Prepared by Stephanie, analyst at BAD BEAT Investing

American Express (NYSE:AXP) is a name that entered 2020 in much better condition than it was just a few years ago. My, how things have changed in three months. Now, our consumer-driven economy has been decimated by stay-at-home orders. We know that millions out of work. Tens of thousands of businesses closed. The financial stocks as a whole sold off extremely hard during the broader market selloff. For the most part, our coverage over at BAD BEAT Investing suggests that results so far, as a whole, have been better than expected believe it or not for the sector. The sector stands to benefit from the massive stimulus and loan programs, which are designed to boost our consumer economy by putting some money into the pockets of millions of Americans. It is likely that many are using the stimulus for basic needs, but credit issuers will get some of this action.

That takes us to American Express, one of the biggest consumer lenders in terms of quality. We have traded this name many times, and with shares hovering around $80, they are still down massively year-to-date. We still believe there are several strengths and weaknesses you need to be aware of in the key metrics that we follow. In this column, we check in on performance of American Express. We believe you need to wait until sub $80 to buy this stock in this climate, and should plan to scale into the investment. In other words, you do not buy all at once. This is a key theme of our investment style. That said, Q1 had some strengths and some notable weaknesses to be aware of. Let us discuss.

Top line sees pressure

One of the metrics that caught our eye was the top line revenues. We were expecting pressure that picked up in March, but handicapping it was difficult. We were expecting revenues of $10.7-$11.0 billion. They came in at $10.31 billion, missing our expectations and delivering a decline of 0.5% versus last year’s Q1:

Source: SEC Filings, graphics by BAD BEAT Investing

The top-line growth is certainly a strength but was also below consensus estimates. This was also the first quarter of revenue contraction in years. In fact coming into the quarter, American Express had racked together 10 consecutive quarters of 8% or more growth in revenues. While the top-line growth saw pressure and was below expectations, it was not outside the realm of possibility, given the erosion of consumer demand. The company has continued to rein in expenses, helping drive earnings.

Expense management

When we see revenue get hit, a company’s expenses can make or break financial services companies. The company is aggressively reducing costs across the enterprise, while at the same time selectively investing in initiatives that are key to its long-term growth strategy. Loan loss provisions skyrocketed, which we will discuss in a moment. With revenues down, we hoped to see expenses fall. They did. The company’s consolidated expenses totaled $7.2 billion, down 5% from a year ago.

Here are the key reasons for the difference year-over-year. There was lower spending on marketing initiatives compared to last year. The decrease was driven primarily by lower operating expenses, in part to a litigation-related charge of $0.21 per share in the year-ago quarter. There was also lower card use in the month of March. But with revenues, a growing loan loss provision, and $7.2 billion in expenses, we saw interesting trends in earnings.

Earnings figures

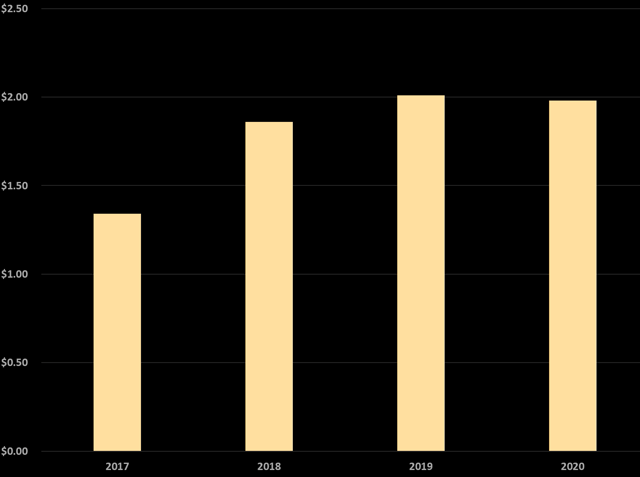

What about the earnings figures themselves? Well, factoring in the 0.5% fall in revenues and 5% decline expenses, and the fact that the company built loan loss provisions, we saw net income come in at just $367 million, down from $1.55 billion a year ago. On a GAAP basis, there was income of just $0.41 per share, down from $1.80 a year ago. However, if we back out the loan loss provisions, the adjusted earnings per share surpassed our expectations by $0.20 and came in at $1.98:

Source: SEC Filings, graphics by BAD BEAT Investing

The first two months of the quarter were likely strong, while March felt the impacts of economic losses, shutdowns, etc. The deterioration in the economy due to COVID-19 impacts that began in the first quarter has as we know accelerated in April. This will dramatically impact volumes. It may last into Q3, but should start to improve as things open back up. But again, GAAP EPS was hit by loan loss provisions, much like other financials, as the company prepares for big losses.

Loan loss provisions

One of the items we always like to look at is the provision for loan losses. This time it is different. As we have seen, provisions for credit losses have expanded dramatically and made the EPS print get crushed for many financial services companies as the companies brace for a wave of consumers being unable to pay. Generally as these provisions rise, it may mean the company is taking on risky debt. Right now, the company is looking at most of its lending being risky just given the situation. The loan loss provisions rose dramatically over last year’s Q1. We believe the rise in this metric represents both a higher loan portfolio and also the expectations of a huge spike in the delinquency rate. Provisions for losses totaled $1.8 billion, up from $551 million a year ago, driven primarily by significant reserve builds. As we look ahead to 2020, expectations are tough to handicap.

Our 2020 projections

Looking ahead, it’s impossible to know when the economy will improve. The market has repriced shares significantly lower in the last few months, though shares have rebounded as the market has clawed back a lot of losses. We still think you wait for a pullback before entering. The growth in provision expense is all about the $1.7 billion credit reserve build, and the credit reserve build is all about the macroeconomic outlook. We just do not know how bad the impacts will be going forward, though we suspect improvement in late H2 2020. We expect operating expenses to be down over $1 billion year-over-year cumulatively over the next three quarters as a whole, with a lot less marketing expenses. If revenue falls say 5-10% in 2020, but expenses are well managed, with loan loss provisions being included, we are looking for $3.20-$5.00 in earnings for the year. Backing out loan loss provisions, this could be $6.60-$8.40. The expectation is so wide because we just do not have color on how bad Q2 and possibly Q3 will be.

Take home

It is a tough time to be invested in AXP and similar ones, but the market is likely to give the company a pass in Q2 and Q3. Thus if activity picks up in late H2 2020, it is a good time to start picking at this stock for the long term, especially on a pullback. Be cautions and selective.

Your Last Chance To Be A Winner Before Prices Rise

This is it. If you want to be a winner you should immediately join the community of traders at BAD BEAT Investing before prices rise and free trials end.

Trade with a winning team. We answer all of your questions, and help you learn and grow. Learn to best position yourself to catch rapid-return trades.

- You get access to a dedicated team, available all day during market hours.

- Rapid-return trade ideas each week

- Target entries, profit taking, and stops rooted in technical and fundamental analysis

- Start winning today

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment