One oil and gas firm I took an interest in last year was Amplify Energy (OTC:AMPY). Due to the firm’s merger with Midstates Petroleum at the time, I decided to delay a deep dive. After all, a lot happens when two firms merge and the financial picture can change markedly compared to what it would look like if the two entities remained separate from one another. Now that they have completed their merger, and in the midst of a historical energy bear market, I figured now would be an excellent time to dive in and see what kind of prospects, if any, the business offers to long-term investors.

Setting the stage for valuation

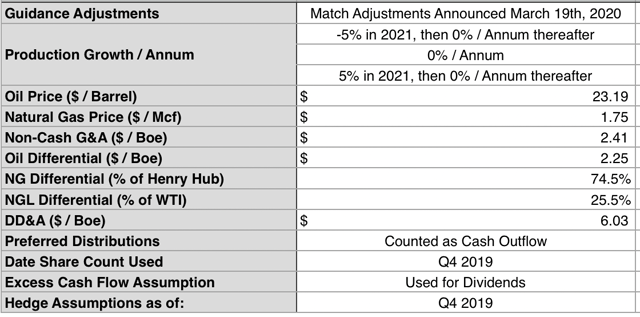

Before I dive into my model’s results, I should discuss first the assumptions I used to create the model. In the image above, you can see select guidance provided by management for the firm’s 2020 fiscal year. This guidance is a great start, but it’s not the only thing I need. In the table below, you can see a set of assumptions I used to finalize the model. These assumptions are based on a historical review of the firm’s financial filings as well as a look at the current state of the energy market.

There are some items I need to discuss here. The biggest issue relates to growth. This year, management expects to see output of 10.248 million boe (barrels of oil equivalent). This is up from the 9.256 million boe the firm produced in 2019 for a gain of 10.7%. Previously, management had forecasted a midpoint capex of $46 million in order to make this happen. Given the significant drop in energy prices, the firm decided to subsequently revise spending lower to $29 million.

Naturally, you would expect such a change to impact output, but management did not update output expectations. In fact, its statement in that release regarding hedges seems to support the same amount of production plus a royalty relief seems to be adding another 500 boe per day (all oil) to its output. This translates to output for the year of 10.431 million boe of production for 2020. This does bring into question, though, what output will look like in future periods. I would say there’s considerable uncertainty since the capex change would have been made previously if it were just cash that wasn’t needed.

To address this uncertainty, I decided to assume that there are three different scenarios that the company can follow with flat output in the years to come. The most conservative one assumes that output next year will actually decline by 5%. In all subsequent years, it will remain flat. In the more moderate scenario, I just assumed that it would remain flat in perpetuity from this year’s figure. In the liberal scenario, meanwhile, I assumed that it will actually grow by 5% in 2021 and then flatline each year thereafter. This may seem like a stretch, but considering the growth seen this year (12.7% in all), it’s not impossible to imagine such a scenario, especially if the firm sees other efficiencies.

Another topic that needs to be addressed is the firm’s cost structure moving forward. Based on their statement on March 19th, the firm expects ‘strong’ free cash flow for the current year. It also expects to generate some cost-savings, but it has not revealed what these figures will look like. I have decided to stick with current guidance for now, but oil prices are marginally lower than the $25.07 they were at on that day. This, combined with the higher numbers I’m using for costs (as opposed to guessing lower numbers), will probably mean that my model is more conservative than what the end results will be if energy prices recover and perhaps even if they don’t. The last issue here relates to warrants. Normally, I would count these for dilutive purposes, but the strike prices of all warrants outstanding are so much higher than the firm’s current share price that I don’t see these becoming an issue. Even if they do, the company will be given significant cash proceeds for them, so it wouldn’t necessarily be a bad thing.

