Torsten Asmus/iStock via Getty Images

By Tony DeSpirito

With inflation at the highest level in decades and interest rates on the rise, equity investors are questioning their next moves. In fact, more than three in five Americans view inflation as the biggest risk facing the U.S. stock market over the next six months, according to a recent BlackRock Fundamental Equities survey of more than 1,000 individual investors.* U.S. Fundamental Equities CIO Tony DeSpirito offers timely perspective.

What is the current state of inflation?

The Consumer Price Index (CPI) reading of 7.9% as of February represents the highest headline inflation level since 1982. Core CPI, which excludes volatile components such as food and energy, registered at 6.4%. This comes after core inflation has lingered around 2% or below since the Global Financial Crisis (GFC) of 2008.

The COVID-19 pandemic and ongoing recovery have fueled the sharp uptick. An unprecedented and disruptive economic shutdown/reopen cycle has left the supply of goods low and consumer demand for them high as coincident fiscal and monetary stimulus helped to pad pocketbooks and set up a strong spending cycle. Intermittent factory closures around the world, which are continuing with the most recent outbreak of COVID in China, have upset global supply chains and exacerbated the imbalance. The war in Ukraine is only going to add to inflationary pressures.

What is your outlook for inflation?

We do not see inflation sustaining at the current decades-high level over the long term, but we do expect it will settle into a range higher than the sub-2% seen in the post-GFC period. This is because some inflation, such as shelter and services inflation, is “sticky” ― meaning it will not work its way out as easily as other inflationary pressures where a rebalance of supply and demand will naturally create price stability.

We could see inflation move toward its new long-run trend starting in the second half of this year. If we use the Atlanta Fed’s “Sticky CPI” gauge as the worst-case predictor, we estimate that could put inflation in the 3%-4% range.

How have stocks historically fared amid rising inflation?

We believe stocks are one of the best places to be in a rising inflation world. Our review of data back to the 1920s finds that equities perform well as long as inflation isn’t out of control ― over 10%, which is historically rare and not our expectation even in this unusual cycle. In above-average inflation environments (5%-10%), value stocks have performed particularly well.

What allows value stocks to do better?

If you think about investing time horizon, the expectation is that a value stock will return capital to shareholders faster than a growth stock. This is because, by definition, much of the expected cash flows from lower-multiple (value) stocks is front-end loaded. Conversely, growth stocks are considered longer-duration assets with expectations of greater cash flows further into the future. In essence, a higher proportion of the stock’s price comes from far-off cash flows, and that gets discounted by higher rates. This gives value stocks, with more stable near-term cash flows, an upper hand in an inflating environment.

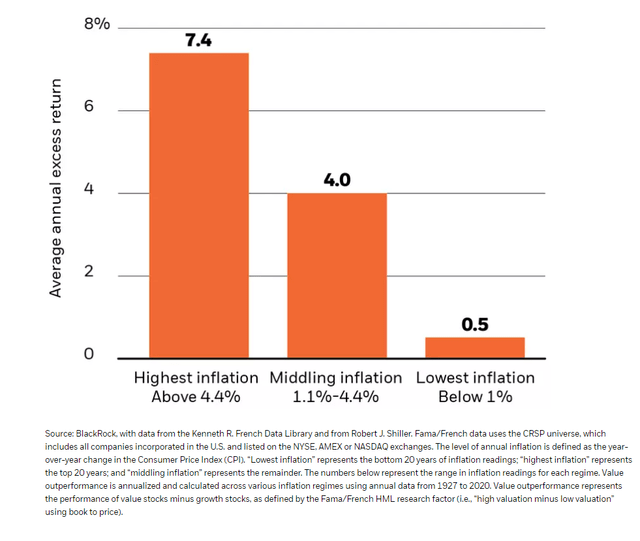

In an analysis of growth versus value using data since 1927, we found value has achieved the greatest outperformance in periods of moderate to high inflation. It is only when inflation was very low that value performance paled. (See chart below.)

A historically strong showing as inflation rises

Value outperformance by inflation regime, 1927-2020

What does higher inflation mean for growth stocks?

Low-interest rates and tame inflation in the years after the GFC were a boon for longer-duration assets, including growth stocks. We’ve seen the drag on growth stock performance early this year as the market priced in the impact of higher rates to fight inflation.

The flip side is that this dynamic does nothing to dilute the innovation that is powering many of these companies, particularly the proven business models with durable growth characteristics. In many cases, the sell-off was indiscriminate. This suggests many growth stocks, especially those unduly punished beyond what the fundamentals suggest, could present a good value for long-term investors.

Which sectors have done well in inflationary times?

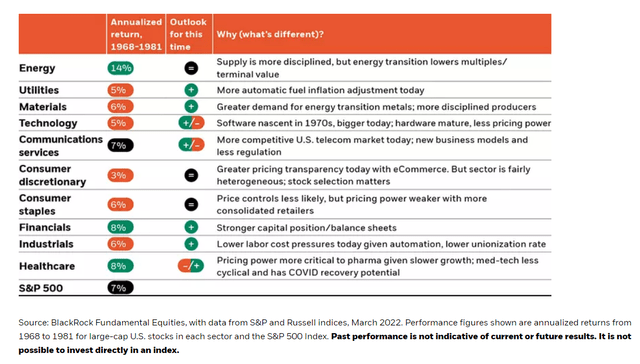

We’ve done a lot of work around how different sectors and industries have performed in prior inflationary environments, particularly the last critical period centered around the 1970s. Sectors that performed the best included energy, healthcare, and financials. Among those that performed the worst: consumer discretionary/staples, utilities, and materials.

While we don’t see high inflation persisting for the extended length of time that it did five decades ago, we see some sector-level patterns that could repeat (or rhyme), and others where it is less likely. Our findings are summarized in the table below.

A stock-by-stock approach

Companies generally have been able to manage higher costs, exhibiting pricing power and a willingness to invest in cost-saving measures to propel their businesses forward. That said, rising inflation and rates is also stoking higher volatility in stocks. All of this makes investing trickier and fundamental research more important to choosing those stocks with the potential to deliver above-market returns as a new post-pandemic investing regime takes hold.

This post originally appeared on the iShares Market Insights

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment