for conversion rates at each step in the sales process. If added up, the total of the unit costs for each step were well below the planned unit selling price. But no account had been taken of the magnification of initial unit costs on final cost due to the progressively reducing number of potential clients as they went through the acquisition process. Such a basic oversight might surprise many, but it was a time when price to earnings ratios were ridiculed as obsolete, and “good stories” and price to revenue ratios were in vogue.

I see similarities to the above website app with Angi. The service/product is highly regarded, for good reasons, but customer acquisition/retention costs are high. There are also issues with one-off sales, i.e., non-repeat business.

Angi service/product offering –

The two most recent articles on Angi published on Seeking Alpha this year describe each authors’ reasons for being bullish on the service/product. Both are well worth reading for anyone considering investing in Angi shares. I include below some brief excerpts, and some of my own comments.

- “Angi Stock: Bullish On The Walmart Partnership” (share price at publication on Feb. 2, 2022 $8.58, Buy rating) – ” Angi recently announced a new partnership with Walmart Inc. (WMT) which will essentially market and distribute Angi services. We believe this development can be a game-changer for the company by providing a boost of exposure to a new audience. While the company still has work to do, the ANGI looks interesting at the current level with significant upside potential as a turnaround pick.”

- “ANGI’s Risk/Reward Is Worth It” (share price at publication on Mar. 1, 2022 $6.89, Strong Buy rating) – “Angi’s customers and service pros are loving the fixed price offering. Angi’s app has 4.4 stars and Angi has seen an increased conversion rate for requests for the fixed price offering driving revenue and contribution margin.”

What these two authors have homed in on is music to my ears. Both are highlighting means by which Angi is addressing high costs of customer acquisitions. In my Aug. 2021 article, I wrote,

I see Angi in a somewhat similar situation to the web-site development app discussed above. For Angi, customer acquisition strategy is slightly different to the above because it relies a great deal on branding to attract its customers. But customer acquisition costs are a real issue for Angi. Angi has a problem with brand strategy and customer acquisition costs. The Angi Chairman, Joey Levin, explained some of the issues in an answer on the Angi Q2-2021 earnings call Q&A. It’s a rather long quote but I found it compelling and essential reading for anyone interested in investing in this stock.

I will not repeat that “rather long quote” here, but it can be accessed through the link provided above. In my previous articles, I included tables to show the impact of what Mr. Levin described in relation to customer acquisition costs. I now include updated versions of those tables.

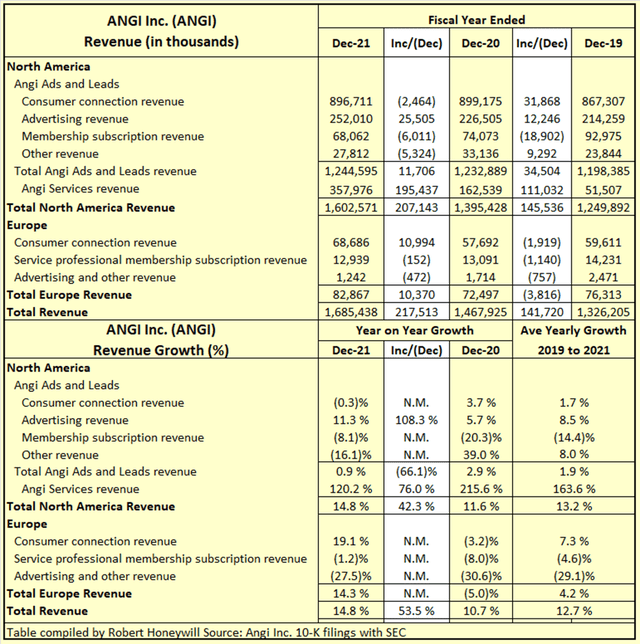

Table 1.1 Fiscal Year Comparisons – Revenues By Segment

Table 1.1 shows the only sub-segments of Angi that are showing really high revenue growth are Angi services revenue at 120.2% YoY and Europe Consumer connection revenue at 19.1%. But Angi services 2021 revenue of $358 million and Europe Consumer connection revenue of $68.7 million combined are only 21.2% of total revenue of $1,685 million. All other sub-segments have low or negative growth. Table 1.2 below highlights the high and increasing costs of customer acquisition.

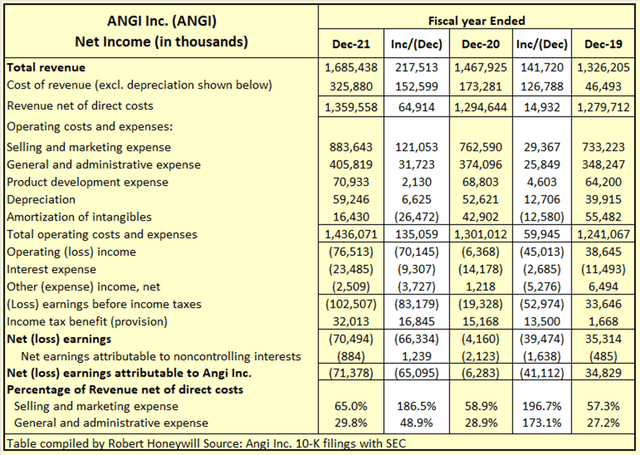

Table 1.2 Fiscal Year Comparisons – Revenues and Earnings

Table 1.2 shows Selling and marketing expense, as a percentage of revenue net of direct costs, increased by what might seem a modest 1.6 percentage points from 57.3% in 2019 to 58.9% in 2020. However, on an incremental basis, Selling and marketing expense was 196.7% of revenue. In other words, ~$2 was spent for every $1 of additional revenue generated. Including General and administrative expense, ~ $3.70 was spent for every $1 of additional revenue generated in FY 2020. The situation for FY 2021 was slightly better, but it still cost ~$2.35 in selling, marketing and admin. costs to generate each additional $1 of revenue. To see if there is any improvement over time I also provide similar tables for quarters ending March 2022, 2021 and 2020. There are a few gaps in this data as Angi restated revenue breakdown to highlight Angi Services (previously combined with various other revenue classifications), but did not provide restated figures by quarter for 2020 year.

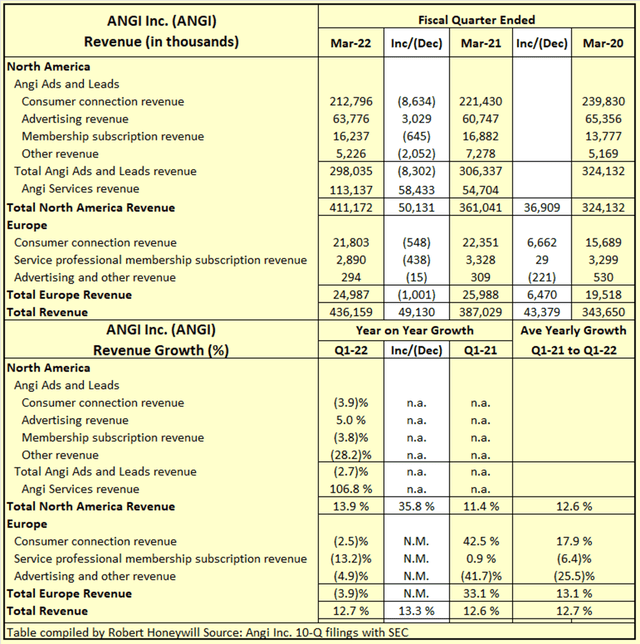

Table 2.1 First Quarter Comparisons – Revenues By Segment

Table 2.1 shows the only sub-segment of Angi that is showing really high revenue growth is Angi Services revenue at 106.8% for Q1-2022 versus Q1-2021 (as mentioned above, separate figures are not available for Q1-2020). But Angi services Q1-2022 revenue of $113 million is only 25.9% of total revenue of $411 million, and overall revenue growth of 12.7% is far below the 106.8% for Angi Services. Table 2.2 below highlights the ongoing high costs of customer acquisition extending into the latest financial results available for Angi.

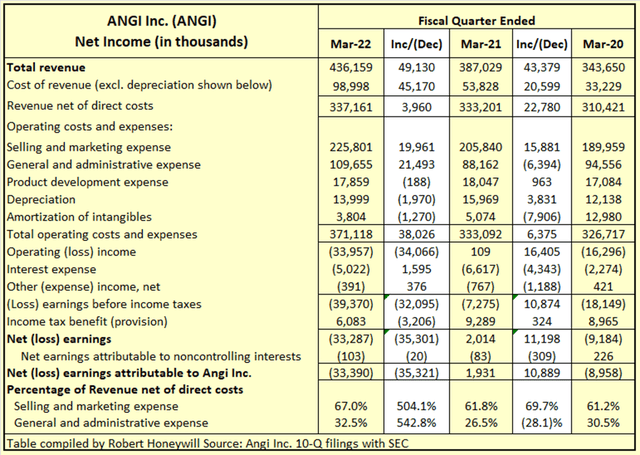

Table 2.2 First Quarter Comparisons – Revenues and Earnings

First quarter 2021 did show some improvement. Incremental Selling and marketing costs at 69.7% were still above average 61.8% for Q1-2021, but lower General and admin charges contributed to a small profit for Q1 2021. First Quarter 2022 was a disaster as far as reining in Selling and marketing and General and admin. expenses. On an incremental basis, Selling and marketing expense was 504% of revenue and General and admin. 542.8% of revenue. In other words, ~$10.47 was spent on those two expense items for every $1 of additional revenue generated.

Angi: Summary and Conclusions

Angi has been experiencing difficulty in efficiently converting marketing efforts into sales revenue. Revenue net of direct costs growth for Q1 2022 was minimal. At the same time selling and marketing and General and admin. expense growth rates are in double digits. Angi must find a way to turn this around for the company to achieve profitability.

The management appear hard working and competent. Possibly more importantly, they appear to understand they have an issue and are diligently addressing it. The two most recent articles on Seeking Alpha, referenced above, highlight recent initiatives by management. Per SA Premium, Q2 2022 earnings release is due around Aug. 4, 2022. It will be interesting to see if there has been any measurable impact from those initiatives. I hope to see progress, but at this time and at current share price I remain bearish on this stock.

Be the first to comment