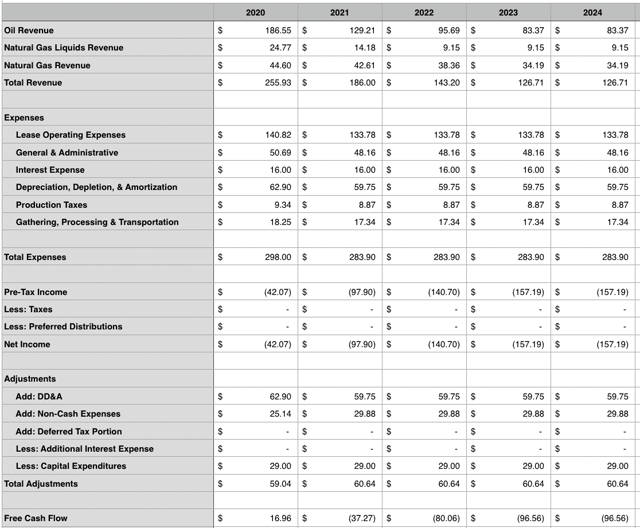

Cash flow will become an issue

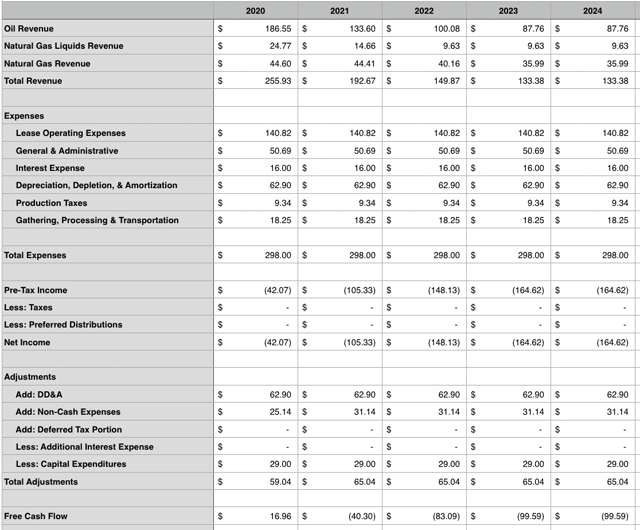

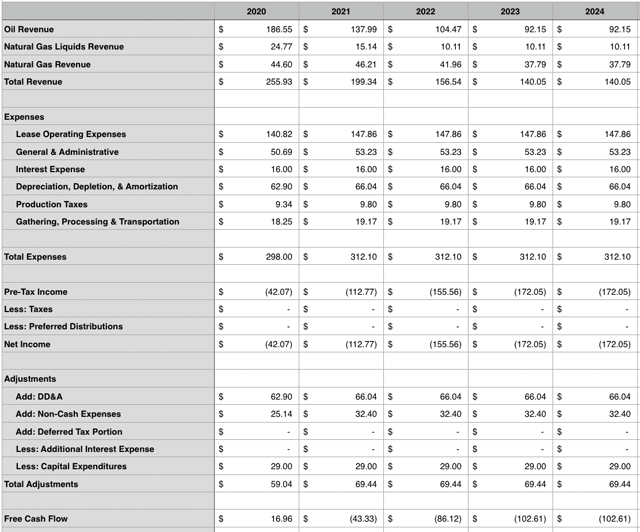

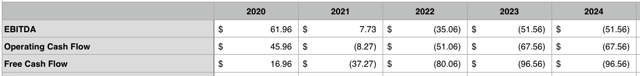

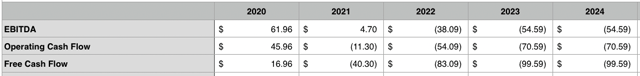

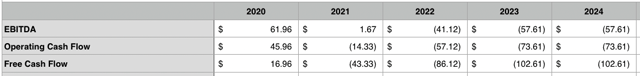

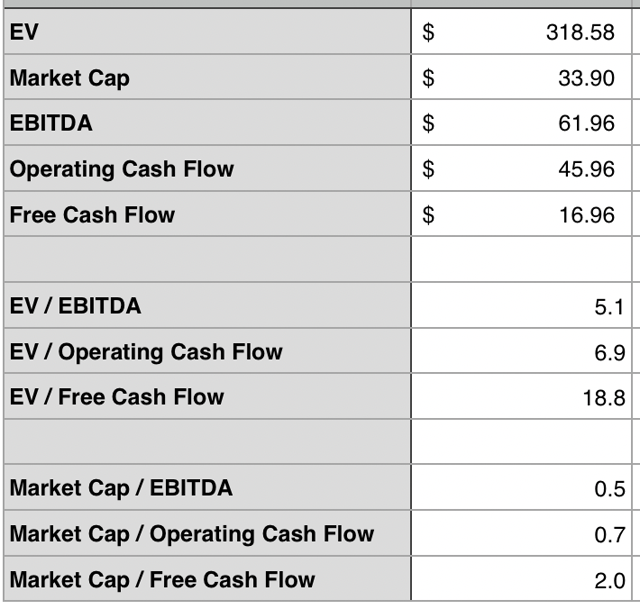

With all of that now behind us, it’s time to dig into my model. In the table above, you can see my calculations for revenue through free cash flow for the most conservative model. As you can see, free cash flow this year should be $16.96 million. I am not sure I would call this ‘strong’, but relative to the company’s market cap of $33.90 million, I suppose it is. Strong hedging makes this a good situation for the firm, but as you can see by looking at 2021’s expected results, this melts off quickly. As hedging rolls off, free cash flow will turn materially negative in 2021 and then worsen until hitting -$96.56 million in 2023 and 2024. That’s not a good situation to be in. In the two tables below, first looking at the moderate scenario and then at the liberal one, you can see the same kind of expectations for shareholders.

Free cash flow is an excellent measure of value. In the long run, it’s the most important you should focus on. However, it’s not the only metric of importance to consider. In the three tables below, sticking with the conservative to moderate to liberal order, I stacked EBITDA and operating cash flow for the five-year window up against free cash flow for the same periods. The trend here is the same. Fairly strong results this year give way to material weakness in 2021 and beyond. What’s especially worrisome is seeing negative EBITDA. No lender will accept that for any material amount of time.

Setting the stage for value

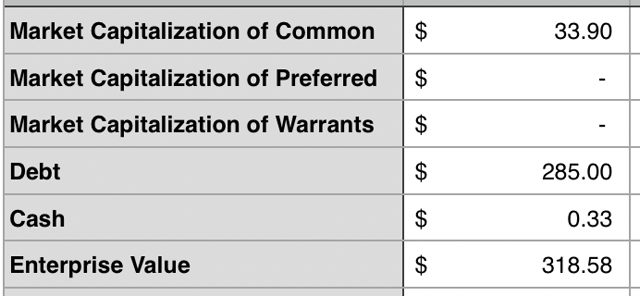

What we see so far is worrisome, but let’s see if there might still be some value to be had from the firm. After all, shares are trading for just $0.90 apiece as I write this. To start with, I created the table above, which looks at Amplify’s market cap, net debt, and EV (enterprise value). I will be using the firm’s financial metrics so far to value it relative to its market cap and EV. Net debt, meanwhile, will come in handy when discussing leverage.

In the table above, you can see how shares of the company are valued for the current fiscal year. At this moment, the company’s EV/EBITDA multiple is 5.1. This is a bit high relative to its peers right now, but it’s fairly low compared to what a healthy E&P (exploration and production) firm should be trading at (a range of 6 to 10 in a positive environment). Its market cap/operating cash flow multiple, meanwhile, is quite low at only 0.7. This suggests significant upside potential on its own, but as you’ll see, this assumes that future years look similar to 2020.

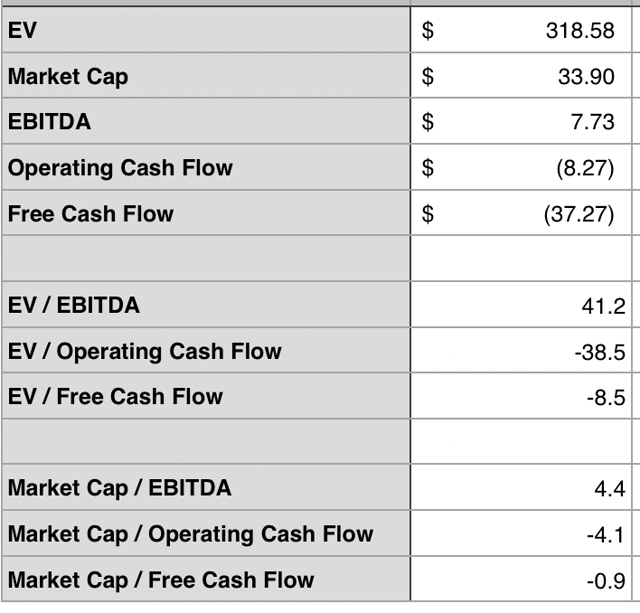

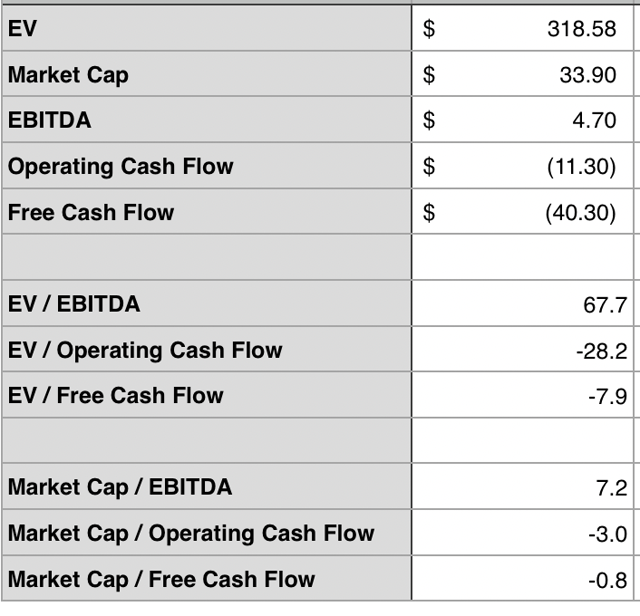

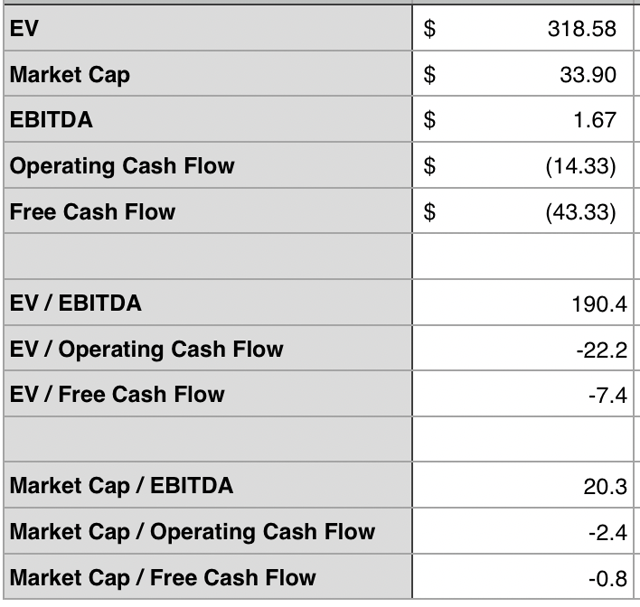

Above, I created the same analysis but for the conservative scenario for 2021. The moderate scenario, followed by the liberal one, can be seen in the two respective tables below. These show a surge in the EV/EBITDA multiples while the market cap/operating cash flow multiples are negative. That’s a significant red flag for investors. Not shown is the set of negative readings we would see in the years after 2021, but the key point, no matter how we look at it, is that the business appears to be in a lot of trouble if current energy prices persist.

Before I move on, one thing that should be brought up is leverage. Generally speaking, lenders want to see a net leverage ratio of around 2, but a reading perhaps as high as 4 (especially if temporary) might be okay. Of course, it would warrant a discount to its peers at that level and management should definitely have a plan to reduce that leverage since it can’t stay that high forever. What the table below illustrates is that Amplify’s net leverage ratio for this year is set to be about 4.55. That’s pretty dangerous, but not as bad as the double-digit (and in one case triple-digit) readings we can expect for 2021. This is very scary and it signifies what we know from the other data so far: something needs to change.

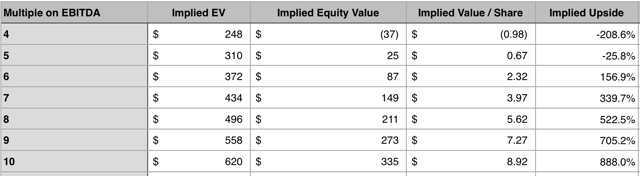

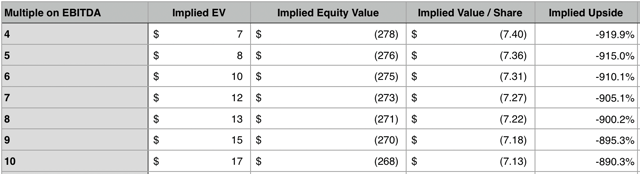

Shares have upside… maybe

Taking what we know, I made the next table above. It illustrates a hypothetical range of prices (and upside or downside from today’s current price) that shares should trade at given a hypothetical EV/EBITDA multiple for the business. This all is for 2020. What it illustrates is that, for this year, there could be real upside for shareholders, perhaps as much as 888%, but a more realistic reading for the company (if future years were to look like the current year) would be for upside of between 156.9% and 522.5%.

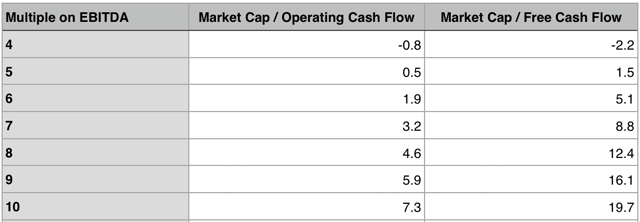

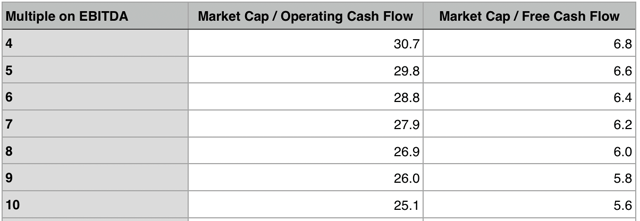

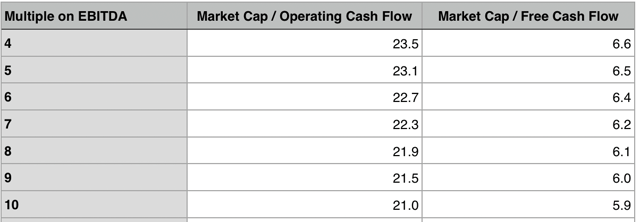

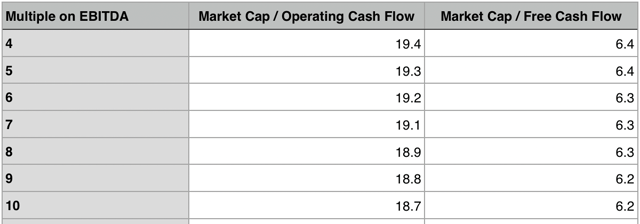

In the next table above, I used the same EV/EBITDA range to look at market cap/operating cash flow and market cap/free cash flow multiples for the business. These illustrate reasonable pricing for the firm at given EV/EBITDA points. Looking solely at this data, nothing really looks bad. In fact, it looks like the firm is a bit overleveraged, but that it could see some nice upside if things go well. Sadly, though, this all is distorted by the hedges the company has on hand.

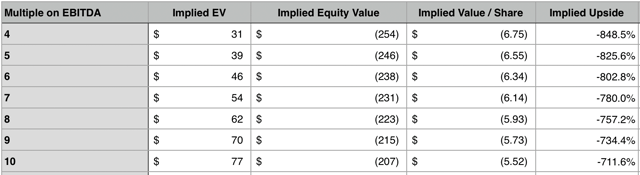

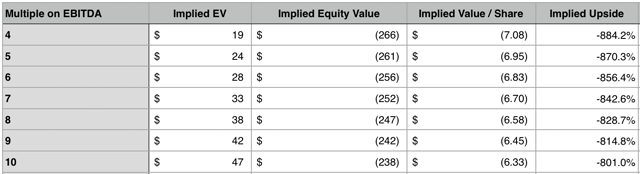

Proof of this can be seen by looking at the same tables (three above and three below) for 2021 under each of the three scenarios. This changes significantly, with now no upside illustrated. In fact, you can’t actually have a negative share price, so the end result here would be a $0 target for shareholders.

Takeaway

Right now, the picture facing Amplify looks pretty awful. This year, technically, should be okay. However, if energy prices don’t recover by the time 2020 is over, there does appear to be a real risk of the company going under. If we were to see pricing recover back to the $40+ range for 2021 and the $50+ range for 2022 and beyond, there could be a true opportunity here, but investors are essentially buying an option on crude and gas pricing. I believe oil is likely to move up far higher from here, so I am more neutral on this name, but I can understand why investors who are not bullish of this space would be cautious or even bearish on Amplify. It’s not meant to survive at these prices for long.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment