JHVEPhoto/iStock Editorial via Getty Images

Investment Thesis – Big Pharma Overview

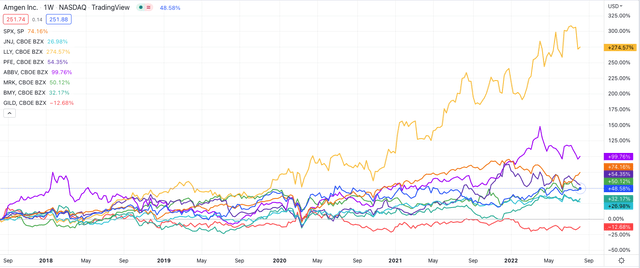

The US “Big Pharma” sector has generally provided investors with strong returns over the past 5 years – not every company has been able to match the S&P 500, which has been remarkably strong, but as we can see below, all but Gilead (GILD) have provided a decent return – Eli Lilly’s (LLY) return being exceptionally good.

Share price performance of US Big Pharma sector – past 5 years. (TradingView)

Furthermore, all of these companies – what I like to term as the “Big 8” US Pharmas – in order of market cap valuation Johnson & Johnson (JNJ), Eli Lilly, Pfizer (PFE), AbbVie (ABBV), Merck (MRK), Bristol Myers Squibb (BMY), Amgen (NASDAQ:AMGN) and Gilead Sciences – are dividend payers, the average yield being 3.2%.

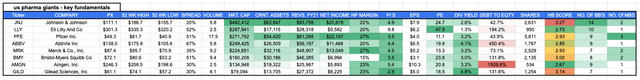

“Big 8” US Pharmas – investment fundamentals compared. (My Table )

As we can see in the table above, there are many similarities – and some striking differences – between these companies, who all operate a similar business model – developing drugs, and gaining permission to market and sell them in the US and around the world.

My rudimentary scoring system – which assesses companies on everything from share price performance, to profitability, debt, dividend, liquidity and more, suggests that Amgen may be the pick of the bunch (the lower the score the better).

There are huge discrepancies in size – from JNJ’s $442bn market cap valuation, to Gilead’s $79bn – and revenue generation – Amgen generated “just” $25bn total revenues in FY21, JNJ $93bn, and Pfizer $81bn – but in general, profit margins, price to sales ratios, price to earnings ratios and dividend yields are closely matched.

It’s interesting to note Eli Lilly’s being valued higher than Pfizer despite Pfizer’s net income being >4x greater than Lilly’s – this illustrates that share prices often move on perceived potential of a company as opposed to what the company is achieving today, and this is especially true of the Big Pharma industry, where drugs have limited shelf lives, being patent protected for ~10 years after which they become victim to generic competitors and their revenues are swiftly eroded.

It’s Tough At The Top – How Do The Likes Of Amgen Grow?

So called “Blockbuster” drugs – drugs that are capable for delivering >$1bn in revenues per annum – are the name of the game in the Big Pharma industry, and as we can see in the above table, all of the “Big 8” have at least 7 blockbusters, JNJ leading the way with 14.

More important still are drugs that drive “mega-blockbuster” sales – roughly speaking, >$5bn per annum would be considered a mega-blockbuster. Bristol Myers Squibb’s Revlimid and Eliquis for example generated revenues of $12.1bn and $9.5bn respectively in 2021, Merck’s Keytruda $17.2bn, AbbVie’s Humira $20.7bn, Eli Lilly’s Trulicity $6.5bn, JNJ’s Stelara $9.1bn, and so on.

Amgen’s best selling drug, Enbrel – indicated for a range of autoimmune conditions including idiopathic arthritis, psoriatic arthritis, and plaque psoriasis, amongst others, falls just short of mega-blockbuster status, although I have included it in the above table.

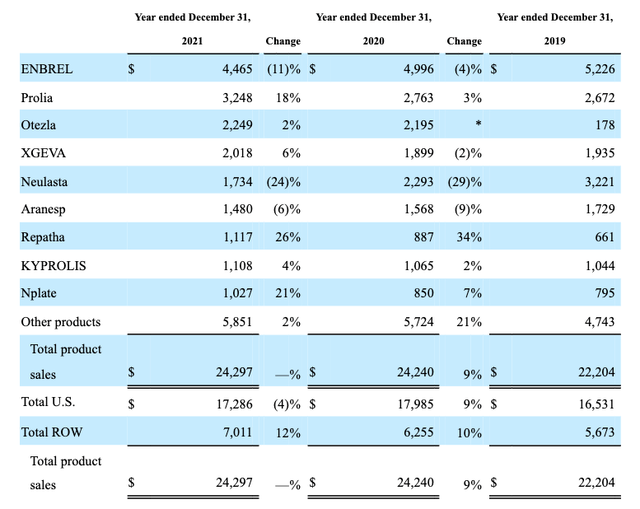

Amgen product sales in FY21. (Amgen 10-K 2021)

As we can see in the table above Enbrel sales fell by 11% last year to $4.5bn, although its patents apparently do not expire until 2029, an extraordinary achievement given that Enbrel was first approved in 1998!

Amgen acquired the company that marketed and sold the drug in 2001, and has successfully protected it from generic competition for 21 years and counting. By 2029, it has been estimated, the drug will have earned >$100bn for Amgen, playing an instrumental role in the company’s transformation from a startup known as Applied Molecular Genetics into a $134bn market cap Pharma giant. There are generic competitors to Enbrel in Europe on the market, but Amgen does not market and sell the drug in Europe – Pfizer does.

Meanwhile, sales of Prolia – approved in the U.S. for the treatment of postmenopausal women with osteoporosis at high risk for fracture – were up 18% year-on-year, however Prolia faces loss of patent exclusivity potentially in 2025, meaning its days as a multi-billion blockbuster are numbered. Otezla is a strong performer in the auto-immune field, approved for plaque psoriasis and psoriatic arthritis amongst other indications, but these are fiercely contested markets and Amgen faces competition from e.g. BMY’s soon to be approved Deucravacitinib, AbbVie’s Rinvoq and Skyrizi, Eli Lilly’s Taltz, JNJ’s Stelara, Novartis’ (NVS) Cosentyx – the list is exhaustive.

Xgeva – another bone therapy – does not appear to have patent protection beyond 2025 (according to Amgen’s 10-K submission) whilst Neulasta, treating low white blood cell count – is experiencing rapidly falling sales owing to generics, and anemia therapy Aranesp faces a patent expiry in 2024.

Repatha may be a saving grace, with sales growing and $2.5bn of peak sales mooted, although competition with another PCSK9 inhibitor, Praluent, is fierce. Kyprolis may be able to target >$2bn in peak sales, analysts have suggested, although multiple myeloma is a disease being targeted by cell therapies which have delivered excellent clinical data.

In short, Amgen has battled its way into the “Big 8”, but faces a struggle to stay there, as many of its best selling drugs are likely to suffer Loss of Exclusivity (“LOE”) beginning from next year and continuing until the end of the decade.

The company has responded by becoming acquisition hungry, although it should be noted Amgen’s debt to equity ratio is high. According to the company’s Q2’22 earnings presentation, cash position was $7.2bn, and long term debt was $35bn, whilst current liabilities stood at $12.6bn – a potential red flag for investors.

Buying Its Way Out Of Trouble – Is ChemoCentryx Deal Good Value For Money?

Amgen has made several acquisitions over the past 18 months, acquiring Five Prime Therapeutics and its gastric cancer drug bemarituzumab – a risky deal given the drug still has safety and efficacy hurdles to clear, it seems, and is unlikely to reach blockbuster sales unless it can win approvals in several markets, and Teneobio, another oncology player and bispecifics and multispecifics specialist, whose lead assets is still in Phase 1 studies.

The latest acquisition of ChemoCentryx (CCXI) at least gives Amgen an already approved product to market and sell. I speculated that ChemCentryx’ Avocapan – indicated to treat ANCA Vasculitis – may not be approved in a Seeking Alpha note from September 2021, and although I was wrong, early sales data did not impress and Chemocentryx stock retreated to ~$15 in May.

