photographer3431

This article was coproduced with Chuck Walston.

American Tower Corporation (AMT) and Crown Castle Inc. (CCI) have a great deal in common; however, one shared trait not welcomed by investors is the marked loss in the stocks’ valuation year to date. AMT is down 35% in 2021, while CCI shares have fallen 41%.

The merger of Sprint with T-Mobile (TMUS) resulted in tower churn for both companies. However, once TMUS sheds redundant towers, that headwind will be resolved. Otherwise, both firms have good growth prospects.

Despite the fact that the heart of both businesses lies in cell towers, the two companies are embracing differing strategies to drive growth. While each has its merits, I will posit that one path is broader and longer than the other.

What American Tower And Crown Castle Have In Common

AMT and CCI own the lion’s share of the cell towers in the U.S. The two operate over 82,000 of the roughly 112,000 towers in the nation. The only other player of any size is SBA Communications Corporation (SBAC), with around 16,400 towers under its banner.

Creating a tower system is capital intensive. AMT estimates the cost to construct one tower in the U.S. at $275,000. Furthermore, the return for a single tenant is poor. Annual operating expenses average $12,000. With rents of $20,000 for a single customer, that results in rather paltry returns. Now consider that CCI reports the company only adds one tenant per tower every ten years on average.

This means potential competitors must devote enormous capex with expectations of poor returns, and herein lies the basis for the durable moat the two companies possess.

Despite the initial poor returns, cell towers’ profitability increases markedly when additional tenants are added. The last time AMT reported the tenant-per-tower figure (in 2017), management gave an average of 1.9 tenants per tower. AMT estimates a 13% return with a second tenant and 24% for a third.

Furthermore, costs to operate towers do not vary appreciably according to the number of tenants per tower. Therefore, as the number of tenants per tower grows, operating leverage mushrooms.

Additionally, churn is very low in the industry, averaging 1% to 2% a year. In part, this is because the costs associated with removing equipment from towers is prohibitive, estimated by CCI at $40,000 to remove equipment from a tower in the U.S. Since leases are $20,000 to $30,000 per year, there is little incentive to move operations from one tower to another.

Wireless carriers also enter into long-term leases with annual rent escalators (generally 3% in the U.S.) resulting in a reliable and transparent revenue stream for both real estate investment trusts (“REITs”).

As previously noted, both companies are suffering from the tower churn associated with T-Mobile’s acquisition of Sprint. For example, American Tower’s billings for the U.S. and Canada were down 4% to 5% this past quarter, and management guides for Sprint churn to result in a 4% negative headwind year-over-year.

AMT sees Sprint churn continuing as late as 2027, but at a markedly lower rate after FY22.

Where The Two Companies Part Paths

Crown Castle is a U.S.-centric company. As of July of 2021, the firm operated around 40,567 towers in the U.S., versus 41,886 owned by AMT.

Where CCI differs markedly from AMT is in the former company’s investment in small cells devoted to 5G networks. While towers generated 70% of the company’s revenue in 2021, CCI also operates 115,000 small cell nodes, and 80,000 route miles of fiber.

CCI’s goal is to use fiber to set up small cells. These are essentially minitowers used by wireless service providers to support their networks. As essential components to 5G, management sees this as a growth avenue.

From my perspective, there are two problems with this strategy. One is that there is a relatively small pool of potential customers, and at the same time, there is an abundance of fiber options. AT&T (T) and Verizon (VZ) own vast swaths of fiber, and much of those two firms’ needs can be met in-house.

In fact, with one-third of Verizon’s small cells on its own fiber, that company has plans to increase that to over 50% in the next few years. AT&T has also voiced plans to increase its fiber footprint, thereby increasing the company’s ability to meet its small-cell needs in many locations.

Unlike the tower business, there are a number of companies competing in this space, and multiple clients are needed on fiber runs to generate robust returns.

My second caveat lies in the results of this initiative to date. CCI has sunk billions of capex into fiber, yet the segment generated less than $2 billion in revenue in 2021 and has been growing at a mid-single digit pace over the last few years.

