Editor’s note: Seeking Alpha is proud to welcome Enthusiastic Investors Club as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Extreme Media/E+ via Getty Images

Investment thesis

Amphastar Pharmaceuticals (NASDAQ:AMPH) is seeing a consistent increase in profitability and cash flows. The company’s management is making much more effort and wants to transform the company into a more profitable business by 2025. I believe the AMPH stock is trading at a considerably cheap valuation at present, and if management’s strategy works out according to plan, then the upside will be huge. I therefore rate the company a Strong Buy.

Product Pipeline

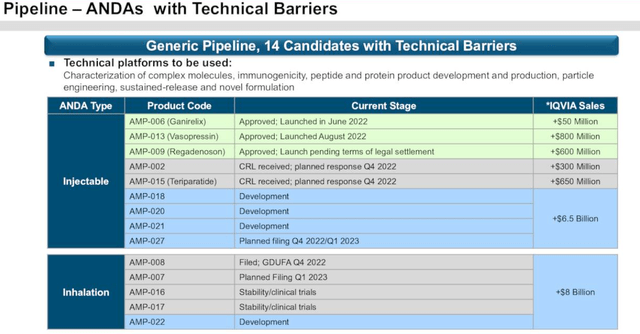

recently approved drugs (investors presentation )

Three recently approved drugs will be launched by the end of 2022, which will increase the company’s revenue and profitability for the year FY2023; many of the company’s drugs are in the development process, which has a very high addressable market, and if these products get approved by FDA it will bring enormous value to the company.

Product segment

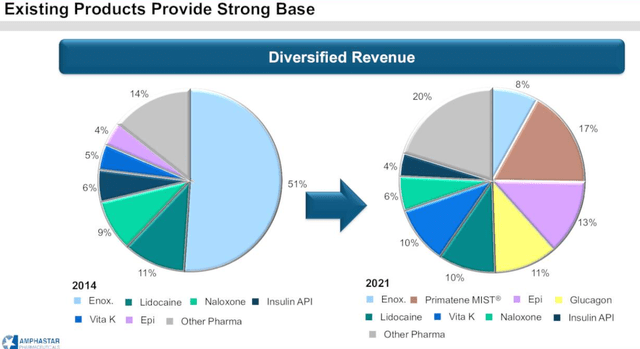

Since its IPO, management has diversified the product mix to a large extent; in 2014, naloxone, a generic form of the drug, consisted of more than 50% of the total sales, but with time management acquired many generic and specialty drugs which led to significant product diversification till date, in 2021 majority of sales came from enox, prematene MIST, epinephrine, glucagon, lidocaine, and vitamin K.

product mix (investors presentation )

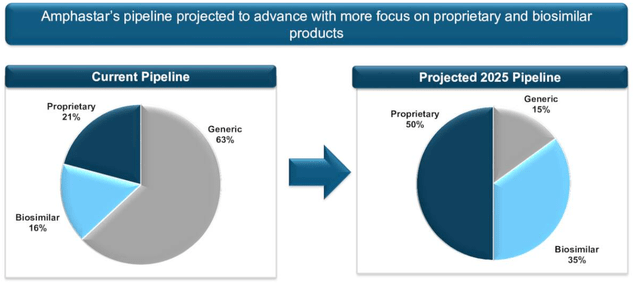

Management has set a target to expand proprietary and biosimilar segments to a large extent till 2025; focused growth in those segments will give Amphastar good margins, leading to ultrahigh profitability.

product pipeline (investors presentation )

Increasing proprietary and biosimilar product mix will help the company reduce its dependence on the highly competitive and rapidly changing generic market, which will increase cash flow significantly.

Historical earnings

To analyze any business more deeply, an investor must assess the company’s historical performance and the effect of management decisions on the company’s performance.

Sales of naloxone, which helped Amphastar to grow during 2014-15, have been decreasing consistently due to lower volume sales led by increased competitive pressure; we can see the same trend with enolaprine, whose sales were booming in 2018. The significant decrease in revenue from such a profitable and high-demand product is because of increased competitive pressure over time; generic pharma companies are much more prone to intense competition due to their low entry barrier operations.

But as we can see in Amphastears case, it took a very long time for the competitor to enter the market, the company took massive benefit of this opportunity and generated huge cash from those drugs, and this is possible because the company operates in a drug segment which is extremely difficult to manufacture, which gave Amphastar a substantial competitive advantage.

But the investor must understand that with time, profitability from existing products will decline. Therefore the company must acquire or approve a new product line to stay profitable for the longer term.

Cash flow

Looking at the income statement, it seems that the company has fluctuating profits and produced losses for several years. But, if you look at the cash flow statement carefully, you can see that the company has been generating tremendous cash flow from operations, which has been increasing every year, and good cash flow from operations is a substantial margin of safety in any business.

Competitive advantage

Vertically integrated business model

Amphastar is a vertically integrated company with high-tech research and development facilities with its own manufacturing & distribution facility, which gives the company an edge in manufacturing and developing complex drugs.

Management has focused extensively on building strong manufacturing and research & development facilities and infused most of the generated cash to develop these facilities to strengthen the business model.

Vertical integration gave the company an enormous advantage for developing and launching complex, difficult-to-manufacture drugs in an accurate and cost-effective manner.

High technical barrier to entry

Amphastar focuses extensively on manufacturing drugs with a high entry barrier, such as complex formulation and a complicated manufacturing process that helps the company achieve high-profit margins.

Unlike many generic drug manufacturers, Amphastar doesn’t face sudden extensive competition; generally, competitors take much more time to enter the market, which gives the company sufficient time to achieve desirable profitability.

Timely launch of new products

As a generic manufacturer, Amphastar has to launch new products to remain profitable. with time management has successfully launched new high-margin products, leading to significant cash generation.

Substant growth in sales occurred during 2015 and 2018 due to the launch of new products such as naloxone in 2015 and medroxyprogesterone, primetime MIST in 2018; those products have turned out to be highly profitable and still producing substantial profit for the company.

It shows that management can consistently bring high-margin products and market them efficiently. Amphastar has spent more than $250 million in the last five years for research and development and has significant applications for FDA registration which will bear fruit in the future.

Equity dilution

pharma companies used to have an extensive history of significant equity dilution. Still, in the case of Amphastar, equity dilution remains moderate over the period, which shows that management treats equity as much more precious than other peer pharma companies. Consistent high cash flow and low acquisition activity might be the reason behind moderate equity dilution.

Management is not involved in expensive acquisitions, which helped the company retain equity, lower the use of debt, and increase cash reserves.

Acquisition activities

It is appreciated that unlike other biotech companies’ management is not involved in costly acquisitions. Acquisitions are made at a reasonable price which is the reason for the low goodwill on the balance sheet, Management’s philosophy of not being involved in the expensive acquisition, treating equity as a precious resource, using low debt, and acquiring profitable drugs gives Amphastar a substantial margin of safety.

Due to low intangibles on the balance sheet, there won’t be a risk of intangible impairment. as in the case of many pharma companies.

Chinese subsidiary

The company has acquired a substantial stake in a Chinese pharma company with significantly high fixed assets but has not produced any significant revenue; any patent approval or acquisition by this subsidiary will increase revenue mainly because it has a substantial manufacturing capacity that is underutilized.

High insider stake

Jack Y. Zhang has served as Amphastar Pharmaceutical’s Chief Executive Officer and a member of the Board of Directors since its inception in 1996. jack holds about a 25% stake in the company, and having a high insider stake for a long time shows that the director believes in the company’s long-term prospects. Jack has also served as Amphastar’s Chief Science Officer since 2005, indicating that the CEO is actively involved in drug selection, But the investor should also note that compensation for the management is too high, and the effect of stock options becomes unseen due to the consistent buyback of common stocks

Recent development

Recently, Ampastar has approved three generic products with a considerable addressable market, which will lead to significant growth in revenue and profitability in 2023. management plan to increase proprietary and biosimilar product mix will increase future earning power.

Is Amphastar a buy?

Recently Amphastar has received FDA approval for three generic drugs and has many drugs in the developmental stage, the aggregate total addressable market for those drugs is much bigger, which will substantially increase future revenue and profitability.

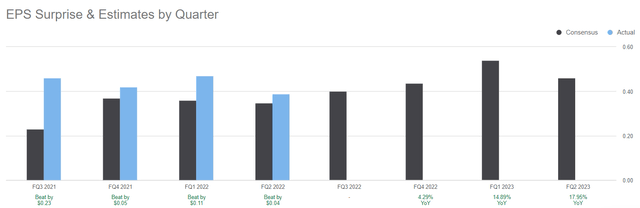

As per the consensus estimate Amphastar will end the year with an EPS of $ 1.71 and in 2023 EPS can reach $1.92, currently stock is trading for $29 which gives a P/E of 15 (as per 2023 earnings) which is a very low valuation for the growing pharma stock. company’s total current market capitalization is about $1.3 billion and has produced an operating cash flow of about $97 million in FY2021.

Amphastar has a five-year average EV/EBITDA of about 50 which has decreased currently to 10, which shows that currently stock is substantially undervalued and as the EPS is growing consistently, soon the market will recognize its value, and I believe, the stock has substantial potential for growth.

Potential risk

failed products – in the past few years, many FDA approved drugs have failed to produce significant revenue for the company, such as the drug Amphadase and 14 ANDAs acquired in 2016. The investor must consider that many of the company’s products might fail to produce significant revenue in the future.

litigations – Amphastar is involved in many litigation matters; an investor must check all the issues carefully before investing, and any significant dispute charge can affect the company’s profitability.

top customers – The majority of the company’s revenue comes from the top 3 customers. The company has maintained solid relationships with them over a period of time. in 2016, the company lost one of its biggest customer, but the revenue was considerably stable due to high product demand; the loss of customer led to a significant increment in SG&A cost, which affected profitability in the year 2016, Any loss of a customer in the coming years will affect the bottom line considerably.

Conclusion

The company is run by able and hungry management who wants breakeven growth without diluting shareholders’ equity. management’s record of acquiring and marketing high-margin products is considerably good, and the new product mix will bring higher revenue and profitability. The conservative approach of management towards capital allocation gives a substantial margin of safety, in my view, Amphastar is a strong buy.

Be the first to comment