JHVEPhoto/iStock Editorial via Getty Images

Investment thesis

Although Amgen (NASDAQ:NASDAQ:AMGN) is among the best companies in its industry, I have been puzzled about its cash management over the past 10 years. From 2012 onward, the company began to buy back its own shares and significantly increase its dividend which provided a great immediate benefit toward shareholders. But I’m doubtful about the sustainability of this corporate strategy. Until 2018 this was possible because Amgen was experiencing quite good earnings growth, but since 2018 earnings have stopped growing. In addition, analyzing the pipeline, I am concerned about the revenue growth of Enbrel®, Prolia® and XGEVA®, the most important drugs in terms of revenue. All this leads me to think that the company is focusing more on immediate term shareholder compensation than on its long-term growth, which is a red flag. The reason I do not consider Amgen a sell is because the company is still solid despite everything and its fair value is in line with the current price. Currently my rating is a hold, but not with little concern about the future.

A stalemate that has lasted since 2018

With a market capitalization of $127 billion Amgen is among the world’s top companies in the health care industry. There are many reasons why investors have appreciated this company over time; however, as of 2018, a number of issues seem to be coming to a head. Since Amgen stock is not that far from an all-time high, moreover in a negative period for the entire S&P500, it doesn’t appear like the market is discounting the weaknesses I’m presenting in this article.

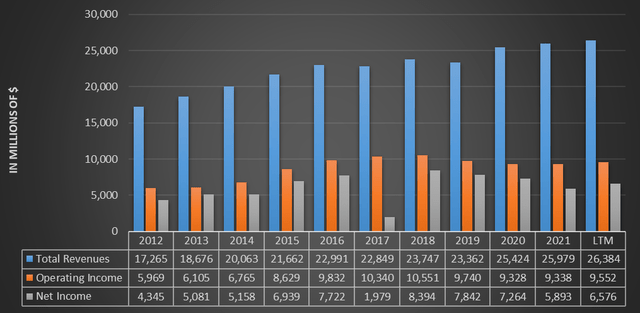

Let’s begin with operating income, which has been declining since 2018.

TIKR Terminal

As we can see from this chart until 2018 there were no signs of weakness in Amgen’s income statement, but since then the company has not grown as much as before. The net income of only $1.9 billion in 2017 was due to as much as $6 billion in higher taxes than other years, otherwise net income would have easily exceeded the previous year’s figures. Revenues were growing after 2018, but the cost of goods sold and operating costs grew even faster, which is why operating income declined.

The company is struggling to operate as efficiently as in the past, which is why revenues are growing but net income is shrinking. Operating costs are increasing more and more and revenues are not growing fast enough. I believe that if the company could launch new drugs it could solve this situation, however now this does not seem to be a priority if we go to look at the numbers related to research and development costs.

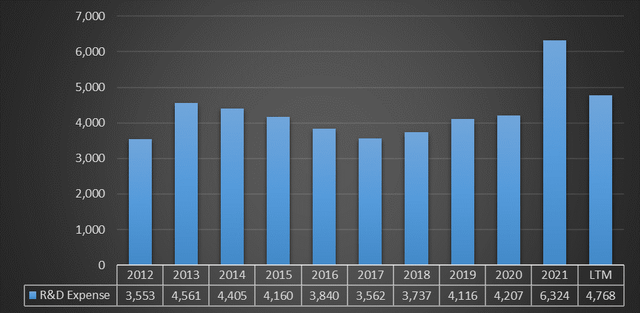

TIKR Terminal

Except for 2021, research and development costs have always remained between $3.5 billion and $4.5 billion. This is not a low figure, but I would have expected a more significant increase considering that the company has spent a huge amount of cash in recent years on dividends and buybacks.

Buybacks and dividends toward unsustainability

When a company issues dividends and buys its own shares it is remunerating its shareholders for the trust maintained by remaining invested in the company. As long as the company making these maneuvers is in a sound economic and financial position the remuneration for shareholders is a strength (since it attracts more investors), but when the company “forces” shareholder remuneration this can be a problem. Contextualizing this with Amgen’s financial economic situation, what it seemed to me is that the company in the last 5 years has been thinking more about immediate-term remuneration for its shareholders rather than improving its core business. In such a context the negative consequences do not manifest themselves immediately, but only when a point of financial weakness is reached. As far as I am concerned Amgen has not yet reached a point of financial weakness, but in recent years the impression is that Amgen’s business has weakened a lot (despite the price per share not collapsing). In this section I will explain how the dividend and buyback are affecting Amgen’s finances.

