JonGorr/iStock via Getty Images

Earnings of Ames National Corporation (NASDAQ:ATLO) will most probably dip this year before increasing next year. Normalization of provisioning for loan losses amid a high-inflation environment will likely hurt earnings this year. On the other hand, low-to-mid-single digit loan growth will support earnings. Further, the margin will likely improve next year due to this year’s interest rate hikes. Overall, I’m expecting Ames National to report earnings of $2.04 per share for 2022, down 22% from last year. For 2023, I’m expecting earnings to grow by 11% to $2.26 per share. The company is offering quite an attractive dividend yield. Based on the total expected return, I’m adopting a buy rating on Ames National Corporation.

Lackluster Loan Growth to Improve in the Year Ahead

Like last year, Ames National Corporation’s loan growth has been quite disappointing so far this year. The loan portfolio grew by just 0.9% in the second quarter of 2022 after falling by 1.2% during the first quarter of the year.

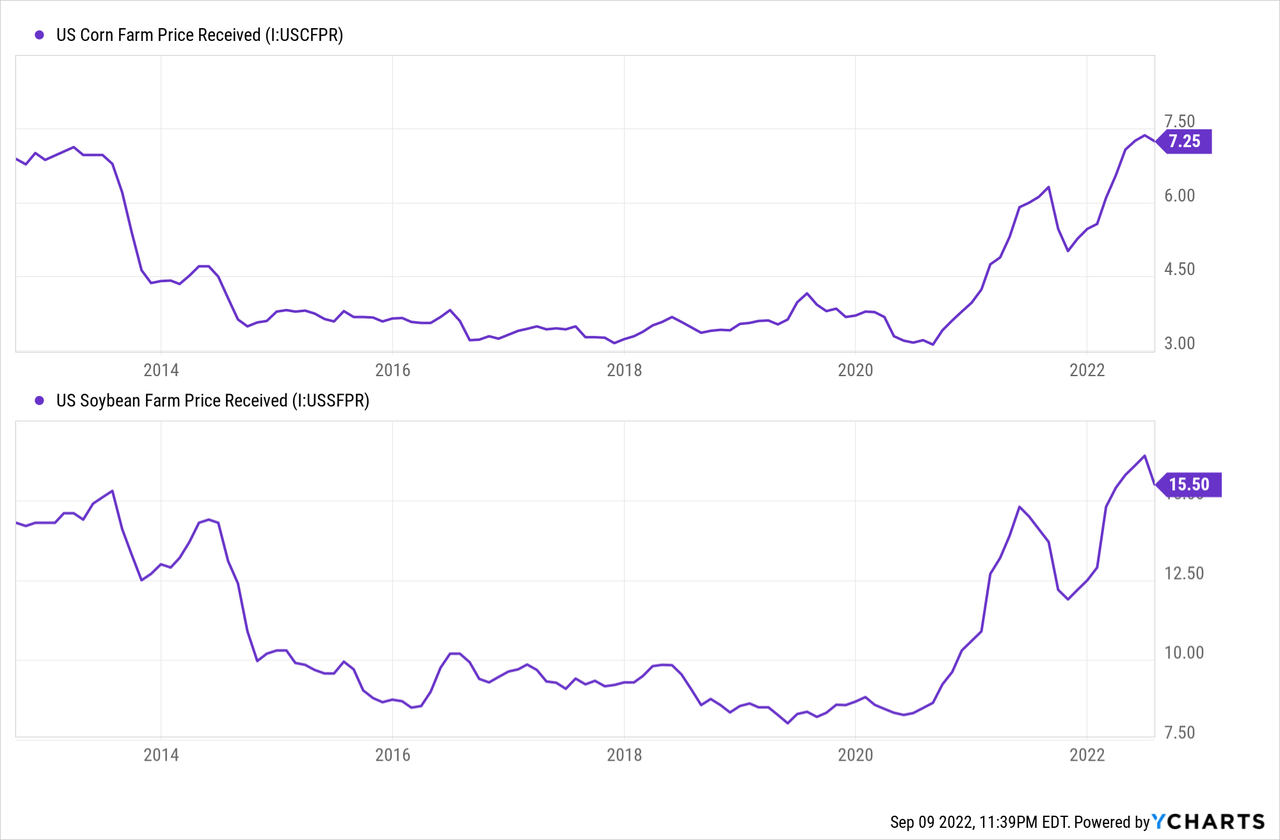

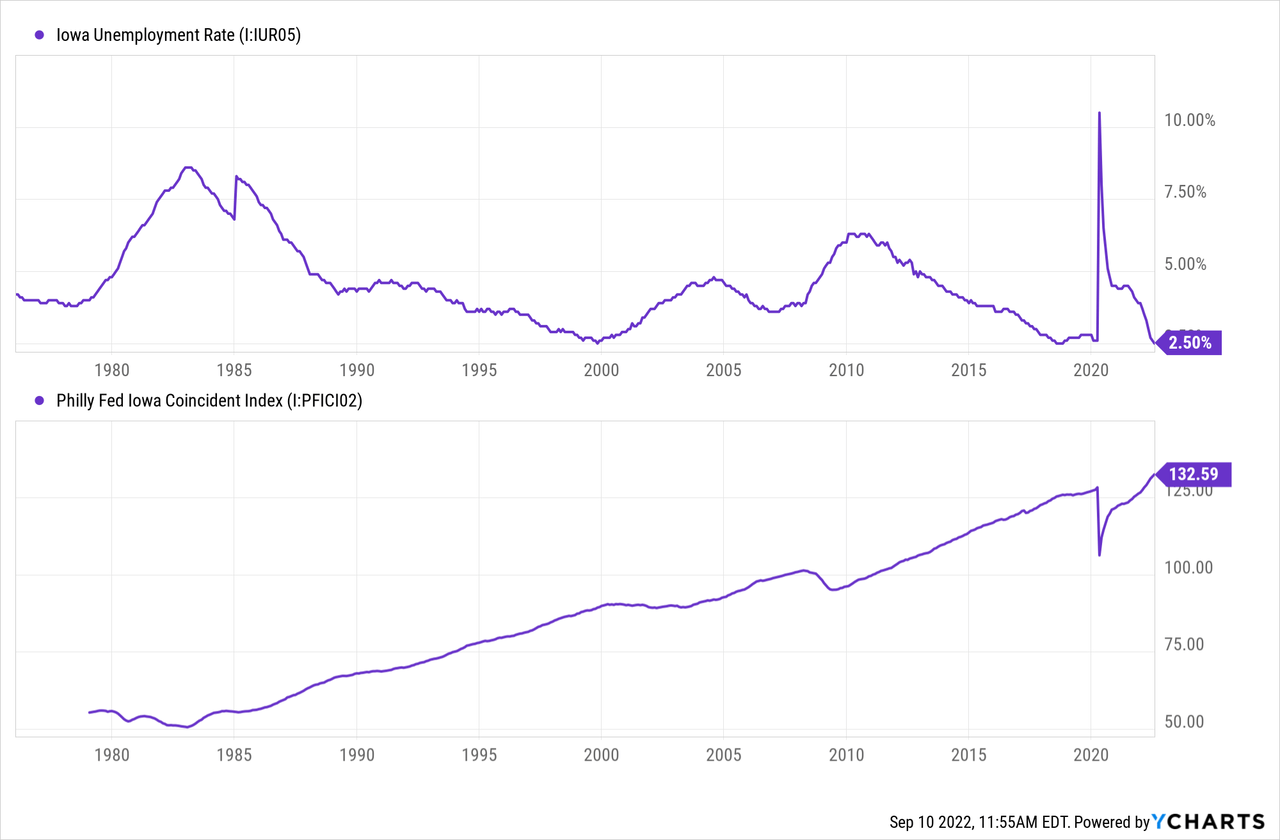

Loan growth will likely improve in the coming quarters on the back of economic factors. Ames National holds several banks which operate mostly in Iowa. These subsidiary banks mostly focus on residential, agricultural, and commercial real estate loans. Therefore, commodity prices of corn and soybeans, Iowa’s two major agricultural products, are a good indicator of the market’s strength and credit appetite.