Unlike CCI, AMT looks for growth through expansion outside the U.S. The REIT’s international operating profit has increased at a 20% CAGR over the last decade, a pace that is nearly twice that of its U.S. and Canadian operations during that time frame.

AMT has approximately 173,000 international properties. The company derived 97% of revenues from leasing and operating towers with international properties generating around 45% of revenues in 2021. The geography breakdown as of the end of 2021 is nearly 78,000 towers in Asia, about 49,000 in Latin America, just over 30,000 in Europe, and over 22,000 in Africa.

During the Q2 earnings call, management outlined a goal to add 40,000 to 50,000 properties to the company’s overseas portfolio over the next few years.

There are two primary drivers of overseas cell tower growth. One is that developing nations are still transitioning from 3G to 4G. Another is that a prolonged period of tower churn in India, due to the consolidation of wireless carriers in that country, appears to be subsiding.

However, like CCI, American Tower has an initiative to diversify the business away from cell towers. In December of last year, AMT acquired CoreSite. CoreSite operated 25 data centers in the U.S. At a price of $10 billion, the deal is designed to give AMT a presence in edge computing.

Detractors of the acquisition point to the company issuing equity to fund the deal and lament that as a consequence, the REIT’s debt levels initially increased to about 5.8x EBITDA.

To address the debt problem, AMT entered into a joint venture with private equity firm Stonepeak. That move will result in a better debt profile for AMT in return for Stonepeak acquiring a 29% stake in the data centers.

The acquisition contributed about $190 million of growth in the last quarter.

Head-To-Head Comparisons

Valuation Metrics

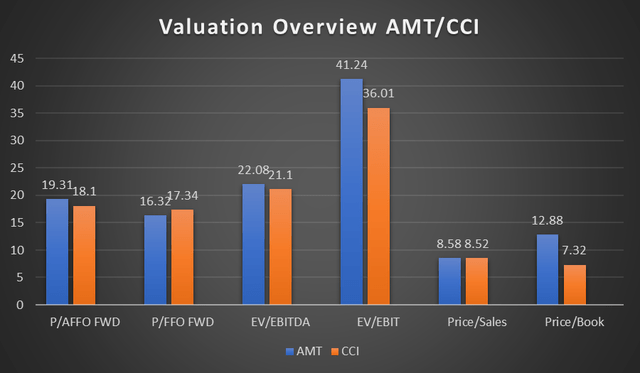

The following chart provides valuation metrics for the two REITs. Forward (FWD) metrics are for the price divided by the next fiscal year’s consensus. Unless otherwise noted, all data relates to the trailing twelve months.

CCI has the advantage.

Analysts’ Price targets

AMT currently trades for $185.60. The 12 month average price target of the 13 analysts covering the stock is $270.50, an approximate 46% upside. The price target of 6 analysts that rated the stock following the last quarterly report is $231.16, a 24.6% upside.

CCI trades for $122.43. The 12 month average price target of the 15 analysts covering the stock is $170.67, an approximate 39% upside. The price target of 5 analysts that rated the stock following the last quarterly report is $149.40, a 22% upside.

AMT has a marginal advantage.

Forward Growth Metrics

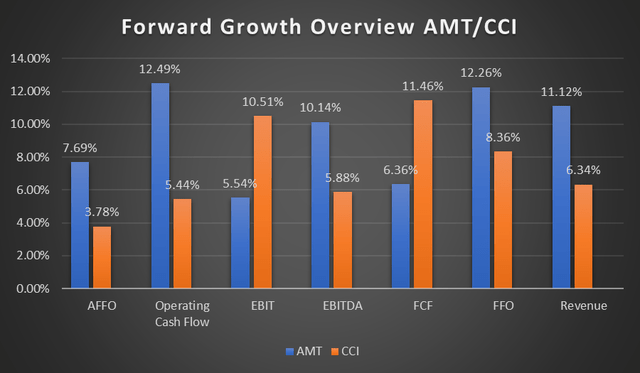

The following chart provides forward growth metrics. These are defined as a comparison of the CAGR from the most recently completed fiscal year’s reported numbers to analysts’ consensus operating estimates for next two fiscal years.

AMT has the advantage.