Dividends

A dividend is an outflow of cash from the company to its shareholders with the goal of remunerating them for their investment. Generally, companies that issue dividends are financially sound companies, because obviously a struggling company needs capital to stay within to finance any future expenses. The reasoning behind all this is that the dividend is welcome as long as it is sustainable. In Amgen’s case, the dividend is still sustainable, but the coverage is worsening year after year.

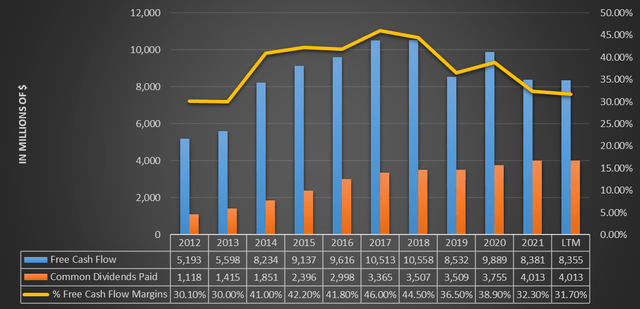

TIKR Terminal

Based on what this chart shows, the deterioration in Amgen’s dividend sustainability is evident. The company’s free cash flow has not grown since 2018, and the free cash flow margin has also been declining for years, a sign that profitability is having some difficulties. Despite this, each year Amgen issues a larger and larger dividend, resulting in an increase in the company’s payout ratio.

Considering the reduction in the dividend increase margin, it is interesting to note how the company is doing in this regard. Looking at the total dividend issued from 2012 to 2017, the growth rate was 20%, while from 2017 to 2021 it was 3.5%. Regarding this divergence in the growth rate, I think the company has realized that it has raised the dividend too fast in the past and is now trying to solve it by adopting a lower growth rate. Since Amgen has been issuing increasing dividends for 10 years and still produces free cash flow 2 times greater than the dividend issued, I would be surprised if this changes in the short term. However, there is no question that this situation needs to be resolved, and one cannot expect to always increase the dividend if free cash flow does not also grow. Investors in Amgen might count on increasing dividends, and if there are disappointments about this in the future, investors might consider selling their stakes. I think this is the main reason for the company to increase its dividend regardless.

Buybacks

Stock buybacks, just like the dividend, are a way to reward shareholders although it does not result in cash inflows toward them. The benefits related to the buyback come from increased shareholder ownership as there are fewer shares outstanding. Looking at past data for Amgen, the buyback was a crucial factor as it changed its entire financial structure. From 2014 to 2021, nearly 30% of the total shares were bought back for a value of nearly $43 billion.

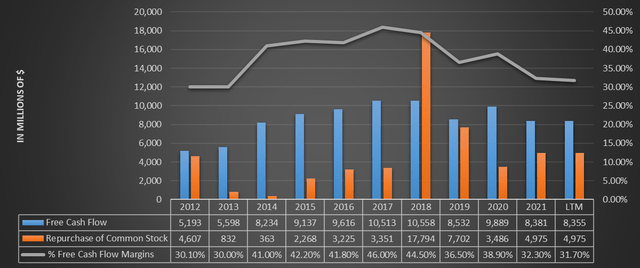

TIKR Terminal

Of this $43 billion spent, $17.7 billion was spent in 2017 alone. For a company that has never exceeded $10.5 billion in free cash flow this is a disproportionate amount in my opinion.

TIKR Terminal

Between rapid dividend increases and strong buybacks the company has preferred to remunerate its shareholders more than $60 billion instead of using this cash to improve future profitability. After years of buybacks and increasing dividends, in fact, the free cash flow margin has been deteriorating and today is far from its peak in 2017, when the $17.7 billion buyback took place. The choices of the past have negative implications in the present, and these may even worsen in the future.

Finally, still regarding the buyback, it is also good to highlight one last aspect of a purely accounting nature. A buyback is an operation that results in a negative reserve being recorded within equity, which is reduced as a result. The more buybacks that are made, the more equity will tend to decrease.

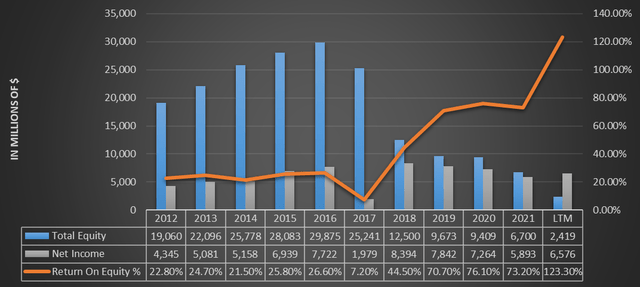

TIKR Terminal

In 2016 Amgen’s equity was $29.87 billion while today it is only $2.41 billion, a radical reduction considering also that the company is profitable every year. Continued buybacks are driving down the book value of equity, distorting its balance sheet. What is more, with an ever-decreasing amount of shares outstanding and equity trending toward 0, some profitability indicators are also skewed such as ROE. From the outside, ROE has increased a lot in recent years, but the problem is that it has not been due to an increase in net income, but to a decrease in equity. The profitability of the company has not improved, and yet ROE signals an improvement.

Weakening of the financial structure

As anticipated earlier, both the dividend and the buyback are shareholder compensation measures, but they result in a weakening of the financial structure as cash flow outflows.

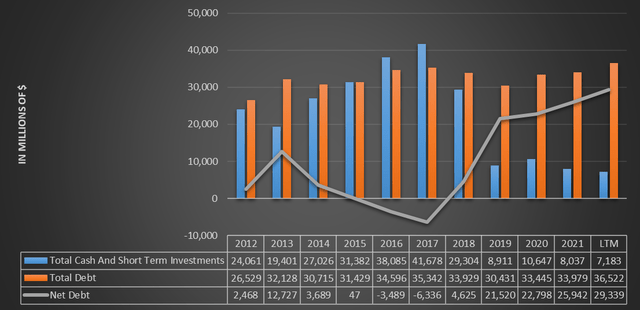

TIKR Terminal

In this graph we can see that there have been major changes in the financial structure over the past 10 years. In 2017 the company was debt-free (-$6.33 billion net debt) while it currently has a net debt of $29.33 billion. Much of this change was not due to the increase in total debt; in fact, debt levels haven’t moved much. The increase in net debt was actually triggered by a reduction in the company’s liquid assets. The money for shareholder remuneration had to come from somewhere, and it was the most liquid assets that the company owned that paid for it. For what it is worth in my opinion, I find this choice questionable since this liquidity could have been used to improve future profitability; instead, in order to remunerate the shareholders, it was preferred to make the financial structure more indebted with an income that to this day is hardly increasing. If the net debt increases and the money produced is always the same, we can clearly say that if there is not a problem in the present it will manifest itself sooner or later in the future.

Analysis of major marketed drugs and the acquisition of ChemoCentryx

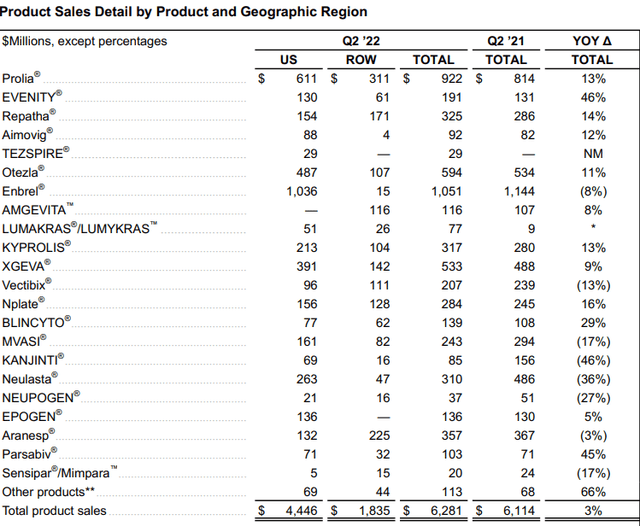

Amgen Q2 2022

According to the latest quarterly report, compared to Q2 2021 Amgen achieved sales growth of $167 million through the sale of its products. This is a positive result overall, but it needs to be analyzed in more detail, in fact for some of the most important drugs their patent expiration is nearing.

Enbrel®

This drug is used to treat rheumatoid arthritis and is the most important for Amgen, in fact it generates 16.70% of total revenues. However, there are two major problems for this drug:

- The patents are set to expire in November 2028 and April 2029, dates that are not that far off for a drug of such importance.

- Although the patents will expire in 6-7 years, sales are already beginning to decline. There was an 8% decrease compared to Q2 2021, and it was due to both lower sales price and lower volumes.

The results this drug is achieving appear to be bucking the market trend. In fact, the market for rheumatoid arthritis drugs is expected to reach $14.90 billion by 2026 (CAGR 7.73%). As previously anticipated, the main reason for the slowdown is increased competition. In particular, HUMIRA®, a drug owned by AbbVie that also fights rheumatoid arthritis, experienced Q2 2021 growth of 9.6% in the U.S., reporting revenues of $4.66 billion. Amgen is suffering from the dominance of HUMIRA, considering that it alone generates more revenue than its entire quarter of sales in the U.S. The last patents of HUMIRA® expire in 2034, so this comparison is quite unbalanced. In addition, in this market segment Johnson & Johnson is also reporting an improvement in its drug SIMPONI: revenues in the U.S. are up 3.80% compared to Q2 2021.

Prolia® e XGEVA®

Prolia® is a drug utilized to treat osteoporosis, while XGEVA® is utilized to combat bone problems caused by multiple myeloma or bone metastases from cancer. Both of these drugs have significant weight within the pipeline, and they also showed good growth compared to Q2 2021. Prolia® achieved 13% growth, 12% of which came from volume growth; XGEVA® achieved sales growth of 9% as a result of the sales price increase. The performance of these drugs has been good; however, they have a common problem: the patents will soon expire.

- U.S. patents will expire in February 2025.

- In France, Italy, Spain and the UK they will expire in 2025, but in the rest of Europe they expired in June this year.

In any case, according to the growth prospects of the two markets in which these two drugs operate, I expect XGEVA® to have greater growth than Prolia® in the coming years. The osteoporosis therapy market has been valued at $12.70 billion in 2022, and is estimated to grow to $14.20 billion in 2026. This is a rather low growth rate, 2.90% CAGR. In contrast, the market for bone metastasis drugs is estimated to grow at a CAGR of 8.01% by 2029, almost three times faster.

Otezla®

Otezla® is a drug that treats active psoriatic arthritis and oral ulcers associated with Behçet’s disease. In terms of financial contribution, it is quite important, generating 9.40% of total revenues. Among drugs with the same or greater weight, its performance is probably the positive note of this quarter as there was 11% income growth, 8% of which came from demand. Its U.S. patent expiration is estimated for February 2028, but until then the company expects growth to continue, especially in the second half of this year. The global active psoriatic arthritis market is estimated to reach $13.64 billion by 2027, registering a CAGR of 9.20%.

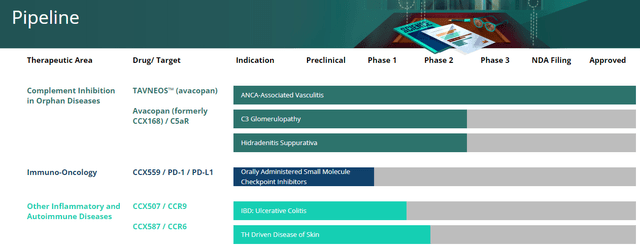

ChemoCentryx

The acquisition of ChemoCentryx was completed on August 4, 2022, for $4 billion in cash. One of the main reasons Amgen acquired ChemoCentryx relates to the opportunity to expand leadership in inflammation and nephrology through the addition of TAVNEOS to its portfolio. Here are the words of Robert A. Bradway, CEO of Amgen, when the acquisition was announced.

The acquisition of ChemoCentryx represents a compelling opportunity for Amgen to add to our decades-long leadership in inflammation and nephrology with TAVNEOS, a transformative, first-in-class treatment for ANCA-associated vasculitis. We are excited to join in the TAVNEOS launch and help many more patients with this serious and sometimes life-threatening disease for which there remains significant unmet medical need.

TAVNEOS was approved by the FDA in October 2021, and is also marketed outside the U.S., specifically in Europe and Japan. From a purely earnings perspective, TAVNEOS sales for the first quarter of 2022 were only $5.40 million. I honestly would have expected a higher figure given that the acquisition cost $4 billion.

Chemocentryx.com

What’s more, no other drugs in ChemoCentryx’s pipeline have passed Phase-2, which is why TAVNEOS is definitely the main reason for the acquisition. The global market for ANCA vasculitis drugs was estimated $463.82 million in 2022 and is estimated to grow to $711.83 million by 2030, thus registering a CAGR of 5.5%. Based on data from the reference market, I therefore do not expect much future growth in revenues from TAVNEOS. I think it is likely that at least in the next few years its weight on total revenues will be almost irrelevant.

Guidance FY2022

Based on the latest guidance released for FY2022 this year should be in line with past performance.

- Expected revenues are between $25.50 billion and $26.40 billion. In FY 2021 revenues were $25.97 billion; therefore, this should be only a small improvement at best.

- GAAP diluted EPS are expected to be between $11.01 and $12.15. In FY 2021 EPS was $10.34, while in FY2020 it was $12.40. This is an improvement from last year but a deterioration from 2 years ago. One must keep in mind that shares outstanding have been decreasing more and more, impacting those per share profit numbers.

- In Q2 2022 the dividend per share increased by 10% compared to Q2 2021 ($1.94 vs $1.76). This increase is not only due to the increase in the dividend issued but also due to the reduction in shares outstanding compared to the previous Q2. Based on this data, it would seem that the company has no intention of ceasing the growth of the dividend issued despite the fact that earnings are struggling to grow.

- After buying back 24.60 million shares in Q1 2022 this quarter there was no buyback. This is probably the most interesting news, but it does not signal the end of buybacks. In February 2022 Amgen declared that it would continue to buy back its own shares up to $6 billion through its cash reserves: we are still far from that target.

Overall, expectations for this fiscal year are not that different from past performance. The company is still focused on acquiring treasury stock which increases earnings ratios as well as dividend per share. There will be no particular improvement on the income side; therefore, we can expect an even higher payout ratio in the future. Thus, this year’s guidance showed no deviation from past years, and the company is once again focusing its attention on the remuneration of its shareholders. Personally, if I were a shareholder of Amgen, I would be more pleased to see the company invest this $6 billion in medium- to long-term projects than to see my ownership share increase. If profits do not increase, there will come a point where this will be unsustainable but the market does not seem to care.

How much is Amgen worth?

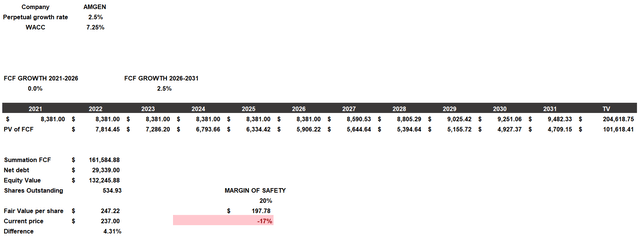

Amgen’s fair value will be calculated through a discounted cash flow, as each investment is the present value of future cash flows. This model will be constructed as follows:

- I calculate a cost of equity of 8.25% and from beta of 0.56, a country market risk premium of 4.20%, a risk-free rate of 3.50%, and additional risks of 2.50%. This last figure is so high because I believe that the continuous buybacks are over-weakening the company’s financial structure. Also, with Prolia® and XGEVA® having patents expiring by 2025 and Enbrel® struggling to grow due to competition, I expect revenue growth may be worse than expected in the future. The after-tax cost of debt is 3.96%.

- The capital structure considered will be 70% equity and 30% debt, with a resulting WACC of 7.25%.

- Free cash flow growth for the next 5 years is modeled to be 0%. This is an almost a forced choice. The pipeline does not have great future expectations and the free cash flow has not improved for years. After 5 years of zero growth, I wanted instead to consider 2.50% per year: after all, Amgen is among the top companies in the world in its field and I believe it can recover from this situation.

Discounted cash flow

According to my assumptions and calculations, Amgen’s fair value is $247 per share, so the company is fairly valued, which is why I do not consider it a sell. The excellent results achieved between 2010 and 2018 have made Amgen the company it is today, however in recent years it is clear that there is a growth problem. The purpose of this article is not to put Amgen in a bad light, but to expose my concerns about cash management to increase profitability and about the growth of major drugs. The company remains solid, but at this rate it may lose in the future its leading position gained from its past successes. Strong share buybacks lead to immediate benefits but take money away from medium- to long-term benefits, the most important for a company to improve its profitability. At this price I would not buy Amgen since I have many doubts about the future of this company, but I might change my opinion if the company’s business strategy changes. At the same time, however, I would also not sell it because the company for now is solid and not overvalued, which is why it is a hold for me. The doubts are many, and I don’t think I have a sufficient margin of safety to invest at this price.

Be the first to comment