wacomka

Investment Thesis

With a diversified portfolio of drugs, Amphastar Pharmaceuticals Inc. (NASDAQ:AMPH) is continuously operationalizing its drugs that receive FDA approval and filing new applications. With 3 ANDAs under review by the FDA and seven more under development, AMPH has promising growth prospects in 2H2022 and beyond. Furthermore, with recent approvals, AMPH can anticipate nearly doubling its revenue by the end of 2023 with proper operationalization and execution of the approved drugs. Investors with a broad time horizon and the ability to weather some modest near-term volatility should consider investing in AMPH.

Background

Amphastar Pharmaceuticals, Inc. is a diversified drug manufacturer that produces various products, including injectibles, biosimilars, complex generic, inhalation, and proprietary products.

The main product lines operated by Amphastar are as follows:

- Enoxaparin: an anticoagulant that prevents blood clots. This drug is abbreviated Enox.

- Lidocaine Injection and Jelly: Helps reduce patient discomfort during peripheral nerve blocks.

- Vitamin K1: vitamin K1, obtained from leafy greens and other vegetables, is used to prevent blood clots.

- Primatene Mist: FDA-approved asthma inhaler is projected to add $100 million to sales by the end of 2024, with an annualized growth rate of 34%. The success is mainly attributable to the physician sampling program and national TV and radio marketing campaigns.

- Glucagon: Glucagon is a hormone that prevents blood sugar from becoming too low. It is a mature product for Amphastar and is projected to have a positive trajectory in terms of sales and growth.

- Epinephrine: This drug is used to treat life-threatening allergic reactions. Like glucagon, this product is on a continued growth trajectory for the foreseeable future. This drug is abbreviated “Epi.” in the chart below.

- Naloxone: Similar to suboxone, Naloxone is used to reverse opioid overdose. Naloxone is the second half of suboxone designed to reverse overdoses. Naloxone is also non-addictive because it only works if the person has opioids in their system.

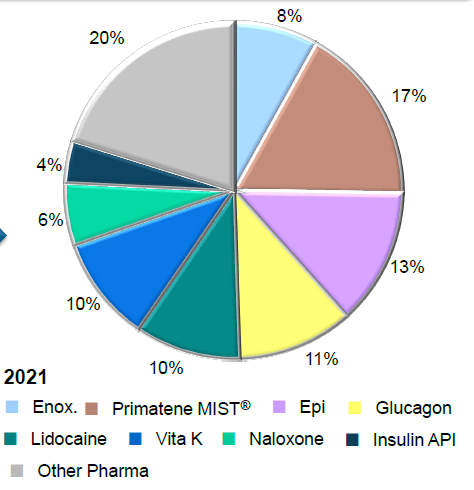

The relative contribution of these medications to the overall portfolio of AMPH is shown below.

Amphastar Drug Manufacturing Portfolio (Source: Amphastar)

Amphastar has the following approved drugs on the horizon in the pipeline for launch and production:

- Generic Ganirelix: Ganirelix was approved by the FDA on April 4th, 2022. The medication was initially developed by Bristol-Myers Squibb’s (BMY) subsidiary Abraxis Bioscience under Abraxane. This drug goes by the generic name albumin-bound paclitaxel. The drug is used to cure female infertility. Amphastar plans to launch the drug production in 2Q2022, which would start to add revenue AMPH production portfolio.

- Generic Vasopressin: Amphastar received the final approval for its generic vasopressin on July 19th, 2022. Vasopressin controls the body’s osmotic balance, blood pressure, sodium homeostasis, and proper kidney functioning. Amphastar anticipates this product’s production and subsequent launch in the 3Q2022.

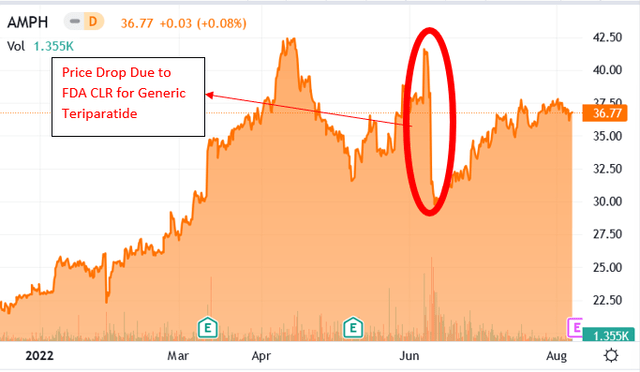

In 2Q2022, the price action of Amphastar saw increased volatility due to the rejection of the following ANDA:

- Generic Teriparatide: On June 14, 2022, Amphastar received a complete response letter, also referred to as CLR, from the FDA, which indicated the drug would not be approved. Teriparatide was the generic version of Eli Lilly’s Forteo, used to treat osteoporosis in postmenopausal women.

Change in Price for AMPH as a Result of FDA’s Rejection of AMP-015 application. (Source: Seeking Alpha)

Company Fundamentals

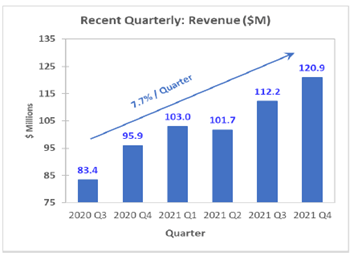

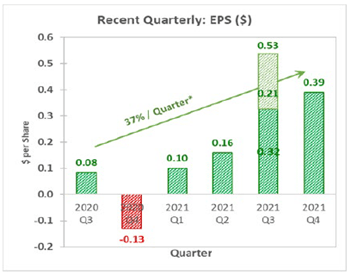

The company’s quarterly revenue has grown at a rate of 7.7%. The EPS has grown at 37%, as shown below.

AMPH Quarterly Revenue Growth Profile (Source: Amphastar)

Amphastar Earnings Growth Profile (Source: Amphastar)

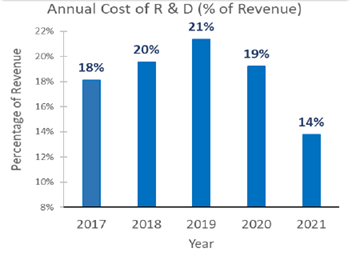

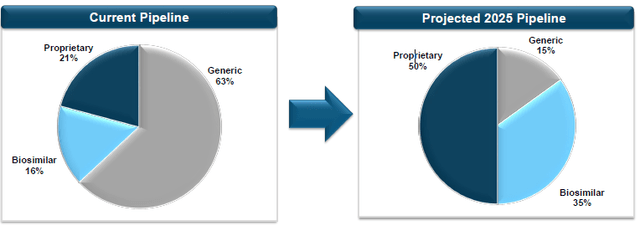

Although AMPH has been able to accelerate the pace of its ANDA requests, the overall R&D expense has reduced to 14%. This reduction is attributed mainly to the shift from receiving GDUFAs for existing drugs to requesting ANDAs for proprietary products and biosimilar drugs.

R&D Spend Optimization by Amphastar (Source: Amphastar)

R&D Optimization Transition While Accelerating FDA Requests and New Drug Development (Source: Amphastar)

Growth Catalysts

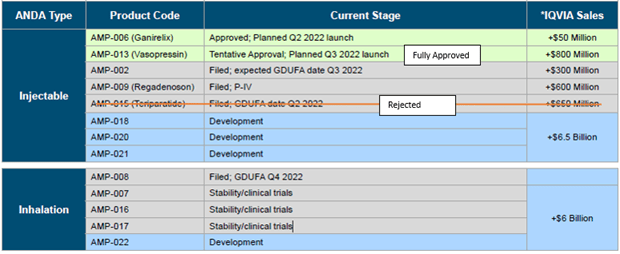

The company has 12 Abbreviated New Drug Applications (ANDAs) in progress:

- Number of ANDAs or Patent Certifications (Paragraph 4 or P-IV) filed with the FDA: 4

- Number Rejected: 1

- Number Remaining: 3

- Number of ANDAs in Development/Clinical Trial Stage: 7

- Fully Approved: 2

A complete breakdown of the ANDAs is given below.

AMPH R&D Development Breakdown: ANDAs in Progress and ANDAs submitted for FDA Approval (Source: Amphastar)

The overall revenue growth potential for AMPH because of the R&D effort of AMPH is $14.25 billion. With the approval of one of the three remaining ANDAs and two products anticipated to launch in 2H2022, AMPH can anticipate doubling its current annual revenue between 2H2022 and 2023.

2Q2020 Earnings Preview

With earnings due on 8/8/2022 after-market hours, investors of AMPH will be interested to hear the management’s views on the current health of the overall business. Investors will also be interested in hearing about the production and launch results from the recently approved Generic Ganirelix AMP-006 in 2Q2022 and Genetic Vasopressin AMP-013 in 3Q2022 products because these products are projected to grow AMPH’s revenue by over $850 million.

Company Valuation Update

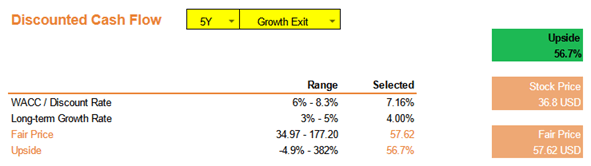

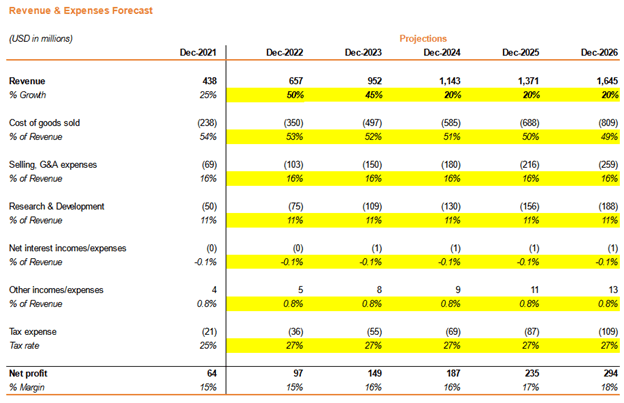

This analysis only considers the drugs that have received FDA approvals and are in the process of production by AMPH. Operationalizing the FDA-approved generic ganirelix and vasopressin is projected to accelerate AMPH revenues between 40% and 50% YoY because the total addressable market of these products is $850 million. The model also assumes a continual reduction and optimization in R&D expenditure to 11%, consistent with the annual cost of R&D reduction targets set by management.

Based on the assumptions above, we can anticipate a fair-value price of AMPH to be around $58/share, representing about a 57% upside from the current market price.

Company Valuation (Source: Author) Company Projected Revenue Growth Profile (Source: Author)

Investment Risk Analysis

As alluded to earlier, the price of AMPH is sensitive to the announcement of FDA approval or rejection of ANDAs filed. The resulting volatility in price can range between 25% and 30%, depending on the news and the event’s timing. Additionally, some of the products of AMPH are seasonal. For example, Primatene Mist, an asthma inhaler, has higher sales during the spring allergy season. Therefore the overall contribution to the revenue may be lower for the remainder of the year. The growth in sales associated with Primatene Mist should be compared on a YoY basis.

Conclusion and Summary

Capitalizing on the generic use authorization process by the FDA and continual focus on developing proprietary biosimilar products, Amphastar Pharmaceutical, Inc. has compelling growth prospects. With seven drugs in the development pipeline, two fully approved and progressing to production, and an existing portfolio of over nine products, AMPH is well positioned to surpass its revenue by YE 2023. Investors should consider investing in AMPH to profit from the growth trajectory of this company.

Be the first to comment