Sundry Photography/iStock Editorial via Getty Images

In our previous analysis of Analog Devices, Inc. (NASDAQ:ADI), we analyzed its business and product portfolio where we determined its diversified revenue streams across various analog products, end markets and geographical diversification. Moreover, we examined its track record of acquisitions and determined it has an acquisition strategy as it acquired 5 companies in the past 6 years with revenue contributions of between $50 mln and $1.4 bln.

In this analysis, we cover its acquisition of Maxim Integrated in a $20 bln deal. We analyze the company’s revenues and forecast its revenues as a combined company as well as the increase in market share as a result of the acquisition. Moreover, we examine the product integration opportunities for its power devices ICs for medical applications and project its medical semiconductor revenue growth within its industrials segment. Lastly, we analyze the profitability impact of both companies to project their gross and operating margins as a combined company.

Maxim Deal Supports Its Growth Through Acquisition Strategy

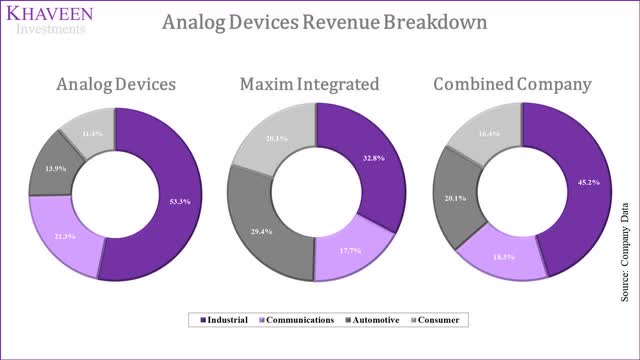

Based on ADI’s and Maxim’s annual reports, both companies have diverse revenue exposure to different end markets including industrials, communications, automotive and consumer. To project ADI and Maxim’s revenues, we derived a weighted average growth rate forecast for each company according to their breakdown by end market based on the market forecast CAGR in the table below. The total analog market is forecasted to grow at a CAGR of 4.8% through 2027 with the automotive and industrial outpacing the market growth at a CAGR of 8.5% and 5.8% respectively. We projected ADI revenues to grow 6.6% organically and Maxim at 6.9% due to its relatively larger exposure in the automotive segment.

|

Revenue Projections |

ADI |

ADI CAGR |

Maxim |

Maxim CAGR |

|

Industrial |

53.3% |

3.1% |

32.8% |

1.9% |

|

Communications |

21.3% |

1.8% |

17.7% |

1.5% |

|

Automotive |

13.9% |

1.2% |

29.4% |

2.5% |

|

Consumer |

11.4% |

0.5% |

20.1% |

1.0% |

|

Total |

100.0% |

6.6% |

100.0% |

6.9% |

Source: Analog Devices, Maxim Integrated, Khaveen Investments

In 2021, we estimate Analog Devices’ revenue excluding ADI based on our estimate of Maxim’s revenue contribution of $2.7 bln based on its prorated H1 2021 results and accounted for the acquisition completion in Q4 2022. We projected Analog Devices for Maxim’s revenue based on our derived forecast growth rate (6.64% and 6.9% respectively). In total, we expect with the full revenue contribution of Maxim in 2022, its total revenues to grow by 37% where Maxim’s contribution represents 29.5% of total company revenue.

|

Combined Company Revenues ($ mln) |

2020 |

2021F |

2022F |

2023F |

2024F |

2025F |

|

Analog Devices Revenues |

5,603 |

6,626 |

7,066 |

7,535 |

8,035 |

8,568 |

|

ADI Growth % |

-6.5% |

18.3% |

6.64% |

6.64% |

6.64% |

6.64% |

|

Maxim Revenues |

692.4 |

2,960 |

3,163 |

3,380 |

3,613 |

|

|

Maxim Growth % |

327% |

6.9% |

6.9% |

6.9% |

||

|

Combined Company Revenues |

5,603 |

7,318 |

10,026 |

10,698 |

11,415 |

12,181 |

|

Combined Company Growth % |

-6.5% |

30.6% |

37.0% |

6.7% |

6.7% |

6.7% |

Source: Analog Devices, Maxim Integrated, Khaveen Investments

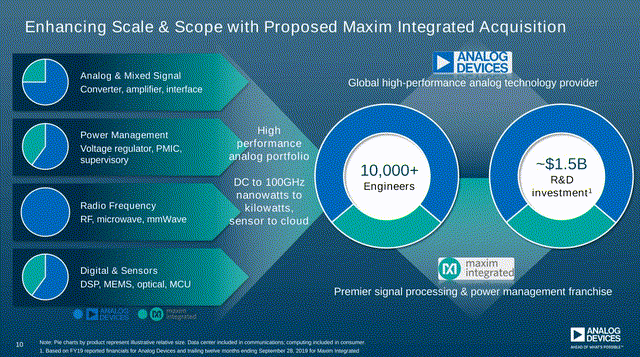

We view the Maxim deal to be even more significant than its past deals as we expect the company to contribute around 29.5% of the combined company’s revenues. Additionally, according to ADI, the combination is expected to create a company with over 50,000 SKUs with over 125,000 customers. In ADI’s 2020 annual report, it is stated that it had 45,000 SKUs and more than 125,000 customers. This translates to roughly 5,000 incremental products targeting a similar customer base. However, in comparison, Texas Instruments (TXN) still has a broader portfolio of around 80,000 analog and embedded processing products but has a smaller customer base of 100,000 worldwide.

Maxim is a respected signal processing and power management franchise with a proven technology portfolio and impressive history of empowering design innovation. – CEO Vincent Roche

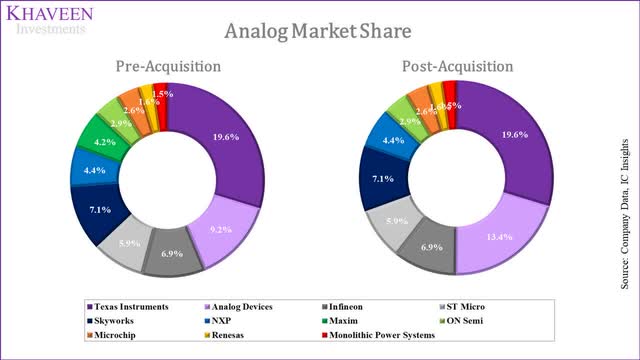

In addition, the deal is likely to cement ADI’s market positioning in the analog market. The company currently trails behind market leader Texas Instruments, but the contribution of Maxim’s revenue boosts its market share to 13.4% from 9.2% pre-acquisition and narrowing Texas Instrument’s lead.

IC Insights, Company Data, Khaveen Investments

Overall, we view the acquisition of Maxim to be significant because of the large incremental revenues to be contributed by Maxim of around 29.5% of the combined company revenues and cementing its market positioning while narrowing TI’s lead in the analog market. In the past 10 years, ADI’s market share has grown from 5.9% in 2015 to 13.4% post-acquisition. Furthermore, we believe this is significant as the analog market was valued at $74 bln in 2021 which represents around 13.3% of the total semiconductor market of $555.9 bln.

Integration of Maxim’s PMIC Products

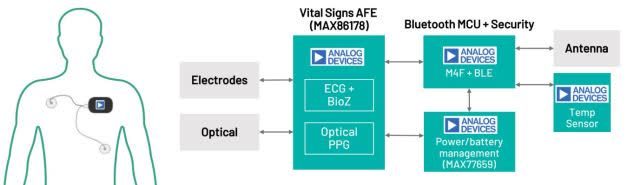

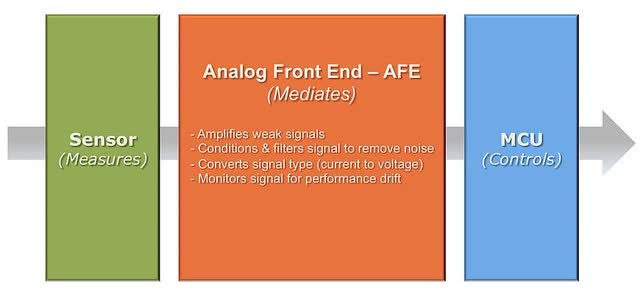

According to ADI, the company only expects revenue cross-selling opportunities from 2025 onwards which is longer than we expect. Meanwhile, the company has already started integrating solutions from Maxim’s power management portfolio with its single-chip Analog Front End (AFE) in medical wearables applications. According to the SIA, the medical end-use market accounts for 11% of the industrial semiconductor market and around 1.3% of the total semiconductor market. Growth is expected to be driven by the development of new healthcare technologies such as wearables and telehealth. We calculated the combined company revenues from industrials to be 45.2% of its total revenue making it still the largest end market for it.

ADI, Maxim, Khaveen Investments

Recently, the company introduced the MAX86178 analogue front-end IC. According to Embedded Computing, an AFE is one of the 3 main components to create a functioning sensing system with the function of converting the sensor’s signals for the MCU component. According to ADI, the new integrates optical, ECG and bio-impedance measurement systems to measure 4 vital signs namely electrocardiogram, heart rate, blood oxygen saturation and respiration rate.

Maxim’s PMIC fits into the picture with its MAX77659 PMIC which provides ultra-low-power features allowing the device to operate at low power with smaller batteries while extending its battery life. This is due to the incorporation of single-inductor, multiple-output (‘SIMO’) technology which uses just one inductor compared to traditional solutions which use multiple inductors for each switching regulator channel. With this technology, Maxim claims its PMIC is 50% smaller and offers a 20% longer battery with its SIMO technology. We believe that the smaller form factor and longer battery lifespan could make this solution highly significant for medical wearables due to the mobility requirements and convenience. According to Medical Design Briefs, medical devices are often worn on the bodies of patients wherever they go while transmitting live medical data to medical professionals, thus this requires devices to be smaller and more convenient.

EETimes

While we view the integration of Maxim’s PMIC to be beneficial for ADI’s AFE, larger competitors such as Texas Instruments not only have a SIMO PMIC portfolio such as the TPS65135 but also an AFE4900 device for medical wearables for biosensing applications like heart-rate monitoring and blood oxygen saturation. One advantage TI has over ADI is the smaller form factor with a 2.6mm x 2.1mm package compared to ADI’s 2.6mm x 2.8mm package. This highlights the size advantage of TI over ADI for medical wearables.

Based on an assumption of 11% of the industrial semiconductor market consisting of medical semiconductors, we estimate ADI’s medical semiconductor revenues at $440.71 mln in 2020. We projected its revenue based on the healthcare semiconductors market CAGR of 10.2% and forecast its medical semiconductor revenues to be 13.5% of its industrial revenues by 2025.

|

ADI Medical Semiconductors Projections ($ mln) |

2020F |

2021F |

2022F |

2023F |

2024F |

2025F |

|

Industrial Revenue |

4,006 |

4,239 |

4,485 |

4,745 |

5,020 |

5,311 |

|

Growth Rate % |

0 |

5.8% |

5.8% |

5.8% |

5.8% |

5.8% |

|

Medical Semiconductor Revenue Estimate ($ mln) |

440.7 |

485.7 |

535.2 |

589.8 |

649.9 |

716.2 |

|

Growth Rate % |

0 |

10.20% |

10.20% |

10.20% |

10.20% |

10.20% |

|

Medical % of Industrial Revenues |

11.0% |

11.5% |

11.9% |

12.4% |

12.9% |

13.5% |

Source: ADI

Overall, we believe that ADI’s product integration such as AFE with Maxim especially with PMICs could provide opportunities to capitalize on the semiconductor market growth in the healthcare industry, but we also highlight the threat of larger competitors like TI with leadership in PMIC.

Margin Impact and Costs Synergies

|

Operating Margins of ADI and Maxim |

ADI |

Maxim |

|

R&D Spending % of revenue |

17.7% |

17.26% |

|

SG&A Spending % of revenue |

12.6% |

12.18% |

|

Operating Margins % |

24.2% |

35.92% |

Source: ADI, Maxim, Khaveen Investments

Comparing both companies in terms of their profitability margins, ADI had higher spending on R&D and SG&A than Maxim. Moreover ADI’s operating margins are lower than Maxim’s as ADI incurs higher other operating expenses than Maxim. We calculated the combined company’s (pre-synergies) gross margin of around 63.3% which is higher than ADI’s margins pre-acquisition at 62% as Maxim’s margins are higher than ADI. Furthermore, we estimate the combined operating margins at 27.7%, which is higher than ADI’s operating margins pre-acquisition (24.2%).

|

Combined Financial Data ($ mln) |

Maxim |

Maxim Margin % |

ADI |

ADI Margin % |

Combined |

Combined Margins % |

|

Revenue |

2,960 |

7,066 |

10,026 |

|||

|

Gross Profit |

1,979 |

66.87% |

4,369 |

61.83% |

6,348 |

63.32% |

|

Operating Profit |

1,064 |

35.93% |

1,712 |

24.23% |

2,776 |

27.69% |

Source: ADI, Maxim, Khaveen Investments

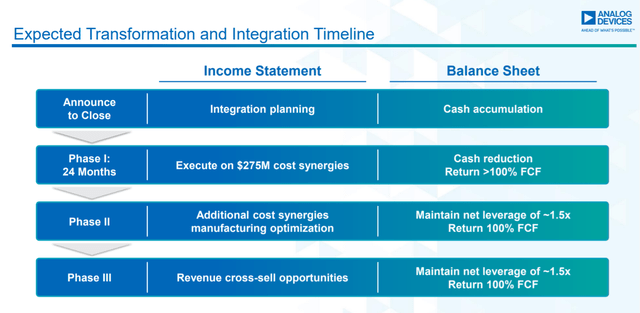

Additionally, according to ADI, the company expects to achieve costs synergies of $275 mln within 24 months after the acquisition primarily driven by the consolidation of its operating expenses and cost of goods sold. We believe that with a common customer base, the company could consolidate its SG&A activities which we believe may support its synergies.

In terms of leverage, the combined company as claimed by management is expected to have a net leverage ratio of 1.2x which is lower than ADI pre-acquisition at 1.8x. Overall, we expect the combined company’s margins to improve over time despite the near-term impact from Maxim as we believe that ADI could leverage its scale and consolidate its operating expenses.

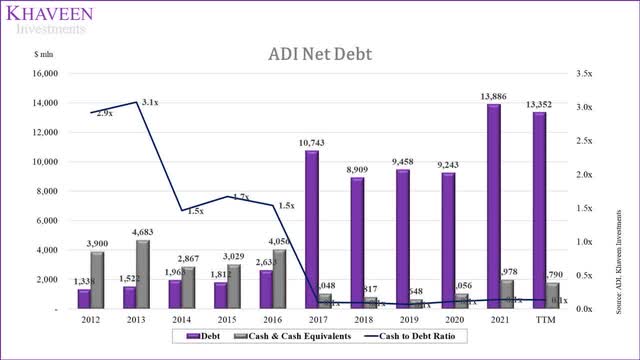

Risk: Leverage Risk to Acquisition Strategy

ADI has had a strong track record of acquisitions in the past and grew its revenue base and market share with it. However, its net debt has also significantly risen in the past 10 years. In 2021, it had a net debt of $11.9 bln compared to net cash of $2.5 bln in 2012. Its debt had grown by over 937% in the past 10 years. As a percentage of market cap, this represents around 14.5% of its market cap. With the growing debt profile of the company, we view this to hinder its ability to continue to pursue its growth through acquisition strategy.

We believe the company’s acquisition of Maxim Integrated in 2021 highlights its commitment to its growth through an acquisition strategy with a strong track record of past acquisitions. This includes Hittite Microwave, Linear Technologies, Symeo GmbH, Otosense and Test Motors. These acquisitions have contributed around $1.95 mln in revenues or around 33% of its revenues in 2020.

|

Company Acquired |

Year |

Cost of acquisition |

Revenue Contribution |

|

Hittite Microwave |

$2.4 bln |

~$300 mln |

|

|

Linear Technologies |

$14.8 bln |

~$1.4 bln |

|

|

Symeo GmbH |

~$25 mln |

Less than $ 100 mln |

|

|

Otosense |

~$25 mln |

Less than $100 mln |

|

|

Test Motors |

$10 mln |

Less than 50 mln |

Source: Analog Devices

As seen in the chart, the company’s net debt has risen tremendously in the past 10 years to $11.9 bln in 2021. Overall, we believe this could be a risk to its M&A strategy with increased debt.

Valuation

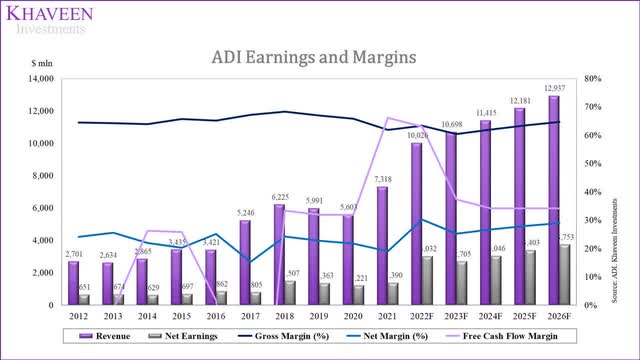

The company has had an average revenue growth rate of 18.47% in the past 5 years as the company pursues growth through an acquisition strategy. Its gross and net margins have an average of 66% and 20.6% respectively.

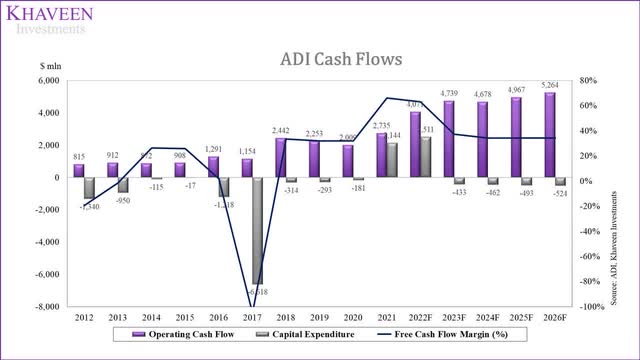

In terms of cash flows, the company has had an average FCF margin of 11.67% in the past 10 years which has been weighed by acquisition. Particularly in 2017, it acquired Linear Technology for $14.8 bln.

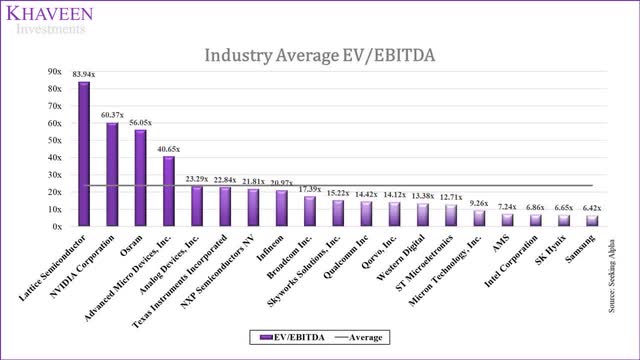

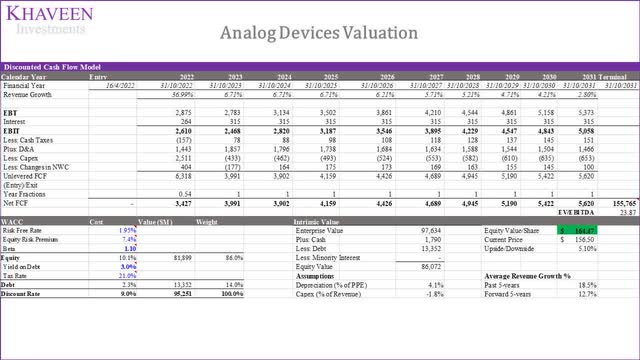

As the company has a lean capex when excluding acquisitions, and solid free cash flows, we valued the company with a DCF analysis based on an industry average of 23.87x.

SeekingAlpha, Khaveen Investments

We accounted for Maxim’s revenue contribution in our revenue projections as discussed in the points above and forecast a growth rate of 6.7% through 2025 for the combined company.

|

Maxim Integrated Revenues |

2021F |

2022F |

2023F |

2024F |

2025F |

|

ADI Revenues |

6,626 |

7,066 |

7,535 |

8,035 |

8,568 |

|

ADI Growth % |

18.3% |

6.64% |

6.64% |

6.64% |

6.64% |

|

Maxim Revenues |

692.4 |

2,960 |

3,163 |

3,380 |

3,613 |

|

Maxim Growth % |

327% |

6.9% |

6.9% |

6.9% |

|

|

Combined Company Revenues |

7,318 |

10,026 |

10,698 |

11,415 |

12,181 |

|

Combined Company Growth % |

30.6% |

37.0% |

6.7% |

6.7% |

6.7% |

Source: Analog Devices, Maxim Integrated, Khaveen Investments

Based on a discount rate of 9%, our model shows its shares are fairly priced.

Verdict

Since our last coverage on ADI, the company has acquired Maxim Integrated for $20 bln and we analyzed the combined company’s revenues. We view Maxim to be one of ADI’s most significant acquisitions yet as part of its acquisition strategy as the combined company is expected to have over $10 bln in revenues with more than 29.5% contributed by Maxim while expanding ADI’s market share to13.4% in the analog market. In terms of product integration, as ADI leverages Maxim’s PMIC portfolio, we expect the company to benefit from the growth of the semiconductor market for the medical applications at a 10.2% CAGR based on the market forecast to reach 13.5% of industrial revenues by 2026. Lastly, we expect the deal to provide a positive impact on its profitability with a combined gross and net margin of 63.32% and 27.69% respectively which is higher compared to ADI’s previous margins of 61.8% (gross margin) and 21.2% (net margin). However, our valuation indicates an upside of only 5% as its stock price has risen by 51% since our last coverage. Overall, we rate the company as a Hold with a price target of $164.47.

Be the first to comment