AleksandarGeorgiev/E+ via Getty Images

American Outdoor Brands (NASDAQ:NASDAQ:AOUT) is a fantastic company. Its history is that it’s born of Smith & Wesson (SWBI) in a spin-off where Smith & Wesson still sells guns but all accessories and other adventure and outdoor products are now owned by AOUT. The selling points are high ticket prices, dedicated markets, and recurring economics in a lot of cases. We don’t have the clearest idea of their profitability at the moment since the company has operated independently only recently, but decent margins should be expected. They launch blockbusters on a regular basis and they’re not so expensive, but our concern comes down to macroeconomics and the consumer discretionary markets. Pass for now.

Q1 2023 Earnings Comment

There was a big bifurcation in performance between the marksman and defender brands, which focus on things like knives, gun maintenance and cleaning equipment, gunsmithing equipment and shooting products for the range, versus the lifestyle brands which include the outdoor grills, things like Schrade cutlery and tools, as well as the full suite of hunting products including newly launched MEAT! Your Maker from the MEAT! line which has been performing phenomenally.

We mentioned a capacity to produce blockbuster products. We were in fact alluding to the MEAT! Your Maker meat processing equipment and the Grilla outdoor grill products which together account for 15% of the company’s overall revenue in a matter of a year. The growth in these products were in the triple-digits.

Net sales declined 28.1% YoY, but were up 31.5% compared to pre-COVID levels. The shooting products saw a lot of pull-forward in 2021 as guns and their ancillary products became very popular in that time, which meant that in this year the declines were being completely driven by the fallout from stocking effects in these products. Outdoor and lifestyle products generated 26.5% growth YoY and 54% over pre-pandemic levels, so the overall decline was driven by essentially a collapse in the defender and marksman brands.

The upshot is that these will see a reversion to the mean from these exceptionally low levels, and these are the products with better economics and generally more stable outlook thanks to recurring elements. On the other hand, it is also the segment that is more linked to gun-control, so note the regulatory exposure here. The outdoor and lifestyle segment now accounts for 54% of revenue versus 46% for marksman and defender.

Remarks

The 2022 (or 2023 according to the AOUT fiscal calendar) period is going to be a low-point for the company. The business is actually characterised by a lot of operating leverage. They are loss-making now with totally flat fixed cost evolutions and now a precipitous decline in gross profits driven both by sales declines directly, but also a loss of scale and logistics inflation.

We think the company has benefited enduringly from a larger base of users for brands that are recurring in nature, but in general the products are all discretionary purchases.

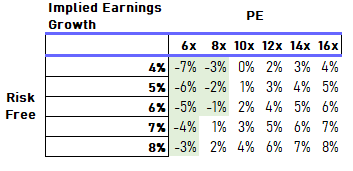

In general, we are unoptimistic about the economy and that means we are not optimistic about consumer discretionary products. What’s more is that the multiple isn’t particularly low. At 17x FWD PE and a 5x EV/EBITDA, it resembles a good deal in the previous rate paradigm. But because we worry about the risk of long-term inflation factors requiring long-term higher rates, the old paradigm may be dead and we want to position away from it. These multiples do not provide sufficient earnings yield to outrun the rising rates while still factoring in a pretty robust recovery in financials from the current year which is shaping up badly from pull-forward. As such, with its earnings growth in the medium-term after this recovery from shock being difficult to achieve due to discretionary markets, and indeed they are already planning less spend on marketing, it is a pass.

Value Chart (VTS)

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment