MartinPrescott/E+ via Getty Images

Investing can be a difficult process. Unfortunately, an opportunity we buy into doesn’t always go in the direction that we want. While this can be disappointing, sometimes the best thing to do is to remain patient and focus on the long haul. The fact of the matter is that some investment prospects just take additional time to bear fruit. That could be especially true during times of instability like what we are currently experiencing in the market. A great example of a company that makes for a solid investment prospect at this time, but that is experiencing a bit of pain, is AMERCO (NASDAQ:UHAL), the parent of do-it-yourself moving company U-Haul International and a couple of other firms. Although the business has not done all that great compared to the broader market, its fundamental condition looks robust and the future for the company is likely going to be positive. Because of this, I have decided to retain my ‘buy’ rating on the firm at this time.

Performance Remains Strong

Back in February of this year, I wrote an article detailing whether or not AMERCO made for a sensible investment prospect. In that article, I lauded the company’s strong revenue and cash flows. I also said that shares were cheap, especially relative to similar firms. At the end of the day, I ended up concluding that it represented an appealing long-term opportunity for investors, a conclusion that ultimately led me to rate it a ‘buy’. So far, the market has not agreed with me. While the S&P 500 is down by 12.5%, investors who would have bought into shares of when I published my article would be down by 17.9%.

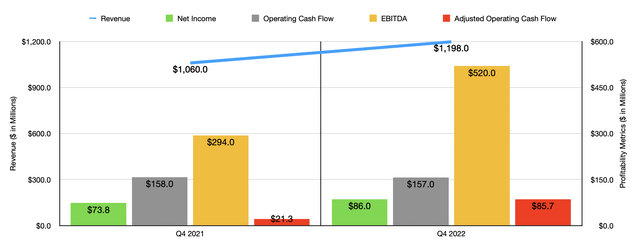

Given this return disparity, it wouldn’t be a stretch to imagine that the company had generated some rather weak performance. Back when I last wrote about the company, we had data covering through the third quarter of the firm’s 2022 fiscal year. Today, we have the entirety of the 2022 fiscal year that we can work with. That additional quarter is certainly telling when it comes to how the company is performing right now. During that quarter, the company generated revenue of just under $1.20 billion. This is 13% above the $1.06 billion the company generated the same time one year earlier.

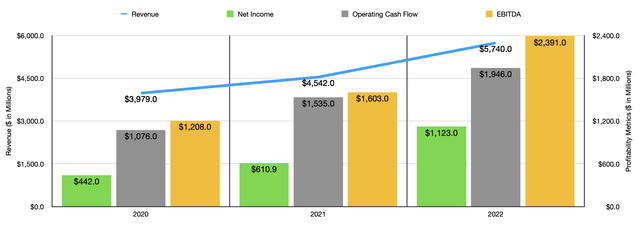

According to management, the business experienced strength across the board during the quarter. Self-moving equipment rental revenue, for instance, grew by 12% or roughly $79 million, largely thanks to higher average revenue per transaction and a greater number of transactions conducted. Even more impressive was the company’s self-storage revenue. This shot up by 28% or $36.8 million a year over a year. A big contributor to this was a 23% increase in the number of occupied units on the company’s books. This translates to an additional 92,600 units being utilized. In all, the occupancy rate of its units grew from 74.3% in the final quarter of 2021 to 82.6% in the final quarter of 2022. And finally, moving and storage revenue increased by $15.7 million, largely thanks to increased moving and storage transactions within the company’s U-Box program. Thanks to the strong performance, total revenue for 2022 came in at $5.74 billion. This is a whopping 26.4% increase over the $4.54 billion generated in the 2021 fiscal year.

Profitability for the company has also increased. Net income of $86 million in the final quarter of 2022 came in stronger than the $73.8 million reported one year earlier. Operating cash flow did worsen, declining from $158 million to $157 million. However, EBITDA for the company managed to improve, skyrocketing from $294 million to $520 million. This final robust quarter had a huge impact on the company’s bottom line for 2022 as a whole. Net income of $1.12 billion in the 2022 fiscal year dwarfed the $610.9 million in profits achieved in 2021. Operating cash flow surged from $1.54 billion to $1.95 billion. And EBITDA for the company grew from $1.60 billion to $2.39 billion. So strong was the company’s financial performance that management announced, in April of this year, the decision to pay out a special dividend of $0.50 per share. This follows another $0.50 per share special dividend paid out in October of last year. Coming in at $9.8 million in cash payouts for the most recent distribution, the amount going to shareholders was not all that great. But every little bit helps in turbulent times.

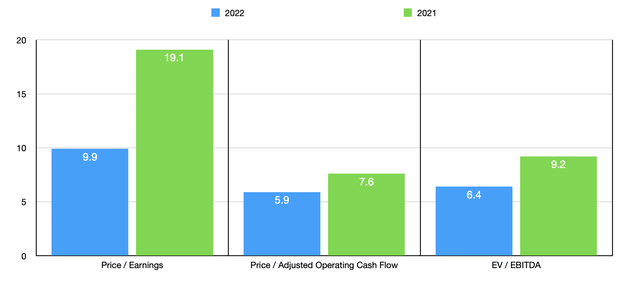

Using the data we have, we can easily value the business. Using the 2022 results, we can calculate that the firm is trading at a price-to-earnings multiple of 8.4. This compares to the 15.5 reading that we get if we rely on 2021 results, and compares to the 21.4 we get if we use 2020 results. Having said that, net earnings have always been pretty volatile for AMERCO, so much so that I don’t believe investors would be wise to rely too much on it. Instead, we should pay more attention to cash flow. On a price to operating cash flow basis, the company is trading at a multiple of 4.9. 2021 results increase this to 6.2, while 2020 results push it to 8.8. And finally, we have the EV to EBITDA multiple. This comes in at 5.3 for the 2022 fiscal year. That’s down from the 8 reading that we get for 2021 and is down further from the 10.6 we get if we rely on 2020 results.

As part of my analysis, I also decided to compare AMERCO to three similar firms. On a price-to-earnings basis, these firms ranged from a low of 6.4 to a high of 68.3, with our prospect being cheaper than only one of the three. On a price to operating cash flow basis, these companies ranged from a low of 3.2 to a high of 7. One of the three companies was cheaper than our prospect. When it comes to the EV to EBITDA multiple, we get a reading of between 5.9 and 10. Using our 2022 results, we can see that AMERCO was the cheapest of the group. I would also make the case that while these are uncertain times and the company could experience some pain as a result, even a return back to 2020 levels of profitability would not make the company look horrible. More likely than not, that would put it closer to fair value on an absolute basis.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| 8.4 | 4.9 | 5.3 | |

| Penske Automotive Group (PAG) | 6.4 | 6.1 | 5.9 |

| Hertz Global Holdings (HTZ) | 68.3 | 3.2 | 10.0 |

| Rush Enterprises (RUSHA) | 10.0 | 7.0 | 6.4 |

Takeaway

Right now, investors seem to be skittish when it comes to most companies, including AMERCO. I understand the concern, but I do think that some of these concerns are unwarranted. If we go into a recession, it could be painful for a short time. Your typical recession lasts about 18 months from peak to recovery. But when you consider the fundamental track record of a company like AMERCO and consider that it is likely fairly valued if financial performance falls from here, the overall downside is limited while the upside could be quite nice. Because of this, I have decided to retain my ‘buy’ rating on the firm for the foreseeable future.

Be the first to comment