SimonSkafar

Ameren Corporation (NYSE:AEE) is an electric and natural gas utility that serves customers in Illinois and Missouri, primarily around the St. Louis area but notably excluding Chicago. As a general rule, risk-averse investors tend to like utilities for their general financial stability, slow but steady growth, and typically high dividend yields. Ameren Corporation does share these characteristics, although its 2.69% current yield is somewhat lower than some other utilities possess.

However, when we consider that the company is well-positioned to grow its earnings per share at a 7% to 9% compound annual growth rate, any investor should be able to generate a reasonably attractive total return from the company. Ameren also announced reasonably solid first quarter 2022 results, which reinforces the thesis that I presented in my last article on the company. In addition to its respectable performance this year, the company continues to offer investors a reasonable valuation so it may still make sense to add it to your portfolio today.

About Ameren Corporation

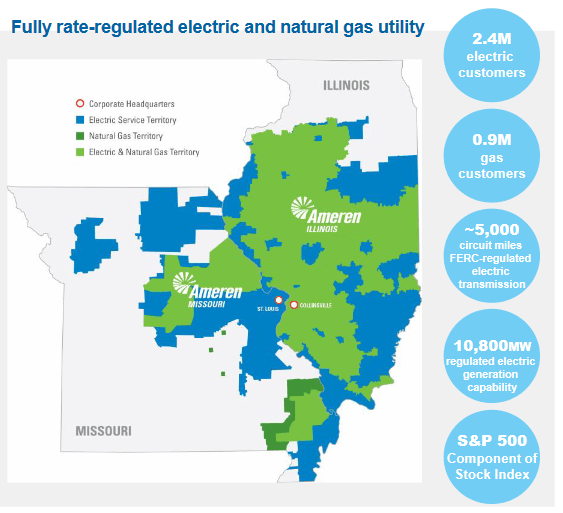

As stated in the introduction, Ameren Corporation is a regulated electric and gas utility that serves customers in eastern Missouri and most of Illinois, excluding the city of Chicago:

Ameren Corporation

Although this area includes a few highly-populated areas, including the city of St. Louis, a sizable proportion of it is fairly rural. As such, Ameren Corporation only serves about 2.4 million electric and 800,000 natural gas customers, despite the size of its service area. Even though the company’s customer base is not as large as might be expected, it does not mean that the stock is a poor investment and indeed it does possess many of the characteristics that we like to see in utilities as we will see over the course of this article. Another thing that we notice here is that the majority of Ameren’s operations are electricity as opposed to natural gas. This is something that may appeal to some investors that believe that electric utilities have a much brighter future than natural gas ones. After all, there is a very concerted push by many in the government and among environmental activists to get us all to abandon natural gas for space heating purposes in favor of electricity.

While this is admittedly unlikely to happen anytime soon, electric utilities do have a few advantages over natural gas ones. The most important of these is that electricity is consumed year-round while natural gas is most heavily consumed in the winter. As a result, electric utilities tend to have relatively consistent cash flows over the course of the year while natural gas ones tend to see most of their annual cash flows during the winter months. Thus, the fact that Ameren’s money primarily comes from electric utility operations could be quite appealing to some investors.

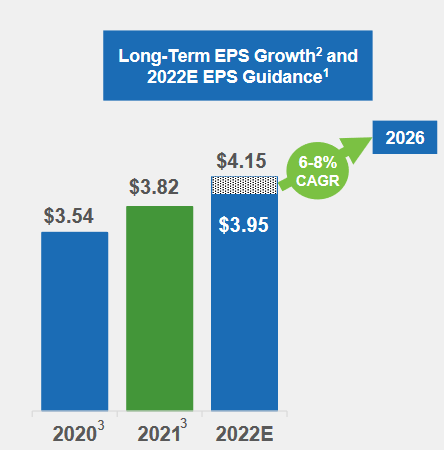

Ameren Corporation has a long history of steadily growing its earnings per share. The company proved this in the first quarter of 2022, as its $0.97 diluted earnings per share represented a 6.59% increase over the $0.91 per share that it reported in the first quarter of 2021. Ameren Corporation seems likely to be able to continue this streak going forward.

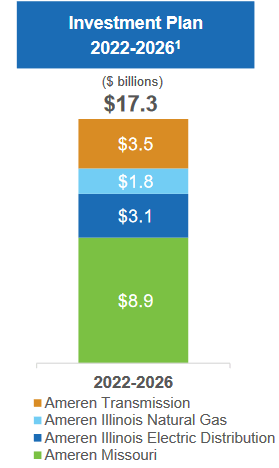

The primary way that the company will accomplish this is by growing its rate base. A company’s rate base is the value of the company’s assets upon which regulators allow the firm to earn a specified rate of return. As this rate of return is a percentage, any increase in the rate base allows the company to increase the price that it charges its customers in order to earn that rate of return. The usual way that the company increases the size of its rate base is by investing money into modernizing, upgrading, or even expanding its utility-grade infrastructure. This is exactly what Ameren Corporation is planning to do, as the company has already outlined a $17.3 billion capital investment program over the 2022 to 2026 period:

Ameren Corporation

A not insignificant proportion of this spending will be directed at furthering the “green transition” that we have heard so much about over the past few years. In particular, Ameren is planning to retire some of its coal generation capacity and replace it with renewables. We can see this in the fact that the percentage of the company’s electricity that is produced from coal will decline from 10% to 6% in 2026. Meanwhile, the proportion of its electricity that is produced by renewables will climb from 63% today to 72% in 2026.

Curiously, though, Ameren does not state exactly what renewable technologies it intends to use to accomplish this capacity buildout. It seems that wind and solar will be the most likely technologies, though, since that is what everybody else is using. We can clearly see that Ameren already derives a large percentage of its electric generation capacity from renewables, so it seems to have some experience with them, which hopefully can help the company solve the reliability problems that these technologies suffer from. Either way, though, the fact that the overwhelming majority of the company’s generation capacity is renewables may help endear it to the various environmental, social, and governance funds that have sprung up over the past few years, which could have a positive impact on the stock price considering the size of these funds.

Although the company focusing so heavily on renewables may bring good feelings, as investors we ultimately want to know what kind of growth we can expect from the capital investment program. The company has guided to earnings per share of $3.95 to $4.15 in 2022, which would obviously be a pretty nice improvement over the $3.82 that the firm had in 2021. Ameren Corporation expects to be able to average a 6% to 8% compound annual growth rate of earnings per share over the 2022 to 2026 horizon of the capital investment program:

Ameren Corporation

When we combine this earnings per share growth with the stock’s current 2.69% dividend yield, investors should be looking at a 9% to 11% total annual return over the period. This is certainly not unattractive for a conservative utility stock. The nice thing here is that we can be relatively confident about these growth projections. This is because the company has a good idea of exactly how much of an impact the capital spending will have on its asset values.

Thus, if we assume that regulators allow Ameren to keep earning the same rate of return, it is not especially difficult to make financial projections. Of course, it is always possible that the regulators will change their minds and begin allowing a lower or higher return or that an unforeseen weather event reduces infrastructure valuations. But, overall, we can be quite confident in these projections.

Fundamentals Of Electricity

Electric utilities like Ameren Corporation have been enjoying a surprising amount of popularity among investors lately, particularly among the younger crowd. This may be because of the government-and media-supported belief that the future of electric utilities is much stronger than that of natural gas utilities. This may explain why the valuations of electric utilities tend to be higher than those of the pureplay natural gas ones.

The biggest reason for this belief is the widely promoted national trend towards electrification, which refers to the conversion of things that are traditionally powered by fossil fuels to the use of electricity instead. The most commonly targeted things for conversion are transportation (electric vehicles) and space heating, but there are some other things that could be converted as well. It can be expected that electrification will substantially increase the consumption of electricity as the trend plays out, which would naturally greatly increase the revenues and profits of the nation’s electric utilities. This growth would come at the expense of natural gas utilities as people move away from natural gas for heating and cooking purposes.

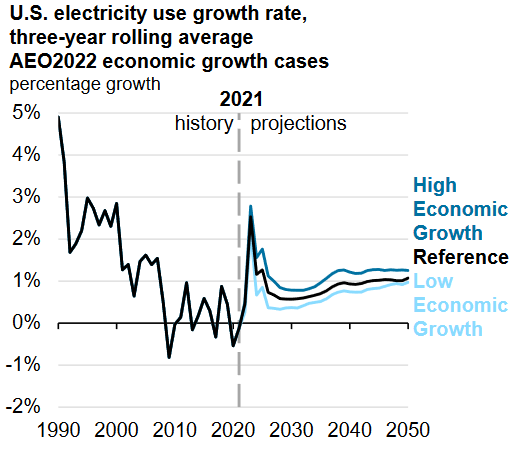

Unfortunately, the United States Energy Information Administration does not think that the electrification trend will play out in the way that its promoters expect. In fact, the agency projects that the national consumption of electricity will grow at a 1% to 2% rate over the 2020 to 2050 period:

EIA Annual Energy Outlook 2022

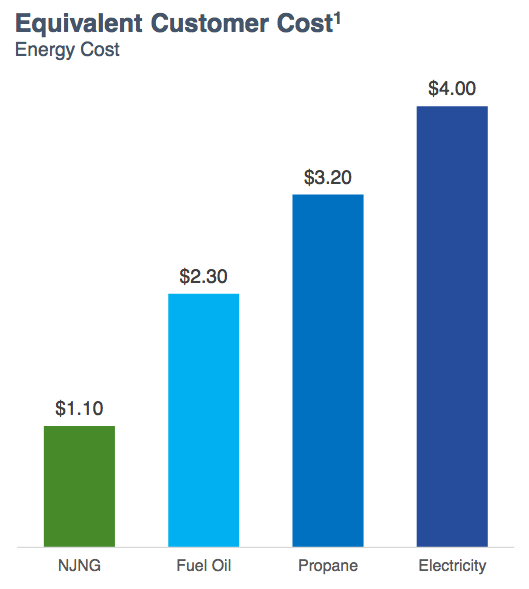

This is nowhere close to the growth rate that we would expect were wide swathes of the American economy to convert from fossil fuels to electricity. In fact, I discussed the impact that electric cars alone would have on the nation’s electricity consumption in a previous article. There are certainly reasons to believe that the agency is correct that the electrification trend will not be nearly as strong as we are being led to believe. This is especially true in the case of space heating because electricity is not as efficient as producing heat as fossil fuels. This results in it being substantially more expensive to heat a building with electricity as with fossil fuels. Indeed, the Energy Information Administration states that it might be approximately four times as expensive to heat a house with electricity as with natural gas:

New Jersey Resources/Data from EIA

This comparison remains true despite the surge in fossil fuel prices that we have seen over the past eighteen months. It seems highly unlikely that very many people would be willing to have their heating bills go up to this degree just to reduce their consumption of natural gas. This is particularly true for people of limited means. Thus, investors should certainly not invest in electric utilities just because they are hoping to profit from the growth of electric consumption that would accompany the “green economy.”

The fact that the electrification thesis appears to be overpromoted does not mean that an electric utility like Ameren Corporation is a bad investment. We just saw that the consumption of electricity is expected at a relatively slow and steady rate. We have also seen that Ameren Corporation is positioned to grow its earnings per share at a 6% to 8% rate over the next five years, which is quite attractive when combined with the dividend. The company therefore might make sense even in the absence of substantial growth from electrification.

Financial Considerations

It is always important to analyze the way that a company finances itself before making an investment in it. This is because debt is a riskier way to finance a business than equity. After all, the debt must be repaid at maturity, which is usually accomplished by issuing new debt and using that money to repay the maturing debt. This could cause the company’s interest expenses to increase following the rollover depending on conditions in the market. In addition to this, a company must make regular payments on its debt if it wishes to remain solvent. As such, a decline in cash flows could push the company into financial distress if it has too much debt. Although utilities like Ameren tend to enjoy remarkably stable cash flows, bankruptcies are certainly not unheard of in the sector so this is still a risk.

One metric that we can use to evaluate a company’s financial structure is the net debt-to-equity ratio. This ratio tells us the degree to which a company is financing its operations with debt as opposed to wholly-owned funds. The ratio also tells us how well the company’s equity will cover its debt obligations in a bankruptcy or liquidation event, which is arguably more important. As of March 31, 2022, Ameren Corporation had a net debt of $14.162 billion compared to $9.935 billion of shareholders’ equity. This gives the company a net debt-to-equity ratio of 1.43. Here is how that compares to some of the company’s peers:

| Company | Net Debt-to-Equity |

| Ameren Corporation | 1.43 |

| DTE Energy (DTE) | 2.08 |

| Public Service Enterprise Group (PEG) | 1.32 |

| Eversource Energy (ES) | 1.39 |

| Entergy Corporation (ETR) | 2.32 |

| CMS Energy (CMS) | 1.62 |

As we can see, Ameren Corporation has a very reasonable debt load relative to its peers. This is a positive sign as it indicates that the company is not using too much leverage to finance its operations. As such, there is not likely to be any outsized risk with regard to the firm’s debt load. Investors do not appear to have anything to worry about here.

Dividend Analysis

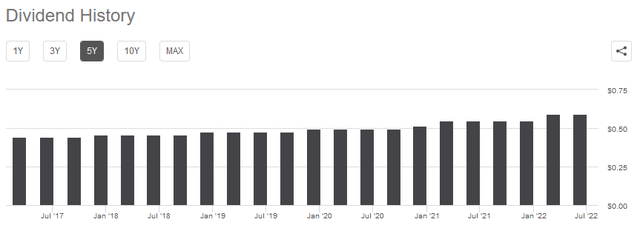

One of the biggest reasons why people invest in utilities like Ameren Corporation is because of the high dividend yields that these companies tend to possess. Indeed, Ameren’s current 2.69% dividend yield is significantly above the 1.55% current yield of the S&P 500 index (SPY). In addition to this, Ameren has a long history of increasing its dividend annually, which adds to its appeal:

The fact that the company increases its dividend annually is especially appealing during inflationary times, like what we are currently experiencing. This is because inflation reduces the number of goods and services that an investor can purchase with the dividend that is received. The fact that the company pays more money each year helps to offset this effect and helps ensure that the investor can maintain their desired lifestyle. As is always the case though, it is critical to ensure that the company can actually afford the dividend that it pays out. After all, we do not want it to suddenly have to reverse course and cut the dividend since that would reduce our incomes and probably cause the stock price to decline.

The usual way that we analyze a company’s ability to afford its dividend is by looking at its free cash flow. The free cash flow is the amount of cash that is generated by the firm’s ordinary operations that is left over after the company pays all of its bills and makes all necessary capital expenditures. This is therefore the money that the company can use to benefit the shareholders in ways such as buying back stock, paying down debt, or paying a dividend. In the first quarter of 2022, Ameren Corporation had a negative levered free cash flow of $566.4 million. This is obviously not enough to pay any dividend, let alone the $152.0 million that the company actually paid out in dividends during the quarter. This may be concerning at first glance.

However, it is not unusual for a utility to finance its capital expenditures through the issuance of debt and equity while using its operating cash flow to finance its dividend. This is mostly due to the incredibly high costs involved in building and maintaining utility-grade infrastructure over a wide geographic area. In the first quarter of 2022, Ameren had an operating cash flow of $388.0 million. This is easily enough to cover the $152.0 million that the firm paid out in dividends with money left over for other purposes. Overall, the dividend is likely secure and investors do not need to worry about a cut here.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a utility like Ameren, one method that we can use to value it is the price-to-earnings growth ratio. This is a modified form of the familiar price-to-earnings ratio that takes a company’s earnings per share growth into account. As a rule, a price-to-earnings growth ratio of less than 1.0 is a sign that the stock is undervalued relative to its forward earnings per share growth and vice versa. However, few companies have a price-to-earnings growth ratio that low in today’s overheated market. That is especially true in the low-growth utility growth. As such, it makes the most sense to compare Ameren to its peers to see which company offers the most attractive relative valuation.

According to Zacks Investment Research, Ameren will grow its earnings per share at a 7.20% rate over the next three to five years. This is in line with the growth rate that we projected earlier in this article so it seems pretty solid. This gives Ameren a price-to-earnings growth ratio of 2.99 at the current stock price. Here is how that compares to some of the firm’s peers:

| Company | PEG Ratio |

| Ameren Corporation | 2.99 |

| DTE Energy | 3.45 |

| Public Service Enterprise Group | 3.93 |

| Eversource Energy | 3.26 |

| Entergy Corporation | 2.59 |

| CMS Energy | 2.83 |

As we can see, Ameren appears to offer a reasonably attractive valuation relative to its peers. It is admittedly not the cheapest company on the list, but both Entergy and CMS Energy are much more levered (and thus riskier) than Ameren Corporation. Ameren, therefore, appears to be offering an excellent risk-reward tradeoff at the present price and may be worth considering.

Conclusion

In conclusion, Ameren appears to have a lot to offer to a utility investor. The company is well-positioned to deliver fairly solid earnings growth going forward along with a high total return when this is combined with the 2.69% current yield. The company is also a significant player in the renewable space, which could benefit the stock price if environmental, social, and governance funds begin buying. This is coupled with a strong balance sheet and an attractive valuation, which adds to the company’s appeal. Overall, Ameren may be worth considering for a portfolio today.

Be the first to comment