Given Amgen is paying $52 per share for ChemoCentryx, and spending $3.7bn in cash to gain access to Avacopan, a drug that made sales of just $5.4m in Q122, is the Pharma getting value for money? It’s been speculated that Avacopan could target other indications, with studies in Lupus nephritis (“LN”), Severe hidradenitis suppurativa (“HS”), and C3 glomerulopathy (“C3G”) underway, which gives the drug blockbuster potential, although the Vasculitis approval was a real struggle, with an FDA Advisory Committee on whether to approve the drug, and the FDA voicing criticisms of the pivotal studies undertaken, mainly around the use of steroids in patients in the Avacopan arm.

At first glance, then, Amgen appears to have paid an eyebrow raising amount of money for an asset that has not yet proven it can deliver in a commercial setting. As with the Five Prime and Teneobio deals management appears to be betting on its own ability to turn promising if unproven assets into blockbusters, keeping pace with the rest of the “Big 8” in the process.

Q2’22 Earnings

Amgen delivered revenues of $6.6bn in FY22m and net income of $2.5bn – an impressive margin of 38% – although revenues up just 1% year-on-year, and guidance for FY22 is for revenues of $25.5bn – $26.4bn, and non-GAAP EPS of $17 – $18, which translates to a forward PE of ~14x, Again, that’s impressive, but based on non-GAAP EPS of $4.65 versus GAAP EPS of $2.45 in Q2’22, perhaps we should double the P/E ratio for a more accurate assessment of value.

Enbrel sales fell year-on-year, to $1.05bn, although Xgeva sales were +9%, and Kyprolis, Otezla, and Repatha all delivered double digit growth year-on-year.

Lumakras, one of the jewel’s in the crown of Amgen’s pipeline, being a drug targeting non-small lung cancer (“NSCLC”) and the KRAS signalling pathway, once thought undruggable but expressed in a multitude of cancer, is now approved, but sales in Q2’22 were just $77m, and fresh safety concerns have surfaced when Lumakras is used alongside checkpoint inhibitors – a very successful type of drug class that includes Merck’s mega-blockbuster Keytruda.

Tezspire – jointly developed with AstraZeneca (AZN) and recently approved to treat asthma – is another potential blockbuster in waiting, but revenues will presumably be divided between the two companies.

Conclusion – Much To Admire But Plenty To Fear – Amgen Would Not Make My Top 5 Pharmas To Buy List

Amgen has made good progress as a company over the past decade, and has rewarded investors with a 47% uplift in the share price and a dividend that currently yields 3%. Most shareholders will likely be satisfied with that performance, but can the company match it between now and the end of the decade?

There has to be some doubt the company can, with some major patent cliffs in view, and despite a flurry of M&A deals, no obvious megablockbusters arriving to take the pressure off the old stagers Enbrel, Prolia et al.

Fundamentally speaking, Amgen looks a solid buy, and perhaps we should leave it at that and trust management to deliver when it matters. Revenue growth has become stagnant, however, and I wonder if $25bn is a realistic target for 2023, or whether expectations will need to be downgraded?

The debt Amgen has is also a potential red flag, with $12.6bn of it apparently falling due imminently, and only ~$7bn of cash.

It could be that Lumakras, Avacopan, and Bemarituzumab ride to the rescue and save management’s blushes, but it seems as though there is a real prospect of Amgen’s revenues slipping and the “Big 8” becoming a “Big 7”.

Other Pharma’s face massive patent cliffs, but where AbbVie spent $66bn acquiring Allergan, and adding ~$15bn of annual revenues to its top line, and BMY acquired Celgene, adding about the same plus 5 near-guaranteed blockbuster pipeline assets, Amgen’s buyouts have been smaller scale and don’t offer those kind of top line growth guarantees.

If I were an Amgen investor I would not necessarily be too concerned, but I also think I’d be happy to cash in my chips at a share price >$250, and look to reinvest elsewhere. With new drug pricing regulations on the horizon, Amgen’s profit margins may shrink, meaning less cash flow generation, and little money to fund an M&A spree. Could the company look to complete a merger? That is not likely to be share price accretive either, in my view, in the short term, although it may pay off in the longer run.

Be the first to comment