The unemployment rate for the state is among the lowest in the country, which also bodes well for loan growth. Additionally, the coincident index shows that the state’s economy is in good shape.

Considering these factors, I’m expecting the loan portfolio to grow by 1% each quarter till the end of 2023 (4% annualized). Further, I’m expecting other earning assets and deposits to grow mostly in line with loans.

Securities Portfolio to Limit the Topline’s Rate-Sensitivity

As mentioned in the latest 10-K Filing, Ames National is more sensitive to the re-pricing of its interest-bearing liabilities than its interest-earning assets in the short term. One of the reasons behind this re-pricing mismatch is that Ames National has a very large investment securities portfolio which is mostly based on fixed rates. As of the end of June 2022, the available-for-sale securities portfolio made up a whopping 41% of total earning assets, according to details given in the 10-Q Filing.

Further, the deposit book is quick to re-price as interest-bearing checking, savings, and money-market accounts made up a hefty 69% of total deposits at the end of June.

Considering these factors, I’m expecting the net interest margin to remain mostly unchanged for the remainder of this year despite the rising rate environment. As the bulk of the deposit re-pricing will be over this year, while loan repricing will continue, I’m expecting the margin to increase by 16 basis points next year.

Earnings to Dip Due to Provision Normalization

After posting large provision reversals in 2021, Ames National continued to book net reversals of provisions during the first half of 2022. I’m expecting provisioning for expected loan losses to return to the historical average in the second half of 2022 partly because I’m expecting higher loan growth in the coming quarters.

Further, the existing loan portfolio will likely require additional provisioning as the current coverage appears insufficient given the high-inflation environment. As mentioned in the 10-Q Filing, the company’s level of problem loans as a percentage of total loans at the end of June 2022 was 1.00%, which is higher than the Iowa State Average peer group of FDIC insured institutions as of March 31, 2022, of 0.46% (most recent available). Compared to the problem loan ratio of 1.0%, the allowances were only a little higher at 1.4% of total loans.

Overall, I’m expecting the net provision expense to be 0.13% of total loans (annualized) in every quarter till the end of 2023, which is the same as the average from 2017 to 2019. The provision normalization will play a key role in dragging down earnings this year. Moreover, non-interest expenses will be higher this year due to the effect of inflation on salary expenses.

On the other hand, loan growth will likely support earnings through the end of 2023. Further, the anticipated margin expansion will lift the bottom line next year. Overall, I’m expecting Ames National to report earnings of $2.04 per share in 2022, down 22% year-over-year. For 2023, I’m expecting earnings to grow by 11% to $2.26 per share. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||||

| Income Statement | ||||||||||

| Net interest income | 42 | 45 | 55 | 56 | 54 | 58 | ||||

| Provision for loan losses | 1 | 1 | 6 | (1) | 1 | 2 | ||||

| Non-interest income | 8 | 9 | 11 | 11 | 10 | 10 | ||||

| Non-interest expense | 28 | 32 | 37 | 37 | 39 | 40 | ||||

| Net income – Common Sh. | 17 | 17 | 19 | 24 | 19 | 20 | ||||

| EPS – Diluted ($) | 1.83 | 1.86 | 2.06 | 2.62 | 2.04 | 2.26 | ||||

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) |

||||||||||

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

Large AFS Portfolio to Result in Equity Erosion

Ames National’s book value dropped to $17.50 at the end of June 2022 from $19.43 at the end of March 2022, as mentioned in the earnings release. This decline was mostly attributable to the unrealized losses accumulated on the fixed-rate, available-for-sale investment securities portfolio. As interest rates increased, the market value of these securities dropped, leading to unrealized losses. These losses decreased the equity book value through other comprehensive income, instead of the income statement.