Dividend Metrics

The current yield for AMT is 3.13%. The AFFO payout ratio is 57.77%, and the 5-year dividend growth rate is 17.88%. I will add that from 2012 through 2021, at no time did AMT’s maximum yield exceed 2.28%.

The current yield for CCI is 5.07%. The AFFO payout ratio is 80.66%, and the 5-year dividend growth rate is 9.12%. I note that from 2012 through 2021, at no time did CCI’s maximum yield exceed 4.34%. However, it is common for the peak yield in most years to exceed 4%.

Undoubtedly, many investors would prefer the higher yield of CCI. On the other hand, AMT has a significantly lower payout ratio as well as a higher dividend growth rate.

Both REITs have BBB- rated debt.

No distinct advantage.

AMT & CCI: Buy, Sell, Or Hold?

T-Mobile’s acquisition of Sprint is causing tower churn in the U.S. for both REITs; however, this headwind will soon slow.

I do not believe Crown Castle’s investment in small cell nodes and fiber will drive robust growth.

I also look askance at American Tower’s acquisition of CoreSite. I will opine that these moves are at least partly responsible for the decline in the stocks’ valuations.

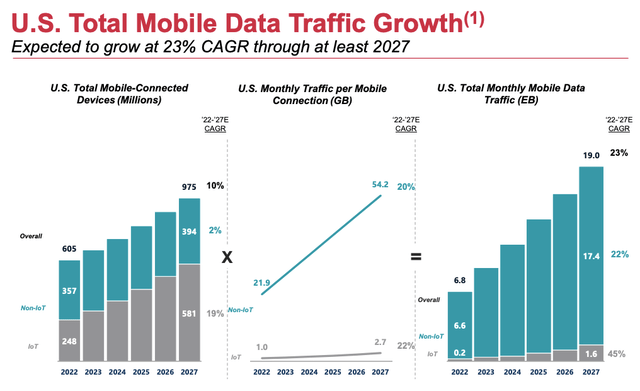

Nonetheless, the demand for cell towers is likely to remain robust due to the marked growth in mobile traffic over the foreseeable future.

AMT Investor Relations

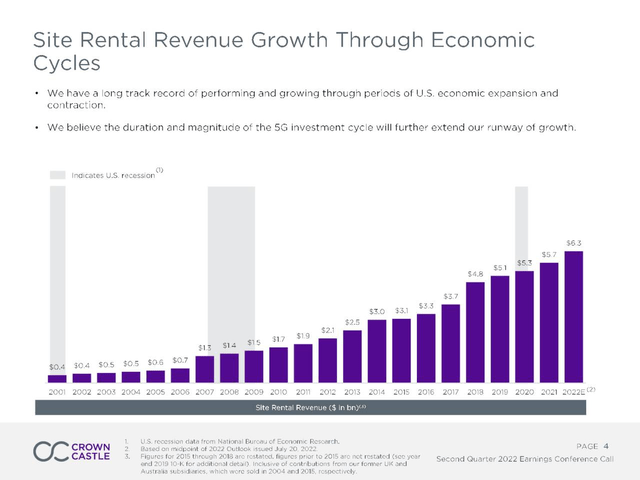

Another consideration to be weighed by prospective investors is the resilience exhibited by this industry during economic downturns. The following chart shows how CCI revenue increased during economic downturns over the last two decades.

Although I predict the dividend growth rates will slow over the short to mid-term for both companies, I do not believe we will witness a marked decline. Know that each firm has grown the dividend at double-digit rates for an extended period.

I rate CCI as a BUY, but by only a narrow margin. I added to my position in CCI last week, albeit incrementally.

I also rate AMT as a BUY.

However, I view AMT’s growth prospects as significantly stronger. This is due to the REIT’s overseas properties which I believe will drive long-term growth.

I’ve waited for years to invest in AMT at a reasonable valuation, and I have been increasing my position in AMT significantly of late. I will reiterate that the stock’s current yield is nearly a full percentage point higher than the maximum yield during any calendar year since 2012.

While I believe the market will go lower for longer, I will be happy to cost average down should AMT shares continue to decline.

The market continues to fall, and my passive income continues to increase.

Be the first to comment