As I’m expecting the fed funds rate to rise by 150 bps in the second half of 2022 (including the 75bps hike in July), the losses will likely climb further. On the other hand, retained earnings will lift the equity book value. The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Financial Position | ||||||

| Net Loans | 890 | 1,048 | 1,130 | 1,144 | 1,164 | 1,211 |

| Growth of Net Loans | 15.4% | 17.7% | 7.8% | 1.3% | 1.7% | 4.1% |

| Other Earning Assets | 489 | 595 | 768 | 921 | 915 | 953 |

| Deposits | 1,221 | 1,493 | 1,716 | 1,878 | 1,965 | 2,045 |

| Borrowings and Sub-Debt | 55 | 47 | 40 | 43 | 40 | 42 |

| Common equity | 173 | 188 | 209 | 208 | 162 | 172 |

| Book Value Per Share ($) | 18.6 | 20.3 | 22.9 | 22.8 | 17.8 | 19.0 |

| Tangible BVPS ($) | 17.2 | 18.6 | 21.2 | 21.2 | 16.2 | 17.4 |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

Attractive Dividend Yield with Secure Dividends

Due to the projected earnings growth for 2023, I’m expecting Ames National to increase its quarterly dividend per share by $0.01, leading to a full-year cash dividend payout of $1.12 per share. This dividend estimate suggests a high forward dividend yield of 5.1%. I’m confident that the dividend payout for 2023 is secure due to the following two factors.

1. The dividend and earnings estimates for 2023 suggest a payout ratio of 49.6%, which is close to the last five-year average of 52.2%.

2. There is no pressure on dividend payout from regulatory capital adequacy requirements. Ames National reported a total capital ratio of 14.7% for the end of June 2022, which is comfortably above the minimum regulatory requirement of 10.5%.

Moderately-High Total Expected Return Justifies a Buy Rating

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Ames National Corporation. The stock has traded at an average P/TB ratio of 1.32 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 17.2 | 18.6 | 21.2 | 21.2 | ||

| Average Market Price ($) | 28.6 | 27.1 | 21.2 | 24.3 | ||

| Historical P/TB | 1.66x | 1.46x | 1.00x | 1.15x | 1.32x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $16.2 gives a target price of $21.4 for the end of 2022. This price target implies a 3.6% downside from the September 9 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.12x | 1.22x | 1.32x | 1.42x | 1.52x |

| TBVPS – Dec 2022 ($) | 16.2 | 16.2 | 16.2 | 16.2 | 16.2 |

| Target Price ($) | 18.1 | 19.8 | 21.4 | 23.0 | 24.6 |

| Market Price ($) | 22.2 | 22.2 | 22.2 | 22.2 | 22.2 |

| Upside/(Downside) | (18.2)% | (10.9)% | (3.6)% | 3.7% | 11.0% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 12.4x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 1.83 | 1.86 | 2.06 | 2.62 | ||

| Average Market Price ($) | 28.6 | 27.1 | 21.2 | 24.3 | ||

| Historical P/E | 15.6x | 14.6x | 10.3x | 9.3x | 12.4x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $2.04 gives a target price of $25.4 for the end of 2022. This price target implies a 14.6% upside from the September 9 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 10.4x | 11.4x | 12.4x | 13.4x | 14.4x |

| EPS 2022 ($) | 2.04 | 2.04 | 2.04 | 2.04 | 2.04 |

| Target Price ($) | 21.3 | 23.4 | 25.4 | 27.5 | 29.5 |

| Market Price ($) | 22.2 | 22.2 | 22.2 | 22.2 | 22.2 |

| Upside/(Downside) | (3.8)% | 5.4% | 14.6% | 23.9% | 33.1% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $23.4, which implies a 5.5% upside from the current market price. Adding the forward dividend yield gives a total expected return of 10.6%. Hence, I’m adopting a buy rating on Ames National Corporation.

Be the first to comment